Optical Encryption Market Outlook:

Optical Encryption Market size was valued at USD 4.85 billion in 2025 and is likely to cross USD 12.02 billion by 2035, registering more than 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of optical encryption is assessed at USD 5.26 billion.

The growth of the market is being attributed to the rising need for cyber security among businesses to control the impacts of cyber-attacks. According to the UK government, over four in ten of all UK businesses suffers at least one breach or cyberattack in 12 months. Additionally, the market growth is attributed to the ability of optical encryption in protecting in-flight data and guarding against network intrusions. These factors are anticipated to significantly expand the optical encryption market.

Optical encryption provides first-level and simple-to-implement defense for communications between data centers as well as simplifies the network architecture. Furthermore, rapidly increasing volumes of data have led organizations to follow various data security laws and regulatory compliance which are expected to fuel the market growth. On the back of these, the optical encryption market is predicted to grow over the forecast period. In addition to these, the factors that are expected to boost the growth of the global optical encryption market includes the increasing adoption of cloud-based services, the growing use of big data analytics, and the need for secure communication and storage of sensitive data in industries such as healthcare, financial services, and defense.

Key Optical Encryption Market Insights Summary:

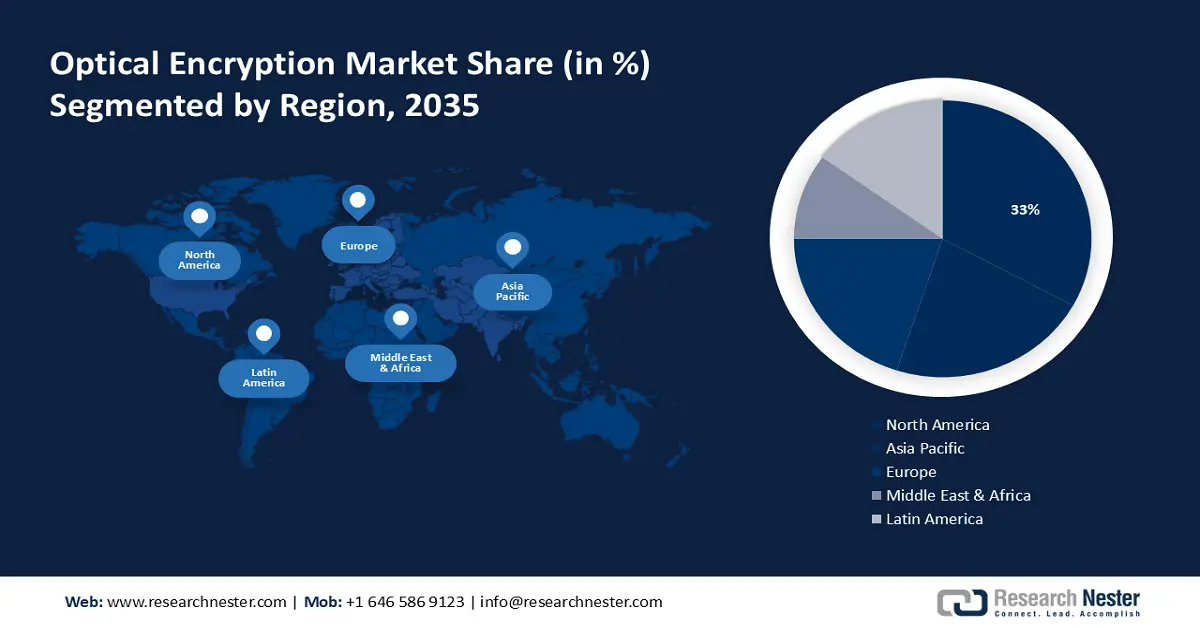

Regional Highlights:

- North America is anticipated to hold a 33% revenue share by 2035 in the Optical Encryption Market, owing to the presence of major market players and escalating demand for cybersecurity amid increasing cloud-based application usage.

- sia Pacific is projected to expand at the fastest pace through 2035, underpinned by rising adoption of OTN data encryption and rapid digitalization driven by 5G, IoT, and widespread smart device usage.

Segment Insights:

- The BFSI segment is estimated to command the largest share by 2035 in the Optical Encryption Market, propelled by the sector’s requirement for robust protection of sensitive financial transactions and personal data.

- The 40G–100G segment is projected to record the highest share by 2035, propelled by the accelerating utilization of high-speed telecom and cloud services worldwide.

Key Growth Trends:

- Growing Demand for Data Security

- Increasing Cloud Based Service Adoption

Major Challenges:

- Lack of Network Stability and Simplicity to Hamper the Market Growth

- Lack of Standardization and Regulations

Key Players: ADVA Optical Networking, Infinera Corporation, Huawei Technologies Co., Ltd., Microsemi, Cisco, Arista Networks, Inc., Acacia Communications, Inc., Ciena Corporation, Nokia, ECI Telecom.

Global Optical Encryption Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.85 billion

- 2026 Market Size: USD 5.26 billion

- Projected Market Size: USD 12.02 billion by 2035

- Growth Forecasts: 9.5%

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Mexico

Last updated on : 19 November, 2025

Optical Encryption Market - Growth Drivers and Challenges

Growth Drivers

- Growing Demand for Data Security: As the volume of data created and transferred grows, so does the requirement for secure data exchange and storage. Optical data encryption ensures a high level of protection for sensitive information, making it an appealing choice for a wide range of enterprises and organizations. For instance, it is estimated that cyberattacks is estimated to cost more than caused over USD 10 Trillion by the end of 2035 around the world.

- Increasing Cloud-Based Service Adoption: As more firms migrate their business processes to the cloud, there is a growing demand for safe transmission of information via the internet. Optical encryption is a safe method of transmitting data across long distances, which makes it a desirable alternative for cloud-based applications. Moreover, it is now estimated that over 3/5th of the corporate data is saved online in cloud servers, across various organizations, worldwide.

- Growing Usage of Big Data Analytics: Since organizations gather and analyses massive volumes of data, there is an increasing demand for secure data storage and transfer. Optical encryption helps to safeguard sensitive data from illegal access, making it a valuable instrument for big data analytics. Over 9 in 10 businesses accept the need to handle unstructured and raw data generated by them in a proper manner.

- Expansion and Increase in the Number of Data Centers: The global expansion of data centers is generating a need for secure data transport and storage solutions. Optical encryption offers a high degree of safety for data transfer between data centers, making it a valuable tool in the data center sector. For instance, there are over 9100 data centers in the world as of now.

Challenges

- Lack of Network Stability and Simplicity to Hamper the Market Growth: Despite the advancement in-flight data encryption solutions, there is a possibility of unstable network infrastructure and limited network-oriented approach. Also, there is incremented complexity associated with managing the network. This is estimated to hinder the growth of optical encryption market in the future.

- Lack of Standardization and Regulations: The optical encryption sector currently lacks standardization and regulation. This makes it hard for businesses and organizations to evaluate and contrast different optical encryption technologies, thus limiting the widespread use of optical encryption.

- Constant Rise and Launch of New Technologies

Optical Encryption Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 4.85 billion |

|

Forecast Year Market Size (2035) |

USD 12.02 billion |

|

Regional Scope |

|

Optical Encryption Market Segmentation:

End-user Segment Analysis

The global optical encryption market is segmented and analyzed for demand and supply by end user into BFSI, healthcare, data centers, energy, telecom and IT, and others. Out of these segments, the BFSI (Banking, Financial Services, and Insurance) segment is expected to garner the largest market share by then end of 2035. Owing to the very sensitive nature of the data they manage, the BFSI industry is one of the main end-users of optical encryption technologies. Optical encryption systems offer a high degree of safety for financial transactions and personal information, making them appealing to the BFSI sector. For instance, the banking sector generated over 350 Billion USD in revenue in 2022. Moreover, owing to the rising volume of sensitive patient data gathered and kept, the healthcare industry is another important end-user of optical encryption technology. Optical encryption protects patient privacy and prevents data breaches by providing a safe mechanism to transmit and retain this data.

Data Rate Segment Analysis

The global optical encryption market is also segmented and analyzed for demand and supply by data rate into <10G, 10G-40G, 40G-100G, and >100G. Out of these segments the 40G – 100G segment is expected to garner the largest market share by the end of the forecast period and display significant growth opportunities. This segment comprises of optical encryption systems with data speeds ranging from 40 to 100 Gbps. This section is commonly seen in high-speed networks such as cloud services and telecommunication systems. With growing use of telecom and cloud services globally, this segment is expected to grow the fastest. For instance, in 2021, an average smartphone consumer around 12 GB data per month.

Our in-depth analysis of the global market includes the following segments:

|

By Encryption Layer |

|

|

By Data Rate |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Optical Encryption Market - Regional Analysis

North American Market Insights

North America industry is anticipated to account for largest revenue share of 33% by 2035. The growth of the market can be attributed majorly to the presence of leading market players in the region. Moreover, increase in the demand for cyber security, followed by the global threat of cyber-attacks owing to huge adoption of cloud-based applications by network operators in this region further promotes optical encryption. Some of the top technological businesses and financial organizations in North America are key end-users of optical encryption technologies. The area has a significant need for safe and dependable data transfer, as well as stringent data protection legislation and compliance requirements. According to the estimated, United States accounts for most targeted country with more than 40 percent of the global cyberattacks. Moreover, the fraud cases in the country have increased by 70 percent since the year 2020.

APAC Market Insights

The market in Asia Pacific region is predicted to grow at the highest rate during the forecast period on account of optical transport network data encryption capabilities in countries such as China, South Korea and India along with the increase in usage of smartphones, laptops, televisions, and several other data generating devices. These economies are spending extensively in technological infrastructure and digitalization. China and India are also investing in the development of sophisticated technologies like 5G and IoT, which are likely to stimulate demand for high-speed and secure data transmission solutions. Moreover, India is the second – largest telecom market in the world, with over 42% of the population using the internet.

Europe Market Insights

The European optical encryption market, amongst the market in all the other regions, is projected to hold the third largest share during the forecast period. The rising volume of data created and transferred throughout the area, the growing use of cloud-based services, and the necessity for reliable and safe communication networks in industries such as healthcare, banking, and government are driving demand for optical encryption solutions in the region.

Optical Encryption Market Players:

- ADVA Optical Networking

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Infinera Corporation

- Huawei Technologies Co., Ltd.

- Microsemi

- Cisco

- Arista Networks, Inc.

- Acacia Communications, Inc.

- Ciena Corporation

- Nokia

- ECI Telecom

Recent Developments

-

The German Federal Office for Information Security (BSI) has authorized Adva Network Security's flagship 10Gbit/s edge solution with ConnectGuard Ethernet encryption for the transport of confidential data.

-

Using Infinera Corporation’s ICE6, Hawiki Submarine Cable LP performed exuberantly with an efficiency of 4.5 b/s/Hz at over 15000 KMs of Subsea Cable Network.

- Report ID: 2643

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Optical Encryption Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.