Nickel Acetate Market Outlook:

Nickel Acetate Market size was valued at USD 61.82 billion in 2025 and is expected to reach USD 89.76 billion by 2035, expanding at around 3.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nickel acetate is evaluated at USD 63.93 billion.

The growth of the market can be attributed to the rising demand for the use of nickel acetate in various industries, such as, automobiles, electronics, electrical, aesthetics, and metallurgy. In addition to protection from rust, nickel acetate is used in automotive plating in order to brighten the finish on metal or non-metal parts, and metalize plastic parts to improve their sturdiness. With worldwide car sales growing steadily from around 60 million in the year 2020 to more than 70 million in 2021, as per the latest survey of the automotive industry, the global nickel acetate market is predicted to grow to a significant size.

Nickel acetate is a green crystalline inorganic compound used in textile dyeing processes, electroplating, anodization applications, as an intermediate catalyst, and in surface treatment. The versatility, popularity, and utility in diverse fields of applications of nickel acetate makes it a highly viable market and is forecasted to grow at a considerable market size. For instance, the textile industry in the U.S is the second largest exporter of textile-related products in the world and the exports were valued at around USD 28 Billion in 2021, according to the National Council of Textile Organizations (NCTO). Therefore, all these factors are anticipated to hike the market growth over the forecast period.

Key Nickel Acetate Market Insights Summary:

Regional Highlights:

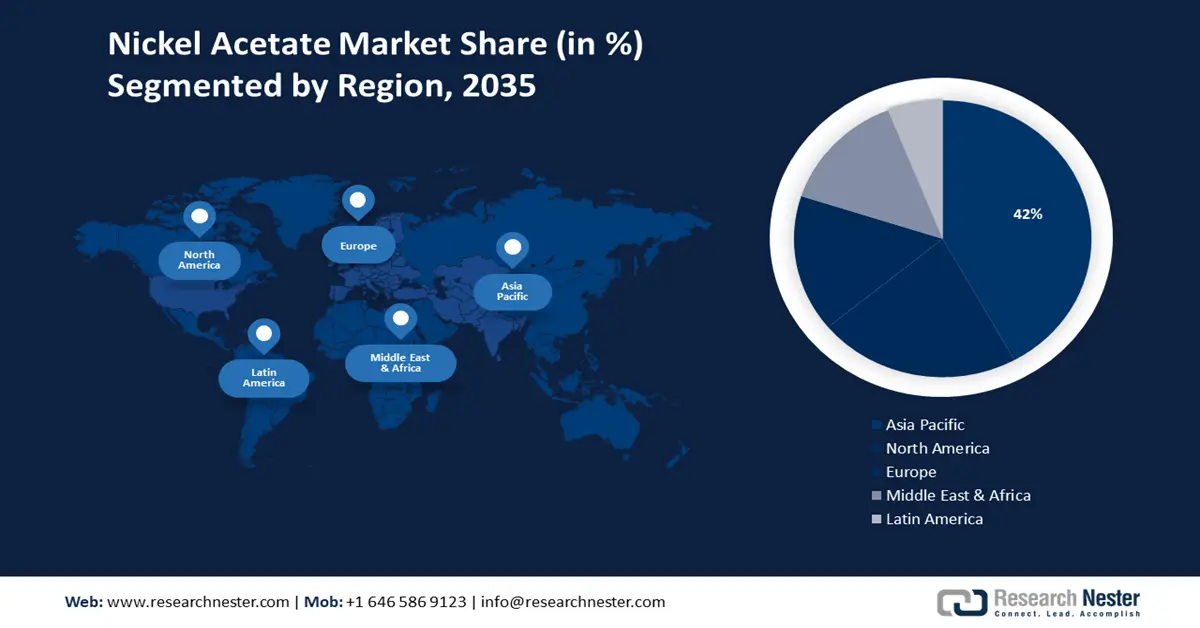

- Asia Pacific nickel acetate market will secure around 42% share by 2035, driven by the increasing mass production and industrialization in developing nations.

Segment Insights:

- The aluminum surface treatment segment in the nickel acetate market is projected to secure the largest share by 2035, fueled by its myriad applications in construction, transportation, and electrical goods manufacturing.

- The ceramics glaze segment in the nickel acetate market is set for significant share by 2035, driven by escalated utilization of ceramics in home décor and decorative products.

Key Growth Trends:

- Advancements in Automobile Industry

- Growth of Textile Industry

Major Challenges:

- Contact with Skin May Cause Dermatitis

- Carcinogenic in Nature

Key Players: Merck KGaA, Fairsky Industrial CO., Limited, Univertical LLC, Noah Chemicals Corporation, Palm Commodities International, Inc., Zhangjiagang Huayi Chemical Co. Ltd., Hunter Chemical LLC, ProChem, Inc., TIB Chemicals AG, Foshan Qiruide Additives Co,Ltd.

Global Nickel Acetate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 61.82 billion

- 2026 Market Size: USD 63.93 billion

- Projected Market Size: USD 89.76 billion by 2035

- Growth Forecasts: 3.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 9 September, 2025

Nickel Acetate Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in Automobile Industry – Nickel acetate is employed in the manufacture of fasteners, bolts, hydraulic systems, shafts, and other engine components because of features, such as, corrosion resistance, wear and abrasion resistance, and ductility. Increasing improvements in the automobile industry are expected to propel the global nickel acetate market growth. According to the International Trade Administration, China has the world’s largest automobile market in terms of both annual sales and manufacturing output, and the production of vehicles is expected to reach 35 million vehicles by 2025.

- Growth of Textile Industry – Nickel Acetate is used as a mordant in textile dyeing to fix the dye onto fabric which is further backed by the growing utilization of digital textile printing ink. The booming textile industry is predicted to propel the nickel acetate market. India alone exported around USD 30 billion worth of textiles between April and December of 2021.

- Advancements in Aerospace Industry - Nickel-based plating has exceptional adhesion and corrosion protection and provides a uniform coating of thickness, which is paramount to the aerospace industry. According to the United States Aerospace & Defense Industry, the total aerospace and defense industry sales revenue was a combined value of` USD 382 billion. The advancing aerospace industry is anticipated to propel the nickel acetate market growth.

- Increased Use in Electronics - Nickel plating is widely used in electronic parts, such as, microprocessors and integrated circuits due to its reliability and functionality. As per recent studies, the number of smartphones sold worldwide rose from about 1.3 billion in 2020 to around 1.4 billion in the year 2021.

- Increased Use in Aesthetic Jewelry – Nickel Acetate is used for decorative purposes to give a bright, shiny appearance to jewelry and also to provide resistance to corrosion and wear. India saw around a 54% rise in jewelry exports in 2021-22 compared to the year before, according to the India Brand Equity Foundation.

Challenges

- Contact with Skin May Cause Dermatitis - It has been observed that is a person comes in repeated and prolonged contact with nickel acetate, that a person may experience some organ damage. It is strictly prohibited to inhale nickel acetate since it can cause asthma, cancer and other significant allergies. Hence, this factor may limit the market growth over the forecast period.

- Carcinogenic in Nature

- Produces Toxic Fumes When Heated

Nickel Acetate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.8% |

|

Base Year Market Size (2025) |

USD 61.82 billion |

|

Forecast Year Market Size (2035) |

USD 89.76 billion |

|

Regional Scope |

|

Nickel Acetate Market Segmentation:

The global nickel acetate market is segmented and analyzed for demand and supply by application into electroplating, ceramics glaze, aluminum surface treatment, coinage, textile dyeing, and others. Out of these segments, the aluminum surface treatment segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to its myriad applications, such as, in the construction industry, transportation industry, and the manufacture of electrical and consumer goods. Nickel acetate is used in surface treatment and precise plating along with ceramic glazing and industrial fabric dying. Hence, all these factors are expected to propel the growth of the segment over the forecast period.

The global nickel acetate market is also segmented and analyzed for demand and supply by application into electroplating, ceramics glaze, aluminum surface treatment, coinage, textile dyeing, and others. Amongst these segments, the ceramics glaze segment is expected to garner a significant share. The growth of the segment can be ascribed to escalated utilization of ceramic in home décor which is further boosted by the higher demand for home decor product such as, pottery, decorative lamps, lightings, and others.

Our in-depth analysis of the global nickel acetate market includes the following segments:

|

By Product Form |

|

|

By Product Type |

|

|

By Purity |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nickel Acetate Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is poised to dominate majority revenue share of 42% by 2035. The growth of the market can be attributed majorly to the increasing mass production of nickel acetate, the establishment of new manufacturing plants across the region, and the rapid industrialization of developing countries such as China and India are expected to propel the growth of the market. For instance, India’s production of major chemicals shot up by 14.09% in 2021-2022 compared to the previous years, with a 7.5% increase in the production of inorganic chemicals such as Nickel Acetate, according to the latest research conducted by the National Investment Promotion & Facilitation Agency.

North America Market Insights

Furthermore, the market in North America region is also projected to witness a noteworthy growth during the forecast time. Surge in the industrialization backed by higher fundings and presence of the robust automotive industry with a huge demand for nickel acetate is projected to expand the market size in the region over the forecast period. Nickel estate is used in plating purposes in the automotive industry. For instance, around 15 million units of automobiles were sold across the United State in 2021.

Nickel Acetate Market Players:

- Merck KGaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fairsky Industrial CO., Limited

- Univertical LLC

- Noah Chemicals Corporation

- Palm Commodities International, Inc.

- Zhangjiagang Huayi Chemical Co. Ltd.

- Hunter Chemical LLC

- ProChem, Inc.

- TIB Chemicals AG

- Foshan Qiruide Additives Co,.Ltd

Recent Developments

-

Hunter Chemical LLC has launched a new conductive nickel product- the Conductive Grade AH55C, to its line of nickel powders. AH55C is suitable for EMI/RFI shielding coatings and caulk.

-

ProChem Inc. announced the addition of new inorganic compounds to its catalog for use in Energy, Electronics, and Chemical Synthesis Applications.

- Report ID: 4195

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nickel Acetate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.