Oil-Free Air Compressor Market Outlook:

Oil-Free Air Compressor Market size was over USD 11.43 billion in 2025 and is projected to reach USD 18.44 billion by 2035, growing at around 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oil-free air compressor is evaluated at USD 11.93 billion.

The growth of the market can be attributed to growing prevalence of oil leakage from air compressor. An air compressor may experience significant mechanical failure, air leakage, or oil leaks. About 2 million litres of water could become contaminated by just about 2 litre of oil. Oil pollution could have a severe impact on the aquatic ecosystem since it spreads across the surface in a thin layer, preventing oxygen from reaching the aquatic plants and animals. Hence, the demand for oil-free air compressor is growing, that is anticipated to boost the market’s growth.

Additionally, high temperatures could cause the oil lubricants used in air compressors to breakdown, emitting deadly levels of carbon monoxide. Moreover, strict government regulation in order to stop CO2 emission is also estimated to boost the demand for oil-free air compressor. The Indian government has pledged to cut CO2 emissions by 50% by 2050 and to zero by 2070. Oil-free compressors consists of benefits, such as: reducing hazardous emissions since the compressed air is as pure as possible and free of any particulate pollution, defending the environment against pollution, and notably lowering running. Hence, given this non-hazardous, secure method of air compression, numerous producers, manufacturers, and healthcare specialists are switching to oil-free air compressors.

Key Oil-Free Air Compressor Market Insights Summary:

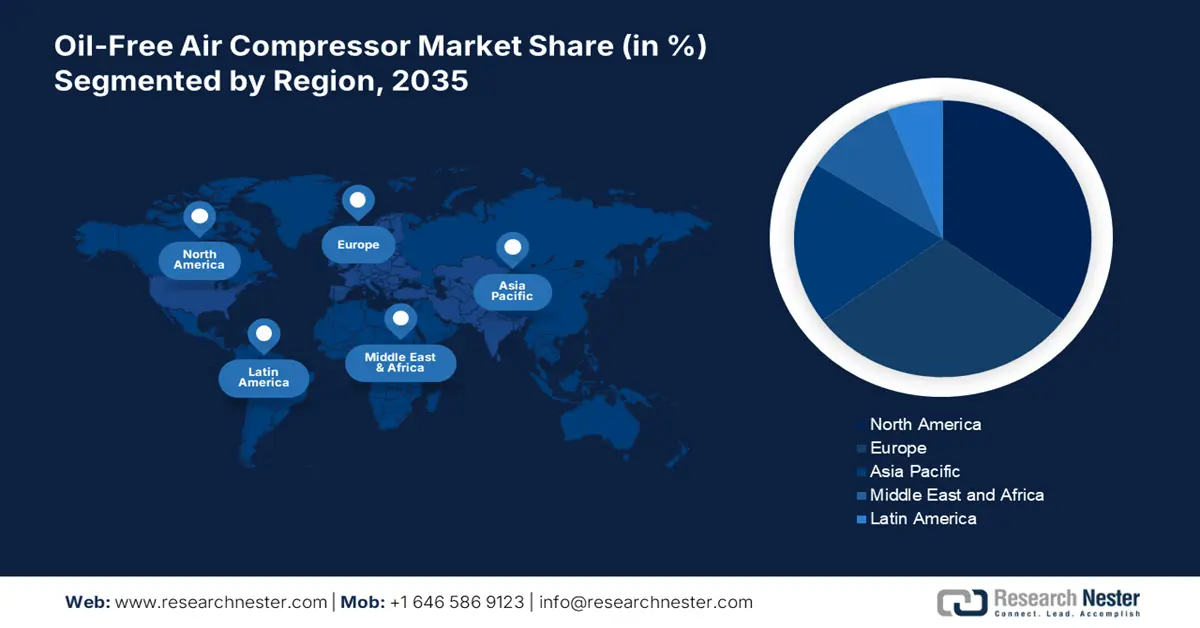

Regional Highlights:

- North America oil-free air compressor market holds the highest share by 2035, driven by industrial demand and reduced maintenance needs.

- Europe market records the highest CAGR during 2026-2035, attributed to energy-efficient compressors and environmental laws.

Segment Insights:

- The 15kw – below 55kw power segment in the oil-free air compressor market is expected to experience significant growth over 2026-2035, attributed to rising usage in chemicals, electronics, pharmaceuticals, and food & beverages industries.

- The automotive segment in the oil-free air compressor market is projected to hold the highest market share by 2035, driven by growing automobile production and increasing demand for paint and compressors.

Key Growth Trends:

- Growing Extraction of Oil & Gas

- Surge in Manufacturing of Medicines

Major Challenges:

- Oil-Free Compressor have Shorter Life-Span

- High Maintenance Cost

Key Players: Atlas Copco, FS Elliott Co. LLC, Hanwha Techwin Co., Ltd., Ingersoll Rand, Sullair, LLC, Sundyne, KAESER Kompressoren SE, Doosan Portable Power, Sullivan-Palatek, Inc., Quincy Compressor LLC.

Global Oil-Free Air Compressor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.43 billion

- 2026 Market Size: USD 11.93 billion

- Projected Market Size: USD 18.44 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 10 September, 2025

Oil-Free Air Compressor Market Growth Drivers and Challenges:

Growth Drivers

- Growing Extraction of Oil & Gas - In 2021, there were about 88 million barrels of oil produced day globally. With approximately 94 million barrels produced, oil production in 2019 reached a record high.

- Surge in Manufacturing of Medicines - About 36 new medications were authorized by the Center for Drug Evaluation and Research in 2022. (CDER). Each year, the number of new pharmaceutical goods approved for sale varies greatly. In 2016, little over 19 unique pharmaceuticals were released; in 2018, approximately 59 new products were released. About 49 new medications received clearance in 2021. Hence, the demand for oil-free air compressor is growing. Oil-free air compressors are employed in a variety of pharmaceutical applications, including the transportation of capsules and packing as well as the provision of factories with a consistent flow of breathable, clean air. Oil less compressors play a crucial role in the manufacturing of medicines, capsules, and other consumable goods, among other pharmaceutical industry activities. Given the stringent purity requirements for these products, using oil-free air compressors helps to prevent contamination in automated production lines and reduce rejection rates for packaging applications.

- Surge in Demand for Automobile - In 2022, the US auto industry sold almost 3 million vehicles. Almost about 12 million cars and light trucks were sold in total that year in the US. The number of vehicles sold in the US peaked in 2016 at around 16 million.

- Growth in Demand for Powder Milk - For the fiscal year 2020, India, a country in south Asia, produced more than 209 thousand metric tons of milk powder. Compared to the about 137 thousand metric tons in the fiscal year 2015, this was a significant increase. Food products, such as cocoa powder or powdered milk, are pushed along pipes using compressed air. However, the powder is expected to be combined with oil contamination, ruining the product. Hence, the demand for oil-free air compressor is estimated to increase.

- Upsurge in Demand for Can Food - In 2020, about 215 million of people consumed veggies in jars or cans in the United States. Compressed air is separated into oxygen and nitrogen during the air separation process. The food is then preserved using nitrogen in larger storage facilities, on ships, and in cans. As the nitrogen comes into direct touch with the foodstuff, the air must be completely devoid of oil. Hence, this is estimated to boost the preference for oil-free air compressor.

Challenges

- Oil-Free Compressor have Shorter Life-Span

- High Maintenance Cost - Oil-free air compressors, particularly rotary screw oil-free air compressors, also have greater maintenance expenses. Despite the fact that users may need to change fewer filters, the compression screws at the air-end are significantly more prone to break than those in a lubricated air compressor. This can result in very pricey repairs. Also, the oil-free rotary screw air compressor compresses in two stages rather than one, which could result in a double-digit increase in repair costs.

- Compared to Oil-Lubricated Air Compressors, Oil-Free Air Compressors Produce More Heat and Noise

Oil-Free Air Compressor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 11.43 billion |

|

Forecast Year Market Size (2035) |

USD 18.44 billion |

|

Regional Scope |

|

Oil-Free Air Compressor Market Segmentation:

Application Segment Analysis

The global oil-free air compressor market is segmented and analyzed for demand and supply by application into home appliances, food & beverage, electronics, automotive and healthcare. Out of which, the automotive segment is anticipated to garner the highest revenue by the end of 2035. The growth of the segment can be attributed to growing production for automobile all around the world. Around 8 million motor vehicles were created in the US in 2021. Over 79 million motor vehicles were built worldwide in the same year. Global motor vehicle manufacturing rose by more than about 2% in 2021 compared to the previous year. Hence, the demand for paint is growing, further boosting the market growth. Paint is applied using robots or paint guns and is propelled onto clean metal surfaces such as vehicle bodywork using compressed air. Oil in compressed air reduces adhesion or results in beading, which lowers the finish's quality. Hence, the demand for oil-free air compressor is high. Moreover, to stop the paint from coagulating, compressed air stirs it. Furthermore, it mixes the paint, ensuring consistency all throughout the bath. However, paint disintegrates into oil in compressed air, which negatively impacts paint adhesion and quality. Hence, the preference of automobile sector for oil-free air compressor is more.

Power (Below 15KW, 15KW - Below 55KW, 55KW - 1 0 KW, Above 160KW)

The global oil-free air compressor market is also segmented and analyzed for demand and supply by power into below 15KW, 15KW – below 55KW, 55KW – below 160 KW, and above 160 KW. Amongst which, the 15KW – below 55KW segment is anticipated to have a significant growth over the forecast period, backed by its growing usage in industries such as chemicals, electronics, pharmaceuticals, and food & beverages. Moreover, there has been growing investment made in electronics sector which is also estimated to boost the segment growth. Additionally, there has been an increase in public awareness of poor air quality and its detrimental effects on the ecosystem. Manufacturers of oil-free air compressors are compelled to create energy-efficient devices as a result of the government's strict rules regarding environmental air protection and CO2 emissions.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Power |

|

|

By Technology |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oil-Free Air Compressor Market Regional Analysis:

North American Market Insights

The market share of oil-free air compressor in North America is projected to be highest by the end of 2035, backed by growth in industries such as manufacturing, healthcare, energy, and oil & gas, along with growing investment in these sectors. These compressors are highly favored for reasons that include such efficient operation at lower prices, superior performance at varying speeds, and a decreased need for repair and maintenance. Also, the oil-free air compressor market in the United States and Canada has remained close to saturation and would keep showing the same pattern without any obvious fall. Further, the growing automobile industry is this region is also estimated to boost the market for oil-free air compressor. Moreover, the demand for backed food such as cake, breads, biscuits, and more is growing. In 2020, about 325 million Americans ate bread. In 2024, this number is anticipated to rise to approximately 334 million. After baking, baked foods are removed from the oven and cooled using compressed air. Air contamination ruins the finished product, resulting in rejections and production losses. Hence, the demand for oil-free air compressor is high.

Europe Market Forecast

The European oil-free air compressor market is estimated to be the second largest, to grow at a highest rate. Conventionally, Europe has been among the most secure markets for oil-free air compressors. Despite varied sales across the region as a result of the unstable economic climate, it continues to be one of the largest markets for oil-free air compressors. With a number of manufacturing hubs, Germany and the United Kingdom continue to be the most promising nations for forthcoming sales and demand of oil-free air compressors. When compared to traditional air compressors, the oil-free air compressor uses less energy, which results in low carbon emissions and cost effectiveness over the course of the product life cycle. These compressors are projected to be more widely adopted in a variety of end user sectors in accordance with industry standards owing to their improved operational efficiency. The need for low-maintenance compressors has increased in Europe as a result of growing environmental consciousness and laws.

APAC Market Insights

Additionally, the market in Asia Pacific region is also estimated to have a significant growth over the forecast period. A multitude of new laws that are intended to ensure better air quality have been created as a response of growing environmental concerns. As a result, it is anticipated that there would be a significant increase in the demand for oil-free air compressor. Additionally, it is anticipated that increased interest in CO2 emissions reduction, energy recovery, and enhanced energy efficiency is anticipated to increase product demand in the region. Also, the market is expanding as a result of the growing demand for value-added services and the necessity to monitor compressed air systems.

Oil-Free Air Compressor Market Players:

- Atlas Copco

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- FS Elliott Co. LLC

- Hanwha Techwin Co., Ltd.

- Ingersoll Rand

- Sullair, LLC

- Sundyne

- KAESER Kompressoren SE

- Doosan Portable Power

- Sullivan-Palatek, Inc.

- Quincy Compressor LLC

Recent Developments

-

Improvements to its "fit-for-purpose" centrifugal compressors, which are used as fuel gas boosters for turbines generating electricity at refineries, chemical plants, hospitals, universities, and other industrial co-gen facilities, were announced by Sundyne, a global leader in the design and manufacture of mission critical pumps and compressors.

-

The newest effort by Atlas Copco to lessen the environmental impact of its activities is the investment in solar cells in India. Leading supplier of sustainable productivity solutions Atlas Copco begun relying nearly entirely on solar energy to run its compressor manufacturing in Chakan, India. The action helps Atlas Copco achieve its objective of continuously reducing the environmental effect of its operations. The construction of solar boilers on the roof of the service centre of the significant compressor plant in Antwerp, Belgium, is one of the most recent instances.

- Report ID: 4758

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oil-Free Air Compressor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.