Artificial Intelligence Software Platform Market Outlook:

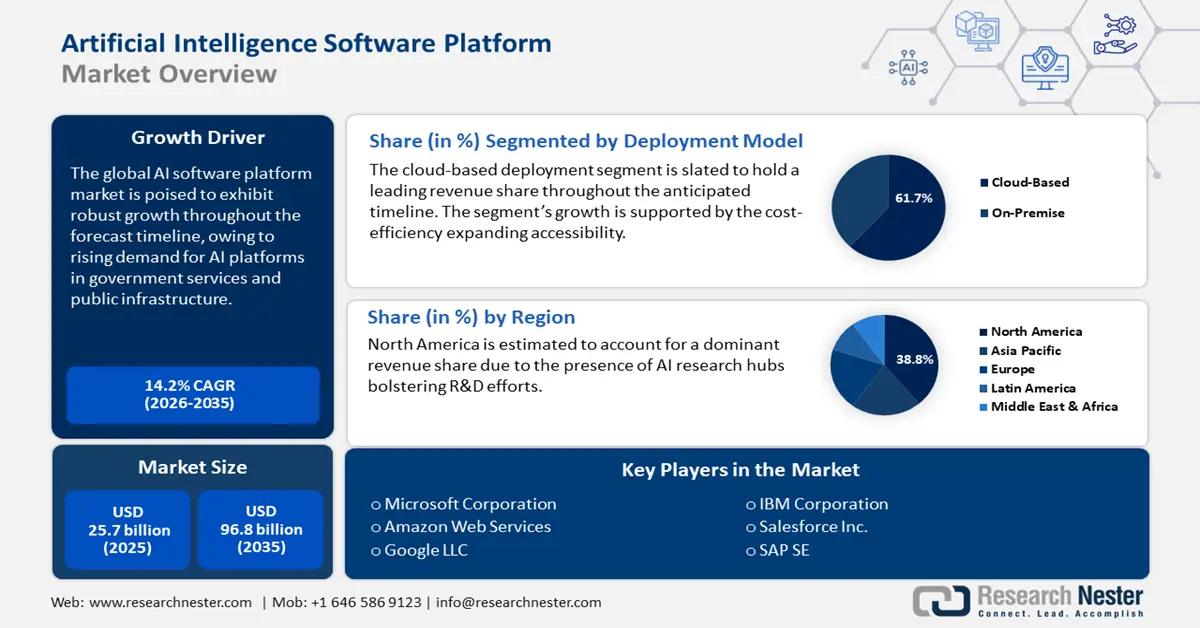

Artificial Intelligence Software Platform Market size was accounted for USD 25.7 billion in 2025 and is poised to reach USD 96.8 billion by 2035, rising at a CAGR of 14.2% during the forecast period from 2026 to 2035. In 2026, the industry size of artificial intelligence software platforms is evaluated at USD 29.3 billion.

A key driver of the global artificial intelligence software platform market is the substantial investment from the private sector towards advancing AI technologies against the backdrop of the intensifying AI race. An additional indicator of the AI software platforms market’s growth is the rising employment demand for software developers from 2020 to 2030. For instance, the U.S. Bureau of Labor Statistics has estimated an 8% increase in employment trends during the same period. Compounding this trend, database administrators and architects are expected to experience a heightened employment rate. The convergence of these trends reflects the surging requirements to manage complex AI-data infrastructures.

The sector’s expansion is reinforced by the expansion of digital infrastructure across the world. Multiple economies have increased their investments in building a robust digital infrastructure. Another crucial aspect is the global semiconductor trade, which remains the backbone of the market. In 2024, the U.S. Census Bureau reported that semiconductor imports totaled over USD 25.4 billion. The improving trade, along with the acceleration of AI adoption, ensures a dynamic growth of the global artificial intelligence software platform market by the end of 2035.

Global Semiconductor Sales Q2 2025

|

Metric |

Value |

|

Q2 2025 Global Semiconductor Sales |

$179.7 billion (up 7.8% from Q1 2025) |

|

June 2025 Global Semiconductor Sales |

$59.9 billion on (June 2025) |

|

Year-over-Year (June 2025 vs June 2024) |

+19.6% (from $50.1 billion) |

|

Month-over-Month (June vs May 2025) |

+1.5% |

Source: SIA

Key Artificial Intelligence Software Platforms Market Insights Summary:

Regional Highlights:

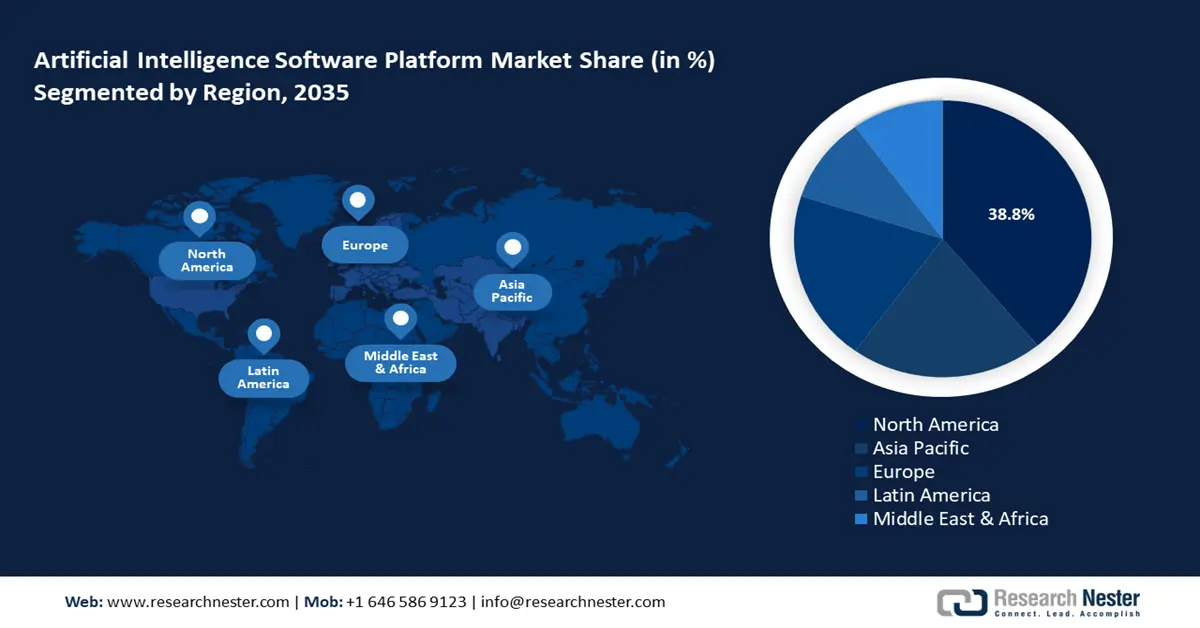

- By 2035, the North America artificial intelligence software platform market is projected to command a 38.8% share, bolstered by its well-established technology ecosystem and intensifying AI innovation race.

- The APAC artificial intelligence software platform market is anticipated to grow at a 24.7% CAGR through 2026–2035, supported by rising AI adoption across both established and emerging digital economies.

Segment Insights:

- The cloud-based deployment model segment in the Artificial Intelligence Software Platform Market is projected to secure about 61.7% share by 2035, sustained by the cost-efficiency advantages of cloud-enabled AI services.

- The ML segment is expected to account for roughly 37.3% share by 2035, strengthened by surging demand for ML applications across healthcare and finance.

Key Growth Trends:

- Integration of AI platforms in government services and public infrastructure

- Rapid surge in AI model licensing and monetization by tech firms

Major Challenges:

- Scarcity of industry-specific pretrained models limits platform monetization at scale

- High implementation and operational costs

Key Players: Microsoft Corporation, Amazon Web Services (AWS), Google LLC (Alphabet Inc.), IBM Corporation, Salesforce, Inc., SAP SE, Siemens AG, NEC Corporation, Fujitsu Limited, NCS Group, Samsung SDS, Tata Consultancy Services (TCS), Infosys Limited, Datacom Group, Fusionex International.

Global Artificial Intelligence Software Platforms Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 25.7 billion

- 2026 Market Size: USD 96.8 billion

- Projected Market Size: USD 29.3 billion by 2035

- Growth Forecasts: 14.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, South Korea, Singapore, Australia, United Arab Emirates

Last updated on : 15 September, 2025

Artificial Intelligence Software Platform Market - Growth Drivers and Challenges

Growth Drivers

- Integration of AI platforms in government services and public infrastructure: A significant driver of the global AI software platforms sector is the increasing deployment in government services as well as in public infrastructure. The implementations by major federal agencies augur well for the future outlook of the sector, highlighting a systematic transition towards AI-powered smart governance. The integration of AI bolsters service delivery, evident in the rising demand for enterprise-grade AI software platforms. India’s Digital Public Infrastructure (DPI) is redefining digital innovation by tagging public funding with private sector-led innovation. AI is now being integrated into financial and governance platforms to enhance their functioning. For instance, for Mahakumbh 2025, AI-driven DPI solutions played a key role in managing the mass gathering and monitoring real-time railway passenger movement to optimize crowd dispersal in Prayagraj.

- Rapid surge in AI model licensing and monetization by tech firms: The AI software platforms are bolstered by the monetization of AI models via commercial licensing on software platforms. For instance, OpenAI’s GPT-4 model is now integrated into Microsoft Azure’s AI platform, allowing third-party developers to build robust enterprise solutions with licensed API access. Between 2002 and 2018, AI-related patent applications expanded by 100% as per the U.S. Patent and Trademark Office (USPTO), from 30,000 to over 60,000 annually, highlighting an exponential increase in patent-protected AI models, which in turn have propelled the rise of licensable AI products.

Additionally, opportunities are predicted to be rife for the deployment of AI software platforms that can facilitate licensing as well as model integration. The commercial deployment demand is expected to rise from both SMEs and Fortune 500 companies by the end of 2035, creating varied profitable segments.

- Rising demand for cloud-based AI platforms: Cloud adoption is fueling the AI software platform market by offering scalability, cost-efficiency, and seamless integration with existing enterprise systems. Companies yet to invest in extensive on-prem infrastructure can access powerful AI capabilities with low barriers to entry. This trend supports the rapid deployment and expansion of AI tools across industries.

- is a standout example. In August 2025, the company reported a surge in demand for its AI-focused database products, driven by enterprises modernizing their data infrastructure to power AI initiatives. Snowflake raised its annual product revenue forecast, and its stock price climbed sharply as analysts acknowledged the booming AI-driven platform demand. Research shows that cloud services are among the key drivers of this market growth, and by 2024, AI platforms powered via the cloud were already seeing major uptake.

Challenges

- Scarcity of industry-specific pretrained models limits platform monetization at scale: A major impediment to the artificial intelligence software platform market is the limited percentage of models with industry-specific training, which in turn puts a constraint on the time-to-value for enterprise users. While general-purpose models, such as GPT, Grok, and BERT, offer foundational capabilities, they tend to lack domain-specific optimization. This limitation causes an increase in the investment required by enterprises for custom data labeling, which in turn lengthens deployment cycles.

- High implementation and operational costs: Deploying AI platforms demands significant investments in infrastructure, GPUs, cloud services, talent (AI/ML engineers), and maintenance. Thus, high operational costs can be a major obstacle for small and medium-scale organizations due to budget constraints and lack of suitable infrastructure. This can slow the widespread adoption and hamper the market growth to a certain extent going ahead.

Artificial Intelligence Software Platform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.2% |

|

Base Year Market Size (2025) |

USD 25.7 billion |

|

Forecast Year Market Size (2035) |

USD 96.8 billion |

|

Regional Scope |

|

Artificial Intelligence Software Platform Market Segmentation:

Deployment Model Segment Analysis

The cloud-based deployment model segment is projected to account for a leading artificial intelligence software platform market share of around 61.7% during the forecast timeline. The segment’s expansion is associated with the cost-efficiency offered by cloud solutions. In addition, the opportunities in the segment are rife due to a heightened adoption of cloud-based AI services, such as NLP, ML, and computer vision APIs, across various sectors. In terms of recent advancements, in 2023, Google Cloud launched a new version of Vertex AI, in a bid to ease the work of developers in deploying and scaling ML models with cloud-based infrastructure.

Technology Segment Analysis

The ML segment is projected to hold a considerable share of 37.3% in the artificial intelligence software platform market. A key driver of the segment is the rising demand for ML in sectors such as healthcare and finance. In healthcare, ML algorithms have assisted in improved disease identification, as well as risk assessment. For instance, Google’s DeepMind developed an algorithm that is capable of identifying retinal images of eye disorders, assisting in the improvement of patient outcomes.

Industry Vertical Segment Analysis

The BFSI sector is expected to experience a large AI software deployment during the forecast period. Key players in the BFSI industry are leveraging AI-based software platforms to automate tasks and improve fraud detection. For instance, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) highlighted that more than $688 million in suspicious activity reports were filed by financial institutions in 2023, reflecting opportunities for the deployment of AI software platforms for fraud detection.

Our in-depth analysis of the global artificial intelligence software platform market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Model |

|

|

Technology |

|

|

Enterprise Size |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Artificial Intelligence Software Platform Market - Regional Analysis

North America Market Insights

The North America artificial intelligence software platform market is projected to account for a leading revenue share of 38.8% by the end of 2035. The regional market’s leading share is propelled by a well-established technology ecosystem as well as the advancements due to the intensifying AI race. For instance, after the launch of DeepSeek in January 2025, the global AI race became much more competitive, prompting OpenAI to release updated models, i.e., GPT-4, that can process both images and text. The regional market also benefits from a high concentration of AI research hubs and a greater adoption rate across various enterprises.

The U.S. artificial intelligence software platform market is poised to retain its leading share in North America. The market is supported by major federal investments along with supportive regulatory frameworks that encourage R&D in AI. The National Artificial Intelligence Office has reported allocation of over USD 3 billion to AI R&D in FY 2022. Such large sums of investment foster an innovation-centric tech ecosystem in the economy. Additionally, opportunities are set to arise from the finance and healthcare sectors in the country, driving the scope of deployment.

APAC Market Insights

The APAC artificial intelligence software platform market is expected to rise at a CAGR of 24.7% throughout the anticipated timeline. A key driver of the APAC market can be attributed to the rising rates of AI adoption. Trends highlight that the established as well as rapidly emerging economies within APAC are transitioning to digital economy models, creating a surge in opportunities for the deployment of AI software platforms. For instance, in July 2025, to boost regional growth, NCS announced a S$130M AI transformation drive across Asia Pacific, guided by the themes of Intelligentization, Internationalization, and Inspiration. Additionally, a significant percentage of adoption, by the end of 2035, is expected to emerge from SMEs in the region.

The China artificial intelligence software platform market is projected to hold a major revenue share in APAC. The regional market is bolstered by a national strategy of prioritizing AI as a dynamic component in the country’s economic development. The presence of key players and investments in the country drives growth. In March 2025, Honor, the Shenzhen-based smartphone manufacturer, announced investments worth $10 billion over the next five years to advance AI technologies for its devices, with ambitions to grow beyond smartphones into AI-powered PCs, tablets, and wearables. Moreover, leading tech companies in China, such as Baidu, Alibaba, and Tencent, have invested in expanding the scope of AI software platforms in a bid to leverage the surging demand for AI-based solutions from multiple sectors.

Europe Market Insights

The Europe artificial intelligence software platform market is rapidly expanding due to a powerful integration of enterprise investment, regulatory support, and vertical innovation. Across sectors such as finance, manufacturing, and healthcare, businesses are increasingly adopting AI-powered platforms to enhance automation, predictive analytics, and operational efficiency. The introduction of the EU AI Act further encourages this growth by supporting higher standards of transparency, safety, and ethical interoperability, thereby boosting enterprise confidence in deploying AI solutions.

Meanwhile, Europe is nurturing its own AI champions, startups like France-based Mistral AI, with its focus on sovereign, multilingual models, and Germany’s DeepL, elevated by a $300 million funding round at a $2 billion valuation, highlight how vertical, regionally grounded AI platforms are gaining traction. These developments are reinforcing Europe’s unique position in the global AI landscape, anchored in ethical, enterprise-facing innovation, rather than consumer-scale platforms alone.

Germany is firmly establishing itself as a powerhouse in AI platform adoption, driven by its robust industrial ecosystem, government support, and rapid startup growth. Behind this growth is strong institutional and infrastructure support, corporate behemoths like SAP are embedding AI into cloud offerings, while Germany hosts vibrant innovation clusters like the Rhine-Main-Neckar, featuring giants such as SAP, T-Systems, and academic nodes like the German Research Center for AI. For instance, Aleph Alpha, which secured $500 million from a blend of industrial and VC investors, is a prime example of German AI players driving both local and international expansion. Another recent example of AI software platforms expanding in Germany is in July 2025, when Oracle announced plans to invest $3 billion over the next five years in Germany and the Netherlands to strengthen its infrastructure for AI and cloud services in Europe.

Key Artificial Intelligence Software Platform Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon Web Services (AWS)

- Google LLC (Alphabet Inc.)

- IBM Corporation

- Salesforce, Inc.

- SAP SE

- Siemens AG

- NEC Corporation

- Fujitsu Limited

- NCS Group

- Samsung SDS

- Tata Consultancy Services (TCS)

- Infosys Limited

- Datacom Group

- Fusionex International

The AI software platforms market is considered mature in certain segments and evolving in others. The market is also exhibiting sustained growth during the forecast timeline. Major players predominantly from the U.S., such as Microsoft, AWS, Google, Salesforce, etc., are leading in revenue shares. The table below highlights the major players of the global artificial intelligence software platform market:

Recent Developments

- In September 2025, Anthropic, an AI startup aiming for enterprise-grade AI (Claude chatbot), recently completed a massive $13 billion funding round, boosting its valuation to $170 billion. Its annualized revenue now exceeds $5 billion, with over 300,000 enterprise clients, a powerful signal of the investor confidence and commercial scalability in AI platform plays.

- In August 2024, Microsoft launched the GPT-40-2024-08-06 API on Azure. The new advancement allows developers to leverage JSON Schema and specify desired output formats. Additionally, input costs were reduced by over 50% whilst output costs were slashed by 33% in comparison to the previous models.

- In May 2024, IBM announced an expansion of its watsonx AI and data platform on Amazon Web Services. The collaboration with AWS has ensured that greater flexibility is offered to customers in the deployment of AI solutions.

- Report ID: 3000

- Published Date: Sep 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Artificial Intelligence Software Platforms Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.