Non-PVC IV Bags Market Outlook:

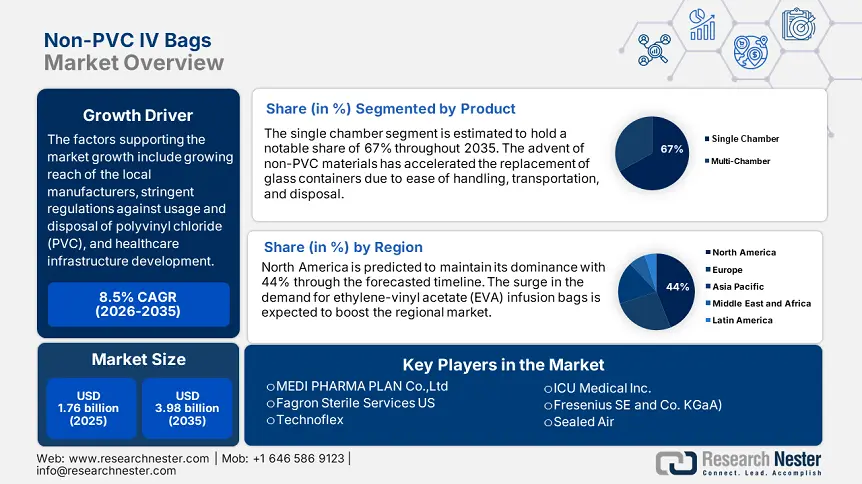

Non-PVC IV Bags Market size was over USD 1.76 billion in 2025 and is poised to exceed USD 3.98 billion by 2035, growing at over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of non-PVC IV bags is estimated at USD 1.89 billion.

The non-PVC IV bags market is growing very rapidly as a result of growing concern over possible health consequences from conventional PVC bags, which can leach toxic plasticizers like DEHP into intravenous fluids and affect vulnerable patient groups. For instance, in February 2024, the new Heparin Sodium 2,000 units in 0.9% Sodium Chloride Injection, 1,000 ml, was introduced by B. Braun Medical, Inc. The product was made with EXCEL IV Containers, which prioritize patient and environmental safety by not utilizing PVC, DEHP, or natural rubber latex.

Moreover, as incidence of disease rises for chronic conditions, hospitalization, and elderly populations, need for IV fluid infusion is also on the rise and consequently the demand for safer, non-PVC-prepared formulations as well. For instance, in December 2024, as per the statistics of the WHO, in 2021, NCDs accounted for at least 43 million deaths worldwide, or 75% of mortality. In addition, the majority of NCD deaths, at least 19 million in 2021 are attributable to cardiovascular illnesses, followed by cancer (10 million), chronic respiratory conditions (4 million), and diabetes (more than 2 million deaths).

The market also expands with increased focus on the environmental sustainability of healthcare since non-PVC materials are more recyclable and have a lesser environmental footprint than PVC. Advances in the technology of the material sciences enabled it to access films based on non-PVC with similar or even superior performance features for flexibility, durability, and compatibility with broad-spectrum medication. Furthering the demand, growing home healthcare and point-of-care markets is projected to help the market sustain and reflect higher growth trajectory.

Key Non-PVC IV Bags Market Insights Summary:

Regional Highlights:

- North America leads the Non-PVC IV Bags Market with a 44% share, fueled by expanding portfolios of IV bags by companies and avoidance of drawbacks in packaging, ensuring strong growth through 2026–2035.

- Asia Pacific's Non-PVC IV Bags Market is expected to see substantial growth by 2035, driven by the expanding use of multi-chambered containers and availability of customized products.

Segment Insights:

- Single Chamber segment is expected to capture a 67% share by 2035, driven by ease of use and convenience in accommodating a wide range of intravenous therapy.

Key Growth Trends:

- Growing awareness of harmful PVC effects

- Increasing healthcare expenditure and infrastructural development

Major Challenges:

- Material compatibility concerns

- Regulatory hurdles

- Key Players: Baxter, B. Braun Melsungen AG, Pfizer, Inc. (Hospira), Fresenius Kabi AG, JW Life Science.

Global Non-PVC IV Bags Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.76 billion

- 2026 Market Size: USD 1.89 billion

- Projected Market Size: USD 3.98 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Non-PVC IV Bags Market Growth Drivers and Challenges:

Growth Drivers

-

Growing awareness of harmful PVC effects: Increased health and environmental-concerns caused by PVC has risen as a key growth driver for the non-PVC IV bags market and thus are propelling a visible shift towards cleaner and greener alternatives. For instance, in September 2022, the high-quality dual chamber bags with peelable aluminum foil that are composed of DEHP-free polypropylene were introduced by Gufic Biosciences Ltd. These bags were used to store delicate pharmaceuticals. Demand for non-PVC IV bags, therefore, with their lower toxicity and higher recyclability is gathering phenomenal upward momentum.

- Increasing healthcare expenditure and infrastructural development: Growing healthcare investments and enhanced ability to provide sophisticated medical care are propelling higher intravenous applications of fluids in the non-PVC IV bags market. For instance, in March 2025, the WHO unveiled that, the HIIP developed multilateral solutions to raise the percentage of development funding allocated to the health sector. It estimated nearly USD 31.1 billion annual funding requirement for pandemic preparedness and a USD 371 billion annual health financing gap for health-related Sustainable Development Goals (SDGs).

Challenges

-

Material compatibility concerns: The issues with material compatibility with a wide variety of pharmaceutical formulations is one of the key challenges in the non-PVC IV bags market. Inhibition of inertness of non-PVC material and leach or adsorption of drug molecules need to be controlled to ensure drug efficacy and safety of patients. Stringent condition-based testing and approval must be made mandatory to evaluate viability of certain of the non-PVC polymers with drugs belonging to different classes, a secondary risk for prolonged development period and enhanced expense, discouraging extensive use on the market.

- Regulatory hurdles: Competition with uneven and restrictive foreign market regulatory environments is a primary threat to the non-PVC IV bags market. Differing standards for material safety, biocompatibility, and leachability require extensive testing and documentation for entry to region-specific markets. Compliance with such multi-faceted and sometimes conflicting standards may be difficult for producers, which can prolong product approvals and the pace of international market entry for non-PVC IV bag substitute.

Non-PVC IV Bags Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 1.76 billion |

|

Forecast Year Market Size (2035) |

USD 3.98 billion |

|

Regional Scope |

|

Non-PVC IV Bags Market Segmentation:

Product (Single Chamber, Multi Chamber)

Single chamber segment is likely to hold non-PVC IV bags market share of more than 67% by 2035, due to the ease to use and convenient to handle in their ability to accommodate a wide range of standard intravenous therapy. For instance, in July 2024, a New Drug Application (NDA) for Amneal Pharmaceuticals' novel potassium phosphates in 0.9% sodium chloride injection IV ready-to-use bags was been approved by the US FDA. Through this approval adults and children with hypophosphatemia receive the injection as a source of phosphorus. In addition, the same simplicity found in single chamber systems also comes with reduced production costs.

Material Type (Polypropylene IV Bag, Polyethylene IV Bag, Ethylene Vinyl Acetate)

The ethylene vinyl acetate segment is projected to garner significant growth traction in the non-PVC IV bags market, because of the better properties of EVA, such as increased flexibility, clarity, and compatibility with an extremely broad spectrum of drugs. For instance, in March 2025, Helapet presented its new line of EVA Infusion Bags, which are intended for the secure intravenous administration and storage of fluids and pharmaceuticals. In addition, it constitutes of three volume ranges ranging from 250ml to 1000ml, suitable for a variety of medicinal uses. Moreover, leachability of EVA is lower relative to PVC, and it is also equipped with adequate impact strength, thus becoming a material choice for most of the intravenous liquid applications.

Our in-depth analysis of the global non-PVC IV bags market includes the following segments:

|

Product |

|

|

Material Type |

|

|

Content Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Non-PVC IV Bags Market Regional Analysis:

North America Market Analysis

North America in non-PVC IV bags market is poised to capture over 44% revenue share by 2035. The growth can be attributed to the expanding portfolios of IV bags by the companies. For instance, in March 2021, Fagron Sterile Services announced that it has expanded its product line to include intravenous (IV) bags. The use of non-PVC IV bags can avoid drawbacks, such as interactions between drugs and packaging materials and challenges with handling, transporting, and discarding the containers.

The landscape of the non-PVC IV bags market in the U.S. will be predominantly influenced by the focus of producers on the manufacturing qualities such as moisture-barrier qualities, thermal stability, and environmentally friendly disposal. For instance, in April 2022. In the U.S., Fresenius Kabi introduced calcium gluconate in sodium chloride injection in freeflex packets that were ready to use. These polyolefin packets are non-PVC and free of Di-2-ethylhexyl phthalate (DEHP) plasticizersik.

In Canada, the non-PVC IV bags market is driven by the rise in cancer cases, hence it has increased the demand for IV bags. For instance, in May 2024, the statistics revealed by the Canadian Cancer Society that, 120,000 women and 127,100 men would receive a cancer diagnosis. Therefore, the growing concern over the cancer instances has shift the focus of manufacturers to develop IV bags to balance dual fold goals that of sustainability and eco-friendly materials. Hence, the market is likely to expand at a steady pace during the projected timeframe.

Asia Pacific Market Statistics

Asia Pacific is expected to witness substantial growth in the non-PVC IV bags market during the forecast timeline from 2025 to 2035. They are frequently employed in medicines because of their exceptional transparency, durability, stability, high pressure agility, thermal sealing, and reusability. Therefore, the main reasons propelling the expansion of the non-pvc IV bags are the expanding use of multi-chambered containers in a variety of materials, including parenteral nourishment and drug reconstitution, as well as the availability of customized product offers.

In the India., the non-PVC IV bags market is propelling due to strategic collaborations between companies to leverage the expertise and render extensive reach to the medical fraternity. For instance, in November 2023, Hindustan Antibiotics and Sanjivani Paranteral have signed a contract for the production of IV formulations and IV sets. As a result of the collaboration, a manufacturing plant was built in Pune, Maharashtra with the monthly capacity of 10 lakh IV sets and 50 lakh IV fluid bottles and a total investment of USD 10 million.

The non-PVC IV bags market in China is fueled by the growing adoption of innovative drug delivery technologies and technical advancements. Furthermore, growing number of elderly people, the rise in acute and chronic illnesses, the growing use of intravenous treatments, and rising healthcare expenditures are propelling the market response. For instance, in October 2024, it was unveiled by the State Council of the People’s Republic of China that, nearly 297 million people in China were 60 years of age or older in 2023, making up 21.1% of the country's total population. In addition, 15.4% of the population was 65 years of age or older.

Key Non-PVC IV Bags Market Players:

- MEDI PHARMA PLAN Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fagron Sterile Services US

- Technoflex

- ICU Medical Inc.

- Fresenius SE and Co. KGaA

- Baxter

- B. Braun Melsungen AG

- Pfizer, Inc. (Hospira)

- Fresenius Kabi AG

- JW Life Science

- RENOLIT

- PolyCine GmbH

- Sealed Air

- ANGIPLAST PVT. LTD

- Shanghai Solve Care Co Ltd.

- Kraton Corporation

- Jiangxi Sanxin Medtec Co., Ltd.

The non-PVC IV bags market is dominated by the significant efforts in research and development by major firms in order to produce technologically improved productsand expand their product niche. For instance, in November 2022, QuVa Pharma, Inc. declared that it has created a two-sided single label for its line of compounded intravenous bags. These new labels were created by QuVa Pharma in accordance with the Institute of Safe Medication Practices' (ISMP) 2022 best practice guidelines and after consulting with its clients.

Here’s the list of some key players:

Recent Developments

- In October 2024, B. Braun Medical Inc. updated on the company's efforts to secure supplies of vital intravenous fluids in response to Hurricane Helene's damage to a sizable IV fluids manufacturing facility in North Carolina and Hurricane Milton.

- In December 2023, Baxter International Inc. concluded its first phase of the pilot project for the intravenous (IV) bag recycling in collaboration with Northwestern Medicine.

- Report ID: 7548

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Non-PVC IV Bags Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.