Orthopedic Braces and Support Market Outlook:

Orthopedic Braces and Support Market size was valued at USD 4.51 Billion in 2025 and is expected to reach USD 8.15 Billion by 2035, registering around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of orthopedic braces and support is evaluated at USD 4.76 Billion.

The market is estimated to grow on the back of the increasing prevalence of orthopedic diseases and disorders. According to the statistics, in 2019, there were around 2 billion people suffering from musculoskeletal conditions globally, of which around 440 million people had fractures and about 222 million people suffered from neck pain. Furthermore, the rising awareness about dental care along with rising expenditure for treatment processes is also estimated to impetus market growth with a significant revenue generation.

The global orthopedic braces and support market is also estimated to witness growth on account of the rising number of sports injuries. According to recent statistics, approximately 3 million sports injuries occur each year in the United States. In addition, each year, approximately 770,000 children aged 14 and younger are treated for sports-related surgeries in hospital emergency rooms in the same region. Moreover, increasing public awareness about preventive care as well as greater affordability and increasing commercialization of products are some of the other contributing factors which are anticipated to drive the growth of the global orthopedic braces and support market during the forecast period. In addition to other factors, the increased occurrence of lifestyle disorders such as obesity and diabetes which aids orthopedic & musculoskeletal injuries is also expected to bring to create a positive outlook for revenue generation for market growth during the analysis period. Along with that, the various advantages offered by orthopedic braces and support which include better affordability, higher efficiency, enhanced patient comfort, and ease of use compared to conventional products is further projected to boost revenue generation for market growth during the forecast period.

Key Orthopedic Braces and Support Market Insights Summary:

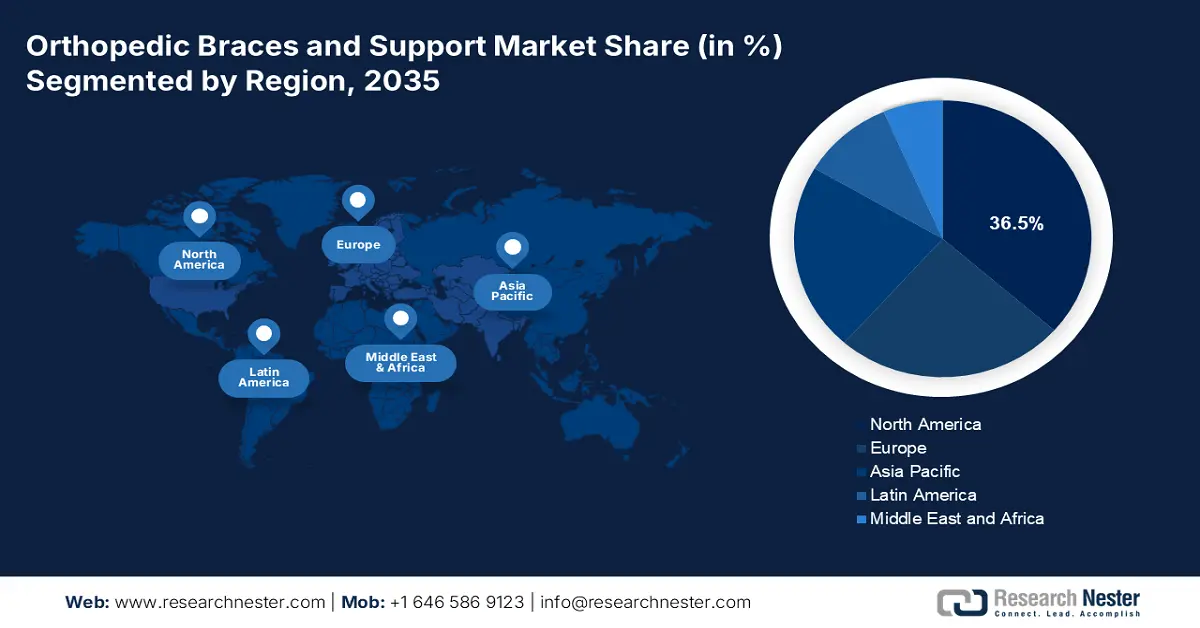

Regional Highlights:

- North America’s orthopedic braces and support market will hold around 36.5% share by 2035, fueled by rising cases of osteoporosis and growing healthcare expenditure.

- Asia Pacific market will achieve the highest CAGR during 2026-2035, driven by increasing geriatric population and rising healthcare expenditure.

Segment Insights:

- The knee segment in the orthopedic braces and support market is anticipated to hold a significant share by 2035, fueled by the rising incidence of knee disorders and a growing elderly population.

- The hospital segment in the orthopedic braces and support market is forecasted to capture the largest share by 2035, attributed to increasing hospital count and favorable reimbursement policies supporting orthopedic brace use.

Key Growth Trends:

- Increasing Level of Geriatric Population

- Increased Research & Development Expenditure

Major Challenges:

- Lack of Awareness among Consumers about the Benefits of Orthopedic Braces and Support

- Less Number of Patients Are Eligible for Bracing-mediated Orthopedic Treatment

Key Players: BSN Medical Inc., 3M Healthcare, DJO Global Inc., Breg Inc., OSSUR, Otto Bock Healthcare, Zimmer Biomet Holdings, Inc., Bauerfeind AG, Alcare Company Ltd, Becker Orthopedic, Frank Stubbs Company Inc., BSN medical Inc.,.

Global Orthopedic Braces and Support Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.51 Billion

- 2026 Market Size: USD 4.76 Billion

- Projected Market Size: USD 8.15 Billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 9 September, 2025

Orthopedic Braces and Support Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Level of Geriatric Population – The elderly population is estimated to be the largest contributor to the demand for orthopedic braces and support. As the elderly population is more prone to musculoskeletal conditions, which further lead to the weakening of ligaments and cartilage owing to age-related factors. According to the World Health Organization (WHO) data, the global population aged 60 years and above stood at around 1 billion in 2020, which is projected to reach 1.4 billion by the end of 2030.

-

Increased Research & Development Expenditure – With the rising global burden owing to orthopedic disorders, governments of different countries and major key players of the market are investing in the research and development sector to develop novel medical equipment such as orthopedic braces and support for the treatment process of the patients. As per data from the World Bank, global research and development expenditure in proportion to gross domestic product (GDP) was around 2.63% in 2020, up from 2.2% in 2018.

-

Increasing Prevalence of Arthritis – Arthritis is one of the most diagnosed diseases among the global population owing to a lack of a healthy lifestyle, immune deficiency, and genetic disorders. As arthritis attacks the tissues of joints to cause inflammation and swelling, the demand for orthopedic braces and support is considered to increase in the near future. As per data from the Centers for Disease Control and Prevention, around 78 million United States citizens are estimated to suffer from arthritis by 2040.

-

Growth of Obesity Rates – Individuals with obesity are at higher risk of ligament tears and joint problems. Thus, with the increase in cases of obesity around the world, the demand for orthopedic braces and support is projected to increase for treating process and providing comfort to patients. According to data from the Centers for Disease Control and Prevention, during 2017–2020, the prevalence of obesity among children and adolescents aged 2–19 years was approximately 19.7%, corresponding to around 14.7 million children and adolescents in the United States.

-

Rising Cases of Osteoporosis Globally – According to estimates, by 2025, osteoporosis will result in approximately 3 million fractures and will cost around USD 24 billion globally.

Challenges

- Lack of Awareness among Consumers about the Benefits of Orthopedic Braces and Support – Although orthopedic braces and support offer a lot of benefits such as increased comfort, faster healing, cost-effectiveness, and others, a large percentage of the population is unaware of these advantages. As a result, people are not adopting orthopedic braces and support for orthopedic diseases and joint & bone disorders which in turn is expected to hinder market growth in the assessment period.

- Less Number of Patients Are Eligible for Bracing-mediated Orthopedic Treatment

- Limited Options to Customize Orthopedic Braces and Support

Orthopedic Braces and Support Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 4.51 Billion |

|

Forecast Year Market Size (2035) |

USD 8.15 Billion |

|

Regional Scope |

|

Orthopedic Braces and Support Market Segmentation:

The global orthopedic braces and support market is segmented and analyzed for demand and supply by orthopedic clinics, hospitals, ASCs, over-the-counter (OTC), and home care settings. Out of these segments, the hospital segment is estimated to garner the largest market share by the end of 2035, owing to the increasing number of hospitals globally and the rapid growth of the healthcare industry. According to statistics, in 2020, there were about 8200 hospitals in Japan, in addition, the number of hospitals in the United States was about 6000 in the same year. Hence, such factors are anticipated to boost segment growth in the coming years. Furthermore, the favorable reimbursement policies present in the hospitals coupled with the presence of advanced and novel orthopedic braces and support are also estimated to augment segment expansion and revenue generation. Along with the other factors, the trust factor associated with hospitals and the availability of highly-educated and trained medical professionals is other factors that are anticipated to increase the utilization rate of orthopedic braces and support in hospitals. Moreover, the high rate of patient inflow and outflow in hospitals on a daily basis is also considered to boost segment growth in the upcoming years.

The global orthopedic braces and support market is also segmented and analyzed for demand and supply by product into knee, ankle, shoulder, neck & cervical, hand & wrist, and others. Out of these, the knee segment is attributed to holding the most significant share by the end of the forecast period. The major factor attributed to segment growth is the rising number of knee disorders such as osteoarthritis, arthritis, gout, and others among the global population which is anticipated to escalate the production rate of orthopedic braces and support. Furthermore, the burgeoning geriatric population across the globe is also projected to fuel segment growth as they are more prone to knee injuries and bone fractions which is estimated to escalate the usage of orthopedic braces and support. Along with other factors, the increasing number of accidents, sports injuries, traumas, and other cases of fatalities where the bone is dislocated or fractured is forecasted to expand segment size.

Our in-depth analysis of the global orthopedic braces and support market includes the following segments:

|

By Product |

|

|

By Product |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Orthopedic Braces and Support Market Regional Analysis:

North America region is set to dominate around 36.5% market share by 2035. This can be accredited to the rising cases of osteoporosis in the region. According to statistics, in 2018, around 52 million Americans either suffered from osteoporosis or were at a higher risk to suffer from the disease owing to low bone mass. Moreover, the presence of major players and manufacturers is also expected to fuel the growth of the market in the region during the forecast period. Furthermore, the rapid growth of the healthcare industry of the region along with the rising healthcare expenditure of Americans are other growth factors for market expansion during the assessment period.

Further, the market in the Asia Pacific is estimated to gain the highest growth during the forecast period, owing to the increasing level of the geriatric population. According to World Health Organization (WHO) data, in 2019, China had a population of about 254 million people aged 60 years and above, of whom 176 million were 65 years of age and older. By 2040, it is estimated that about 402 million people to be over the age of 60, which is about 28% of the total Chinese population. Moreover, rising expenditure on healthcare by the population of Asia Pacific and the increasing focus of manufacturers to expand their regional presence are other factors that are anticipated to propel the growth of the global orthopedic braces and supports market in the region during the forecast period.

Orthopedic Braces and Support Market Players:

- BSN Medical Inc

- 3M Healthcare

- DJO Global Inc.

- Breg Inc

- OSSUR

- Otto Bock Healthcare

- Zimmer Biomet Holdings, Inc.

- Bauerfeind AG

- Alcare Company Ltd

The major players in the market include:

Recent Developments

-

Breg Inc. has launched two new lines of spinal orthoses Pinnacle and Ascend.

-

DJO Global Inc. announced that it has launched the new DonJoy X-ROM Post-Op Knee Brace. Featuring DonJoy’s most advanced range of motion (ROM) protection and improved user-friendly design. It facilitates faster and easier application and adjustment for patients recovering from ACL repair and surgeries.

- Report ID: 4270

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.