Nuclear Medicine Market Outlook:

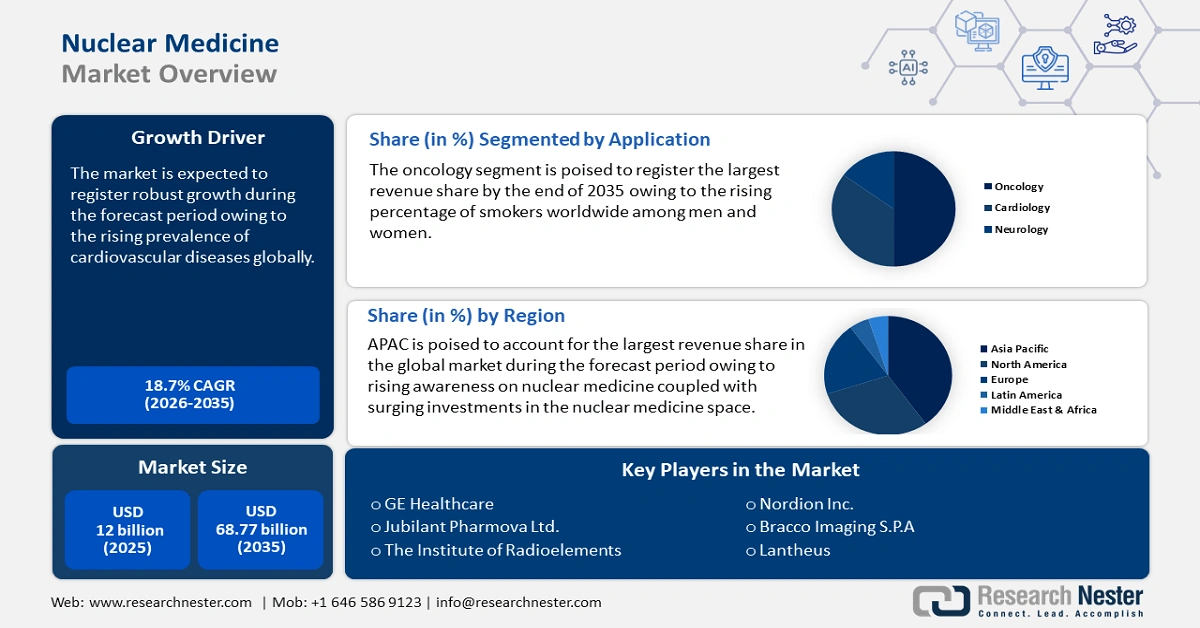

Nuclear Medicine Market size was valued at USD 12 billion in 2025 and is projected to reach USD 68.77 billion by the end of 2035, rising at a CAGR of 18.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of nuclear medicine is assessed at USD 13.97 billion.

The market is believed to expand considerably because of rising demand for personalized healthcare, continuing advances in technology, and increasing incidence of chronic disease. Major trends affecting the market include the increasing proliferation of PET and SPECT imaging technologies sufficiently to provide clinically valid diagnostic imaging information. The growth of technologies such as theranostics, which provide the capability of imaging upon injection of a targeted agent and then treating the patient with the targeted agent. The growth of radiopharmaceuticals and their use in radioligand therapy has emphasized the role of radiopharmaceuticals in treating cancer, which leverage the ability to deliver targeted radiation that destroys cancer cells while limiting damage to healthy cells. The focus on new and/or more effective early diagnosis has expanded the role of nuclear medicine in diagnosing diseases such as Alzheimer's Disease and disease processes related to the heart during the earliest stages, which may improve outcomes for patients. Finally, the market is also characterized by significant regulatory support, which includes streamlined regulatory approval for new radiopharmaceuticals and diagnostic imaging technologies.

In nuclear medicine, the momentum towards personalized medicine is particularly evident, with treatments being increasingly individualized based on a patient's genetic makeup or the particular traits of their disease. This shift relies heavily on the discovery of biomarkers, which is essential to avoiding the overtreatment of patients with therapies that will not benefit. At the same time as this is occurring, there are also signs that regulatory factors are an increasingly important ingredient to stimulate market growth. Regulatory bodies such as the FDA and EMA are working to simplify the approval pathways for new nuclear medicines, encouraging the timely integration of novel therapies and imaging technology.

Key Nuclear Medicine Market Insights Summary:

Regional Highlights:

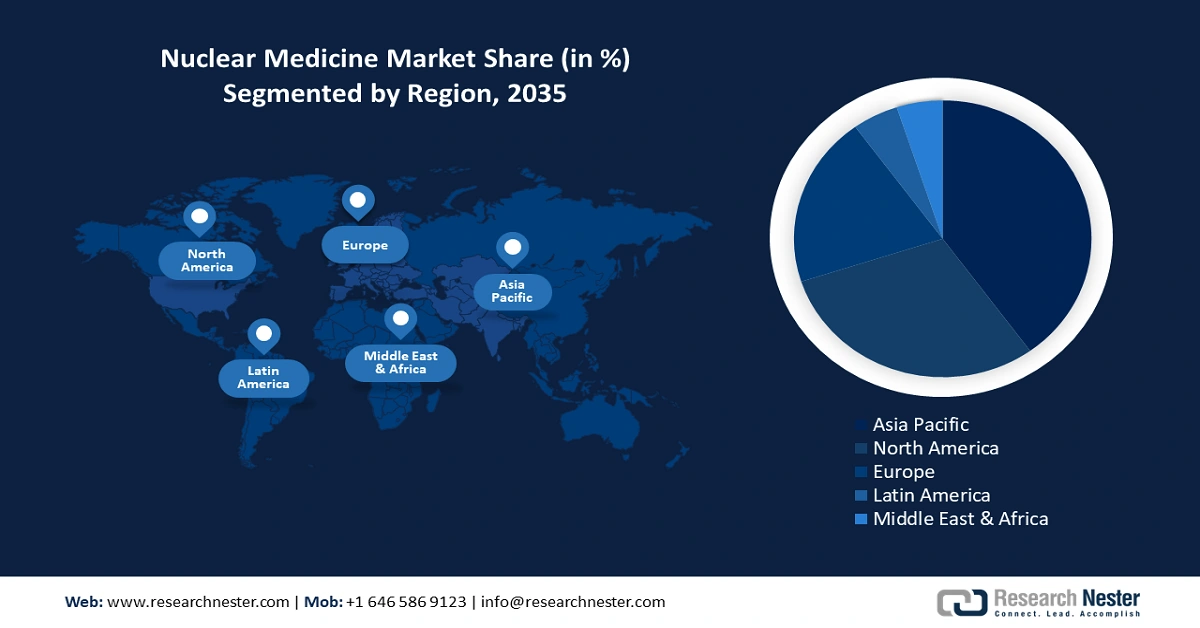

- North America is projected to hold the largest share of 43% in the nuclear medicine market by 2035, driven by advanced healthcare systems, robust r&d in radiopharmaceuticals, and strong reimbursement policies under Medicare and Medicaid.

- Europe is expected to witness strong growth during the forecast period, supported by favorable regulatory frameworks, stable research environments, and investments in precision diagnostics and radioligand therapies.

Segment Insights:

- Within the imaging segment, pet imaging is expected to capture the largest share of 41% by 2035, owing to its superior diagnostic performance and ability to combine metabolic and structural imaging for precise disease evaluation.

- In the therapy segment, radioligand therapy is poised to dominate with a 33% share by 2035, driven by its targeted delivery of radiation to cancer cells and effectiveness in prostate and neuroendocrine tumor treatment.

Key Growth Trends:

- Technological advancements in imaging systems

- Increase in cancer prevalence and demand for targeted therapies

Major Challenges:

- High costs of radiopharmaceuticals and imaging equipment

- Regulatory and safety concerns

Key Players: Curium Pharma, Lantheus Medical Imaging, Bayer AG, Siemens Healthineers, Bracco Imaging, Advanced Accelerator Applications (AAA), Cardinal Health, Philips Healthcare, Nordion Inc., Jubilant DraxImage, PharmaLogic Holdings, Eczacıbaşı-Monrol, NTP Radioisotopes, Life Molecular Imaging, IBA (Ion Beam Applications), Nihon Medi-Physics, Jubilant Pharmova (Lifesciences), Brightonix Imaging, Mediso Ltd.

Global Nuclear Medicine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest region: North America (43% share by 2035)

- Fastest growing region: Asia-Pacific

- Dominating countries: United States, Germany, France, UK, Japan

- Emerging countries: China, India, South Korea

Last updated on : 3 September, 2025

Nuclear Medicine Market - Growth Drivers and Challenges

Growth Drivers

-

Technological advancements in imaging systems: Advancements in nuclear imaging technology continue to be a major contributor to the share of the market. For example, the development of hybrid imaging systems such as PET-CT and PET-MRI has transformed the diagnostic paradigm and enabled more precise diagnostic imaging even earlier in the disease process for cancers, neurological disorders, and cardiovascular diseases. In June 2025, Stanford Medicine announced the extension of its research partnership with GE HealthCare to develop and study new total body PET/CT technology to explore new clinical opportunities and improve patient outcomes through disruptive imaging technologies. The partnership advances the boundaries of molecular imaging through the combination of the clinical and research expertise of Stanford Medicine with the engineering expertise of GE HealthCare.

-

Increase in cancer prevalence and demand for targeted therapies: As per the National Cancer Institute, globally, there were 9.7 million cancer-related deaths and about 20 million new cases in 2022. It is anticipated that there would be 18.2 million cancer-related deaths and 33 million new cancer cases annually by 2050. As a result, the use of radiopharmaceuticals for targeted therapy with applications in oncology has steadily increased in importance since it allows for the targeted delivery of radiation to cancer cells. As more radiopharmaceuticals are being developed to treat a variety of cancers, there will be an increased need for nuclear medicine, including demand for personalized treatment. This makes a significant contribution to the market growth.

-

Aging population and rise in age-related diseases: The World Health Organization (WHO) forecast predicts that one in six individuals worldwide will be 60 years of age or older by 2030. As people continue to live longer lives, the prevalence of age-related illnesses also continues to rise. This will lead to a greater need for diagnostic devices such as PET scans and SPECT imaging. These imaging modalities are essential for early diagnosis of neurodegenerative diseases, which can allow for timely intervention and better management of these types of diseases in the future.

Challenges

-

High costs of radiopharmaceuticals and imaging equipment: A key problem for the market is the price of radiopharmaceuticals and imaging equipment. In most cases, radiopharmaceuticals are produced in specific facilities with often very specific equipment, leading to overall higher costs for treatments. Imaging equipment is costly to obtain and maintain as well. These costs and the situation in limited and middle-income countries and areas with constrained health care budgets mean access to nuclear medicine may be limited.

-

Regulatory and safety concerns: The nuclear medicine industry must deal with heavy regulation because of safety concerns over radioactive materials. Radiopharmaceuticals, as well as the devices used in nuclear imaging, will require regulation from both the FDA and EMA safety concerns. The combination of regulatory oversight and product approvals slows the timing, risk, and costs of bringing market approval for the product into consideration when approved. The handling, administration, and disposal of radioactive materials is a risk as well, which requires substantial safety protocols and training. This can impact availability for nuclear medicine in some specific geolocation regions.

Nuclear Medicine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

18.7% |

|

Base Year Market Size (2025) |

USD 12 billion |

|

Forecast Year Market Size (2035) |

USD 68.77 billion |

|

Regional Scope |

|

Nuclear Medicine Market Segmentation:

Imaging Segment Analysis

The PET imaging segment is estimated to account for the largest share of 41% in the market over the discussed timeframe. PET imaging is projected to have the largest revenue share within the Imaging segment by 2035, due to effective diagnostic performance. In particular, PET scans have been found effective at an early stage in diagnosing cancers, cardiovascular diseases, and neurological disorders. PET imaging's performance is superior, as it demonstrates both tissue structure as well as metabolic function for high precision diagnosis and disease outcome. In addition, PET imaging plays an integral role in cancer staging, which is essential in treatment design and treatment outcomes.

Therapeutics Segment Analysis

The radioligand therapy segment is poised to dominate the market with a share of 33% during the analyzed period. Radioligand therapy (RLT) utilizes targeted radiopharmaceuticals to deliver radiation directly to cancer cells, sparing healthy tissue. The growing efficacy of RLT in treating both prostate cancer and neuroendocrine tumors accelerated the market growth. RLT can also treat cancer, where conventional therapies have limited options.

Therapeutic Radiopharmaceuticals Segment Analysis

During the examined period, the radioactive iodine segment is expected to hold a 37% market share in the nuclear medicine industry. Radioactive iodine has been used to treat thyroid cancer and hyperthyroidism for decades. Its success as the most utilized radiopharmaceutical in the Therapeutic Radiopharmaceuticals segment will continue as the incidence of thyroid conditions increases across the globe. It is effective because it targets thyroid tissue and is a very effective and minimally invasive therapy. Recent advances in dosimetry and proper patient selection have resulted in greater success.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Imaging |

|

|

Therapeutics |

|

|

Radiopharmaceuticals |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nuclear Medicine Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 43% in the global market by the end of 2035. The growth is led by the presence of an advanced healthcare system and a heavy focus on early detection and personalized medicine. Because of significant research and development funding, the region is also seeing massive innovation with its radiopharmaceuticals and theranostic treatment models for cancer and neurological diseases. Robust reimbursement policies at the federal government level for procedures/billings under Medicare and Medicaid will allow more patients to access nuclear medicine diagnostics. With a working supply chain for nuclear medicine and radioisotopes, and advanced technology imaging tools (like PET and SPECT) also being more available to the usual healthcare practitioner than in the past.

It is predicted that the U.S. will have a large corner of the world's market share by 2035 due to its advanced healthcare delivery system and its emphasis on innovative diagnostic imaging and the development of radiopharmaceuticals. With Federal support from Medicare and Medicaid, providers in the oldest hospitals in the world now have access to and use the latest nuclear medicine technology. With the dramatic increase of chronic illnesses, mainly due to increased cancers and neurological diseases, there is a great demand for early and accurate diagnostics. In addition, as a region, we also have a robust infrastructure of medicinal isotopes and even higher utilization of PET and SPECT imaging as a region. This allows the U.S. market to be a leader in the world of nuclear medicine as well.

Government funding at the federal and provincial levels is driving growth in nuclear medicine in Canada. The public healthcare system in Canada supports the uptake of nuclear medicine procedures. Ongoing funding increases by provinces, including Ontario and British Columbia, have added infrastructure for PET/CT and SPECT imaging. Several research institutions are currently in collaboration with industry partners to develop new technologies, processes, and clinical trials. This will further enhance and strengthen the market. Together with increasing chronic disease incidence, all of these attributes will likely allow Canada to maintain a substantive share of the global market by 2035.

Europe Market Insights

Throughout the projection period, Europe is anticipated to experience a strong CAGR in the global nuclear medicine market associated with a stable research environment, a favorable regulatory environment, and growing investment to enhance innovation in radiopharmaceuticals. Germany, France, and the UK are making significant investments in precision diagnostics and target radioligand therapies. This is further facilitated as the region is equipped with a well-established healthcare infrastructure to enhance accessibility infrastructure for imaging modalities such as PET/CT and SPECT/CT. Additionally, there are collaborative partnerships between governmental health agencies, research institutions, and private pharmaceutical firms moving necessary clinical trials and developing radiotracers.

Germany is expected to account for a significant share of the global nuclear medicine market by 2035, owing to its technologically advanced medical care system, emphasis on cancer diagnostics. This country has several research institutions and industry participants that spur the development of radiopharmaceuticals and theranostic products. The existence of public-private partnerships and government money in the sector are stimulating the adoption and development of both PET/CT and SPECT/CT technologies. In October 2024, GE HealthCare (GEHC) announced a partnership with University Medicine Essen in Germany for the development of a new Theranostics Center of Excellence. According to GEHC, the facility will promote the application of theranostics in clinical settings and further studies on more individualized methods of cancer treatment. The vendor will also install a new Omni Legend 32cm PET/CT scanner, a SIGNA PET/MR scanner, and several SPECT/CT systems, including StarGuide, NM/CT 870 DR, and NM 830.

By 2035, France is forecasted to account for a significant share of the global nuclear medicine market due to its large pharmaceutical manufacturing capacity, strong research and development capacity in the field of radiopharmaceuticals. France has dynamic organizations such as Curium, which is the world's preeminent provider of diagnostic radioisotopes. France's national health care system also permits access to nuclear imaging services by a wide swath of the population, permitting higher procedural volumes. Public funding that France is providing for the modernization of diagnostic equipment and the production of radio tracers will also help support the market's expansion. The future demand for molecular imaging will be strong, particularly with an aging society, in addition to a significant rise in lifestyle-associated chronic diseases.

APAC Market Insights

Asia Pacific is expected to have a substantial CAGR in the global nuclear medicine market during the forecast period due to the rapid development of healthcare infrastructure, growing adoption of advanced diagnostic technologies, and the increasing incidences of cancer and cardiovascular diseases. Countries such as China, India, Japan, and South Korea are investing in nuclear medicine facilities, PET/SPECT imaging, and domestic radioisotope production to be less reliant on imports. The government programs accelerate the expansion of improved early disease detection and provide momentum for market adoption. The rise of the middle-class populations will continue to increase healthcare spending will also contribute to the demand for precision diagnostics. The overall strategic collaboration between global players and regional capital and funding institutions strengthens, develops, and commercializes advanced radiopharmaceuticals and provides solid, sustained growth in nuclear medicine across the region.

Given the increasing healthcare systems, government's increasing support anticipated that India will capture a large portion of the global nuclear medicine market by 2035. The Department of Atomic Energy (DAE) and Bhabha Atomic Research Centre (BARC) are actively involved in funding the domestic development of vital medical isotopes that would allow for less reliance on imports. The increase in the number of cases of cardiovascular diseases and the increase in cancer cases increasingly demand accurate and early diagnosis. For instance, as per the National Institutes of Health, the crude incidence rate and anticipated number of cancer cases in India for 2022 were 14,61,427, with a higher estimated number of female cases than male cases.

By 2035, China is anticipated to dominate the Asia-Pacific nuclear medicine market, fuelled by robust government support, a large number of potential patient growth, and a significant commitment to renewing diagnostic imaging infrastructure. China has also bolstered its domestic capacity for radioisotope production, connected to nuclear energy programs supported by the government. Its growing population of elders, bears a greater burden of chronic disease than other emerging nations in the region, yet, the government policies favour new innovation in the health care sectors, thus are poised to carve out a share in the total global nuclear medicine market.

Key Nuclear Medicine Market Players:

- GE HealthCare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Curium Pharma

- Lantheus Medical Imaging

- Bayer AG

- Siemens Healthineers

- Bracco Imaging

- Advanced Accelerator Applications (AAA)

- Cardinal Health

- Philips Healthcare

- Nordion Inc.

- Jubilant DraxImage

- PharmaLogic Holdings

- Eczacıbaşı-Monrol

- NTP Radioisotopes

- Life Molecular Imaging

- IBA (Ion Beam Applications)

- Nihon Medi-Physics

- Jubilant Pharmova (Lifesciences)

- Brightonix Imaging

- Mediso Ltd

The nuclear medicine market is primarily led by imaging and radiopharma companies like GE HealthCare, Siemens Healthineers, Curium and Lantheus. These companies are proactively positioning themselves to cement and expand their supply chain and technological advantages. Further, we see and expect rapid consolidation as pharmaceutical companies continue to invest in radioligand growth given the increase demand for theranostics. In the Asia-Pacific region, firms are focusing on an integrated model of cyclotron leasing, tracers, AI-assisted imaging, and clinical training to boost their footprint in the regional market.

Recent Developments

- In July 2025, Purdue announced the introduction of an innovative graduate program in radiopharmaceutical production in Indianapolis in collaboration with the industry

- To satisfy the increasing need in the rapidly developing field of targeted cancer diagnostics and therapeutics, a new master's program places a strong emphasis on manufacturing competence.

- In October 2024, Jubilant Radiopharma, together with the second-largest network of Radio pharmacies in the United States (U.S.) and Simplified Imaging Solutions (SIS), a leading Diagnostic Services Organization (DSO), intended to improve the operational effectiveness of nuclear medicine services provided to medical offices and healthcare facilities across the country. Through this strategic relationship, Simplified Imaging Solutions' fixed and mobile diagnostic solutions are combined with Jubilant Radiopharma's nationwide network of 43 SPECT radio pharmacies and three PET manufacturing facilities.

- Report ID: 4456

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nuclear Medicine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.