Online Clothing Rental Market Outlook:

Online Clothing Rental Market size was valued at USD 1.61 billion in 2025 and is expected to reach USD 3.88 billion by 2035, registering around 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of online clothing rental is assessed at USD 1.74 billion.

The growth of the market can be attributed to increasing spending on shopping for clothes. With the rising disposable income of people, they are willing to spend on luxurious items. Also, it has given them a chance to groom themselves in a better way. According to the OECD Better Life Index, the net adjusted average of household disposable income reached USD 51,147 per year. Also, the gross household adjusted disposable income in Europe was valued at USD 12,630 billion in 2023.

Additionally, the market growth can also be ascribed to the burgeoning textile industry. The textile industry is witnessing the amalgamation of various trends such as nanotechnology, 3D printing, and smart and breathable fabrics. According to The Observatory of Economic Complexity in 2023, the worldwide trade of textiles reached USD 807 billion. Market players are investing in including customer-centric features in the fabrics.

Key Online Clothing Rental Market Insights Summary:

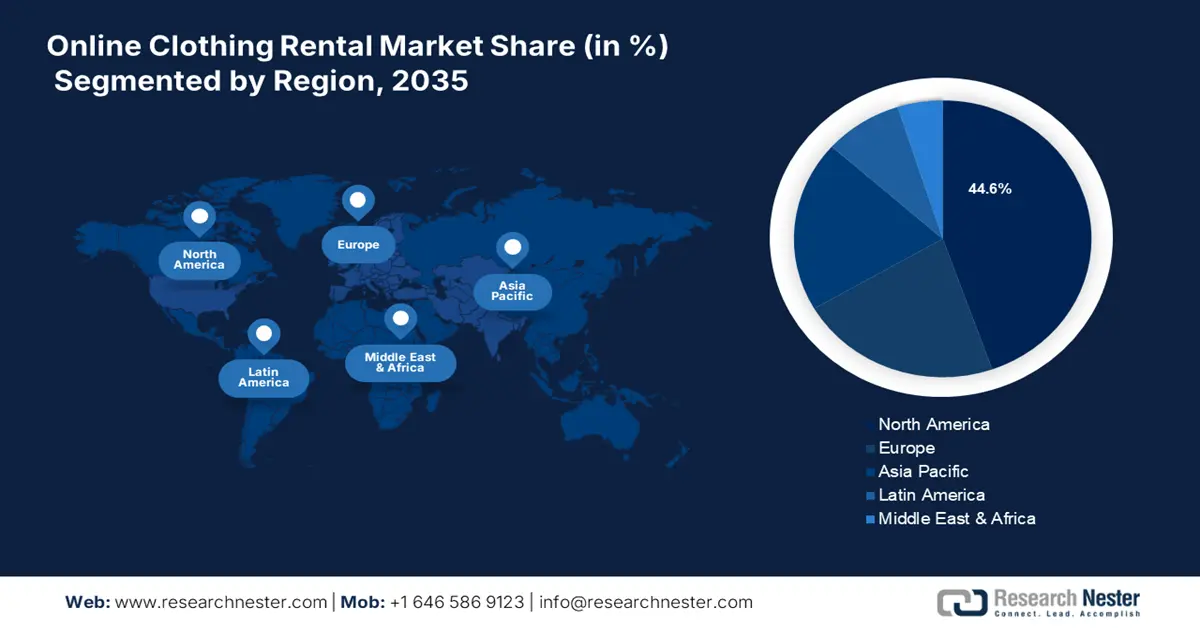

Regional Highlights:

- North America online clothing rental market will dominate over 44.6% share by 2035, driven by fashion-conscious consumers and a robust e-commerce presence.

- Asia Pacific market will exhibit significant growth during the forecast timeline, driven by rising disposable income, a large young population, and growing demand for affordable and luxury clothing.

Segment Insights:

- The women segment in the online clothing rental market is projected to hold the largest share by 2035, attributed to changing fashion trends and cost-efficiency of rental clothing for women.

- The b2c segment in the online clothing rental market is anticipated to hold a major share by 2035, fueled by superior customer experience and flexible membership plans.

Key Growth Trends:

- Surge in eco-conscious consumers

- Increasing internet penetration

Major Challenges:

- Risk of damaged and stained clothing

- Complexity in the subscription process

Key Players: Rent the Runway, Flyrobe, Rent frock Repeat, Le Tote Inc., Style Lend, Girl Meets Dress, Dress & Go, GlamCorner Pvt Ltd, MEWA Textile-Service AG, Bag Borrow or Steal, The Secret Wardrobe Limited, Poshmark Inc.

Global Online Clothing Rental Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.61 billion

- 2026 Market Size: USD 1.74 billion

- Projected Market Size: USD 3.88 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Singapore, South Korea, Mexico

Last updated on : 8 September, 2025

Online Clothing Rental Market Growth Drivers and Challenges:

Growth Drivers

-

Surge in eco-conscious consumers: According to data published by the European Parliament in March 2024, the production of textiles is projected to be around 20% of global clean water pollution from the finishing and dying products. People are acknowledging this and renting out the clothes to reduce the demand for more production. By renting clothes, people also lower the demand for the production of mass textile production. These rental services offer an easy and sustainable way to get clothing items without spending a large amount on them. When a consumer is renting clothes, they have the liberty to wear the clothes of their preference in an eco-friendlier way.

- Increasing internet penetration: The widespread expansion of internet connectivity is facilitating access to myriad online shopping platforms. The data published by the Division for Inclusive Social Development in 2023, almost 5.4 billion people were using the internet. The exponential growth in internet users is further boosting e-commerce traffic. From the online rental clothing platforms, consumers are getting diverse outfit solutions.

- More demand for convenient shopping: The online shopping is becoming popular amongst the population as the consumer can get clothes at their doorsteps without any hassle-free experience. The other factors due to which consumers are preferring online rental clothing are that they get their order within a maximum of 1-2 business days. In fact, in some cities, rental clothing companies are providing same-day delivery. This surge in demand for convenient shopping through online portals is acting as a catalyst for the growth of the market.

Challenges

-

Risk of damaged and stained clothing: People remain apprehensive about the quality of rented clothes. The consumer perceives rental clothing with less trust in quality, which may hamper the sale on the online platforms.

-

Complexity in the subscription process: Most of the online platforms provide subscription-based services. Sometimes, when people are not utilizing a rental subscription to the full extent, it may seem unworthy of the money.

Online Clothing Rental Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 1.61 billion |

|

Forecast Year Market Size (2035) |

USD 3.88 billion |

|

Regional Scope |

|

Online Clothing Rental Market Segmentation:

Demography Segment Analysis

The women's segment in online clothing rental market is projected to lead and is expected to occupy a larger global market share. Constantly changing fashion trends among women are anticipated to propel the demand for rental clothes. Furthermore, the market players in the region are providing rental dresses only for women, mainly at reasonable prices, with different membership packages. Companies such as Rent an Attire, Ruby Clothing, The Outfit Club, etc., are rendering exemplary services to the customers and harnessing high profit margins. Additionally, globally, more women are getting exposed to fashion and the latest trends through social media. This is influencing them to remain trendy and rental clothing is one of the best cost-efficient options for this.

End user Segment Analysis

The B2C segment in online clothing rental market is projected to acquire the major share of the market on the back of a superior customer experience. The online rental clothing companies are offering an exemplary platform for the market players at reasonable prices and numerous brand options. For instance, Rent the Runway is offering 60-day replacement, 1-3 business days delivery, scheduled pick up, and various other flexible plans. Also, the membership for the company is just USD 89 for the potential customer. Such facilities are compelling customers to purchase through B2C channels and avail the benefits.

Our in-depth analysis of the global online clothing rental market includes the following segments:

|

Demography |

|

|

Clothing |

|

|

Business Model |

|

|

End-use |

|

|

Price Range |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Online Clothing Rental Market Regional Analysis:

North America Market Insights

North America region is projected to account for more than 44.6% market share by 2035, due to the presence of fashion-conscious consumers. Also, there is a robust presence of e-commerce in the region, leading to increased demand for rental clothing. In the U.S., women tend to spend more on shopping than in any other place in the world. For instance, in 2023, the household spending on women’s apparel averaged USD 655 in the country. People are also preferring rental clothing to avail of the various benefits and get a wide range of options. Similarly, in Canada, online rental clothing companies such as REHEART are renting, buying, selling, and lending clothing and dressing, even at a 90% discount.

Asia Pacific Market Insights

The market in Asia Pacific is anticipated to witness significant growth owing to the rising disposable income of the people and the presence of a large consumer base. Other than this, in India, there is a large young population going to offices and colleges, demanding a variety of affordable clothing. For instance, according to the Press Information Bureau, the country could support almost 60 to 65 million digitally enabled jobs by 2026. The rising number of people employed in the IT industry in India is propelling the market growth during the assessed time. Additionally, in China, there is a rise in demand for luxury clothing among the population. For instance, Yclostet, an online platform, offers clothing rental services across major cities, and the business model has acquired high turnover. Consumers are also giving preference to sustainability. Various rental clothing companies are aiming to eliminate the linear clothing system that is heavily dependent on non-renewable sources. These factors are bolstering the growth of the market and render lucrative opportunities to the market players.

Online Clothing Rental Market Players:

- Rent the Runway

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Flyrobe

- Rent frock Repeat

- Le Tote Inc.

- Style Lend

- Girl Meets Dress

- Dress & Go

- GlamCorner Pvt Ltd

- MEWA Textile-Service AG

- Bag Borrow or Steal

- The Secret Wardrobe Limited

- Poshmark Inc.

The competitive landscape of the market is rapidly evolving as established key players, textile giants, and new entrants are investing in novel sustainable techniques. Key players in the market are focused on developing new services and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In January 2025, Poshmark marks a milestone with the debut of smart list AI, ushering a revolution in AI-powered resale. The game-changing new feature is designed to streamline the listing process by enhancing efficiency with the power of generative AI.

- In April 2022, David Jones announced an amalgamation, sustainability-driven clothing rental portal RELOOP. The portal has been launched with GlamCorner, a resale clothing initiative that aims to power the future of the circular economy.

- Report ID: 1799

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Online Clothing Rental Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.