Neurovascular Guidewires Market Outlook:

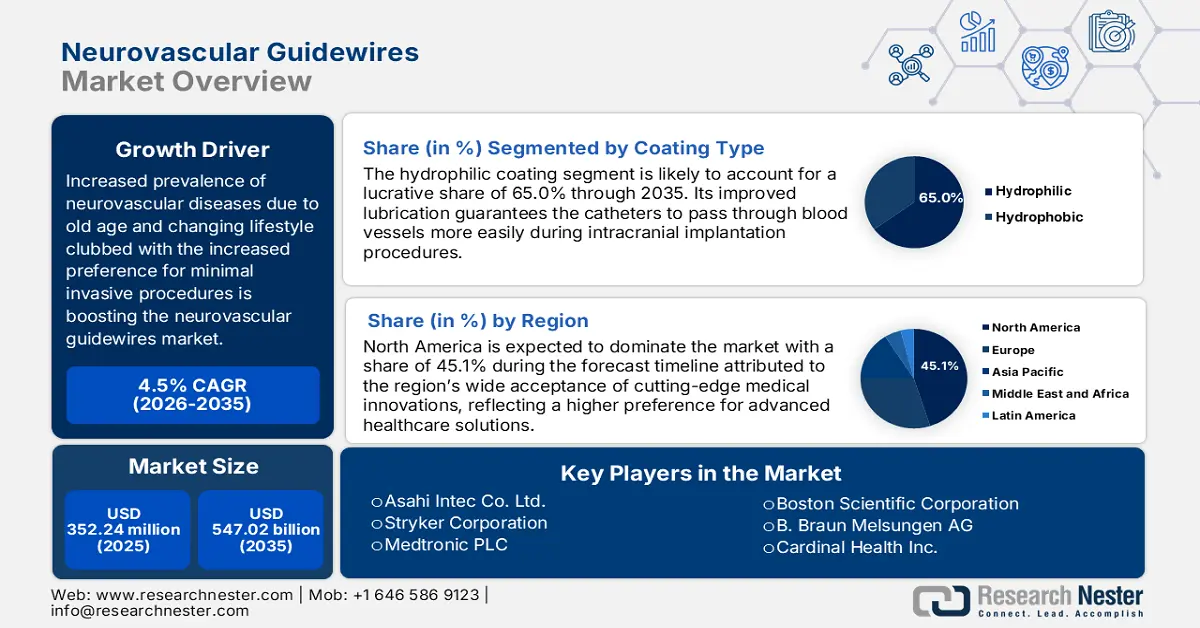

Neurovascular Guidewires Market size was valued at USD 352.24 million in 2025 and is expected to reach USD 547.02 million by 2035, registering around 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of neurovascular guidewires is evaluated at USD 366.51 million.

Neurovascular guidewires market reflects a strong growth with rising prevalence of cerebrovascular disease and increased application of minimally invasive neuro interventions. In addition, constant advancements in guidewire technology are further accelerating industry expansion. For instance, in May 2024, SIGNA MAGNUS, a magnetic resonance (MR) scanner, was revealed by GE HealthCare. Its purpose is to investigate improvements in neuroscience that have been hampered by the performance constraints of traditional whole-body MR systems. This invention demonstrates the dedication to research and development and have a significant effect on patient outcomes and our comprehension of the human brain.

Furthermore, application of newer imaging modalities for real-time imaging and optimization of procedures is a recent trend. For instance, in January 2025, GE HealthCare and the Department of Radiology & Biomedical Imaging at the University of California, San Francisco (UCSF) announced the opening of a Care Innovation Hub. It is a collaborative research effort that will focus on three major clinical challenges such as precision oncology, non-invasive diagnosis and treatment of neurological and neurodegenerative diseases, and accessibility to advanced medical imaging. Hence, the companies will strive to supply safer and more efficient neurovascular access systems.

Key Neurovascular Guidewires Market Insights Summary:

Regional Highlights:

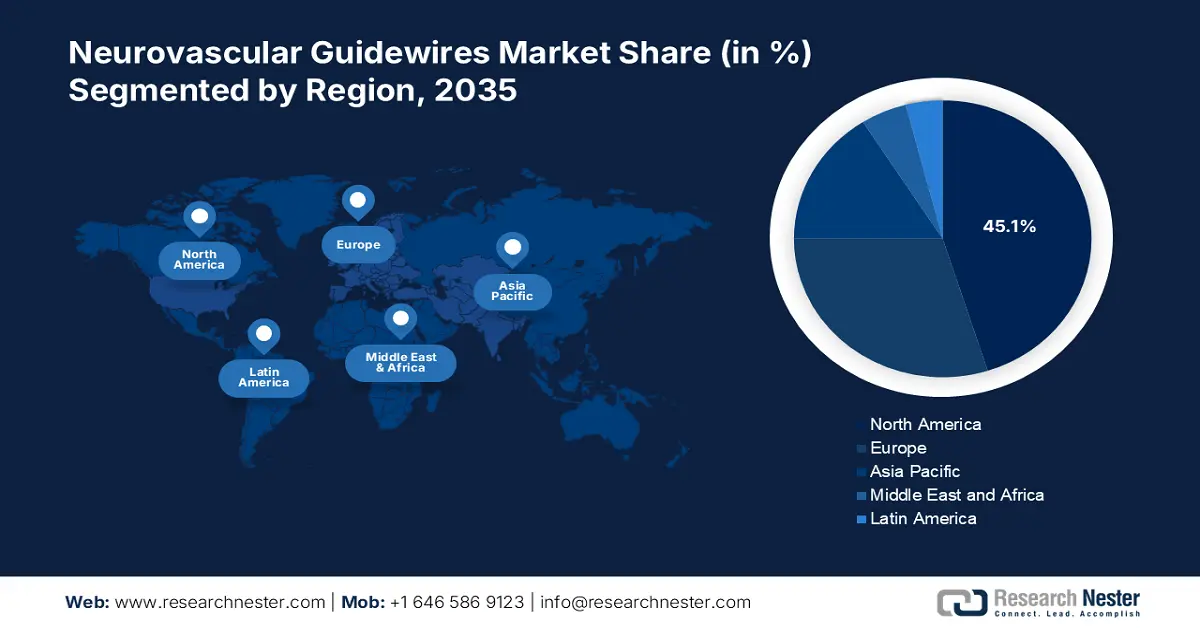

- North America leads the Neurovascular Guidewires Market with a 45.1% share, propelled by the trend of minimally invasive procedures and the need for precise placement of medical devices, fostering strong growth prospects for 2026–2035.

- The Asia Pacific region is expected to achieve lucrative growth in the Neurovascular Guidewires Market from 2026 to 2035, driven by advancements in guidewire materials and coatings, improving surgery precision.

Segment Insights:

- The Hydrophilic Guidewires segment is projected to capture a 65% share by 2035, fueled by their ability to reduce friction, enhancing navigability and safety in neuro interventions.

- The Straight Guidewires segment of the Neurovascular Guidewires Market is expected to capture a major market share from 2026 to 2035, driven by their versatility and broad applicability in neurointerventional procedures.

Key Growth Trends:

- Growing incidences of neurovascular diseases

- Expansion in neurovascular centers

Major Challenges:

- Device integration and comparability

- Risk of Thromboembolism

Key Players: Stryker Corporation, Medtronic PLC, Boston Scientific Corporation, B. Braun Melsungen AG, Cardinal Health Inc., and more.

Global Neurovascular Guidewires Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 352.24 million

- 2026 Market Size: USD 366.51 million

- Projected Market Size: USD 547.02 million by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, China

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 12 August, 2025

Neurovascular Guidewires Market Growth Drivers and Challenges:

Growth Drivers

- Growing incidences of neurovascular diseases: The rising worldwide prevalence of neurovascular disorders such as ischemic and hemorrhagic stroke is one of the primary drivers of growth in the neurovascular guidewires market. For instance, in September 2024, it was revealed by IHME that worldwide, 65·3% of incident strokes were ischemic stroke, 28·8% out of them were intracerebral hemorrhage, and 5·8% were subarachnoid hemorrhage. Stroke was the 4th most prevalent cause of DALYs (160·5 million) and the 3rd most common GBD level 3 cause of death (7·3 million) in 2021. There were in total 11·9 million incident of strokes and 93·8 million prevalent strokes in 2021.

- Expansion in neurovascular centers: The expanding of high-end neurovascular centers around the world has direct proportionality with rising demand in the market. For instance, in February 2023, it was unveiled by the National Library of Medicine that, in 2020, 165 intensive care units (NCCUs) from 152 tertiary hospitals across 29 provinces reported relatively comprehensive data severe neurological illnesses. This expansion boosts the availability of critical care among patients and sparks business and innovation growth through high-performance neurovascular access devices.

Challenges

- Device integration and comparability: A challenge for the market as a result of the heterogeneity of the data in neurointerventional devices and imaging systems. Seamless compatibility is necessary for procedural efficacy and patient safety but is a multifaceted engineering and logistics problem. Moreover, real-time data exchange between guidewires, imaging devices, and navigation software is required to enable precise navigation and deployment with complicated integration processes. Therefore, producers have to stress cooperative functionality and satisfy rigorous industry standards to deliver proficient device integration and reduce potential complications.

- Risk of Thromboembolism: The thromboembolism that is part of neurovascular procedures represents a challenging issue for the market. The cerebral vasculature is extremely susceptible to embolic events, which can result in severe neurological complications, including stroke. This requires the development of guidewires with very low thrombogenicity, aided by advanced material science and surface treatment technologies. Therefore, the firms must employ biocompatible materials that restrict platelet adhesion and activation. Therefore, in vitro and in vivo testing in a systematic way must be performed to determine the thrombogenicity of new guidewire designs.

Neurovascular Guidewires Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 352.24 million |

|

Forecast Year Market Size (2035) |

USD 547.02 million |

|

Regional Scope |

|

Neurovascular Guidewires Market Segmentation:

Coating Type (Hydrophilic, Hydrophobic)

Hydrophilic segment is anticipated to hold more than 65% neurovascular guidewires market share by 2035, due to the capability to significantly reduce friction. Increased navigability promotes enhanced effectiveness during interventions by allowing faster access to the target lesion; they play a critical role in complex interventions within aneurysms and AVMs. For instance, in December 2024, SCW Medicath offered a high-performance hydrophilic guide wire for catheterization that is made to provide excellent torque transmission, flexibility, and simple navigation through intricate anatomical paths. Their blood compatibility and hence the resultant safety and effectiveness have made them a neuro interventionist's first choice, thus being popular.

Product (Shapeable, Straight, Angled, Round Curve Tip)

Based on product, the straight segment is expected to garner the major share in the neurovascular guidewires market by the end of 2035 attributed to its intrinsic value and cross-cutting applicability across a broad spectrum of neuro interventional procedures. Its utilization is priceless to the clinician in his day-to-day diagnosis and therapeutic maneuvers, yielding economies of procedure, as well as minimizing complication. For instance, in March 2024, Baylis Medical Technologies Inc. announced the PowerWire Pro Radiofrequency (RF) Guidewire's 510(k) clearance and US launch to restore vascular patency and normal blood flow, patients with stenotic or occluded peripheral vessels frequently have stents placed.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Coating Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Neurovascular Guidewires Market Regional Analysis:

North America Market Statistics

North America in neurovascular guidewires market is expected to hold over 45.1% revenue share by the end of 2035. The trend of minimally invasive procedures is tracing attention due to their many advantages over open surgeries, such as faster recovery periods, shorter hospital stays, and a lower chance of problems. Furthermore, makers understanding of the exact placement of catheters and other medical devices is made possible by guidewires, which are essential to various procedures, thus spurring market growth.

The U.S. market is growing exponentially owing to the continuous innovations in techniques and treatment modalities. For instance, in March 2025, Shockwave Medical, Inc., announced the U.S. launch of its Javelin Peripheral IVL Catheter. It is a cutting-edge intravascular lithotripsy (IVL) platform, which is intended to handle rigorously narrowed vessels in patients with peripheral artery disease (PAD) and modify calcium. The company's market-leading IVL portfolio is strengthened by the introduction of this product.

Canada market is likely to witness substantial growth during the forecast period research institutions focus on developing cutting-edge solutions in neurology. For instance, in November 2024, as part of the CAN-PRIME project, UHN was first institution in Canada to carry out a ground breaking neurosurgery treatment using the Neuralink implanted device, which represents a major advancement in medical innovation. The implantation of a wireless brain-computer interface (BCI) at UHN's Toronto Western Hospital, was the first treatment of its kind and offers an intriguing new research avenue in neurosurgery.

Asia Pacific Market Analysis

The neurovascular guidewires market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline. The improved materials and coatings used by manufacturers in the design of modern guidewires provide flexibility, longevity, and mobility. These developments have improved patient outcomes by making it simpler for surgeons to carry out intricate surgeries more precisely and foster regional growth. Moreover, growing number of patients with chronic illnesses and older individuals frequently need medical interventions on a regular basis in the region.

India market is experiencing robust growth due to the diversifying facilities in neurosurgery with reliable and apt medication planning. For instance, in December 2022, Stryker inaugurated its Neurovascular (NV) lab, a cutting-edge facility intended to spur stroke-related innovation in Asia Pacific and facilitate communication between cross-functional teams, product development engineers, customers, and other important stakeholders. Moreover, to improve patient outcomes, this lab provides the perfect setting for medical education, research and development, and consumer engagement initiatives.

China market is exponentially scaling owing to educational conferences being executed, to disseminate the invaluable insights on neurological diseases and their treatments. For instance, The Shanghai International Convention Center hosted the Oriental Conference of Interventional Neurovascology (OCIN 2024) brought together industry pioneers and top specialists to discuss most recent developments and insights in neurovascular treatment. In addition, in October 2024, China's National Medical Products Administration (NMPA) formally granted the Class III Medical Device Registration Certificate to the PANVIS-ATM Neurovascular Interventional Robotic System created by Abrobo.

Key Neurovascular Guidewires Market Players:

- Smith Group PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Festo SE & Co. KG OMEGA Engineering (Spectris PLC)

- Asahi Intec Co. Ltd.

- Stryker Corporation

- Medtronic PLC

- Boston Scientific Corporation

- B. Braun Melsungen AG

- Cardinal Health Inc.

- Cook Medical Inc.

- Integra Life Sciences Corporation

- Conmed Corporation

Numerous well-established and startup companies that provide a range of therapies worldwide define the competitive landscape of the neurovascular guidewires market. Moreover, the market participant emphasize on pricing tactics, customer service, innovation, regulatory compliance, and treatment quality. For instance, in July 2024, MicroVention, Inc., declared the SOFIA's release in order to treat acute ischemic stroke brought on by major artery obstruction, the SOFIA™ Flow Plus Aspiration Catheter (SOFIA 6F) which was evaluated in the SOFAST research.

Here's the list of some key players:

Recent Developments

- In February 2025, Johnson & Johnson MedTech announced the launch of the CEREGLIDETM 92 Catheter System, a next-generation.092" catheter with the INNERGLIDETM 9 delivery aid. This device is aimed to facilitate the insertion and guidance of interventional devices in the neurovascular system.

- In October 2023, Perfuze announced that the second version of the Millipede 088 Access Catheter and the Millipede 070 Aspiration Catheter have been approved by the FDA to treat acute ischemic stroke.

- Report ID: 7557

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Neurovascular Guidewires Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.