Nuclear Deaerator Market Outlook:

Nuclear Deaerator Market size was over USD 21.4 billion in 2025 and is estimated to reach USD 46.8 billion by the end of 2035, expanding at a CAGR of 9.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of nuclear deaerator is evaluated at USD 22.6 billion.

The nuclear deaerator market is a crucial juncture, shifting from a maintenance-centric and stabilized industry to witnessing renewed growth fueled by urgent energy security concerns and decarbonization imperatives. Besides, as countries strongly pursue net-zero emission targets while integrating grid stability, the aspect of nuclear power is re-evaluated as a severe source of low-carbon and reliable baseload electricity. According to an article published by the World Nuclear Association Organization in September 2025, the international reactor fleet operates at an average capacity factor, accounting for 83% as of 2024. Besides, nuclear reactors across nations generated 2,667 TWh of electricity as of 2024, which is the largest electricity amount supplied within a year from nuclear energy, amassing 2,660 TWh as of 2006. Moreover, the regional nuclear power capacity is also driving the nuclear deaerator market internationally.

Nuclear Power Capacity Generation by Region (2010-2050)

|

Years |

Advanced Economies (GW) |

China (GW) |

Other EMDE (GW) |

|

2010 |

337.5 |

10.9 |

54.1 |

|

2015 |

317.4 |

28.6 |

60.4 |

|

2020 |

297.9 |

51.0 |

66.2 |

|

2025 |

290.1 |

65.9 |

71.6 |

|

2030 |

294.1 |

121.0 |

92.6 |

|

2035 |

309.1 |

194.2 |

124.1 |

|

2040 |

350.4 |

238.4 |

159.3 |

|

2045 |

381.9 |

261.6 |

187.0 |

|

2050 |

399.2 |

277.1 |

197.9 |

Source: IEA Organization

Furthermore, factor fabrication and modularization, predictive maintenance, digitalized integration, advancements in material science, expansion in aftermarket services, and diversification, along with supply chain localization, are also fueling the nuclear deaerator market globally. According to an article published by the Decision Analytics Journal in March 2023, digital twin technology has become a mainstream approach for organizations, with a prediction that 75% of Internet of Things (IoT)-based companies will utilize this technology. In addition, it has also been estimated that more than 40% of large-scale organizations globally will be using digital twins in their respective projects by the end of 2027 to enhance revenue generation. Therefore, this technology enables actual oxygen levels monitoring, along with pressure and temperature, which is readily bolstering the market’s exposure.

Key Nuclear Deaerator Market Insights Summary:

Regional Insights:

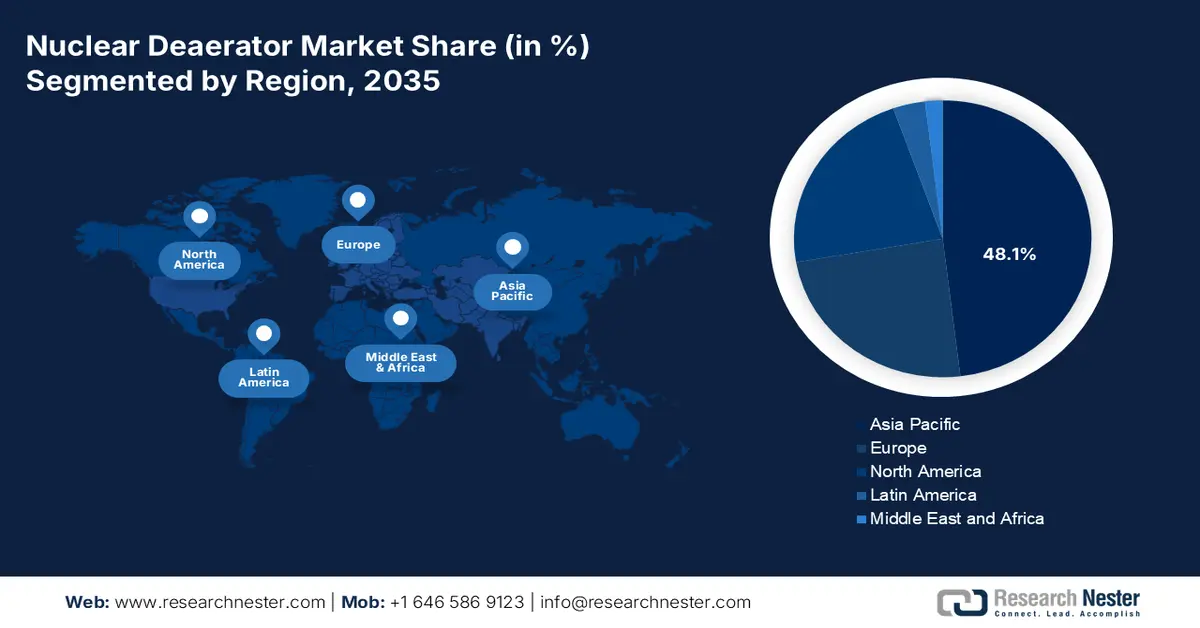

- The Asia Pacific region is anticipated to secure a 48.1% share by 2035 in the nuclear deaerator market, propelled by strategic energy-security policies, ambitious decarbonization targets, and an accelerating new-build reactor pipeline.

- North America is projected to be the fastest-growing region by 2035, supported by long-duration operation programs and tactical investment in advanced nuclear technologies.

Segment Insights:

- The power generation segment is projected to account for a 92.5% share by 2035 in the nuclear deaerator market, sustained by its role in improving equipment longevity, operational flexibility, and overall plant efficiency.

- The direct/OEM sales sub-segment is expected to garner the second-largest share by 2035, bolstered by proprietary nuclear-plant integration and OEM-led system accountability.

Key Growth Trends:

- Increase in new nuclear construction pipeline

- Rise in small modular reactors (SMRs)

Major Challenges:

- Increased capital intensity and financing gaps

- Licensing inertia and regulatory complexity

Key Players: Framatome (France), GE Vernova (U.S.), Westinghouse Electric Company (U.S.), Mitsubishi Heavy Industries, Ltd. (Japan), Bharat Heavy Electricals Limited (India), Power Machines (Russia), Alstom (France), SPX FLOW, Inc. (U.S.), Thermax Limited (India), Babcock & Wilcox Enterprises, Inc. (U.S.), Hitachi, Ltd. (Japan), Larsen & Toubro (India), Korea Hydro & Nuclear Power (South Korea), Siemens Energy AG (Germany), China First Heavy Industries (China), Dongfang Electric Corporation (China), Harbin Electric Corporation (China), Cockerill Maintenance & Ingénierie (Belgium), Andritz AG (Austria).

Global Nuclear Deaerator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.4 billion

- 2026 Market Size: USD 22.6 billion

- Projected Market Size: USD 46.8 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, South Korea, France

- Emerging Countries: India, Canada, United Kingdom, United Arab Emirates, Poland

Last updated on : 8 December, 2025

Nuclear Deaerator Market - Growth Drivers and Challenges

Growth Drivers

- Increase in new nuclear construction pipeline: The presence of ambitious national energy strategies, especially in Europe and the Asia Pacific, is resulting in the highest wave of the latest reactor construction, which is positively impacting the nuclear deaerator market. According to an article published by the IEA Organization in January 2025, over 70 GW of the latest nuclear capacity is currently under construction internationally. In addition, this is considered the highest level within the past 30 years, and more than 40 nations across the world are planning to extend nuclear’s role in their respective energy systems. Besides, over 99% of the nuclear enrichment capacity significantly takes place across 4 supplier nations, with Russia majorly accounting for 40% of the international capacity, thereby making it suitable for bolstering the market.

- Rise in small modular reactors (SMRs): The existence of SMRs demonstrates a transformative growth in the nuclear deaerator market internationally. Their suitable deployment in fleets, potentially for non-electric applications, such as district heating and hydrogen production, along with the increased demand for standardization and modular components, has created a scalable and new market for advanced deaerator designs from conventional large-scale plant models. As per an article published by the World Nuclear Association in November 2025, SMRs are usually defined by standard electrical output, which is less than 300 Mwe, with a few expansions for medium-sized reactors of almost 600 Mwe. Moreover, there exist more than 100 SMR designs, with the present fleet of nuclear reactors operating on uranium fuel, which is enriched by 5% uranium-235, thus denoting a positive impact on the market.

- Decarbonization of industrial heat: The aspect of advanced reactor designs, beyond power generation, is being readily created to effectively supply process heat, which is suitable for heavy industries, such as steelmaking and chemical production. This emerging application is projected to need specialized deaerators that are capable of operating at various parameters, which creates a positive impact on the overall nuclear deaerator market. For instance, as stated in the August 2022 Energy Transitions Commission Organization article, the 2030 decarbonization agenda in India constitutes the aspect of decarbonizing energy to 50% and gaining 500 GW of fossil fuel-based generating capacity by the end of 2030. Besides, the per capita electricity consumption in the country currently stands at 1,208 kWh, which is predicted to triple the country’s economic development.

Challenges

- Increased capital intensity and financing gaps: The presence of nuclear projects, be it major refurbishments or new builds, displays a few of the most capital-intensive infrastructure investments across nations. Besides, the nuclear deaerator market, which is part of the mega-project ecosystem, is readily defined to financial challenges. The long-term development and construction horizons significantly expose investors to strict regulatory, construction, and political risks. While governments are unveiling the latest financing models, the aspect of attracting sufficient private capital continues to remain difficult. Moreover, for utilities, there has been a surge in opportunity expenses since capital that is allocated to a nuclear overhaul is not spent on grid modernization or renewables.

- Licensing inertia and regulatory complexity: The nuclear deaerator market readily operates within the world’s most strict administrative environment, which is considered a necessity for safety. Despite this, a formidable gap in advancement and speed is readily limiting the market’s growth. Besides, unveiling a new deaerator design and even effectively modifying a current one for a different type of reactor requires an expensive, uncertain, and lengthy licensing process. Therefore, to combat this, regulators need to approve the installation procedures, manufacturing processes, materials, and design, which is considered a cycle that can take years. This particular inertia is challenging for SMRs, which promise factory-built and standardized designs, thereby negatively impacting the market’s growth.

Nuclear Deaerator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 21.4 billion |

|

Forecast Year Market Size (2035) |

USD 46.8 billion |

|

Regional Scope |

|

Nuclear Deaerator Market Segmentation:

Application Segment Analysis

The power generation segment, part of the application, is anticipated to hold the largest share of 92.5% in the nuclear deaerator market by the end of 2035. The segment’s upliftment is highly attributed to its importance within a nuclear power plant, which is primarily related to equipment longevity, operational flexibility, and plant efficiency. For instance, according to an article published by the PIB Government in June 2025, the overall installed power capacity in India has successfully reached 476 GW. This has eventually resulted in reduced power shortages from 4.3% to 01% as of 2025. Besides, more than 2.8 crore households in the nation are electrified, and there has been an increase in the electricity consumption by 45.8%. Further, non-fossil fuel sources presently contribute 235.7 GW, which is 4% of the overall capacity, and comprises 8.8 GW of nuclear and 226.9 GW of renewable, thereby uplifting the segment in the market.

Sales Channel Segment Analysis

The direct/OEM sales sub-segment, which is part of the sales channel segment, is predicted to garner the second-largest share in the nuclear deaerator market during the forecast timeline. The sub-segment’s growth is highly driven by the proprietary nature and uniquely implemented nuclear power plant technology. Organizations, such as Mitsubishi Heavy Industries, GE Vernova, Westinghouse, and Framatome, readily act as primary system integrators and reactor design authorities. Besides, when a particular utility orders the latest reactor, the secondary system components, such as the deaerator, are readily sourced and specified as part of an engineered and complete island by the OEM to ensure single-point accountability and guaranteed system performance, thus denoting an optimistic outlook for the overall segment’s exposure.

Material Segment Analysis

Based on the material, the stainless steel (SS316/304) segment in the nuclear deaerator market is expected to cater to the third-largest share by the end of the projected period. The segment’s development is highly fueled by the presence of overwhelmingly and foundational preferred material class for the nuclear deaerator field. The development is proactively dedicated to a non-negotiable requirement for outstanding corrosion resistance in the environment of the plant’s feedwater systems. Besides, even the presence of trace oxygen amounts can lead to critical pitting as well as stress corrosion cracking in carbon steel, ultimately resulting in catastrophic failure. Moreover, SS316, along with its additional molybdenum content, provides superior resistance to corrosive agents, such as chlorides, thus making it a suitable standard for severe wetted parts.

Our in-depth analysis of the nuclear deaerator market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Sales Channel |

|

|

Material |

|

|

Reactor Type |

|

|

Type |

|

|

Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nuclear Deaerator Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the nuclear deaerator market is anticipated to garner the highest share of 48.1% by the end of 2035. The market’s upliftment in the region is highly propelled by the presence of strategic energy security policies, robust decarbonization pledges, and an unprecedented new-build pipeline. Besides, India and China are considered primary locomotives, with joint plans for reactors. Simultaneously, South Korea and Japan are revitalizing their respective fleets through restarts as well as life-extension programs. As stated in the October 2025 World Nuclear Association Organization article, there exist almost 145 operable nuclear power reactors, along with nearly 45 under firm construction plans to develop about an additional 60 reactors. In this regard, Japan comprises 33 operable reactors, accounting for 31.7 GWe of energy, of which 2 are under construction. In addition, the country has been generating almost 30% of its electricity from nuclear power, while there has been an increase in nuclear contribution to 41%, thereby readily contributing to the nuclear deaerator market’s growth.

Nuclear Power and Involvement with the Nuclear Fuel Cycle in Asia (2025)

|

Countries |

Power Reactors Operable |

Power Reactors Under Construction |

Power Reactors Planned |

Research Reactors Operable |

|

Australia |

- |

- |

- |

1 |

|

China |

58 |

33 |

43 |

16 |

|

India |

24 |

6 |

14 |

5 |

|

Indonesia |

- |

- |

- |

3 |

|

Japan |

33 |

2 |

- |

3 |

|

South Korea |

26 |

3 |

1 |

2 |

|

Malaysia |

- |

- |

- |

1 |

|

Vietnam |

- |

- |

- |

1 |

Source: World Nuclear Organization

The nuclear deaerator market in China is growing significantly, owing to the existence of the state-controlled and aggressive nuclear expansion program. Besides, as stated in a data report published by the EIA Government in May 2024, over a decade, over 34 GW of nuclear power capacity have been added in the country, which has successfully brought the nation’s operating nuclear reactors to 55 with an overall net capacity of 53.2 GW in April 2024. Additionally, 23 reactors are currently under construction in the country, which is also positively impacting the market’s upliftment. Moreover, there has been an upsurge in coal-based capacity by 19.5 GW in the country as of 2022, which has brought back its overall coal capacity to 1,089 GW. Additionally, the nation’s nuclear fleet comprises mostly pressurized water reactors, including the U.S. Westinghouse-designed AP1000s, constituting a 1,157 MW capacity, along with the French Orano Europe-driven Power Reactors, with 1,660 MW capacity, thereby enhancing the market’s exposure.

Yearly Installed Net Nuclear Power Capacity in China (2014-2023)

|

Year |

Capacity (GW) |

|

2014 |

19.0 |

|

2015 |

26.8 |

|

2016 |

31.4 |

|

2017 |

34.5 |

|

2018 |

42.8 |

|

2019 |

45.5 |

|

2020 |

47.5 |

|

2021 |

50.0 |

|

2022 |

52.1 |

|

2023 |

53.2 |

Source: EIA Government

The nuclear deaerator market in India is also growing due to the decisive policy transition to triple the nuclear capacity as the cornerstone of its clean energy transition. As per the 2025 World Nuclear Association article, the country’s government has significantly set an ambitious target to boost nuclear capacity to almost 100 GWe by the end of 2047. In addition, at present, there are 24 operable reactors, with 7,493 Mwe capacity, of which 6 reactors are under construction, accounting for 4,768 Mwe capacity. Besides, there has been an increase in the overall operable nuclear power capacity in the country from 6,290 Mwe between 2022 and 2024 to 7,438 MWe as of 2025. Furthermore, the country comprises a population of more than 1.4 billion, based on which there is a huge demand for energy growth, which, in turn, is skyrocketing the market’s exposure.

North America Market Insights

North America in the nuclear deaerator market is projected to emerge as the fastest-growing region during the forecast duration. The market’s development in the region is highly propelled by long-lasting operation programs and tactical investment in innovative nuclear technology. Besides, in January 2024, the U.S. Department of Energy (DOE) notified the signing of the payment agreement and credit award with Pacific Gas and Electric Company to readily finalize USD 1.1 billion for credit payments through the Civil Nuclear Credit (CNC) Program. In addition, the Grid Deployment Office's Civil Nuclear Credit Program is also driving the nuclear deaerator market since it is a USD 6 billion tactical investment to assist in preserving the U.S. reactor fleet and successfully save high-paying opportunities across the region. Therefore, with the presence of such programs and investments, there is a huge opportunity for the overall nuclear deaerator market.

The U.S. in the nuclear deaerator market is gaining increased traction, owing to its association with the chemical industry’s demand for process-grade and reliable clean and steam power. The America Chemistry Council (ACC) has identified cost-effective and stabilized electricity as a severe competitive industry, with the chemical sector being considered the largest industrial customer of power. As per an article published by the U.S. Department of the Treasury in January 2025, the 48C Program, which is managed by the IRS with assistance from the Department of Energy’s (DOE) Office of Manufacturing & Energy Supply Chains (MESC), readily expanded with a USD 10 billion investment under the IRA. Of this investment, USD 10 billion, that is 40% has been effectively reserved for projects, which are designated for communities with coal plants or coal mines, thus boosting the market’s exposure.

Canada in the nuclear deaerator market is also developing due to the existence of major fleet reimbursement, along with long-lasting operation, tactical deployment of small modular reactors, along with federal policy and financial support for nuclear technology. For instance, as stated in an article published by the Ontario Government in November 2025, the Ontario Power Generation (OPG) plan has been approved by the government, based on which an increased capacity of almost 2,200 megawatts of electricity can be generated, which is equivalent to powering 2.2 million homes in the country. In addition, the project is further projected to develop an estimated 30,500 employment opportunities while effectively sustaining 6,700 jobs. Moreover, with USD 26.8 billion as the finalized budget, over 90% of the project will be spent in the nation to support economic benefits and localized businesses.

Europe Market Insights

Europe in the nuclear deaerator market is predicted to witness steady and considerable growth by the end of the projected timeline. The market’s growth in the region is highly propelled by the presence of ambitious life-extension programs, along with new-build commitments to effectively ensure energy security and significantly decarbonization objectives. Besides, the major refurbishment program in France for its reactor fleet and the UK’s support for the newest projects, such as Rolls-Royce and Sizewell C SMRs, has created a high-value and sustained demand for the nuclear deaerator market. According to an article published by Europe Institute for Security Studies in February 2025, the region has been dependent on imports for 62.5% of its overall energy supply as of 2022. At the same time, it is 97.7% of petroleum products and 97.6% for natural gas. In addition, the region has spent €448,800,000,000 on fossil fuel imports as of 2023, thereby creating a huge opportunity for expanding the nuclear deaerator market.

France in the nuclear deaerator market is gaining increased exposure, owing to the unparalleled scale of its Grand Carénage life-extension program, along with its concurrent new-build plans. As stated in an article published by Enerdata in July 2025, ASN has readily authorized the country’s EDP to ensure upgradation for its 1,300 MW reactors, which has enabled it to operate beyond the original 40-year design lifespan. This particular decision has affected 20 out of the nation’s fleet of 56 reactors, which are projected to be approved by the end of 2040. In addition, these reactors are located on sites, such as Saint-Alban, Penly, Paluel, Nogent, Golfech, Flamanville, Catternom, and Belleville, and presently these cater to over 40% of the country’s nuclear power production. Therefore, EDF has planned to readily invest €6 billion to expand their operational life, thus denoting a massive growth for the overall market.

The UK in the nuclear deaerator market is also growing due to the unique confluence of a strategic policy shift and new-build projects to significantly revive its nuclear supply chain. Besides, the government’s British Energy Security Strategy and Nuclear Energy (Financing) Act 2022 offer a financial and legalized framework that has unveiled the Regulated Asset Base (RAB) model to attract private investment for long-term projects. As per the June 2025 UK Government article, based on the government’s modern Industrial Strategy to significantly revive Britain’s industrial heartlands, the government has pledged more than £2.5 billion for the complete small-scale modular reactor program, with this particular project potentially backing up 3,000 new skilled employment opportunities. Moreover, this is poised to power the equivalent of almost 3 million homes with secured and clean homegrown energy, thereby making it suitable for the market’s upliftment.

Key Nuclear Deaerator Market Players:

- Doosan Enerbility (South Korea)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Framatome (France)

- GE Vernova (U.S.)

- Westinghouse Electric Company (U.S.)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Bharat Heavy Electricals Limited (India)

- Power Machines (Russia)

- Alstom (France)

- SPX FLOW, Inc. (U.S.)

- Thermax Limited (India)

- Babcock & Wilcox Enterprises, Inc. (U.S.)

- Hitachi, Ltd. (Japan)

- Larsen & Toubro (India)

- Korea Hydro & Nuclear Power (South Korea)

- Siemens Energy AG (Germany)

- China First Heavy Industries (China)

- Dongfang Electric Corporation (China)

- Harbin Electric Corporation (China)

- Cockerill Maintenance & Ingénierie (Belgium)

- Andritz AG (Austria)

- Doosan Enerbility is considered an international leader in aggressive manufacturing and forging, which serves as the primary supplier of reactor pressure vessels and steam generators for the Korea-based APR1400 design and other global projects. Additionally, the company’s integrated manufacturing capabilities make it a high-volume and crucial supplier of large nuclear island components, such as deaerators, for the latest builds internationally.

- Framatome is regarded as the OEM and historic architect of the French EPR as well as the overall domestic reactor fleet. In addition, the organization has possessed unparalleled lifestyle management expertise and in-house design authority for pressurized water reactor systems. This has positioned it as the most dominant and specification-setting provider of secondary system components, such as deaerators for both the French and Europe-based export projects. Besides, as per its 2024 annual report, the organization has generated EUR 4,676 million in revenue, EUR 623 million in EBITDA, and EUR 706 million in cash flow generated by operators.

- GE Vernova is considered the actual equipment manufacturer as well as the design authority for the overall global Boiling Water Reactor (BWR) technology, owing to its continuous legacy nuclear business. This has readily given it a captive and installed-based benefit for supplying replacement deaerators and upgradation for the extended international BWR fleet, along with contributions to the latest innovative reactor designs.

- Westinghouse Electric Company is regarded as the technology licensor for the industry-based AP1000 pressurized water reactor and a massive international fleet of earlier PWR designs, giving it proprietary design control over its linked secondary systems. The organization has leveraged this to offer replacement and original deaerators as part of its integrated services and fuel portfolio for PWR operators. Therefore, as stated in its 2024 sustainability report, the company has gained 10% of international electricity and 20% of U.S.-based electricity that derives from nuclear power, and it is further poised to achieve international nuclear capacity by 2050

- Mitsubishi Heavy Industries, Ltd. is regarded as a notable Japan-based heavy machinery conglomerate as well as the developer of the Advanced Pressurized Water Reactor (APWR) technology. It is also a key supplier of the majority of components, which include deaerators, especially for domestic nuclear plants, and has been an effective global partner in nuclear projects, especially in Turkey and the U.S.

Here is a list of key players operating in the global nuclear deaerator market:

The international nuclear deaerator market is considered an oligopolistic landscape, which is readily dominated by integrated specialized heavy equipment manufacturers and nuclear plant OEMs. Notable players, such as GE Vernova from the U.S., Framatome from France, and Doosan Enerbility from South Korea, have leveraged their respective roles as primary system suppliers for the majority of reactor designs, intended to achieve captive demand. Moreover, tactical approaches are significantly focused on gaining long-lasting service deals for present fleets and creating outstanding design partnerships with developers of SMR developers. Besides, in November 2024, Navitas Semiconductor has declared the world’s first-ever 8.5 kW power supply unit, which is readily powered by SiC and GaN technologies to gain 98% efficiency for cutting-edge hyperscale data centers and cutting-edge AI, which denotes an optimistic outlook for the overall nuclear deaerator market.

Corporate Landscape of the Nuclear Deaerator Market:

Recent Developments

- In February 2025, GE Vernova Inc., along with the Ministry of Electricity (MoE), has notified the successful completion of upgradation at different notable power plants, suitable for significantly boosting the output as well as the performance of the company’s present generating units.

- In February 2024, Wärtsilä supplied the generating equipment for 18 MW extension to the existing power plant in New Mexico by utilizing reciprocating internal combustion engine (RICE) technology. The plant operates on natural gas fuel, and has replaced lost generating capacity after the coal-based power plant closure.

- Report ID: 8282

- Published Date: Dec 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nuclear Deaerator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.