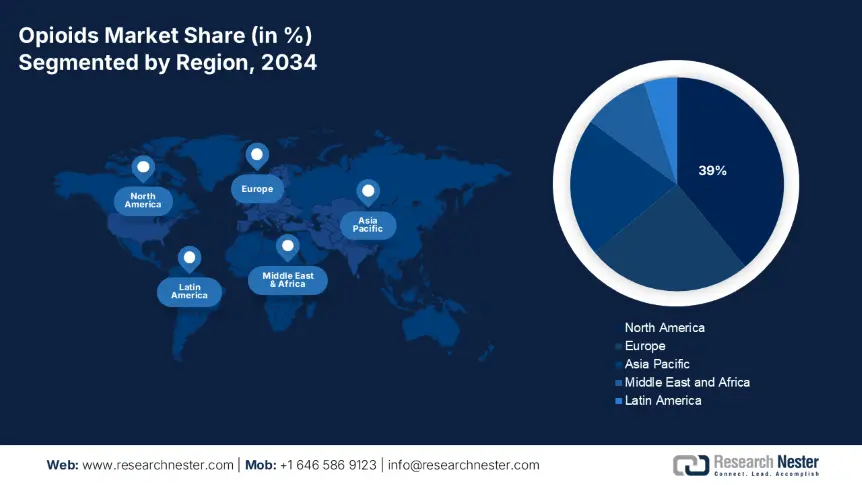

Opioids Market - Regional Analysis

North America Market Insights

North America is expected to dominate the global opioids market with a share of 39% by the end of 2034. The growth is driven by widespread chronic pain, considerable surgical volumes, and strong government funding. The area is expected to have a CAGR of 1.5% growth from 2025 to 2034 due to continued patient access, growing treatments for opioid use disorder (OUD), and an increase in abuse-deterrent formulations. Several regulatory actions aimed at improving prescribing practices and funding overdose prevention programs further bolster long-term demand. Focus by manufacturers to develop long-acting formulations and overdose-reversal products has also supported volume growth in both the U.S. and Canada.

The U.S. opioids market benefits from extensive government intervention and payer coverage. Between 2011 and 2016, Medicaid's spending on medications for opioid use disorder (OUD) rose from USD 392 million. This demonstrates payer commitment. The legalization of opioid treatment programs (OTP) in Medicare saw 38,871 beneficiaries reported by 2022. This demonstrates increased federal reinforcement. CDC funding for overdose prevention rose from 18 million in 2015 to 240 million by 2018. Consequently, this is providing upstream reinforcement for the demand side of the market. This means that the market was making a strategic decision to move away from pain and more toward OUD. These interventions, coupled with invested funding in overdose prevention. With these dynamics, operators should focus on institutional contracts and payer pathways in the OTP/MAT model to build sustainable revenue, consolidated within a unique period of federal health policy change.

The opioids market in Canada operates through a collaborative model of federal and provincial funding, along with public health initiatives. Additionally, provincial partners receive up to USD 113 million each year from the federal government to support these efforts. This initiative is further enhanced by over USD 4 billion allocated to strengthen provincial capabilities. The Public Health Agency of Canada has reported a rise in opioid-related deaths. Ontario has implemented naloxone distribution and safer supply programs. A pilot safer-supply initiative in Ontario has shown a slight reduction in the risk of opioid overdoses among a small group of drug users. Moreover, some provincial systems have broadened their coverage for addiction services.

Europe Market Insights

The Europe opioids market is estimated to garner a notable industry value from 2025 to 2034. The growth can be attributed to the impact of public health policy reforms, the expansion of opioid agonist treatment (OAT), and the evolution of clinical pain management. In 2023, the EU recorded approximately 1 million high-risk opioid users. The ambitious EU health initiatives are designed to support surveillance, preventive care, and the responsible use of opioids. This further strengthens market growth. The real-world usage tracked by the EMA’s DARWIN EU study in 2025 will provide detailed insights. Market trends indicate an increase in the use of both strong and weak opioids through oral, transdermal, and parenteral methods.

In 2022, the UK experienced about 0.80% of its 15–64-year-olds grappling with problematic opioid use. The financial toll of this issue adds up to a staggering annual burden of approximately €65 million. The NHS has ramped up its opioid prescribing and opioid agonist treatment (OAT) efforts. The push for digital prescription monitoring and the rise of abuse-deterrent products show a strong national commitment to tackling this issue.

Germany holds the largest share among countries at 9.2%. Public health spending is around €6,644 per person. Opioids make up roughly 7% of Germany’s pharmaceutical budget. The steady expansion of the market is supported by national prescribing guidelines and government-funded prevention initiatives. France is projected to account for 6.0% of the revenue share in 2034. Opioids are estimated to consume about 5% of the national health budget.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global opioids market by the end of 2034. The growth of healthcare infrastructure, the rising number of chronic pain conditions, and an increasing awareness of opioid-based therapies in cancer and palliative care are all driving factors in this landscape. Japan stands out with its high per-capita healthcare spending and significant budget dedicated to opioids. China is experiencing rapid growth. The growth in the country is fueled by a rise in patient diagnoses and government initiatives aimed at improving access to pain management. South Korea is also seeing a rise in opioid prescriptions owing to expanding reimbursement policies.

2034 Opioids Market Revenue Share & Government Data

|

Country |

Government Spending on Opioids |

Patient Data (Latest Year Available) |

|

Japan |

12% of the healthcare budget in 2024 |

Major use in geriatric & cancer pain |

|

Malaysia |

20% increase in opioid funding from 2013–2023 |

Patient numbers doubled from 2013 to 2023; focus on opioid substitution therapy |

|

Australia |

National Opioid Pharmacotherapy Statistics 2023 reports growing OST investment |

~1.1 million opioid prescriptions dispensed in 2023 |

|

India |

$1.8B spent annually in 2023 |

2.4 million patients received opioid treatment in 2023 |