Oil and Gas Data Monetization Market Outlook:

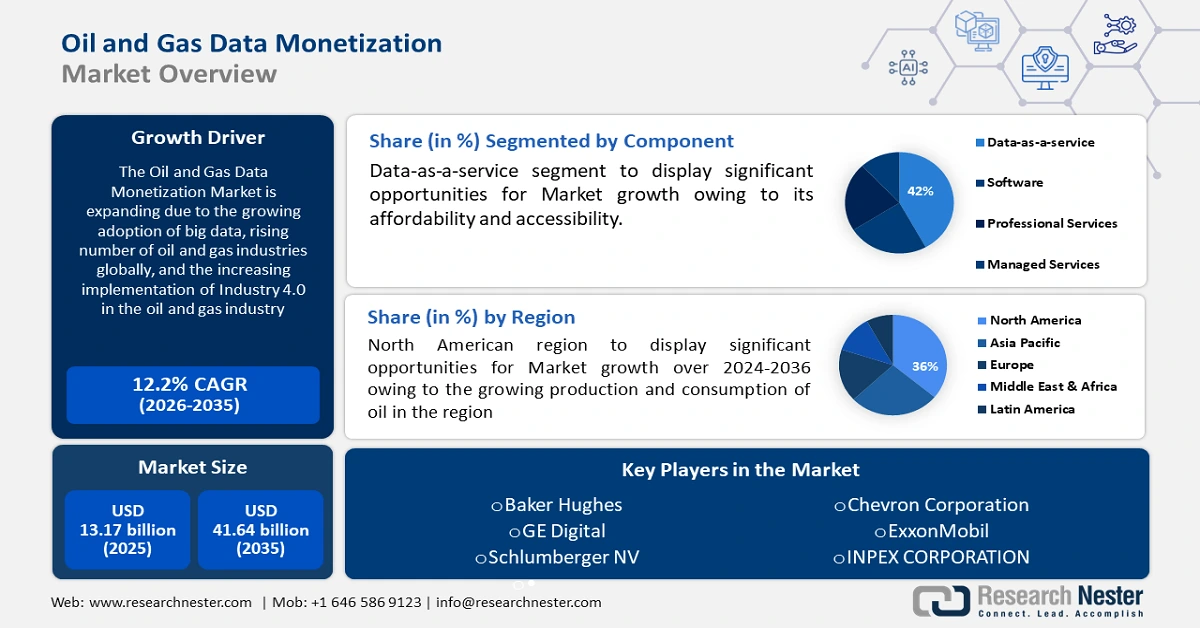

Oil and Gas Data Monetization Market size was over USD 13.17 billion in 2025 and is poised to exceed USD 41.64 billion by 2035, witnessing over 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oil and gas data monetization is estimated at USD 14.62 billion.

Potential avenues for data monetization include investing in renewable energy, cutting carbon emissions, and increasing operational transparency. Major oil and gas firms are expected to invest more than USD 4.6 billion in renewable energy projects by 2021, with offshore wind power generation accounting for more than half of total capital expenditure (USD 2.7 billion).

Companies make sure that, in the framework of changing data privacy laws, they safeguard the security and privacy of their stakeholders and consumers. It will take cross-industry cooperation, including alliances between oil companies and technology businesses, to fully monetize oil and gas data. All of these factors contribute to the oil and gas data monetization market growth.

Furthermore, oil and gas firms can use data monetization to leverage their current data sets and obtain insights into their operations. In addition to cutting expenses, it can raise safety regulations and customer satisfaction. Moreover, data monetization can help businesses discover new oil and gas data monetization market and customize goods and services to suit the wants of their clients. Data monetization can help oil and gas companies compete more successfully, in addition to finding new business opportunities and creating creative solutions.