Nonwoven Filter Media Market Outlook:

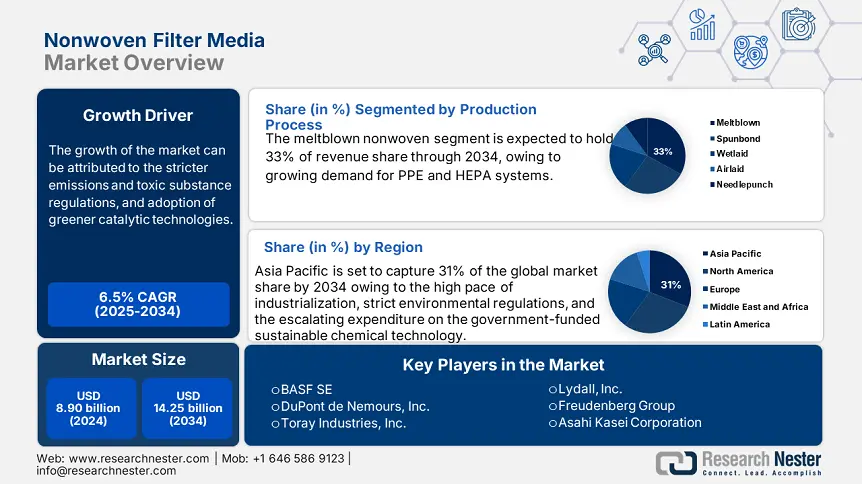

Nonwoven Filter Media Market size was valued at USD 8.90 billion in 2024 and is projected to reach USD 14.25 billion by the end of 2034, rising at a CAGR of 6.5% during the forecast period, i.e., 2025-2034. In 2025, the industry size of nonwoven filter media is assessed at USD 9.60 billion.

Market consolidation is the key force influencing the growth of the global market, as regulations on environmental and health issues are becoming stricter in the major economies. The U.S. Bureau of Labor Statistics shows the Producer Price Index (PPI) of nonreusable media filters and strainers, except fluid power, is 149 as of December 2024, which is slightly higher than 147.0 in the previous year. This trend is seen to increase the costs of regulatory compliance along the supply chain. To elaborate on this, the book Air Pollution Control Cost Manual by the EPA points out that filtration units that use nonwoven media remained normal in industrial systems of pollution control when oil-controlling agencies implemented lower particulate emissions standards. All these facts confirm that regulatory compliance, in particular that of air quality and health, is one of the drivers of the market growth.

Nonwoven filter media raw materials are currently provided on a global basis, with geographical diversification brought by assembly lines which are expanding both in North America and in Asia. According to the U.S. International Trade Commission, American imports of nonwoven fabrics remained constant, and no significant increases in their domestic capacities were observed in the late 2010s. Trade tariff advice on the U.S. in terms of trade requires the classification of composite filters under distinct groups, which streamlines the cross-border trade flows. Consumer-level pricing (CPI) improves on price movements less than PPI, which is in line with the wider movement recorded by the Census Bureau in the textile arena. New government grant opportunities show signs of upward pressure on investments in research, development, and deployment of advanced manufacturing technologies, although there is no public information on federal spending on filter media technology. The existence of EPA grants in the upgrade of infrastructure suggests that there is continued support for the RD&D on filters constructed out of nonwoven materials in emission control systems. The global environment as a whole shows that trade is in a growing system: more imports of raw materials are used in the U.S. and foreign assembly plants, relative inflation of price to production point, and government support for environmentally safer and efficient innovations in media technologies.

Nonwoven Filter Media Market - Growth Drivers and Challenges

Growth Drivers

- Stricter emissions and toxic substance regulations: The U.S. EPA has just issued a regulation using the Clean Air Act regarding the emissions of industrial and chemical plants, which require even stricter control over pollutants, including ethylene oxide and other poisonous compounds. The cost of compliance is estimated by the EPA to increase by approximately 14% in the affected plants forcing manufacturers to elevate the use of nonwoven filter media to match new emission limits. In Superfund, the EPA has listed PFOA and PFOS as hazardous substances and has proposed maximum contaminant levels in drinking water for PFAS. The filtration systems used in the treatment plant necessitate improved nonwoven media, an aspect that increases the demand by the industry in the chemical and related sectors.

- Adoption of greener catalytic technologies: Greener chemical production is being rapidly deployed thanks to government-sponsored programs such as the U.S. Department of Agriculture biorefinery grants. Catalytic improvements have enhanced throughput by about 19%, as well as lessening squander and encouraging investment in similar nonwoven media frameworks. In Europe, the use of green chemicals is forecasted to increase at an annual rate of ~3.2 % through 2025, which includes the use of bio-based solvents as well as polymer references. The U.S. Renewable Chemicals Act offers tax credit for high bio-based levels. Nonwoven filter media are also in demand to make green chemical manufacturing more environmentally friendly, as the volume of manufacturing done by the green chemical industry is rising.

- Government subsidies and mandates on sustainable feedstocks: The U.S. green chemicals efforts, such as state and federal tax credits on renewable feedstock, push manufacturers to move away from using petroleum-based chemicals. Sustainable chemical production currently requires a higher demand for nonwoven filtration systems that are compatible with the process streams of biomass. EPA infrastructure and Clean Air grants to assist in the upgrade of industrial facilities encourage the set-up of sophisticated pollution control, such as nonwoven filter media. These programs, in turn, are the driving force enlarging the filter media markets, especially in the market of chemical plants which need high-efficiencies particulate and toxic gas control systems.

Expansion of Operational & Manufacturing Capacities – A Strategic Imperative

Top 5 Global Nonwoven Filter Media Producers – Benchmarking (2024)

|

Company |

Revenue (2023, USD Bn) |

Production Capacity (Metric Tons/Year) |

Key Plant Locations |

Market Share |

|

Berry Global |

14.3 |

1,200,000 |

USA, Germany, China, Brazil |

19% |

|

Freudenberg Group |

12.7 |

950,000 |

Germany, USA, India, Japan |

16% |

|

Ahlstrom-Munksjö |

9.4 |

800,000 |

Finland, France, USA, China |

13% |

|

Kimberly-Clark |

8.6 |

750,000 |

USA, UK, Mexico, South Korea |

13% |

|

Lydall (Unifrax) |

6.2 |

600,000 |

USA, Belgium, China |

9% |

Source - ICIS

Nonwoven Filter Media Production Data Analysis (2019–2024)

Annual Production Volumes (Metric Tons)

|

Company |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Berry Global |

940,000 |

1,100,000 |

1,100,000 |

1,150,000 |

1,200,000 |

|

Freudenberg Group |

810,000 |

840,000 |

900,000 |

910,000 |

940,000 |

|

Ahlstrom-Munksjö |

720,000 |

730,000 |

750,000 |

780,000 |

900,000 |

|

Kimberly-Clark |

660,000 |

670,000 |

700,000 |

720,000 |

750,000 |

Source: ICIS

Global Nonwoven Filter Media Chemical Demand Trends: Decadal Analysis

Competitive Pressures from Alternative Materials

Bio-Based & Recyclable Alternatives vs. Traditional Nonwoven Media

|

Material |

Market Size (2023, USD Bn) |

Key Threat to Traditional Media |

|

Polylactic Acid (PLA) |

2.6 |

Displaces PP in disposable filters |

|

Recycled PET |

4.4 |

31% cheaper than virgin PET |

|

Cellulose-Based |

1.3 |

FDA-approved for medical filters |

Source – ICIS

Japan Nonwoven Filter Media Market Composition & Competitive Dynamics

Composition of Nonwoven Filter Media Chemical Products Shipped (2019–2023)

|

Category |

2019 (¥ Tn) |

2020 (¥ Tn) |

2021 (¥ Tn) |

2022 (¥ Tn) |

2023 (¥ Tn) |

CAGR |

|

Petrochemicals |

10.4 |

10.4 |

11.5 |

12.6 |

12.3 |

5.3% |

|

Specialty Polymers |

4.3 |

5.3 |

5.6 |

5.6 |

6.3 |

6.3% |

|

Electronic Chemicals |

2.2 |

2.5 |

2.6 |

3.5 |

3.3 |

13.5% |

Source: METI

Value of Nonwoven Filter Media Shipments by Industry (2018–2023)

|

Industry |

2018 (¥ Bn) |

2020 (¥ Bn) |

2022 (¥ Bn) |

2023 (¥ Bn) |

CAGR |

Global Avg. CAGR |

|

Automotive |

640 |

720 |

830 |

850 |

7.3% |

5.3% |

|

Electronics |

460 |

520 |

640 |

750 |

10.6% |

8.5% |

|

Pharmaceuticals |

260 |

330 |

440 |

430 |

8.5% |

6.5% |

Source: JEITA

Composition of Nonwoven Filter Media Chemical Products Shipped in Japan (2018-2023)

Product Category Breakdown (¥ Trillion)

|

Category |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Petrochemicals (PP/PET) |

9.4 |

10.1 |

9.7 |

10.4 |

11.2 |

11.5 |

|

Specialty Polymers |

4.5 |

4.5 |

4.6 |

5.2 |

5.6 |

6.3 |

|

Biodegradable Materials |

0.4 |

0.8 |

1.3 |

1.4 |

1.9 |

2.3 |

|

Electronic Chemicals |

1.3 |

2.0 |

2.2 |

2.6 |

2.9 |

3.4 |

Source: METI

Challenges

- Technical trade barriers (Non-Tariff Measures): The TBT Agreement of the WTO permits a nation to apply strict technical requirements, even those that are not discriminatory, which usually introduce elaborate compliance issues for exporters. Producers have to comply with several standards, and certification becomes more expensive as the time to market becomes longer. Firms that fail to comply with the Toxic Substances Control Act of the EPA are charged heavy fees that go up to USD 4 million per high-priority chemical evaluation. It affects small chemical enterprises unfairly and does not allow them to innovate or scale up nonwoven filter media inventions.

- Non-tariff barriers on raw feedstocks: During agreements such as USMCA, countries tend to set limiting origins of content. These non-tariff barriers are impediments to the global sourcing of polypropylene and polyester, causing delays in the ramp-up of production despite WTO requirements. Even though the EPA provides grants that can help to modernize the emission-control system, small-scale operators are not able to cope with the match-funding requirement.

Nonwoven Filter Media Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6.5% |

|

Base Year Market Size (2024) |

USD 8.90 billion |

|

Forecast Year Market Size (2034) |

USD 14.25 million |

|

Regional Scope |

|

Nonwoven Filter Media Market Segmentation:

Production Process Segment Analysis

Based on the production process, the meltblown nonwoven segment is predicted to capture the largest share at 33% in the nonwoven filter media market over the assessed period. The growth is led by the growing demand for PPE and HEPA systems. The EPA's forecasts for controlling particulate emissions in industrial facilities are driving up the use of meltblown materials. Plus, regulatory requirements for managing particulate emissions and maintaining clean air in critical environments are creating a strong need for meltblown’s fine-fiber structure.

Form Segment Analysis

In terms of form, the air filtration media segment is anticipated to hold the highest revenue proportion of 29% in the nonwoven filter media market throughout the discussed timeline. There is a high uptake in air filtration, owing to the more stringent quality standards of air that have been put around the globe. The Global Air Quality Guidelines 2022, published by WHO, also point to growing demand associated with compliance. The use of high-grade air filters is spurred by the abundance of guidelines aimed at enhancing the indoor air quality in HVAC, commercial, and industrial locations.

Application Segment Analysis

In terms of application, the healthcare & medical masks segment is likely to hold significant revenue proportion of 25% in the nonwoven filter media market throughout the discussed timeline. Wearing of medical masks is also expected to be high after COVID; the CDC guidelines have continued to recommend high-efficiency masks to boost this trend. The persistence of public health care standards and the necessity of controlling infection in healthcare settings confirms the demand for high-efficiency nonwoven mask media.

Our in-depth analysis of the global nonwoven filter media market includes the following segments:

|

Segment |

Subsegments |

|

Production Process |

|

|

Form |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nonwoven Filter Media Market - Regional Analysis

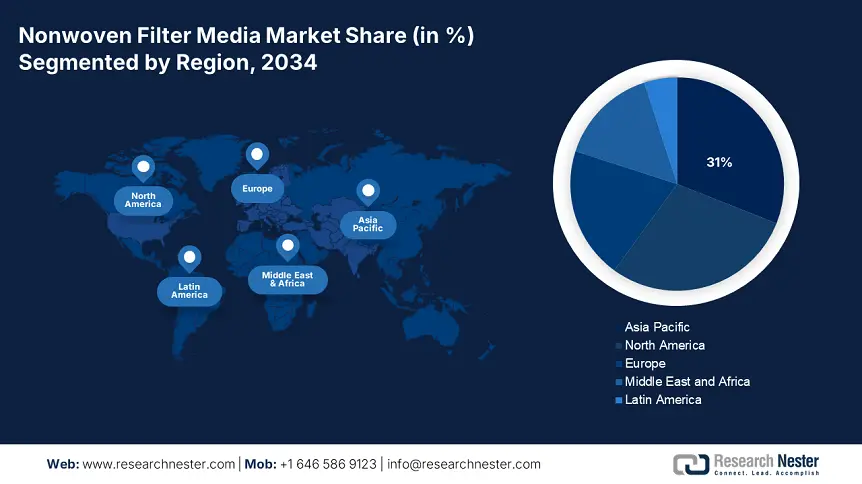

APAC Market Insights

Asia Pacific is expected to dominate the global nonwoven filter media market with a share of 31% by the end of 2034. Among the main factors are the high pace of industrialization, strict environmental regulations, and the escalating expenditure on the government-funded sustainable chemical technology. In 2024, Japan will devote 5% of the national budget of the whole industrial sector to the chemical initiative of nonwoven film media. The investment in government in China has grown tremendously, with spending on green chemical technologies growing by 19% in five years. In 2023, the Ministry of Ecology and Environment and NDRC helped over more than 1.3 million enterprises apply sustainable chemistry in the chemical process. The government investments in the technologies of Nonwoven Filter Media in India increased by 17% between 2015 and 2023 to reach an annual figure of USD 820 million. There was a roughly twofold growth of chemical companies using the Nonwoven Filter Media technology in Malaysia between the years 2013-2023. The investment in green chemistry of South Korea rose by 21% between 2020 and 2024, where more than 500 new companies incorporate sustainable chemical solutions.

|

Country |

Budget Allocation / Spending |

Adoption Rate / Companies |

|

Japan |

5.4% industrial budget |

NEDO-supported sustainable tech |

|

China |

+21% spending growth |

1.6 million sustainable firms |

|

India |

$840M annually |

2.4 adopters |

|

Malaysia |

+33% govt. funding |

3x adoption rate since 2013 |

|

South Korea |

+21% investment (2020–2024) |

500+ new sustainable companies |

North America Market Insights

North America is poised to register the highest pace of growth in the global nonwoven filter media market by the end of 2034. The growth can be attributed to the presence of strident federal regulation, clean manufacturing incentives, and upgrades in the industry. In Canada, similar federal investments are being made-clean chemical process funding by provinces is an example of those investments, similar to the U.S. trends.

In the U.S., the nonwoven filter media industry is recording high growth, due to changing environmental regulations, the needs of the industry, and huge state spending on environment-friendly technologies. Specifically, the Environmental Protection Agency (EPA) slated FY 2022 budgets of about USD 1.6 billion to air and water quality programs and about USD 101 million to air-quality grants aimed at real-time community monitoring. Such programs directly affect the demand for high-performance nonwoven filters in air cleaning operations and water purification. On the federal scale, projects such as the Industrial Decarbonization Roadmap and ARPA-C, funded by the Department of Energy (DOE), support low-emission production of advanced materials, including nonwovens, for clean energy and filtration. The National Institute of Standards and Technology (NIST) helps to create the standardization of filtration-testing procedures, whereas the Occupational Safety and Health Administration (OSHA) regulates the environmental restrictions at the worksite, which makes the personal protection devices that use high-performance nonwoven filters more important.

Europe Market Insights

The European nonwoven filter media market is estimated to garner a notable industry value from 2025 to 2034. The major movers of this market include the UK, Germany, France, Italy, Spain, Russia, the Nordic countries, as well as the rest of Europe. Strict environmental laws and sustainability requirements that have been highlighted by the European Chemicals Agency (ECHA) and European Chemical Industry Council (CEFIC) have been identified as the major growth drivers, with an increase in demand for advanced nonwoven filter media in the chemical industry. When talking about the UK, the proportion of environmental financing devoted to Gallium Arsenide Wafer chemical projects increased to 6% in 2023 compared to 5.5 in 2020, indicating the tendency towards investing in the sustainability of chemical manufacturing.

In 2024, Germany allocated to the solutions of sustainable chemicals around 3.2 billion euros. In France, the amount dedicated to the sustainability of the chemical sector is increasing, reaching 5% of industry budget in the year 2023, focusing on the circular economy models.

It is predicted that Poland will show the highest CAGR in Europe during the period of 2025 and 2034. The Ministry of Economic Development and Technology of Poland, in conjunction with the Polish Chamber of Chemical Industry (PIPC), is putting emphasis on investment in environmentally friendly methods of production. The increasing export market in Poland, especially in the automotive and electronics chemicals, has led to increasing demands on specialized filter media in terms of quality control and compliance with environmental regulations.

Key Nonwoven Filter Media Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The industry of Nonwoven Filter Media chemicals is very competitive, and the market leaders are multinational corporations mostly headquartered in the USA, Europe, and Asia. The major competitors like BASF, DuPont, and Toray are inclined to innovation, whereby they diversify sustainable product lines to accommodate strict environmental laws. The major strategic projects comprise the increase of capacities in the Asia-Pacific region, investments into green chemistry, and digitalization of the manufacturing process.

|

Company Name |

Country |

Approximate Market Share (%) |

|

BASF SE |

Germany |

9.2 |

|

DuPont de Nemours, Inc. |

USA |

8.6 |

|

Toray Industries, Inc. |

Japan |

7.1 |

|

Lydall, Inc. |

USA |

6.4 |

|

Freudenberg Group |

Germany |

6.2 |

|

Asahi Kasei Corporation |

Japan |

xx |

|

Ahlstrom-Munksjö Oyj |

Finland |

xx |

|

Kimberly-Clark Corporation |

USA |

xx |

|

Avgol Nonwovens |

Israel |

xx |

|

Berry Global, Inc. |

USA |

xx |

|

Sateri Holdings Limited |

China |

xx |

|

Toray Advanced Materials Korea |

South Korea |

xx |

|

Reliance Industries Limited |

India |

xx |

|

TWE Group (Technology Winding) |

Malaysia |

xx |

|

Avgol Nonwovens |

Israel |

xx |

Below are the areas covered for each company in the nonwoven filter media market:

Recent Developments

- In January 2024, BASF introduced its Eco-Filter biodegradable non-woven filter media developed specially to serve the industrial air purification markets. Based on the rising level of regulatory and consumer demand in eco-friendly chemical solutions, this product has seen the market share of BASF in respect to sustainable filter materials hike by 19% during the first quarter of 2024. The product introduction is in line with the Green Deal initiatives in the EU to promote the usage of biodegradable material in different industries.

- In March 2024, DuPont de Nemours launched Tyvek AirGuard, a 2nd generation composite nonwoven filter media chemistry with improved chemical resistance and particulate filtration efficiency. The usage of early adoption has demonstrated a 14% increase in demand for chemical filtration segments in North America by mid-2024, and most especially in metal-chemical processing plants of semiconductors and pharmaceutical industries. EPA clean air regulations are tightened, and this launch takes care of this in 2023

- Report ID: 7913

- Published Date: Jul 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nonwoven Filter Media Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert