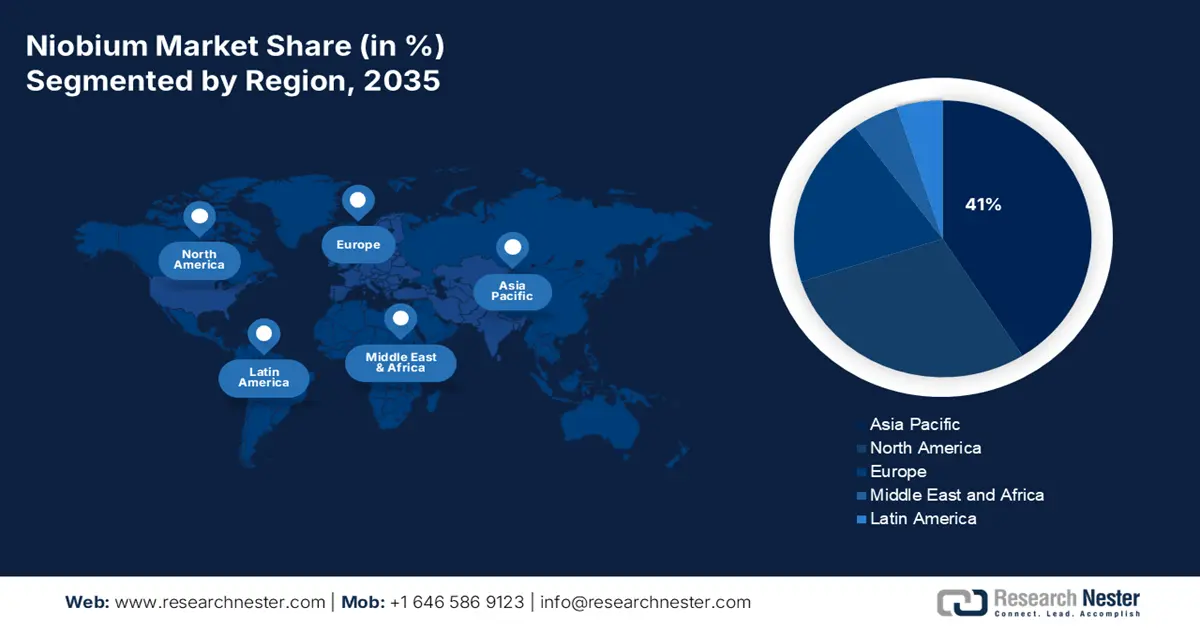

Niobium Market - Regional Analysis

APAC Market Insights

Asia Pacific is expected to account for the largest 41% share in the world niobium market by the end of 2035. The demand for niobium is mainly being propelled by nations such as China, Japan, and India. Based on the PIB report in December 2023, nearly 141 procedures were conducted regarding orthopedic diseases, and the Ayushman Bharat healthcare plan had reported 20.25 million hospital stays for orthopedic-related treatment in December 2023, immensely driving the demand for niobium. The trend in the market is shifting towards strategic stockpiling and forming alliances with secure mining facilities to diversify sources of supply and mitigate geopolitical risk.

China's niobium market has grown quickly, largely because of the country’s expansion in infrastructure and EV production. Data from the National Medical Products Administration (NMPA) shows that government spending on niobium rose over the last five years. China produced approximately 354.39 million tons of steel from January to April 2023, a 4.1% increase compared to the same period in 2022, buoying niobium demand as a key alloying element in high-strength steel, based on the GMK Center report in April 2023. Additionally, China is a major consumer of niobium in industrial applications, including the production of high-strength steel for its fast-growing automotive industry.

Ferro-niobium Import and Export Data in 2023

|

Country |

Import |

Export |

|

India |

USD 62.7 million |

USD 1.16 million |

|

China |

USD 18.1 million |

USD 1.01 billion |

|

Japan |

USD 184 million |

USD 234 K |

Source: OEC 2023

North America Market Insights

North America is poised to exhibit a notable CAGR in the global niobium market throughout the discussed period. The U.S. and Canada are dominating the region and are driven by strong demand from the aerospace, automotive, and defense sectors. Based on the Mineral Commodity Summaries 2025, the U.S. Department of Defense awarded USD 26.4 million in 2024 for establishing high-purity niobium oxide production facilities domestically, which is critical for aerospace and defense sectors. These industries depend on niobium alloys for their lightweight and strong properties. More investments in EVs and sustainable energy solutions also increase niobium usage. Moreover, federal healthcare budgets encourage the use of niobium-based treatments in medical devices.

Canada is leading the niobium market in North America and is expected to benefit from its industrial growth and government investments in health care. As per the Minerals Industry of Canada in 2021, Canada niobium reserves 9.4% of the world’s niobium reserves and is the second largest in the world after Brazil. The emphasis on innovation in alloy development used in high-tech manufacturing and green technologies will continue to create demand for niobium alloys. Furthermore, tax incentives offered to manufacturers will allow for further increases in domestic production of niobium-based products.

Europe Market Insights

From the years 2026 to 2035, the Europe niobium market is projected to achieve significant industry valuation growth due to increasing demand for more lightweight and high-performance materials in the automotive and aerospace sectors and the medical fields. These sectors are experiencing a shift into more sustainable solutions and vehicles, leading to an increase in niobium consumption. The Eurostat report in June 2025 depicts that the nation is highly dependent on imports for niobium, mainly ferro-niobium, obtaining approximately 86% of its niobium from Brazil. The EU aims to advance research and innovation in materials science, which will augment the region's consumption of niobium.

In the UK, niobium is increasingly in demand across both the aerospace and automotive industries and applications such as medical devices. Quite significantly, the UK earmarked 7% of its healthcare budget (in terms of technology and treatments) for niobium in 2023; reflecting a substantial increase from 6.2% in 2020. The niobium market growth is driven by the investment from the National Health Service (NHS) in high performance medical devices and infrastructure. Another primary factor increasing niobium is the UK government is focusing on reducing carbon emissions in the automotive industry.

Germany’s niobium market is set to grow by 2034. The OEC report in 2035 states that Germany has exported USD 13.6 million worth of niobium, tantalum, vanadium, and zirconium. With one of the biggest healthcare and automotive industries in the world, Germany heavily utilizes niobium in high-strength alloys to create lightweight vehicles. The Federal Ministry of Health (BMG) has invested significantly in the development of niobium-based products for medical uses. On the other hand, the government programs are providing subsidies to companies that are innovating in sustainable technologies.