Octafluoropropane Market Outlook:

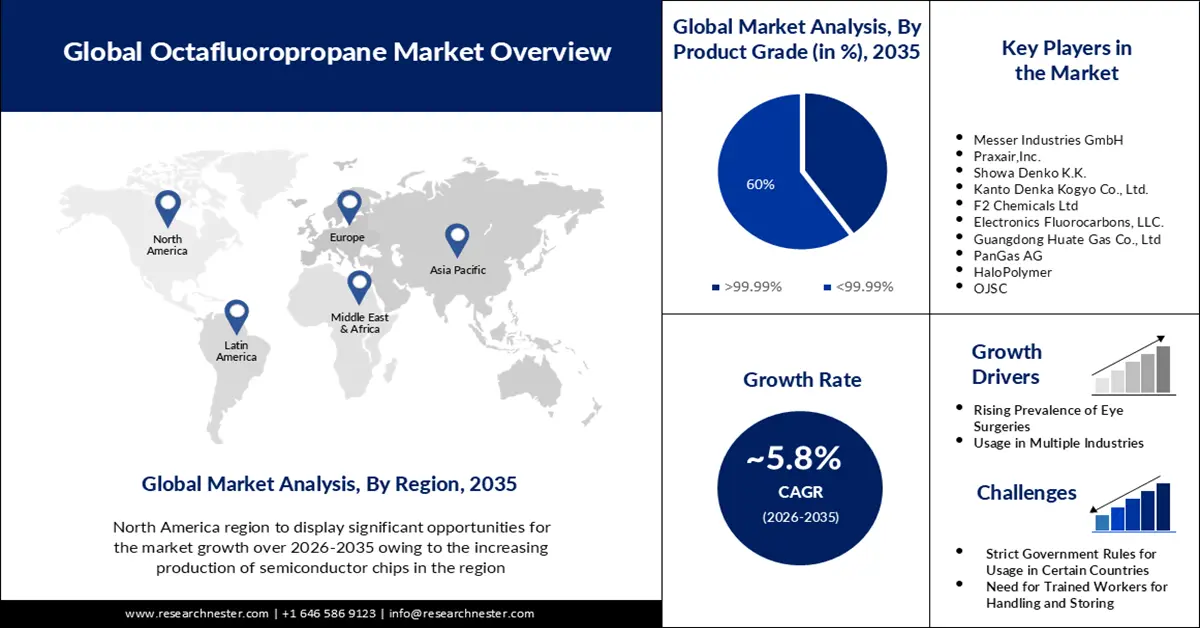

Octafluoropropane Market size was valued at USD 465.31 million in 2025 and is expected to reach USD 817.71 million by 2035, registering around 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of octafluoropropane is evaluated at USD 489.6 million.

The growth of the octafluoropropane market can be attributed to the growing demand for self-driving cars. Further, the rising demand for premium cars in both developed and emerging countries among people across the globe is also expected to add to the market growth. Additionally, octofluoropropane is utilized in semiconductors, which are used in the production of self-driving automobiles, as a plasma etching material. As per data, more than 1,000 self-driving cars are now operating on American roadways.

In addition to these, factors that are believed to fuel the market growth of the octofluoropropane market include the increasing need for octofluoropropane in the medical industry. For instance, in the world of medicine, the gas cores of the tiny contrast agents used in contrast-enhanced ultrasonography may be made of octafluoropropane. Furthermore, to enhance the backscatter of the ultrasonic signal, octafluoropropane microbubbles are utilized. Additionally, in echocardiography, activated octafluoropropane improves pictures of the borders or inner boundaries of the heart, creating a better picture that could help doctors diagnose patients more accurately. It is used in patients who have unsatisfactory echocardiograms to opacify the left ventricular chamber.

Key Octafluoropropane Market Insights Summary:

Regional Highlights:

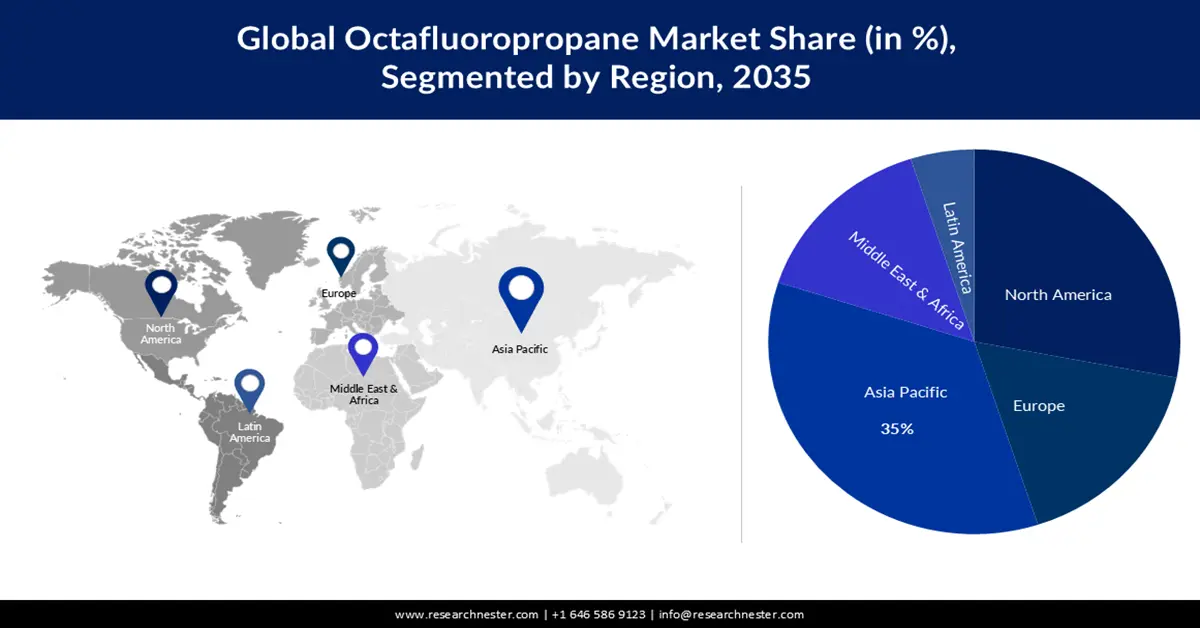

• By 2035, the Asia Pacific region is projected to command nearly 35% share of the octafluoropropane market, stemming from expanding semiconductor chip production.

• North America is anticipated to secure about 24% share by 2035, supported by escalating demand for advanced electronic components.Segment Insights:

• By 2035, the semiconductor segment is expected to capture around 28% share in the octafluoropropane market, propelled by rising semiconductor chip manufacturing.Key Growth Trends:

- Rising Smartphone Production and Demand for Electronics

- Growing Prevalence of Eye Surgeries

Major Challenges:

- Health Risks Might Result from Inhaling Fumes

- Strict Government Rules for Usage in Certain Countries

Key Players: Linde plc, Messer Industries GmbH, Praxair, Inc., Showa Denko K.K., Kanto Denka Kogyo Co., Ltd., F2 Chemicals Ltd, Electronics Fluorocarbons, LLC., Guangdong Huate Gas Co., Ltd, PanGas AG, HaloPolymer, OJSC.

Global Octafluoropropane Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 465.31 million

- 2026 Market Size: USD 489.6 million

- Projected Market Size: USD 817.71 million by 2035

- Growth Forecasts: 5.8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Mexico, Poland, Indonesia

Last updated on : 21 November, 2025

Octafluoropropane Market - Growth Drivers and Challenges

Growth Drivers

- Rising Smartphone Production and Demand for Electronics – On account of the growing phone usage across the globe, the market is expected to expand more in the upcoming years as octofluoropropane is considered a vital component in electrical design. Further, octofluoropropane is being utilized more often in semiconductor-based devices including computers, calculators, and cell phones which in turn boosts the demand for octofluoropropane. As of 2023, there are more than 6 billion smartphone users worldwide.

- Growing Prevalence of Eye Surgeries – The rising prevalence of eye-related diseases such as glaucoma, cataract, diabetic retinopathy, and others across the globe is estimated to drive octafluoropropane market growth. Furthermore, octofluoropropane gas is used to provide long-term tamponade during vitrectomy operations when a tear and retinal hole are healed. To keep the retina in place and lessen fluid leakage through the retinal aperture, octofluoropropane gas is utilized. Thus, the rising cases of eye-related diseases and surgeries, it is expected to bring lucrative growth opportunities for market growth during the forecast period. According to statistics, over 5 million cataract surgeries are carried every annually worldwide.

- Expanding Automotive Industry– Owing to the growing integration of electronic controls in today's generation of vehicles, the octofluoropropane market is predicted to grow as the automotive industry expands. In 2023, the market size for the Car & Vehicle Manufacturing sector has grown by more than 3% globally.

- Increasing Demand for Refrigerators – The demand for refrigerators is being driven by developing metropolitan regions and high-income consumers. In certain technologically-developed refrigerators, manufacturers mix octofluoropropane as a component. For instance, octofluoropropane is known to be an effective refrigerant. As per estimates, With India's refrigerator business is worth more than USD 4 billion.

Challenges

- Health Risks Might Result from Inhaling Fumes- The increasing concern amongst individuals for the health risks associated with inhaling fumes is one of the major factors predicted to slow down the market growth. For instance, certain negative consequences such as oxygen deficiency, which can result in suffocation are possible.

- Strict Government Rules for Usage in Certain Countries

- Need for Trained Workers for Handling and Storing

Octafluoropropane Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 465.31 million |

|

Forecast Year Market Size (2035) |

USD 817.71 million |

|

Regional Scope |

|

Octafluoropropane Market Segmentation:

Application Segment Analysis

The global octafluoropropane market is segmented and analyzed for demand and supply by application segment into the semiconductor, liquid crystals & LEDs, optical fibers, refrigerants, medical, transformers, and others. Out of the seven segments, the semiconductor segment is estimated to gain the largest market share of about 28% in the year 2035. The growth of the segment can be attributed to the growing manufacturing of semiconductor chips. The demand for consumer goods is growing, which has had a significant impact on the manufacture of semiconductor chips. Moreover, octofluoropropane gas is used to etch and clean the surfaces of semiconductor devices. As of 2021, worldwide shortages of semiconductor chips were caused by an over 10% rise in demand. Also, the rising investment in the automotive semiconductor sector is estimated to create a positive outlook for both segment growth and market expansion in the upcoming future.

The global octafluoropropane market is also segmented and analyzed for demand and supply by application segment into the semiconductor, liquid crystals & LEDs, optical fibers, refrigerants, medical, transformers, and others. Amongst these segments, the refrigerant segment is expected to garner a significant share. Octofluoropropane gas is a component of several refrigerator mixes, which are used for refrigeration. It can be compressed at high pressure into a liquid that can be used as a coolant in a variety of industries, including electricity generation, the food and beverage industry, the medical and pharmaceutical industry, and computer and data storage facilities. As per the recent statistics, it has been calculated that approximately 215 million refrigerators are sold each year across the globe which is responsible for generating around USD 125 billion in the industry.

Our in-depth analysis of the global market includes the following segments:

|

By Product Grade |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Octafluoropropane Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is estimated to dominate majority revenue share of 35% by 2035, attributed to increasing production of semiconductor chips. The growth of the market can be attributed majorly to the increasing production of semiconductor chips. For instance, China is recognized as the world's largest manufacturer of silicon, which is needed to create semiconductors, making it the leading producer of semiconductors. Further, the growing consumption of consumer electronics in the region is also anticipated to contribute to market growth in the region. Octofluoropropane is used for various semiconductor applications such as reactive ion etching, as it is a combination source of highly reactive trifluoromethyl, difluorocarbenyl, and fluorine radicals. As per data, more than 60% of the world's semiconductors and approximately 90% of the most sophisticated chips are produced in Taiwan.

North American Market Insights

The North American octafluoropropane market is estimated to be the second largest, registering a share of about 24% by the end of 2035. The growth of the market can be attributed majorly to the surging demand for electronic components. For instance, more and more people in the region are shifting towards new product innovations. Also, the growth of smart workplaces and smart homes has increased demand for consumer electronics products such as smart Televisions, refrigerators, air conditioners, and more, which in turn will rise the demand for octafluoropropane in the area, as it is used in the electronics industry as an etching agent for SiO2 layers in semiconductor applications when mixed with oxygen.

Europe Market Insights

Further, the octafluoropropane market in the European region, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035, backed by the higher use of octofluoropropane in both semiconductors and the automotive industry, and the growth expected to witness in both these industries in the region over the coming years. Besides this, the surge in the focus of the government of the European Union in raising its share in the global semiconductor industry, which is expected to reach close to 29% by the end of 2030, up from about 10% in the current year, is also anticipated to add to the market growth in the region. Recently, the digital transformation in Europe has helped in revitalizing the semiconductor industry, and the region has been rethinking its approach to the manufacturing of microchips and placing itself as a competitor in the global arena. Further, the world-famous European automotive industry, which occupies a majority of the share of the global automotive industry, is witnessing an increase in the adoption of driver assistance systems, as well as fully autonomous vehicles. According to the European Commission, on May 17th, 2018, a proposition for strategizing automated and connected mobility systems by the Commission was raised which was aimed to make the region a world leader in automated mobility systems.

Octafluoropropane Market Players:

- Linde plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Messer Industries GmbH

- Praxair, Inc.

- Showa Denko K.K.

- Kanto Denka Kogyo Co., Ltd.

- F2 Chemicals Ltd

- Electronics Fluorocarbons, LLC.

- Guangdong Huate Gas Co., Ltd

- PanGas AG

- HaloPolymer, OJSC

Recent Developments

- Linde plc entered into a long-term contract for the supply of industrial gases, with one of the world's largest semiconductor manufacturers. Further, the company will provide the client ultra-high-quality nitrogen, oxygen, and argon, to meet the most demanding standards of the semiconductor industry.

- Praxair, Inc. one of the largest industrial gas companies in the world started to raise nitrogen capacity at its Pyeongtaek, South Korea plant to satisfy rising demand at Samsung's semiconductor production complex.

- Report ID: 4199

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Octafluoropropane Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.