Nutritional Yeast Market Outlook:

Nutritional Yeast Market size was valued at USD 621 million in 2025 and is projected to reach USD 1.26 billion by the end of 2035, rising at a CAGR of 7.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of nutritional yeast is assessed at USD 666.9 million.

The global market is driven by the plant-based dietary patterns and public health initiatives that are targeting micronutrient deficiencies. Nearly 65% of the yeast products' global production is located in Asia Pacific, Europe, and North America, according to the FAO report released in February 2024. These regions have the advantage of an established industrial infrastructure, government nutrition policies, and consumer awareness, which all contribute to the promotion of fortified and functional foods. Further, the production footprint addresses the rising need for quality and volume required to meet the rising industrial demand from the food manufacturing sector. This geographic distribution supports efficient integration into the global B2B food ingredient supply chain, enabling reliable delivery to food manufacturers operating in key growth markets for plant-based and fortified products.

Trade Flow for Active Yeast in 2021

|

Geographical Zone |

Export Value (USD Million) |

Import Value (USD Million) |

Trade Balance (Export − Import) (USD Million) |

|

Africa |

89.9 |

314.5 |

-224.6 |

|

Asia |

532.6 |

375.9 |

156.6 |

|

Europe |

767.5 |

568.9 |

198.6 |

|

North America |

282.7 |

323.7 |

-41 |

|

South America |

49.3 |

115.7 |

-66.4 |

|

Oceania |

5.3 |

28.5 |

-23.1 |

Source: FAO report February 2024

From the supply and regulatory standpoint, production is subjected to strong food safety regulations. In the U.S, the Food and Drug Administration is responsible for the regulations regarding ingredient identity, whereas labeling and fortification are implemented in accordance with the Code of Federal Regulations. Alternatively, the Codex Alimentarius, which is managed by both FAO and WHO, develops worldwide standards for food additives and contaminants - ensuring product quality and facilitating international commerce. Further, the government-backed investment in food technology and agriculture, including the European Commission’s Farm to Fork strategy, aims to accelerate the transition to a sustainable food system, further incentivizing the development and integration of ingredients like nutritional yeast into the broader food supply chain.

Key Nutritional Yeast Market Insights Summary:

Regional Insights:

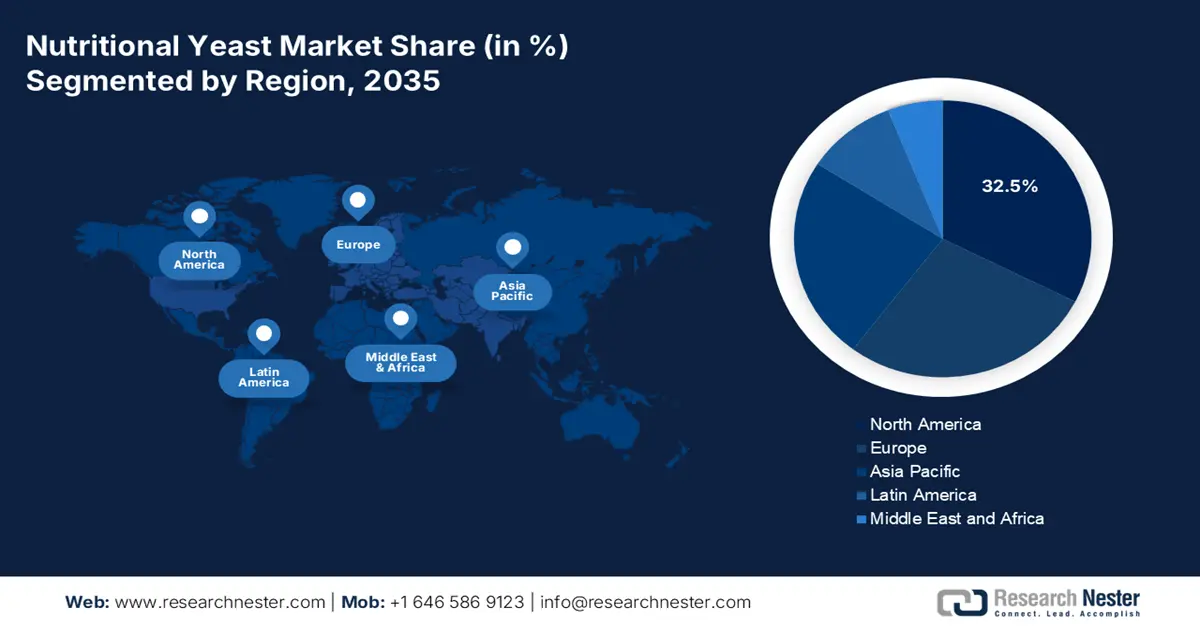

- By 2035, North America is set to command a 32.5% share in the nutritional yeast market, spurred by strong consumer adoption of plant-based diets.

- Rising at a CAGR of 10.4% from 2026–2035, Asia Pacific is emerging rapidly as health-conscious consumers accelerate demand for fortified and functional food ingredients.

Segment Insights:

- By 2035, the fortification segment – fortified products is projected to secure a 70.4% share in the nutritional yeast market, underpinned by growing reliance on vitamin B12 enrichment for preventive wellness.

- The conventional sub-segment is set to retain its lead through 2035 as manufacturers prioritize cost-efficient and widely available yeast inputs for large-scale food production.

Key Growth Trends:

- Expansion of Plant-Based and Vegan Diets

- Strategic government investment in agri-food innovation

Major Challenges:

- Health claim authorization hurdles

- Supply chain and raw material volatility

Key Players: Lallemand Inc. (Canada), Lesaffre (France), Blue Mountain Organics (U.S.), AB Mauri (UK), Bob's Red Mill Natural Foods (U.S.), NOW Foods (U.S.), Bragg Live Food Products, Inc. (U.S.), Hansen Holding A/S (a part of Chr. Hansen) (Denmark), Alltech (U.S.), Biomin (Austria), Kohjin Life Sciences Co., Ltd. (Japan), Mitsubishi Corporation Life Sciences Limited (Japan), Daiya Foods Inc. (Canada), Sari Foods Company (U.S.), LivaNova PLC (UK), Marigot Ltd. (Ireland), NutraGenesis (U.S.), Unilever (with brands like Marmite) (UK), Garden of Life (acquired by Nestlé) (U.S.).

Global Nutritional Yeast Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 621 billion

- 2026 Market Size: USD 666.9 billion

- Projected Market Size: USD 1.26 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 10 November, 2025

Nutritional Yeast Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of Plant-Based and Vegan Diets: The increasing number of people following vegan and flexitarian diets is keeping the demand for nutritional yeast high as a cheese substitute and flavor enhancer. The NLM study in February 2021 depicts that 1 in 8 people are vegetarian or vegan in the U.S. Further, the plant-based meat alternatives are expected to reach USD 3.5 billion by 2026. The authorities are also supporting the trend, for example, Canada's revised Food Guide emphasizes plant-based protein choices. Companies such as Daiya Foods build their entire product lines using nutritional yeast to achieve authentic cheesy flavors in their dairy-free offerings, which directly capitalizes on this macro-trend.

- Strategic government investment in agri-food innovation: Direct government grants to food technology propel the market growth. The agencies are actively funding efforts to advance the sectors of plant-based and fermented foods. Further, companies are expanding via mergers and acquisitions to broaden their footprint in the market. For example, Angel Yeast has officially announced the strategic acquisition of Bio Sunkeen's yeast-related assets in August 2021. Over USD 9.2 million was invested by Angel Yeast in this acquisition to increase the production capacity and enhance the market position. These initiatives are often indicated by broader governmental support for food technology, hence illustrating how public-sector funding priorities and private-sector capital allocation synergize to expand production capabilities and strengthen the global nutritional yeast supply chain.

- Government led public health nutrition initiatives: Government spending on public health to combat micronutrient deficiencies fuels the demand for fortified foods. Nutritional yeast is fortified with B12, aligning with the programs targeting deficiency, mainly in vulnerable groups. Agencies fund the WIC and SNAP programs that are used for eligible nutritional products, hence indirectly supporting the market growth by increasing the customer purchasing power for health options. This creates a stable, policy-driven demand stream for fortified staples. For instance, the USDA's annual report on WIC funding indicates the scale of this public investment in nutritional access, which indirectly benefits manufacturers of fortified foods like nutritional yeast.

Challenges

- Health claim authorization hurdles: Manufacturers face a robust evidence requirement to make approved health claims. For instance, the nutritional yeast supports the immune system, as the beta-glucan content requires a scientific dossier approved by the European Food Safety Authority. Most generic health claims for yeast-based products are rejected due to the insufficient cause-and-effect evidence, hence preventing companies from marketing their products' benefits effectively and differentiating their products on the shelf, which stifles consumer demand and market growth.

- Supply chain and raw material volatility: The production of nutritional yeast is liable to disruptions and is influenced by weather and global sugar production. This directly impacts the manufacturing costs and final product pricing. Further, companies are forced to engage in complex futures contracts and agricultural partnerships to stabilize the supply of the nutritional yeast. The WHO’s report on climate change impacts agriculture, indicating a long-term risk to consistent and affordable production that can price out cost-sensitive government nutrition programs.

Nutritional Yeast Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 621 million |

|

Forecast Year Market Size (2035) |

USD 1.26 billion |

|

Regional Scope |

|

Nutritional Yeast Market Segmentation:

Fortification Segment Analysis

Under the fortification segment, fortified products are dominating the segment and are poised to hold the share value of 70.4% by 2035. The segment is driven by the role in addressing the vitamin B12 deficiencies, mainly in vegetarian and vegan diets. Nutritional yeast is high in natural sources of vitamins. Organizations such as the WHO recognized Vitamin B12 fortification as an important component to prevent neurological disorders and anemia. The NLM data in May 2022 has provided evidence stating that 2 spoons of nutritional yeast contain an equal amount of the US RDA 2.4 mcg/day for adults. Further, the segment is fueled by consumer awareness, creating a strong demand for products that offer targeted nutritional benefits, making fortified nutritional yeast a staple in preventive health and wellness diets.

Nature Segment Analysis

The conventional sub-segment is leading the nature segment mainly due to its high cost-effectiveness and relatively broader availability for bulk industrial food manufacturing. Even though the consumption is organic products is increasing, the high pricing of the yeast often keeps it in premium retail products. The higher price point of nutritional yeast most often limits its use to premium retail products. Besides that, most of the manufacturers of food in the plant-based meat and snack industries are focusing on supply chain stability and cost efficiency, making conventionally produced yeast is their default bulk ingredient for use. This economic practicality ensures that conventional nutritional yeast maintains a substantial volume and revenue lead over its organic counterpart.

Distribution Channel Segment Analysis

The B2B/industrial distribution holds the largest share value in the distribution channel segment. This dominance is due to the large-scale food manufacturing companies purchasing nutritional yeast as a functional ingredient. Sectors like plant-based meat, snack production, and flavor manufacturing rely on bulk purchases for cost efficiency and consistent quality. This dominance is reinforced by governmental initiatives, such as the grants from Agriculture and Agri-Food Canada's Protein Industries Canada supercluster, which directly fund innovation in plant-based ingredient processing. Such institutional support reduces the barriers for manufacturers and actively aids the industrial-scale incorporation of nutritional yeast into a diverse range of processed and packaged foods, thereby solidifying the B2B channel's leading position.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Form |

|

|

Nature |

|

|

Application |

|

|

Distribution Channel |

|

|

Fortification |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nutritional Yeast Market - Regional Analysis

North America Market Insights

North America is dominating the nutritional yeast market and is poised to hold the market share of 32.5% by 2035. The market is driven by the high consumer adoption of plant-based diets. The key drivers of the market include the rising vegan and flexitarian population demanding clean-label and fortified food products, and robust retail distribution. The U.S. and Canada are dominating the market by holding the largest regional share. Further, the launch of flavored varieties, increased use in condiments and snacks, and growing consumer awareness of vitamin B12 content as a health supplement are boosting the market.

The U.S. nutritional yeast market is driven by the sustained demand for plant-based diets and consumer focus on preventive health. Government initiatives promote plant-based diets via the Dietary Guidelines for Americans, encouraging yeast as a protein-rich alternative. Angel Yeast Co., Ltd in 2024 announced officially that the company is going to start the production of next-generation yeast protein in Baiyang Biotechnology Park in Yichang, Hubei. The facility is capable of making a production of 11,000 tons of high-purity yeast protein with more than 80% of the protein content. This marks a key step in meeting the standards of high quality and demand for sustainable protein, which enhances the global manufacturing footprint and reinforces its leadership in the alternative protein and sustainable nutrition markets.

Canada market is expanding due to the strong governmental promotion of plant-based eating and a health-conscious populace. The country is witnessing robust regulatory, innovation activity, and product adoption. For example, AIDP data announced Puremune in April 2022, which is an insoluble yeast beta-glucan. The product is obtained from Immudyne Nutritional and has secured a Health Canada product license as a yeast beta-glucan source. This source has a high level of immunomodulating properties at 30 mg per dose, compared to 250mg to 500 mg that are used in other baker’s yeast beta-glucans. This low dose indicates the advanced formulation and growing preference for clinically backed yeast-based immune ingredients in Canada focuses on wellness and clean-label nutrition.

APAC Market Insights

Asia Pacific is expected to the fastest growing in the nutritional yeast market and is poised to rise at a CAGR of 10.4% during the forecast period 2026 to 2035. The rising awareness of health and wellness drives the market. Further, the market is also driven by the expansion of the vegan and flexitarian population in countries such as India. Japan and China show a strong adoption in the market. Governmental support is also evident, with the State Council advocating for a national health policy that emphasizes nutritional supplementation, further propelling the functional food ingredient market

China is a leading player in the nutritional yeast market and is supported by the large-scale fermentation capacity, expanding applications in food, and competitive production costs. The 2023 OEC data depict that China is the leading exporter of yeast, accounting for USD 490 million, indicating a strong international demand and robust manufacturing infrastructure. On the other hand, the consumer mostly preference for clean-label and plant-based protein sources boosts the market as a natural flavor enhancer and B-vitamin source. Additionally, supportive government policies for biotechnology and rising vegan and flexitarian lifestyles continue to strengthen China’s market leadership.

Japan’s market is defined by the demand for high-quality and functional foods from an aging population. The Ministry of Health, Labour and Welfare regulates these products under the Foods with Function Claims. The OEC 2023 data highlights that Japan has exported USD 11.5 million of yeast around the world, including nutritional yeast. Further, this nutritional yeast is positioned as a natural source of B vitamins and dietary fiber, appealing to elderly people seeking metabolic and digestive health benefits, and is increasingly used in supplements and fortified everyday foods.

Trade Flow Data of Yeast in 2023

|

Country |

Import (USD million) |

Export (USD million) |

|

China |

490 |

28.9 |

|

Japan |

11.5 |

67.8 |

|

India |

8.97 |

38 |

|

Malaysia |

16.9 |

22.3 |

Source: OEC 2023

Europe Market Insights

Europe is expanding rapidly in the nutritional yeast market and is largely driven by the adoption of vegetarian, vegan, and flexitarian lifestyles. The demand for natural and fortified foods with nutritional yeast is valued as a source of vitamin B12 and protein is the key trend dominating the market. Robust EU regulations by the European Food Safety Authority ensure the quality and trust to build a strong consumer base. The market's growth is accelerated by its mainstreaming beyond health food stores into major retail channels, which are supported by the European Commission's Farm to Fork strategy, which promotes sustainable and plant-based food systems.

Germany is expected to hold the highest revenue share in Europe and is driven by the country’s deeply entrenched sustainability culture and high number of vegans. The USDA data in January 2023 depicted that Germany has a high rate of vegetarianism with over 1.5 million individuals in 2022, compared to other European neighbors. The country witnesses a consistent annual rise in the consumer spending on functional and organic foods, which directly benefits the market expansion. Consumer preference for plant-based protein alternatives, which includes vegan cheese and gluten-free products, accelerates the growth. Continuous efforts from German food regulatory bodies ensure strict quality control, boosting market confidence. Nutritional yeast innovation thrives with the flavored varieties customized to premium food sectors. The rising trend of artisanal bakery and craft brewing expands niche applications further in Germany.

The UK market is expected to be the second-largest market, fueled by high consumer awareness. The market is driven by the strong retail marketing and incorporation of nutritional yeast into innovative product categories, that as ready meals and vegan cheese. The UK government indirectly supports the market by reducing meat consumption and shifting towards plant-based protein sources. Further, it is noted that the country has witnessed a significant rise in consumer inquiries regarding vitamin B12 in non-animal products, which is a key driver for nutritional yeast adoption. On the other hand, the expanding plant-based foodservice, such as vegan-focused restaurants and meal kit providers, is accelerating the adoption of nutritional yeast in every diet. Retailers and manufacturers are also investing in flavored variants to cater to health-conscious consumers seeking nutrient-dense and versatile food solutions.

Key Nutritional Yeast Market Players:

- Angel Yeast Co., Ltd. (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lallemand Inc. (Canada)

- Lesaffre (France)

- Blue Mountain Organics (U.S.)

- AB Mauri (UK)

- Bob's Red Mill Natural Foods (U.S.)

- NOW Foods (U.S.)

- Bragg Live Food Products, Inc. (U.S.)

- Hansen Holding A/S (a part of Chr. Hansen) (Denmark)

- Alltech (U.S.)

- Biomin (Austria)

- Kohjin Life Sciences Co., Ltd. (Japan)

- Mitsubishi Corporation Life Sciences Limited (Japan)

- Daiya Foods Inc. (Canada)

- Sari Foods Company (U.S.)

- LivaNova PLC (UK)

- Marigot Ltd. (Ireland)

- NutraGenesis (U.S.)

- Unilever (with brands like Marmite) (UK)

- Garden of Life (acquired by Nestlé) (U.S.)

Here is a list of key players operating in the global market:

The above-listed players are dominating the nutritional yeast market by a mix of specialized ingredient corporations and health food specialists. The competitive landscape is defined by the strategic initiatives that are focused on the non-GMO and fortified product lines, geographic diversification, and capacity expansion to meet the rising vegan and health-conscious demand. Companies are investing heavily in partnerships and mergers, and acquisitions to expand their global distribution networks. For instance, Lesaffre completed the acquisition of DSM-Firmenich’s yeast extract business in October 2024.

Corporate Landscape of the Nutritional Yeast Market:

Angel Yeast is the key player in the market and is using its massive industrial-scale fermentation capabilities to provide cost-effective and high-volume production. Their strategic initiatives focus on extensive B2B ingredient supply and expanding into the APAC region, capitalizing on the growing health and wellness trend. The company invests heavily in R&D for new yeast-related applications, hence aiming to solidify its position as the foundational supplier in the market.

Lallemand Inc. is a leading player in the nutritional yeast market by supporting its scientific expertise and high-quality, specialty strains. The company focuses on product differentiation via extensive research on health benefits, which includes immune and gut health support. By targeting the human nutrition and animal feed segment with customized solutions, Lallemand captures a vast value chain within the market. This builds a reputation for efficiency and scientific credibility among health-conscious consumers.

As a global player in the nutritional yeast market, Lesaffre competes in the market via innovation and sustainability. Their key strategies, such as non-GMO, clean label, and fortified products, are promoted for the sustained consumer demand in North America and Europe. Further, initiatives such as investing in sustainable production processes and forming strategic partnerships with food brands enable the company to integrate its nutritional yeast into a wide array of finished products, hence driving the competitive market

Blue Mountain Organics carves the nutritional yeast market and is focused on raw, organic, and vegan-based foods. Their main strategy is to appeal to the health purist segment by guaranteeing a minimally processed, clean-label product. By maintaining a strong direct-to-consumer presence via an online platform, and secures a placement in natural food cooperatives. They build a loyal consumer base that focuses on quality and dietary-specific attributes, enabling them to broaden the nutritional yeast market. The company has witnessed gross sales of USD 3.81 million in 2023 to 2024.

Alltech uses its deep expertise in yeast fermentation for animal nutrition to secure a dominant and unique position in the nutritional yeast market. Their focus is on the development and promotion of specialized yeast-based additives for livestock and aquaculture feed. By supporting the natural growth promotion, gut health improvement, and immune support in animals, the company effectively drives the demand for feed grade, indicating a high capability in the global shift from antibiotics in animal agriculture. The company has achieved 3,205,551 yen in profit in the year 2024.

Recent Developments

- In March 2025, Goldie’s Superfoods announced the new standard in nutritional yeast with the launch of its first-of-its-kind organic, non-fortified, high-protein formula, bringing a better option to health-conscious consumers, plant-based eaters, and dairy-free foodies.

- In March 2024, Foods Alive has introduced two new blends of nutritional yeast, Zesty and Nacho. These flavor-packed seasoning combines the natural umami of nutritional yeast with our own special south-of-the-border spice blend and our own herb-infused blend.

- Report ID: 8229

- Published Date: Nov 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nutritional Yeast Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.