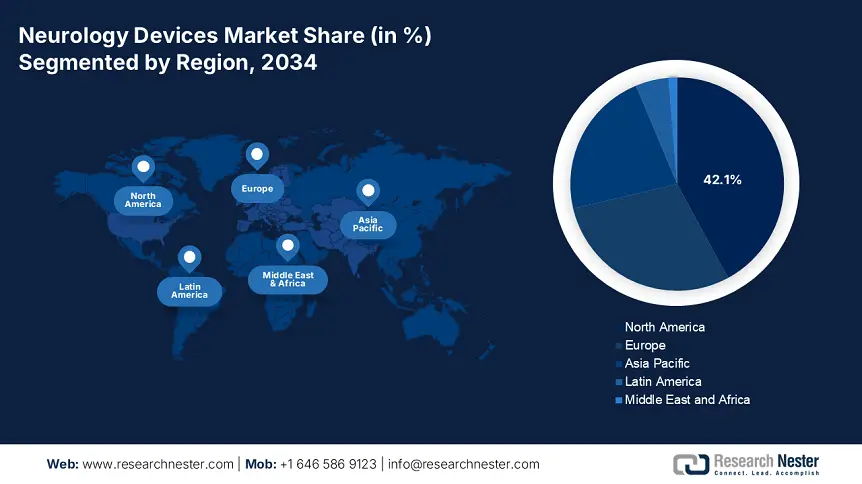

Neurology Devices Market - Regional Analysis

North America Market Insights

North America is considered the dominant region in the neurology devices market, with an expected share of 42.1%, along with a 7.1% growth rate by the end of 2034. The market’s growth in the region is effectively driven by the presence of innovative health and medical facilities, as well as an increase in the implementation of neurotechnology. The U.S. constitutes the majority of the regional demand, which is driven by administrative funding and extended reimbursement coverage, particularly for deep brain stimulation procedures. Meanwhile, Canada also caters to the overall region’s growth, which is further backed by provincial strategies, such as the DBS subsidy, thereby suitable for uplifting the market in the overall region.

The neurology devices market in the U.S. is significantly growing, with the allocation of USD 6.1 billion by the NIH for conducting research and development for neurotechnology. In addition, AI-powered diagnostics cater to approximately 31% of the latest PMA approvals, while the Coverage with Evidence Development (CED) program by Medicare has severely enhanced reimbursement for 9 neurostimulators as of 2023. Besides, Medicaid presently covers 74% of epilepsy monitoring devices, which has increased from 60% as of 2020, thereby denoting an optimistic outlook for the market in the country.

The neurology devices market in Canada is also steadily growing at a 6.7%, which is driven by the USD 3.3 billion in federal health funding as of 2024. In addition, the NeuroHealth Initiative in Ontario has effectively subsidized 42% of DBS expenses, while the AI Adoption Fund in Alberta backs an estimated 15 neurodiagnostic startup organizations. Besides, the Progressive Licensing Pathway of Health Canada has successfully approved 11 notable neurostimulators as of 2023, which has skyrocketed the market’s exposure in the country. Meanwhile, the TeleNeurology Program of BC has extended the coverage for remote EEG monitoring, which is also driving the market’s growth.

North America Neurology Devices Market Supply Chain & Trade Facilities (2022-2025)

|

Facility Type |

U.S. (2022-2025) |

Canada (2022-2025) |

|---|---|---|

|

Semiconductor Fabs |

5 new FDA-compliant neurochip plants (2023) |

2 Health Canada-approved facility (2024) |

|

Medical-Grade Polymer Production |

13 facilities (2022) → 16 (2025) |

5 facilities (2022) → 6 (2025) |

|

Neurodevice Assembly Hubs |

9 major hubs (e.g., Texas, California) |

3 hubs (Ontario, Quebec) |

|

Cold Chain Logistics |

26 CDC-certified warehouses (2024) |

7 PHAC-approved centers (2023) |

|

R&D Centers |

19 NIH-funded neurotech labs (2022-2025) |

8 CIHR-funded centers (2023-2025) |

Sources: U.S. DOC, Health Canada, FDA, CIHI, NIH, ISED, CDC, PHAC, CIHR

APAC Market Insights

Asia Pacific market is projected to be the fastest-growing region, garnering a share of 22.4% during the forecast duration. The market’s upliftment in the region is highly attributed to an increase in the aging population, as well as a surge in neurological disease occurrence. Japan is deliberately leading in the region, owing to the funding provision by METI subsidies for neurostimulators. This is followed by China, owing to an increase in DBS procedures every year, while the market in India has also gained more attention due to the growth in people suffering from Parkinson’s disease. Therefore, all these developments in these countries are effectively driving the market in the region overall.

The market in China is witnessing rapid expansion, with a predicted share of 37.2% in the region. The country comprises 26 million neurology patients, which is fueling the market demand, further backed by the NMPA’s escalated acceptances for 17 AI-based neurodevices as of 2023. Besides, the 2030 Healthy China initiative by the regional government has increased neurology expenditure by an estimated 16.5% on a yearly basis since 2020, thereby reaching USD 4.4 billion as of 2024. Meanwhile, the presence of centralized procurement policies has diminished neurostimulator expenses by 55% as of 2022, which has enhanced accessibility in the country.

The market in India is also gaining increased exposure by grabbing 17.5% of the region’s share, displaying an increase in neurology patients by approximately 16 million. Besides, the 2023 National Neurohealth Mission by the government has generously allocated USD 160 million for improving accessibility and focusing on localized manufacturing. There is an effective presence of tactical strategies, such as ICMR’s USD 8,000 Made in India DBS program, which has aimed to aid at least 55,000 patients by the end of 2030. Meanwhile, the private sector in the country is readily dominating approximately 77% of the market share, which is led by hospital centers, such as Apollo, readily deploying AI-based stroke detection systems.

Europe Market Insights

Europe in the neurology devices market is expected to hold a considerable share of 29.2% by the end of the forecast timeline, which is fueled by technological innovations, along with a surge in the aging population. Germany is efficiently leading the region, which is propelled by yearly expenditure for robotic neurosurgery and neurostimulator systems. The UK follows closely, with the NIH allocating budget for neurology devices, which include AI-powered diagnostics. France has effectively prioritized affordability in health and medical spending, which is also driving the market demand in the region.

The market in Germany is also gaining increased exposure by garnering almost 33.7% of the revenue share, which is propelled by technological leadership, along with the existence of strong administrative support. The country has generously allocated €4.2 billion every year for neurology devices as of 2024, with increased focus on robotic neurosurgery systems and deep brain stimulators. Besides, the 2023 G-BA’s decision to augment coverage for DBS has successfully added 12,500 eligible patients affected with Parkinson’s disease, while 47% of tier 1 hospitals have implemented robotic neurosurgery platforms.

The market in the UK is also growing, projected to account for 22.7% of the region’s share, with the NHS England generously making the provision of £2.3 billion, which is 8.5% of the total health budget for neurotechnologies as of 2024. In addition, the NICE MedTech Early Access Program has readily fast-tracked 6 neurology devices as of 2023, which include AI-based seizure prediction systems. Besides, during the post-Brexit period, the country’s MHRA unveiled escalated pathways, thereby diminishing approval duration by 41.5% for neurostimulators. Meanwhile, the market has displayed robust development for stroke intervention devices in the country, denoting an optimistic outlook for the market.

Government Neurology Device Funding and Policies in France, Italy, and Spain (2022-2025)

| Country | Policy/Initiative | Funding/Scope | Launch Year |

|

France |

NeuroPlan 2025 |

€1.4 billion for stroke & Parkinson's devices |

2023 |

|

HAS Fast-Track Neurotech Pathway |

33% faster approvals for AI diagnostics |

2022 |

|

|

Italy |

PNRR Neurohealth Allocation |

€658 million for robotic neurosurgery systems |

2023 |

|

AIFA Neurostimulator Reimbursement Reform |

Covers 13 new DBS indications |

2024 |

|

|

Spain |

NeuroTech España Strategy |

€424 million for epilepsy & migraine devices |

2024 |

|

AEMPS Priority Review for Stroke Devices |

52% shorter approval timelines |

2022 |

Sources: Solidarites, HAS, Salute, AIFA, Sanidad, AEMPS