Oil Storage Terminal Market Outlook:

Oil Storage Terminal Market size was over USD 35.19 billion in 2025 and is projected to reach USD 52.09 billion by 2035, growing at around 4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oil storage terminal is evaluated at USD 36.46 billion.

The significantly increasing infrastructure development activities across the world are directly fueling the oil trade. The booming consumption of oil is further anticipated to drive the sales of storage and transportation technologies in the years ahead. The International Energy Agency (IEA) underscores that the oil demand is estimated to cross 1 mb/d in 2025, up from 830 kb/d in the previous year. The emerging economies are dominating the global oil demand, and Asia captured around 60.0% of the total share. The high consumption of petrochemical feedstocks is also backing the dominance of the region.

In February 2025, the global oil supply increased by 103.3 mb/d, and was driven by the organization of the petroleum exporting countries (OPEC). Kazakhstan pumped a high demand, and Iran and Venezuela also dominated the flows despite strict sanctions. The U.S. is currently leading the production and supply of crude oil, followed by Canada, Brazil, and Guyana. Mexico and Canada accounted for 70.0% of U.S. crude oil imports in 2024. The increasing energy demand is contributing to the high consumption of oil. The steady use of petroleum feedstocks in the majority of countries is also emerging as a profitable driver for the sales of oil storage terminal technologies.

Key Oil Storage Terminal Market Insights Summary:

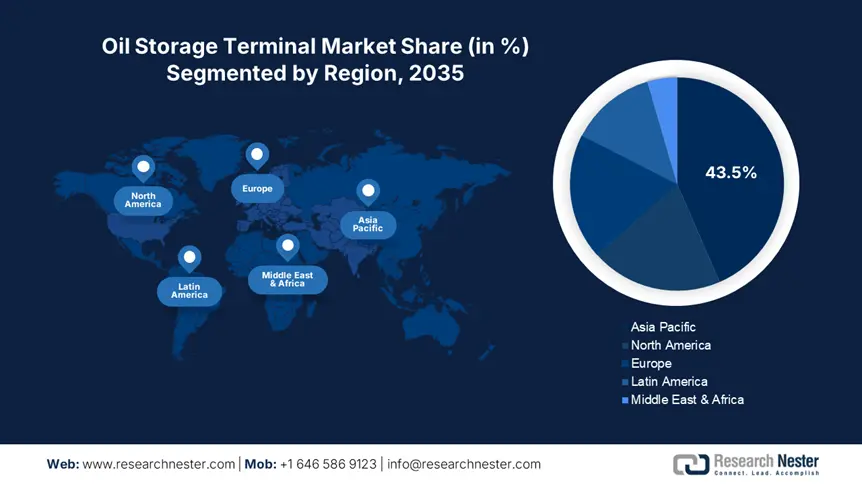

Regional Highlights:

- Asia Pacific commands a 43.5% share of the Oil Storage Terminal Market, propelled by robust industrial and urban activities fueling energy demand, driving significant growth through 2026–2035.

- North America’s oil storage terminal market is expected to experience rapid growth through 2026–2035, driven by huge crude oil reserves and high hydrocarbon exploration activities.

Segment Insights:

- Strategic Reserves segment are projected to hold a 67.8% share by 2035, driven by energy security needs and government-backed investments.

- The refineries segment is expected to hold a 44.5% share by 2035, fueled by its role as a primary oil storage solution amid rising demand.

Key Growth Trends:

- Growth in offshore hydrocarbon exploration

- Profitable opportunities lie in greenfield and brownfield terminal projects

Major Challenges:

- Highnvestments and maintenance costs

- Changes in trade policies

- Key Players: Venture Global, AltaGas Ltd., Royal Vopak N.V., Belco Manufacturing, and Brooge Energy Limited.

Global Oil Storage Terminal Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 35.19 billion

- 2026 Market Size: USD 36.46 billion

- Projected Market Size: USD 52.09 billion by 2035

- Growth Forecasts: 4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Singapore, Japan, Netherlands

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Oil Storage Terminal Market Growth Drivers and Challenges:

Growth Drivers

- Growth in offshore hydrocarbon exploration: The rising offshore hydrocarbon exploration activities are creating a lucrative space for floating oil storage and transportation companies. Continuous technological advancements and the integration of improved digital technologies are augmenting the oil storage terminal market growth. The supportive government policies and investment strategies are expanding the deepwater hydrocarbon exploration projects worldwide. For instance, the research of Global Energy Monitor highlights that currently, many new oil and gas extraction farms are being explored in the oceans. The Nokhatha and Mopane fields are the largest offshore projects globally. The new farms are poised to provide around 8.0 billion barrels of oil equivalent (bboe) of resources in the years ahead. The same source also projects that over 80.0% of the new farms are of offshore hydrocarbons.

- Profitable opportunities lie in greenfield and brownfield terminal projects: The increasing public-private investments in the greenfield and brownfield terminal projects are creating lucrative earning opportunities for oil storage terminal companies. The need for modern infrastructure and enhanced capacity is driving installations of advanced oil storage technologies. The developing regions are opening lucrative doors for oil storage terminal companies. In April 2023, ExxonMobil Corporation announced its final investment verdict for the Uaru development offshore Guyana, particularly after the needed regulatory approvals. The 5th project of the company in Guyana’s offshore is estimated to add around 250,000 barrels of daily capacity from 2026.

Challenges

-

Highnvestments and maintenance costs: The oil storage terminal is a highly capital-intensive business, which majorly deters new companies and small-scale players from expanding their operations. The advanced technologies and modern infrastructure require hefty upfront investments. Apart from th iese, the high maintenance costs are also a financial barrier for budget-constrained companies. Strategic collaborations and partnerships are estimated to aid these companies in sustaining their market positions and expanding business operations in the years ahead.

-

Changes in trade policies: The changes in the trade strategies of the oil-producing countries influence the revenue growth of the key market players. The recent tariff implementations by the U.S. created trade tensions between several countries. Market volatility also hampers investments in the oil sector, further challenging the production and commercialization of manufacturing and storage technologies. The integration of digital technologies and public-private strategies is likely to overcome this issue.

Oil Storage Terminal Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4% |

|

Base Year Market Size (2025) |

USD 35.19 billion |

|

Forecast Year Market Size (2035) |

USD 52.09 billion |

|

Regional Scope |

|

Oil Storage Terminal Market Segmentation:

Type (Strategic Reserves, Commercial Reserves)

The strategic reserves are estimated to account for 67.8% of the global oil storage terminal market share by 2035. Energy security and stable prices are prime factors driving the oil exploration from strategic reserves. During the period of sudden disruptions and geopolitical instability, strategic reserves help in securing energy security. These reserves owned by the governments offer lucrative gains through the strategic public-private investment strategies. The U.S. Energy Information Administration (EIA) projects that the stock of crude oil in the strategic petroleum reserves increased from 358,013 thousand barrels in January 2024 to 395,064 thousand barrels by January 2025.

Application (Refineries, Commercial Use, Residential/Industrial Heating, Others)

The refineries are poised to capture 44.5% of the global oil storage terminal market share throughout the forecast period. The main driver uplifting the position of refineries is their vital role as primary oil storage facilities for consumers and end users. The U.S. EIA report states that the global oil refining capacity amounted to 103.5 million barrels per day in 2023. Asia Pacific (China and India) and the Middle East are leading the refined product output. Furthermore, the short-term energy outlook of the same source underscores that the world consumption of petroleum and liquid fuels totaled 103 million b/d in 2024 and is anticipated to reach 105 million b/d by 2028. This steady growth is directly uplifting the position of the refineries as the prime oil storage facilities.

Our in-depth analysis of the global oil storage terminal market includes the following segments:

|

Type |

|

|

Tank Type |

|

|

Material |

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oil Storage Terminal Market Regional Analysis:

Asia Pacific Market Forecast

The Asia Pacific oil storage terminal market is projected to hold 43.5% of the global revenue share through 2035. The robust industrial and urban activities fueling energy demand are creating a high-earning space for oil storage terminal companies. The supportive government policies for hydrocarbon production and commercialization are likely to augment the demand for advanced oil storage solutions. China and India lead the crude oil production and consumption owing to ongoing infrastructure development projects. Dominance in technological innovations is estimated to uplift the market position of Japan and South Korea in the years ahead.

The strategic partnerships with high-tech companies are increasing the revenue growth chances of oil storage terminal companies in China. Public-private collaborations and investments in new deepwater hydrocarbon reserve exploration are set to boost the country’s position in the Asia Pacific oil storage terminal market. For instance, in March 2025, new deepwater hydrocarbons were discovered in the Beibu Gulf of the South China Sea by the China National Offshore Oil Corporation (CNOOC). The reserve is estimated to offer nearly 13.2 million cubic feet of natural gas and 800 barrels of crude oil per day once it starts its operations. Such exploration moves are directly fueling a high demand for oil storage terminals.

The oil production and consumption in India are poised to register a boom in the years ahead. The India Brand Equity Foundation (IBEF) study highlights that the oil demand in the country is expected to increase at 2x growth to reach 11 million b/d by 2045. The demand for diesel is foreseen to cross 163 MT by 2029-30, with gasoline and diesel representing around 58.0% of the country’s oil demand. Furthermore, the consumption of natural gas reached 25 billion cubic metres in 2024. Also, the government is aiming to commercialize 50.0% of its strategic petroleum reserves by raising funds with the motive to construct extra storage tanks to reduce high oil prices. Overall, investing in India is a win-win opportunity for oil storage terminal companies.

North America Market Statistics

The North America oil storage terminal market is likely to register the fastest CAGR from 2026 to 2035. The huge crude oil reserves, continuous investments in technological advancements, and high hydrocarbon exploration activities are contributing to the oil storage terminal trade. The cross-border oil exploration and trade activities are directly boosting the revenues of the key market players. The increasing investments in offshore hydrocarbon exploration activities are also augmenting the sales of floating storage units. Canada and the U.S. are both the most lucrative marketplaces for oil storage solution manufacturers.

The increasing crude oil production and sales are amplifying the sales of effective and efficient storage solutions in the U.S. The EIA study estimates that the liquid fuels production is poised to experience a boom in 2025 and 2026. The field production of crude oil is expected to rise from 12.554 thousand barrels per day to 13.146 thousand b/d between January 2024 to 2025. The strong presence of strategic oil reserves is also promoting the sales of storage terminals in the country.

The increasing production and commercialization activities of deepwater hydrocarbons are anticipated to propel the sales of oil storage solutions in Canada. For instance, the EIA analysis highlights that the U.S. witnessed 97.0% of the hydrocarbon gas liquids imports from Canada in FY 2022. The robust neighboring trade is offering double-digit percent revenue growth opportunities to oil storage terminal companies. Furthermore, the country’s offshore exploration is foreseen to hold 4.0% of the total oil production, according to the Canadian Association of Petroleum Producers (CAPP). The easy and efficient availability of offshore landscapes such as Newfoundland and Labrador, Hibernia, Terra Nova, and Hebron is further backing the overall market growth.

Key Oil Storage Terminal Market Players:

- Venture Global

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AltaGas Ltd.

- Royal Vopak N.V.

- Belco Manufacturing

- Brooge Energy Limited

- Buckeye Partners L.P.

- CIM-CCMP Group

- CLH Group

- Containment Solutions, Inc.

- Ergon International Corp.

- Horizon Terminals Ltd.

- Koole Terminals B.V.

- LBC Tank Terminals

- Odfjell SE

- Oiltanking GmbH

- Olivia Petroleum

- S.A.U.

- Oman Tank Terminal Company

- Puma Energy Group

- Shell Oil Company

- Vitol Group

The leading companies in the oil storage terminal market are employing several organic and inorganic strategies to earn high profits and propel their reach. They are investing in research and development activities to enhance the capabilities of storage terminals by integrating digital technologies. They are also forming strategic collaborations with other players to increase their customer base. The industry giants are also entering into partnerships with public entities to secure their sales growth. Investments in deepwater hydrocarbon exploration and emerging economies are set to double the revenues of oil storage terminal companies in the coming years.

Some of the key players include:

Recent Developments

- In April 2025, Venture Global revealed the commercialization of its LNG export project, Calcasieu Pass. This multi-billion-dollar contract project is poised to positively influence the US balance of trade with several European allies.

- In May 2024, AltaGas Ltd. and Royal Vopak N.V. entered into an investment strategy for the Ridley Island Energy Export facility. This move is expected to boost Canada’s position in the large-scale liquefied petroleum gas (LPG) and bulk liquids terminal activities.

- Report ID: 7589

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oil Storage Terminal Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.