Neuro-navigation Systems Market Outlook:

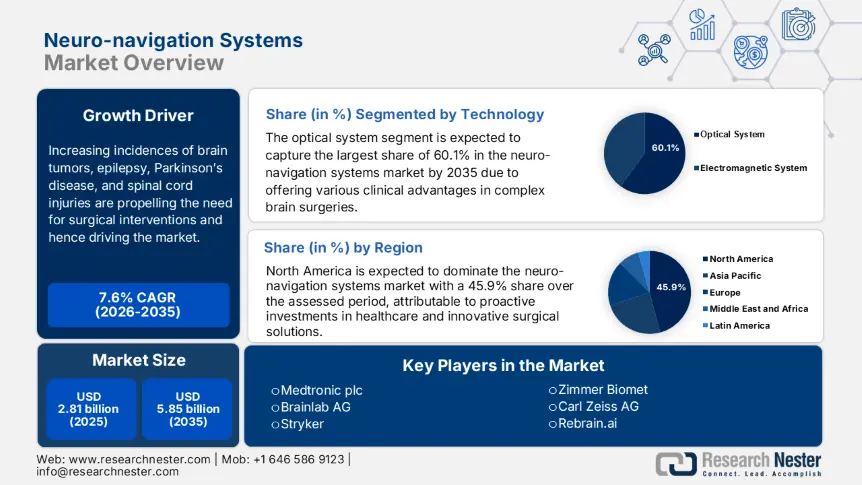

Neuro-navigation Systems Market size was over USD 2.81 billion in 2025 and is projected to reach USD 5.85 billion by 2035, growing at around 7.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of neuro-navigation systems is evaluated at USD 3 billion.

Increasing incidences of brain tumors, epilepsy, Parkinson’s disease, and spinal cord injuries are propelling the need for surgical interventions. According to an NLM study, worldwide, over 322,000 new registries for brain and CNS (central nervous system) tumors were found in 2022. Globally, the counts of prevalent cases of traumatic brain injury (TBI) and spinal cord injury (SCI) surpassed 55.0 billion and 27.0 billion, respectively, in 2021: NLM. In addition, annually, around 22.6 billion people from across the world consulted for neurological surgeries, and 13.8 among them were identified to have a need for operation (2022 ScienceDirect article). Hence, the market is witnessing a magnification in consumer base and business opportunities.

As the demography rises, the pressure on healthcare settings increases, which creates a surge for workflow automation and efficient management. Tools from the market are specifically designed to assist surgeons and associated professionals with precise overviews and informed decision-making. Furthermore, the clinical and in-hand evidence of acquiring improved patient outcomes are inspiring both consumers and MedTech companies to invest in this sector. For instance, in September 2024, Blackrock Health invested USD 1.6 billion to advance to accommodate advanced neurosurgical technology in its operating facilities. This fund was intended to install the ExcelsiusGPS Robotic Navigation Platform, making it the first medical setting in Ireland that offers robotic cranial surgery.

Key Neuro-navigation Systems Market Market Insights Summary:

Regional Highlights:

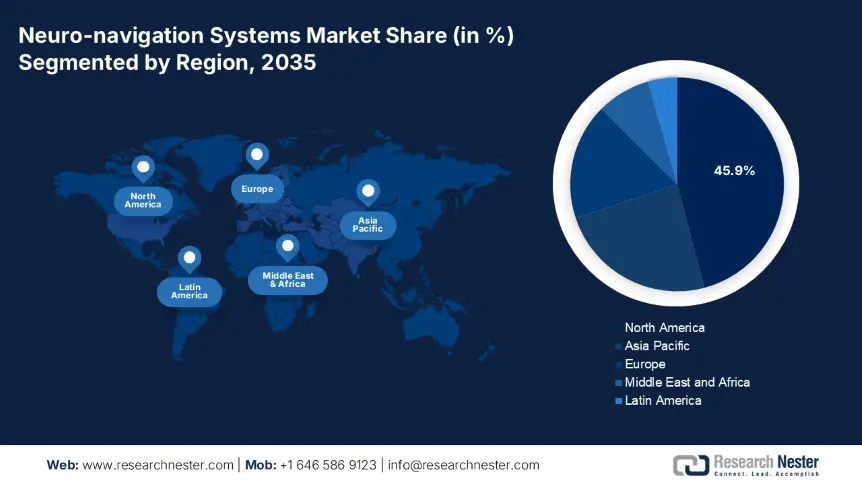

- North America leads the Neuro-navigation Systems Market with a 45.9% share, driven by robust healthcare infrastructure and adoption of surgical tech, ensuring sustained growth through 2035.

- Asia Pacific’s neuro-navigation systems market is set for rapid growth by 2035, driven by the rise in neurological disease burden and tech development.

Segment Insights:

- The optical system segment is projected to hold a 60.1% share by 2035, driven by its rising use in complex brain surgeries and minimally invasive interventions.

Key Growth Trends:

- Shifting preference toward minimally invasive surgeries

- Positive impact of integrating tech-based solutions

Major Challenges:

- Limitations in integration with legacy systems

- Concerns related to data security and privacy

- Key Players: Medtronic plc, Stryker, 7D Surgical, Inc., Soterix Medical Inc., Brainlab AG.

Global Neuro-navigation Systems Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.81 billion

- 2026 Market Size: USD 3 billion

- Projected Market Size: USD 5.85 billion by 2035

- Growth Forecasts: 7.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Neuro-navigation Systems Market Growth Drivers and Challenges:

Growth Drivers

- Shifting preference toward minimally invasive surgeries: The surge for less-invasive surgeries to reduce hospital stay and blood loss has created a tendency to adopt surgical robots among professionals. According to a report from the UK Robotics and Autonomous Systems Network, the global industry of surgical robots is expected to rise to USD 9.5 billion by 2026. Another NLM article on a worldwide survey revealed that around 48.5% of the total 406 respondent neurosurgeons used robotic technology in clinical practice. On the other hand, these advanced tools require a reliable navigation and visualization tool to improve precision and mitigate errors, testifying to the continuous expansion in the neuro-navigation systems market.

- Positive impact of integrating tech-based solutions: Several clinical studies proved the efficacy of AI and machine learning (ML) integration in neurosurgeries. For instance, the use of 3D convolutional neural network and transfer learning in brain tumor surgery yielded an impressive accuracy of 88.2%. Similarly, the implementation of a random forest algorithm in treatment prognosis for glioma showed a 78.2% successful prediction rate, as per data collected from the 2023 NLM article. These positive responses in utilizing the capabilities of AI and ML in evaluating surgical outcomes help surgeons make informed decisions, subsequently fuelling growth in the market.

Challenges

- Limitations in integration with legacy systems: Implementing solutions from the neuro-navigation systems market may become difficult for inadequate infrastructure. The absence of healthcare IT and electronic health records (EHRs) in medical settings from resource-constrained regions fails to support the advanced platforms and software systems. This incompatibility issue may further lead to limited adoption and product efficiency disruption, which hinders the global-scale expansion of this sector.

- Concerns related to data security and privacy: The risk of data breaching is one of the major factors restricting the wide adoption of tools from the market in the healthcare industry. The potential threat of cyberattacks may erode consumer trust and hinder compliance with data protection laws such as HIPPA. It results in additional complexity and expenses in the process of development and globalization, discouraging new entrants from participation.

Neuro-navigation Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 2.81 billion |

|

Forecast Year Market Size (2035) |

USD 5.85 billion |

|

Regional Scope |

|

Neuro-navigation Systems Market Segmentation:

Technology (Optical System, Electromagnetic System)

Based on technology, the optical system segment is set to account for neuro-navigation systems market share of more than 60.1% by the end of 2035. This type of instrument is highly used in complex brain surgeries for crucial clinical advantages such as real-time instrument tracking, improved surgical accuracy, and minimized surgical trauma. Thus, with the heightening surge in minimally invasive interventions, this segment is gaining traction worldwide. For instance, in October 2024, RWJBarnabas Health installed two minimally invasive technologies, ClearPoint Navigation System and ROSA ONE Brain system, to offer surgeons precise assistance during the treatment of epilepsy, movement disorders, and other neurological conditions.

Application (Neurosurgery, Craniomaxillofacial Surgery, Spinal Surgery, Others)

In terms of applications, the spinal surgery segment is predicted to generate considerable revenue for the neuro-navigation systems market throughout the forecasted timeline. The aging population and increasing cases of SCI are a few of the major driving factors in this segment. As per NLM observations, the global incidence of traumatic spinal cord injuries (TSCI) maintained a high occurrence from 2000 to 2021, ranging between 20 and 45 per one million people. In the same timeline, the burden of SCI incidence, prevalence, and years lived with disability (YLDs) increased with age: ScienceDirect. On the other hand, the projected volume of the age group of 60 and over around the globe is 2.1 billion by 2050 (WHO). These figures testify to the growing captivity of this segment over neurosurgical territory.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Neuro-navigation Systems Market Regional Analysis:

North American Market Forecast

North America neuro-navigation systems market is predicted to dominate revenue share of around 45.9% by the end of 2035. Well-established healthcare landscapes, such as the U.S. and Canada, are proactively investing in innovative healthcare solutions, including surgical technologies. In this regard, a 2020 NLM study observed 2nd highest rate of adoption, 51.0%, of robotics in neurosurgery in North America. This indicates the presence of an optimistic business atmosphere in this region, attracting global leaders to participate. For instance, in June 2024, ClearPoint Neuro extended its portfolio in the U.S. market by launching its SmartFrame OR platform and Prism Neuro Laser Therapy System. The company demonstrated the product’s efficacy in treating Parkinson’s Disease, Essential Tremor, and Dystonia.

With the enlarging patient pool, coupled with a favourable regulatory framework, the U.S. is augmenting the market with greater opportunities. As per the projections from Parkinson’s Foundation, the number of people with Parkinson’s disease in this country is poised to reach 1.2 billion by 2030. Simultaneously, the regulatory support can be testified by the FDA 510(k) clearance on Stryker’s Spine Guidance 5 Software, released in July 2024. Thus, the demography and accepting culture across the nation are stimulating growth in this sector, making it a hub of commercial expansion for global pioneers.

APAC Market Forecast

Asia Pacific is anticipated to exhibit the fastest CAGR in the neuro-navigation systems market over the analysed timeframe. The increasing burden of neurological diseases such as epilepsy, migraine, Parkinson’s disease, and incontinence is presenting an emerging consumer base for this sector. According to a study published in ScienceDirect in May 2024, the annual prevalence of epilepsy in Asian countries was 52.5 per 100,000 people. It also revealed a predominant occurrence of active and lifetime forms of the disease in West Asia. Additionally, notable developments in technology are signifying ongoing progress and heightening commercial engagement.

Japan is emerging as a lucrative destination for profitable business for global leaders in the market. The country consists of a rapidly aging population, which is highly prone to developing associated neurological conditions. The results of a population-based study published by NLM in February 2024 revealed a notable prevalence of epilepsy, 6.9 per 1,000, among habitats aged 40 and over in Japan. It also observed comparatively high incidence in older age groups (70–74 years). Furthermore, the nationwide revolution in healthcare technology and wide AI penetration is fostering a profitable atmosphere for this sector.

Key Neuro-navigation Systems Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker

- 7D Surgical, Inc. (SeaSpine)

- Synaptive Medical

- Soterix Medical Inc.

- Nexstim Oyj

- Claron Technology Inc.

- Zimmer Biomet

- Brainlab AG

- Northern Digital Inc.

- Carl Zeiss AG

- Rebrain.ai

Key players in the neuro-navigation systems market are currently focused on bringing new features in their pipeline to make them more acceptable and widely applicable. Their rigorous R&D activities are resulting in fast progression and innovation in this sector. In addition, many MedTech pioneers are expanding their territory by gaining maximum regulatory compliance and forming strategic alliances, propelling globalization. For instance, in April 2024, FUJIFILM signed a distribution agreement with Brainlab to outstretch the reach of its ARIETTA Precision Ultrasound. The conjunctive use of this tool with Brainlab’s surgical navigation systems helped the company solidify its neurology portfolio in the U.S. market. Such key players are:

Recent Developments

- In September 2024, ZEISS Medical Technology extended its successful ZEISS KINEVO 900 platform with the launch of KINEVO 900 S. The latest robotic navigation system allows precise digital visualization and seamless robotic interactions for complex surgical procedures in neurosurgery.

- In September 2024, Medtronic announced the commercial launch of several software, hardware, and imaging innovations at the annual meeting of the North American Spine Society (NASS). This move was intended to expand its AI-powered smart ecosystem of robotic navigation, AiBLE, for spine surgery.

- In August 2024, RebrAIn attained FDA 510(k) clearance for the commercialization of its OptimMRI software to help surgeons optimize the planning of stereotactic and functional neurosurgery. It is backed by AI targeting technology delivering precise and data-driven assistance in both deep brain stimulation (DBS) and lesioning procedures.

- In July 2023, Stryker commercially launched its Q Guidance System with Cranial Guidance Software to assist surgeons in positioning instruments and identifying patient anatomy during cranial surgery. It offers image-based planning and intraoperative guidance for craniotomies, skull base & transsphenoidal procedures, shunt placements, and biopsies.

- Report ID: 7576

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.