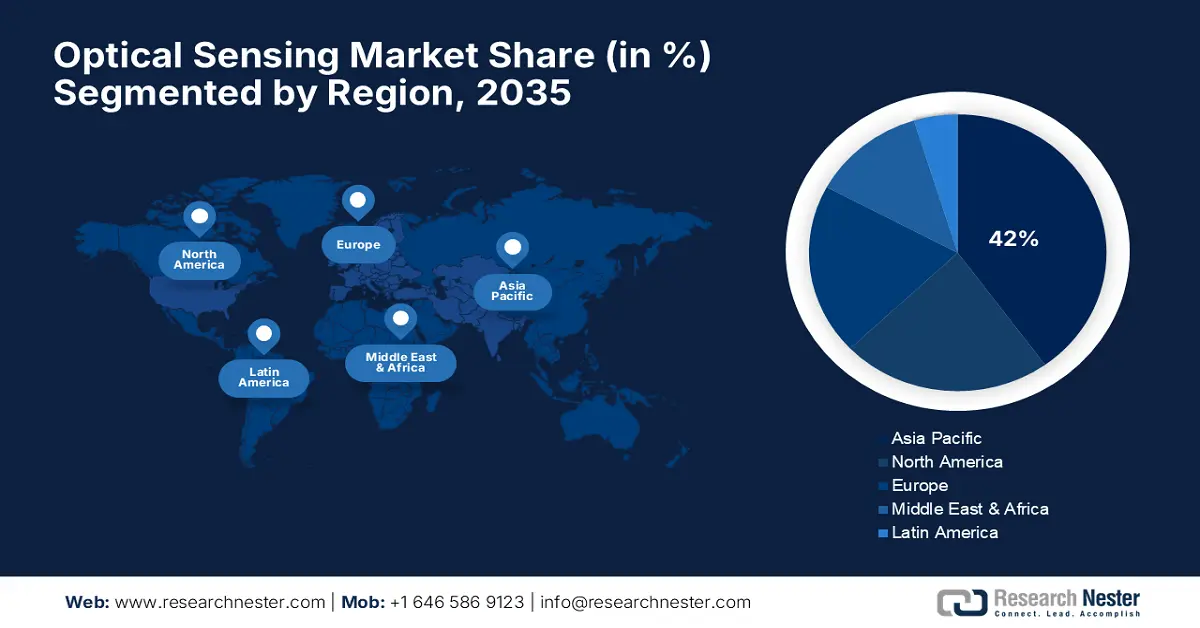

Optical Sensing Market - Regional Analysis

APAC Market Insights

Asia Pacific optical sensing market is anticipated to hold a dominant 42% market share during the forecast period. This is driven by the region's rising electronics manufacturing hub, rapid industrialization, and widespread use of automation technology. China, Japan, and South Korea's huge production capacities make APAC the leading consumer and producer of optical sensing components. According to World Bank statistics in 2023, the East Asia & Pacific high-technology exports represented 33% of its total manufactured exports, demonstrating the region's focus on cutting-edge technology.

China market is experiencing significant expansion, fueled by a strategic national focus on robotics and smart manufacturing. China's fast-expanding automation rate is creating enormous demand for optical sensors for industrial robots and other machines. The International Federation of Robotics (IFR) during the first half of 2024 reported that China's national industrial robot production increased by a record 17% year-on-year, the rate of expansion that is most fueling the demand for optical sensing components.

India optical sensing market is growing at a rapid rate with the government policies, including Make in India, which are geared towards promoting local manufacturing of electronic hardware. The push in policies is leading to a steep rise in the manufacture and export of electronic items based on optical sensors for various applications. In the financial year 2023-2024, data published by India's Ministry of Commerce and Industry indicated that exports of Indian electronics products rose by approximately 6%, a clear indication of the increasing domestic manufacturing base for these critical technologies.

North America Market Insights

North America is expected to achieve a CAGR of 10% by 2035 on account of its technological superiority and extensive investment in rapidly growing sectors such as aerospace, healthcare, and the automotive industry. The region has a strong research and development infrastructure with a good combination of established firms and start-up companies continuously developing and innovating optical sensing technology. The innovative environment, complemented by high demand driven from an industrialized base, ensures that companies in North America witness stable growth.

The U.S. industry is garnering stable growth, with stable government backing for strategic technology industries and a robust domestic production base. One tangible indicator of such industrial growth, figures released by the U.S. Bureau of Labor Statistics indicated a 2.6% increase in employment in the production of semiconductors and other electronic devices in 2023. Such job growth is an indicator of higher manufacturing and demand for the advanced electronic devices that rely heavily on optical sensors for a wide range of applications.

Canada optical sensing market is leading the charge for innovation, particularly in high-performance, niche applications in challenging environments. One example of this expertise is the May 2025 introduction of the Ontario-based Voyis company's Deep Vision Optics. This cutting-edge optical solution is designed to correct for distortion in underwater imaging, a critical technology for subsea inspection and mapping. This focus on specialist, high-margin solutions is propelling Canada's growing share of the global market.

Europe Market Insights

Europe is expected to drive significant expansion between 2026 and 2035. This growth is anticipated to be powered by its robust industrial foundation and a widespread commitment across the continent to Industry 4.0 and automation. In turn, demand for optical sensors is closely tied to the health of the region's manufacturing base, a big user of these technologies for process control, quality assurance, and robotics. In 2023, Eurostat data recorded a 3.2% increase in the EU's annual production of electronic components and boards, a healthy indicator of the underlying demand for optical sensing components.

Germany is another considerable sector in Europe, and its leading automotive and capital goods industries generate high demand for advanced optical sensors. Industrial production in Germany's capital goods sector saw a positive trend in the first half of 2024, with the Federal Statistical Office reporting a 1.8% increase. This is considered favorable news for the sector. This segment, including machinery and equipment, is a big end-user of optical sensors for automation and quality control, a sign that there is a trend up in the use of these important technologies in Germany's industrial powerhouse.

The UK market is being shaped by strategic government investment in high-technology sectors and a high research and development focus. In April 2025, the UK Space Agency issued a procurement for a new national optical tracking station network, a move that will generate high demand for advanced optical sensing systems to advance the sovereignty of the nation's space capabilities. This is supported by a broader trend of increasing R&D investment, with Office for National Statistics data showing an 8.2% increase in R&D spend by UK manufacturing firms in 2023.