Oncology/Cancer Drugs Market Outlook:

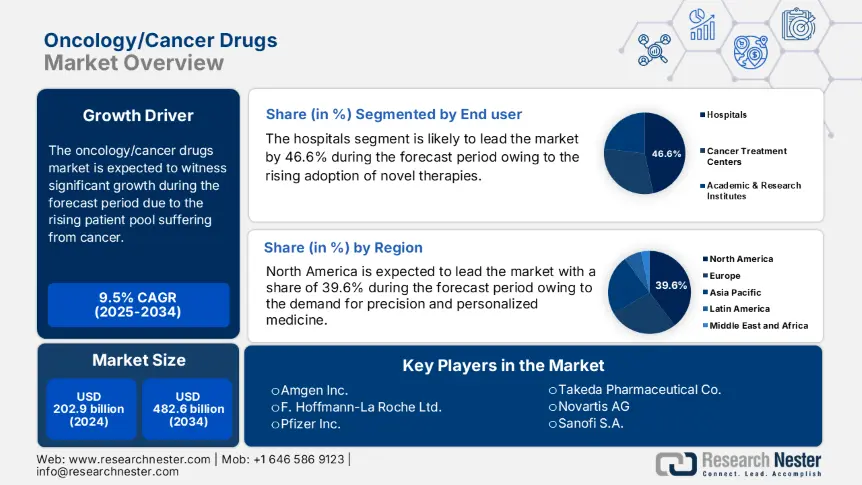

Oncology/Cancer Drugs Market size was valued at USD 202.9 billion in 2024 and is projected to reach USD 482.6 billion by the end of 2034, rising at a CAGR of 9.5% during the forecast period, i.e., 2025-2034. In 2025, the industry size of oncology/cancer drugs is evaluated at USD 221.3 billion.

The global oncology/cancer drugs market is driven by the rising patient pool suffering from cancer and advancements in cancer therapies to address the rise in the incidence and increasing challenges. As per the WHO February 2024 report, 1 in 5 individuals develop cancer, with approximately 1 in 12 women and 1 in 9 men dying from cancer. Further, the WHO report has also stated that nearly 39% of the survey’s participating countries cover the basic management of cancer as part of their healthcare budget. With the growing population in emerging and developed countries, there is a rise in the causes of cancer, such as alcohol, smoking, changes in diet, and others.

On the production side, there are nearly 568 cancer drugs globally, out of which 35% were launched in 2022, based on the report published by BMJ Global Health in October 2024. Furthermore, in 2024, the FDA issued approvals for 60 oncology products, including 9 new therapies into the oncology/cancer drugs market. The approvals have expanded the molecular alterations targeted for cancer cells. For instance, on October 2024, the FDA approved Zolbetuximab, an antibody to target protein claudin 18.2 and enhance the treatment outcome among cancer patients. Moreover, advancements in precision medicine and biomarker therapies are surging the development of oncology treatments customized to individual patient profiles.

Oncology/Cancer Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Rising incidence of cancer cases: The American Cancer Society has analyzed the new cancer cases that emerge every year and the deaths that occur, with the recent data on population based on cancer occurrence. According to an article published by NLM in February 2024, the National Center for Health Statistics has stated that in the U.S., nearly 2,001,140 new cases and 611,720 deaths from cancer were registered in the same year. The report further states that though the deaths due to cancer have decreased since 2021, there is always a threat on the rise in the increasing incidence of cancer for the top 6 cancers impacting the market growth. This rise demands enhanced oncology treatments, preventive measures, and diagnostic solutions.

- Rising role of precision medicine: As per the report from NLM, precision and personalized medicine have the potential to reduce the risk and cost during the cancer drug discovery and development. Further, the report has stated that nearly 11 % of drugs have entered phase I clinical trials with FDA approval. Moreover, these precision and personalized medicines help to target the cancer cells and block their growth, resulting in improved therapeutic outcomes. Hence, it is the most effective and personalized treatment compared with traditional therapies, resulting in shaping the future of cancer care customized to patient-specific approaches.

- Growing innovations in R&D: Globally, both public and private sectors are actively investing and improving the standard of care in cancer treatment with various innovations in the drug formulation. People suffering from cancer are improving their quality of life with these innovative drug therapies. Further, Pfizer, the leading player in the oncology/cancer drugs drug market, depicts that nearly 40% of its R&D investment is allocated to oncology, estimating over 50 programs in development of cancer drug and 25 in new molecular entities. The rise in oncology R&D is accelerating the discovery of innovative therapies and expanding treatment options for all regions.

Historical Patient Growth Analysis: Foundation for Future Oncology/Cancer Drugs Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

2010 (Million Patients) |

2020 (Million Patients) |

Growth (%) |

|

U.S. |

9.9 |

14.5 |

48.1% |

|

Germany |

2.6 |

3.8 |

52.5% |

|

France |

2.4 |

3.4 |

50.3% |

|

Spain |

1.8 |

2.7 |

57.5% |

|

Australia |

1.1 |

1.9 |

58.8% |

|

Japan |

4.1 |

5.6 |

42.4% |

|

India |

1.9 |

3.9 |

112.3% |

|

China |

4.8 |

9.2 |

97.9% |

Sources: SER.cancer, gco.iarc.fr, Santé publique France, isciii, AIHW, ganjoho, ncdirindia, chinacdc

Manufacturer Strategies Shaping Oncology/Cancer Drugs Market Expansion

Revenue Opportunities for Manufacturers

|

Company |

Strategy |

Market Share Growth |

Revenue Impact (USD) |

|

Merck |

Expanded Keytruda indications (FDA.gov) |

+4.6% (US/EU) |

+$2.4 billion |

|

Roche |

Companion diagnostics integration |

+3.8% (APAC) |

+$1.8 billion |

|

Novartis |

Launched radioligand therapy (FDA.gov) |

+2.9% (EU/US) |

+$950.3 million |

|

Pfizer |

Oncology AI alliances (NIH.gov) |

+3.2% (Global) |

+$1.4 billion |

|

AstraZeneca |

Immunotherapy combo approval |

+2.5% (EMEA) |

+$860.3 million |

|

Bristol-Myers |

Expanded CAR-T access |

+2.7% (US) |

+$780.5 million |

|

BeiGene |

Localized PD-1 launch in China |

+6.1% (China) |

+$670.4 million |

|

Eisai |

Co-commercialized with Merck |

+2.1% (Japan/US) |

+$510.6 million |

Source: FDA, NIH, Cancer.gov

Challenges

- Lack of diagnostic services in emerging nations: The major barrier in the oncology/cancer drugs market is the lack of diagnostic services in the low- and middle-income nations. Most of the people in the underdeveloped region die without any proper diagnosis of the disease and treatment options. In Sub-Saharan Africa, there is limited or restricted access to effective target therapies related to cancers. Further enhanced molecular profiling is also limited in certain regions of Rwanda and Sub-Saharan Africa. Hence, there is an urgent need for sufficient operational detail and effective implementation of easily available anticancer treatment in all regions.

- Rising cancer drug costs: Though there are many innovative and improved drugs for cancer patients, the cost is a major challenge faced by most people in emerging nations. The rising cost of the cancer drugs have become a burden to patients, societal resources and health systems. As per the Medscape article dated June 2025, the launch price of cancer drugs in 2014 was USD 10,954, which significantly rose to USD 27,891 between 2023 and 2025. This inflation has highly impacted the drug price, with the rise from 14.8% to 200.9% according to the Medicare formulary. This disproportionate rise has led many people to discontinue their treatment, resulting in delayed diagnosis or high death rates.

Oncology/Cancer Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

9.5% |

|

Base Year Market Size (2024) |

USD 202.9 billion |

|

Forecast Year Market Size (2034) |

USD 482.6 billion |

|

Regional Scope |

|

Oncology/Cancer Drugs Market Segmentation:

End user Segment Analysis

In the end user segment, hospitals lead the oncology/cancer drugs market and are poised to hold the market share of 46.6% by 2034. The hospital sub-segments dominate due to a rise in the patient pool suffering from cancer, reimbursement initiatives, and the adoption of novel therapies. As per the MOHFW report, the Ministry of Health and Family Welfare has been allocated Rs 99,858.56 crore, out of which the Department of Health Research is allocated Rs 3,900.69 crore and Rs 95,957.87 crore for the Department of Health and Family Welfare. Additionally, the government intends to build 200 Day Care Cancer Centers by 2025–2026 in all district hospitals throughout in the next three years. Moreover, strategic policies, interventions, and financial assistance schemes are scaling up to enhance patient outcomes nationwide.

Distribution Segment Analysis

Under the distribution channel, the hospital pharmacies lead the segment and are expected to hold the oncology/cancer drugs market share of 44.9% by 2034. Hospital pharmacies play a crucial role in the cancer drug market by distributing and administering complex cancer treatments. Further, with the rise in cancer patients’ hospitalization in the healthcare sector, hospital pharmacies ensure to provide the required drug, dosing, and administration to the patients. They are equipped to manage complex cancer therapies and maintain proper treatment management to support patients’ quality of care.

Drug Type Segment Analysis

In the drug type segment, targeted therapy dominates the segment and is expected to hold the oncology/cancer drugs market share value of 40.1% by 2034. The segment is accelerated by the development of targeted drugs drug approvals. Further, in the technologically advanced era, targeted therapy is one of the successful new classes of anti-cancer therapies. The FDA has approved several drugs between 2022 to 2025. In January 2025, as per the National Cancer Institute report, the FDA approved Adagrasib, a drug to treat colorectal cancer among elderly adults. Though there are several approved drug therapies globally, development in targeted therapies is surging due to effective genetic mutations and molecular pathways in cancer.

Our in-depth analysis of the global oncology/cancer drugs market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Drug Type |

|

|

Cancer Type |

|

|

Therapy Type |

|

|

Distribution Channel |

|

|

Route of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oncology/Cancer Drugs Market - Regional Analysis

North America Market Insights

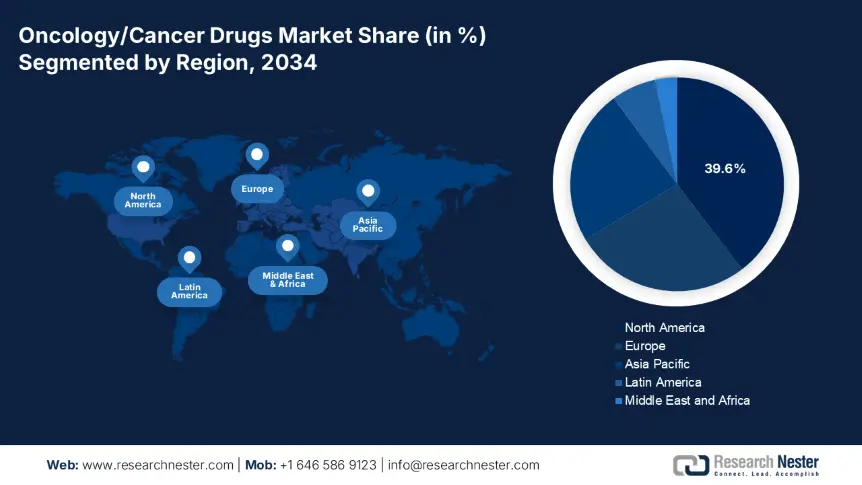

The oncology/cancer drugs market in North America is dominating and is expected to hold the market share of 39.6% at a CAGR of 9.1% by 2034. The market is driven by rising cancer patients, demand for precision and personalized medicine, and first-line detection and treatment. Aligning with the May 2025 NIH report, the number of cancer cases registered in the U.S. is 2,041,910 in 2025, out of which 618,120 people have a severe condition. The market in North America has a robust healthcare infrastructure with a dominating pharmaceutical company influencing high R&D investments and strong government regulations to drive the market.

The U.S. oncology/cancer drugs market is experiencing growth with the robust healthcare infrastructure and rising cancer patients. One of the rising cancers in the U.S. is breast cancer, with the people 316,950 new cases of invasive breast cancer in women and 2,800 cancer cases in men. Further, the American Cancer Society also stated in its Cancer Facts and Figures 2025 report that nearly 42,680 breast cancer deaths are expected to occur by the end of 2025. The American Cancer Society collaborated with Cervical Cancer Action for Elimination (CCAE) in 2025, a global initiative working to eliminate cervical and other HPV-related cancers worldwide. To progress this, the U.S. is actively implementing various initiatives for patients to access anti-cancer medicine and cancer education to improve quality care.

The Canada oncology/cancer drugs market is accelerating with the rise in cancer prevalence and innovative therapies in the country. Canada has a strong pipeline for drugs, especially driving the market. According to the article published by Patented Medicine Prices Review Board in June 2025, the country is developing various innovative medicines with variations in formulation. Canada has introduced more than 40 new drugs over the past ten years, and the cost for oncology treatment ranges from $10,000 per year $5,000 per 28-day cycle. Further, the publicly funded healthcare system in Canada supports for cancer drug funding process.

Asia Pacific Market Insights

The APAC is the fastest-growing region in the oncology/cancer drugs market and is poised to hold the market share of 23.4% at a CAGR of 10.8% by 2034. The market is driven by rising healthcare costs, an increase in the occurrence of cancer, and an improvement in healthcare infrastructure. According to the article published in American Society of Clinical Oncology, nearly half of the cancer cases are registered in the APAC region, with more than 58% of the cancer deaths occurring in the region. Further, the NLB article published in March 2023 on cancer estimates and projection for the year 2022 states that China is leading the record in cancer cases, and India ranks third after China. The region is actively planning, monitoring, and implementing cancer control initiatives across the region to provide a quality lifestyle among the people.

India is addressing different variations in the healthcare sector, such as infrastructure, affordability, and coverage. The NLB article published in March 2023 has depicted that nearly 1.46 cancer cases are registered in India, demanding targeted therapies. Additionally, many people are uninsured and face healthcare expenses. To address out-of-pocket costs, the government of India has initiated the Ayushman Bharat PM-JAY initiative to provide INR 5 lakh per family every year. The scheme has benefited 4.5 crore families in the country. To address out-of-pocket costs, the government of India has initiated the Ayushman Bharat PM-JAY initiative to provide INR 5 lakh per family for a year and has benefited 4.5 crore families in the country. Furthermore, according to the Invest India article published in November 2023, the Pharma Vision 2047 program aims to make India a global leader in producing high-quality and innovative pharmaceuticals and medical devices.

China is a significant producer and consumer of cancer treatment drugs. The nation is actively implementing various innovative formulations in cancer drugs. Further, China's oncology/cancer drugs market is driven by increased cancer screening, national policy reforms, and rising demand for innovative treatments. As per the NLB article published in February 2022 on cancer statistics in China, the cancer cases and deaths in China are increasing, with age-specific rates and 35 new types of cancer. In China, nearly 4,820,834 cancer cases were registered in 2022, with the leading case as lung cancer. Hence, this rise in the rates benefits the country in adopting new preventive measures, including innovative drug formulation.

Country-wise Government Provinces

|

Country |

Initiative / Program |

Type |

Launch Year |

Investment Value |

|

Australia |

National Oncology Medicare Benefits Expansion |

Budget Allocation (Screening & Drug Access) |

2023 |

AUD 1.8 billion |

|

Japan |

4th Basic Cancer Control Plan |

National Policy & Precision Medicine Fund |

2023 |

¥140.4 billion |

|

South Korea |

Moonshot Project – Precision Oncology |

Government R&D Funding |

2021 |

₩800.6 billion |

|

Malaysia |

National Strategic Plan for Cancer Control |

Policy Framework + Drug Subsidies |

2022 |

MYR 210.4 million |

Sources: Australia: AIHW, ganjoho, nih, moh

Europe Market Insights

The oncology/cancer drugs market is expanding rapidly in Europe region and is anticipated to have a market share of 26.8% at a CAGR of 8.8% by 2034. The market is fueled by a rise in R&D, innovative therapies, and supportive reimbursement policies. According to a report published by the OECD in September 2024, the European Union and European Economic Area, together in 2021 and 2022, witnessed the approval of 17 and 15 new cancer medicines. Additionally, the number of extensions approved for new indications has increased in recent years. The research pipeline in oncology signals that this development will probably be continued shortly. Further, the cancer research pipeline indicates that this trend is likely to continue in the foreseeable future.

The UK oncology/cancer drugs market experiences steady growth and is fueled by increasing cancer incidence, NHS initiatives, and accelerated regulatory approvals to expand innovative therapies. As the cancer cases rise in the UK, alternative options open the door to support investment in early diagnosis and targeted therapies. Further, the House of Common Library in July 2025 has stated that the public sector and third sector have spent a total of £469 million on cancer research in 2022. Moreover, the largest funder of cancer drugs was Cancer Research UK, by provided £221 million in 2022. The nation is actively investing in R&D to be a dominant player in the cancer drug market.

Germany demands the oncology/cancer drugs market, with the rising cases registered mostly in men. As per the OECD report in 2025, the country has reported that breast cancer is the leading registered cancer, stating more than 50% of women have experienced it in the past decade. Further, Germany is implementing various methods to improve survival and provide quality care among the cancer-affected patients. Moreover, rehabilitation centers and financial support are also provided to patients. Further the OECD data in 2025 has also depicted that in Germany, all high-benefit cancer medicines are publicly covered, while similar countries only cover about 75%. Also, 90% of cancer drug biosimilars are reimbursed in Germany, much higher than the 63% average in peer nations.

Government Investments, Policies & Funding

|

Country |

Initiative / Program |

Investment Value |

Launch Year |

|

Spain |

Strategic Framework for Cancer Care |

€780.4 million |

2021 |

|

France |

INCa 10-Year Cancer Plan (2021–2030) |

€2.2 billion |

2021 |

|

Italy |

National Oncology Network Digitalization Program |

€650.4 million |

2023 |

Sources: mscbs, e-cancer, salute.gov

Key Oncology/Cancer Drugs Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global oncology/cancer drugs market is competitive, with leading manufacturers including Roche, Bristol-Myers Squibb, and Merck & Co., together holding a share of over 25.6%. These players innovate various trends in precision medicine, immunotherapy, and AI-based discovery platforms. Strategic initiatives such as acquisitions, global licensing deals, and regional expansion in Asia Pacific are driving the market. Further companies in India and South Korea are providing biosimilars and generics to the underserved market. Moreover, the regulatory programs, including orphan drug designations and faster FDA approvals, shape the market to be a more competitive and innovative landscape.

Below is the list of some prominent players operating in the global oncology/cancer drugs market:

|

Company Name |

Country of Origin |

Market Share (%) |

Industry Focus |

|

Roche |

Switzerland |

9.2% |

Targeted therapies (Herceptin, Tecentriq), immuno-oncology |

|

Merck & Co. |

USA |

8.6% |

Checkpoint inhibitors (Keytruda), cancer vaccines |

|

Bristol-Myers Squibb |

USA |

7.9% |

Immunotherapies (Opdivo, Yervoy), CAR-T therapies |

|

Pfizer Inc. |

USA |

6.8% |

Precision oncology (Ibrance), biosimilars |

|

Novartis AG |

Switzerland |

6.5% |

Radioligand therapies (Kymriah), breast cancer drugs |

|

AstraZeneca |

UK |

xx% |

Lung and breast cancer drugs (Tagrisso, Enhertu) |

|

Johnson & Johnson |

USA |

xx% |

Hematologic malignancies (Darzalex), combination regimens |

|

Eli Lilly and Co. |

USA |

xx% |

Breast/lung cancer (Verzenio), targeted therapies |

|

Sanofi |

France |

xx% |

ADCs, prostate/breast cancer pipeline |

|

Amgen Inc. |

USA |

xx% |

Immunotherapies (Blincyto), biosimilars |

|

BeiGene |

China |

xx% |

PD-1 inhibitor (Tislelizumab), APAC expansion |

|

Ipsen |

France |

xx% |

Neuroendocrine tumor drugs (Somatuline Depot) |

|

Dr. Reddy’s Laboratories |

India |

xx% |

Generics, biosimilars for emerging markets |

|

CSL Behring |

Australia |

xx% |

Hematologic and rare blood cancer therapies |

|

Pharmaniaga Bhd |

Malaysia |

xx% |

Oncology biosimilars, regional ASEAN expansion |

Sources: FDA, ASCO, EMA, Cancer.gov

Below are the areas covered for each company in the oncology/cancer drugs market:

Recent Developments

- In September 2024, Eli Lily and Co. launched selpercatinib for pediatric and adult patients with advanced thyroid cancer. The FDA approved selpercatinib for patients aged 2 to 12 and older.

- In September 2024, Roche announced the approval of Tecentriq Hybreza, the first subcutaneous anti-PD-(L)1 cancer immunotherapy. The launch has reduced the treatment time to 7 min from 30 to 60 min for IV infusion

- Report ID: 7920

- Published Date: Jul 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oncology Cancer Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert