Global Needle Coke Market

- An Outline of the Global Needle Coke Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

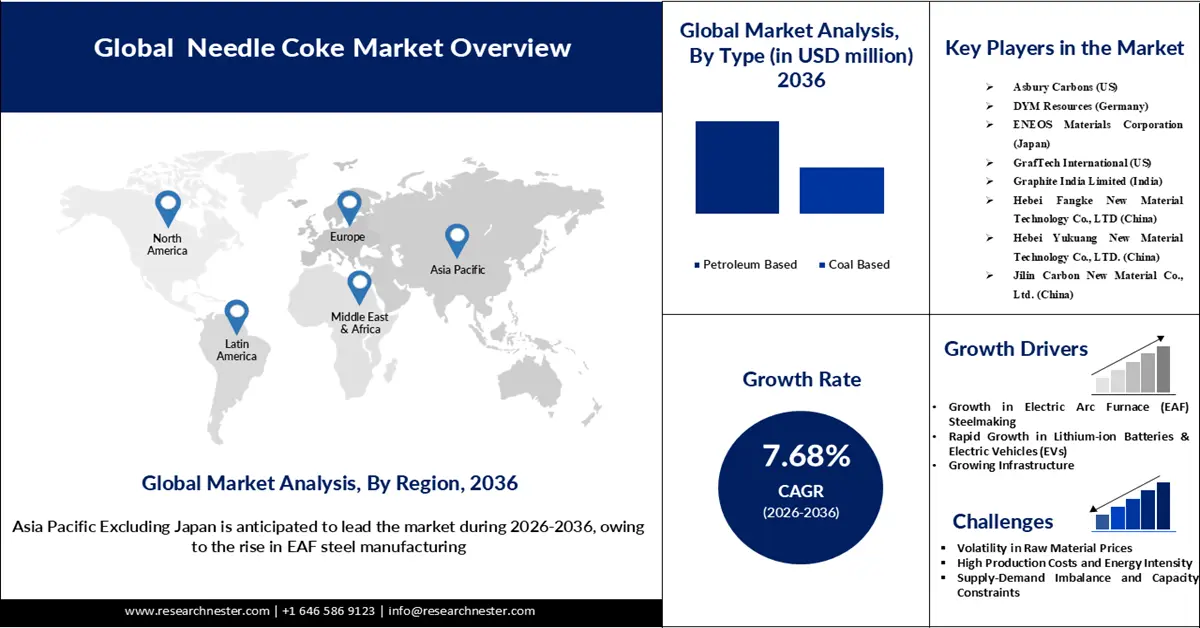

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Needle Coke

- Recent News

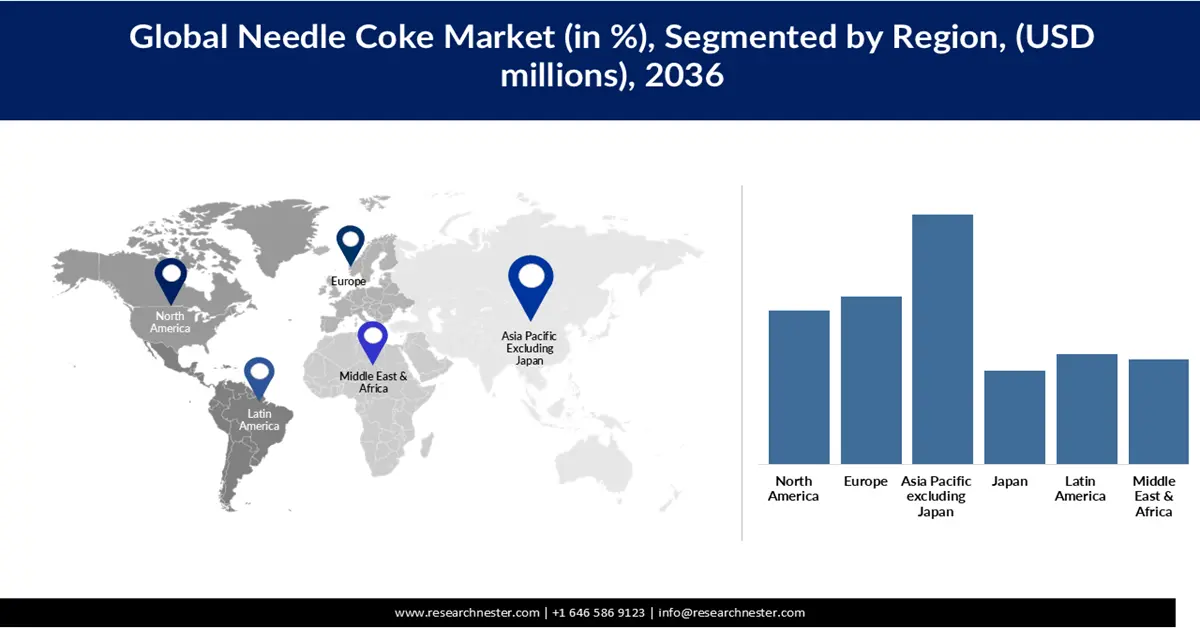

- Regional Demand

- Global Needle Coke by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Needle Coke Demand Landscape

- Global Vascular Guidewire Demand Trends Driven by EAF, EV Adoption, and Government Support (2020-2036)

- Root Cause Analysis (RCA) for discovering problems of the Needle Coke Porter Five Forces

- PESTLE

- Comparative Positioning

- Needle Coke – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- Sumitomo Corporation

- Asbury Carbons

- DYM resources

- ENEOS Materials Corporation

- GrafTech International

- Graphite India Limited

- Mitsubishi Chemical Corporation

- Philips 66 Company

- Sojitz JECT Corporation

- Business Profile of Key Enterprise

- Global Needle Coke Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Tons), and Compound Annual Growth Rate (CAGR)

- Global Segmentation Needle Coke Analysis (2020-2036)

- By Type

- Petroleum Based, Market Value (USD Million), and CAGR, 2020-2036F

- Coal Based, Market Value (USD Million), and CAGR, 2020-2036F

- By Grade Value

- Super Premium, Market Value (USD Million), and CAGR, 2020-2036F

- Premium Grade, Market Value (USD Million), and CAGR, 2020-2036F

- Intermediate Grade, Market Value (USD Million), and CAGR, 2020-2036F

- By Application

- Electrode, Market Value (USD Million), and CAGR, 2020-2036F

- Silicon Metal & Ferroalloys, Market Value (USD Million), and CAGR, 2020-2036F

- Carbon Black, Market Value (USD Million), and CAGR, 2020-2036F

- Rubber Components, Market Value (USD Million), and CAGR, 2020-2036F

- Others, , Market Value (USD Million), and CAGR, 2020-2036F

- By End Use Industry

- Steel EAF, Market Value (USD Million), and CAGR, 2020-2036F

- Aluminum , Market Value (USD Million), and CAGR, 2020-2036F

- Semi Conductor, Market Value (USD Million), and CAGR, 2020-2036F

- Automotive, , Market Value (USD Million), and CAGR, 2020-2036F

- Others, , Market Value (USD Million), and CAGR, 2020-2036F

- Regional Synopsis, Value (USD Million), 2020-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Type

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Segmentation (USD Million), 2020-2036, By

- By Type

- Petroleum Based, Market Value (USD Million), and CAGR, 2020-2036F

- Coal Based, Market Value (USD Million), and CAGR, 2020-2036F

- By Grade Value

- Super Premium, Market Value (USD Million), and CAGR, 2020-2036F

- Premium Grade, Market Value (USD Million), and CAGR, 2020-2036F

- Intermediate Grade, Market Value (USD Million), and CAGR, 2020-2036F

- By Application

- Electrode, Market Value (USD Million), and CAGR, 2020-2036F

- Silicon Metal & Ferroalloys, Market Value (USD Million), and CAGR, 2020-2036F

- Carbon Black, Market Value (USD Million), and CAGR, 2020-2036F

- Rubber Components, Market Value (USD Million), and CAGR, 2020-2036F

- Others, , Market Value (USD Million), and CAGR, 2020-2036F

- By End Use Industry

- Steel EAF, Market Value (USD Million), and CAGR, 2020-2036F

- Aluminum , Market Value (USD Million), and CAGR, 2020-2036F

- Semi Conductor, Market Value (USD Million), and CAGR, 2020-2036F

- Automotive, , Market Value (USD Million), and CAGR, 2020-2036F

- Others, , Market Value (USD Million), and CAGR, 2020-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Type

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Segmentation (USD Million), 2020-2036, By

- By Type

- Petroleum Based, Market Value (USD Million), and CAGR, 2020-2036F

- Coal Based, Market Value (USD Million), and CAGR, 2020-2036F

- By Grade Value

- Super Premium, Market Value (USD Million), and CAGR, 2020-2036F

- Premium Grade, Market Value (USD Million), and CAGR, 2020-2036F

- Intermediate Grade, Market Value (USD Million), and CAGR, 2020-2036F

- By Application

- Electrode, Market Value (USD Million), and CAGR, 2020-2036F

- Silicon Metal & Ferroalloys, Market Value (USD Million), and CAGR, 2020-2036F

- Carbon Black, Market Value (USD Million), and CAGR, 2020-2036F

- Rubber Components, Market Value (USD Million), and CAGR, 2020-2036F

- Others, , Market Value (USD Million), and CAGR, 2020-2036F

- By End Use Industry

- Steel EAF, Market Value (USD Million), and CAGR, 2020-2036F

- Aluminum , Market Value (USD Million), and CAGR, 2020-2036F

- Semi Conductor, Market Value (USD Million), and CAGR, 2020-2036F

- Automotive, , Market Value (USD Million), and CAGR, 2020-2036F

- Others, , Market Value (USD Million), and CAGR, 2020-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Type

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Segmentation (USD Million), 2020-2036, By

- By Type

- Petroleum Based, Market Value (USD Million), and CAGR, 2020-2036F

- Coal Based, Market Value (USD Million), and CAGR, 2020-2036F

- By Grade Value

- Super Premium, Market Value (USD Million), and CAGR, 2020-2036F

- Premium Grade, Market Value (USD Million), and CAGR, 2020-2036F

- Intermediate Grade, Market Value (USD Million), and CAGR, 2020-2036F

- By Application

- Electrode, Market Value (USD Million), and CAGR, 2020-2036F

- Silicon Metal & Ferroalloys, Market Value (USD Million), and CAGR, 2020-2036F

- Carbon Black, Market Value (USD Million), and CAGR, 2020-2036F

- Rubber Components, Market Value (USD Million), and CAGR, 2020-2036F

- Others, , Market Value (USD Million), and CAGR, 2020-2036F

- By End Use Industry

- Steel EAF, Market Value (USD Million), and CAGR, 2020-2036F

- Aluminum , Market Value (USD Million), and CAGR, 2020-2036F

- Semi Conductor, Market Value (USD Million), and CAGR, 2020-2036F

- Automotive, , Market Value (USD Million), and CAGR, 2020-2036F

- Others, , Market Value (USD Million), and CAGR, 2020-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Type

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2020-2036, By

- By Type

- Petroleum Based, Market Value (USD Million), and CAGR, 2020-2036F

- Coal Based, Market Value (USD Million), and CAGR, 2020-2036F

- By Grade Value

- Super Premium, Market Value (USD Million), and CAGR, 2020-2036F

- Premium Grade, Market Value (USD Million), and CAGR, 2020-2036F

- Intermediate Grade, Market Value (USD Million), and CAGR, 2020-2036F

- By Application

- Electrode, Market Value (USD Million), and CAGR, 2020-2036F

- Silicon Metal & Ferroalloys, Market Value (USD Million), and CAGR, 2020-2036F

- Carbon Black, Market Value (USD Million), and CAGR, 2020-2036F

- Rubber Components, Market Value (USD Million), and CAGR, 2020-2036F

- Others, , Market Value (USD Million), and CAGR, 2020-2036F

- By End Use Industry

- Steel EAF, Market Value (USD Million), and CAGR, 2020-2036F

- Aluminum , Market Value (USD Million), and CAGR, 2020-2036F

- Semi Conductor, Market Value (USD Million), and CAGR, 2020-2036F

- Automotive, , Market Value (USD Million), and CAGR, 2020-2036F

- Others, , Market Value (USD Million), and CAGR, 2020-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Type

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2020-2036, By

- By Type

- Petroleum Based, Market Value (USD Million), and CAGR, 2020-2036F

- Coal Based, Market Value (USD Million), and CAGR, 2020-2036F

- By Grade Value

- Super Premium, Market Value (USD Million), and CAGR, 2020-2036F

- Premium Grade, Market Value (USD Million), and CAGR, 2020-2036F

- Intermediate Grade, Market Value (USD Million), and CAGR, 2020-2036F

- By Application

- Electrode, Market Value (USD Million), and CAGR, 2020-2036F

- Silicon Metal & Ferroalloys, Market Value (USD Million), and CAGR, 2020-2036F

- Carbon Black, Market Value (USD Million), and CAGR, 2020-2036F

- Rubber Components, Market Value (USD Million), and CAGR, 2020-2036F

- Others, , Market Value (USD Million), and CAGR, 2020-2036F

- By End Use Industry

- Steel EAF, Market Value (USD Million), and CAGR, 2020-2036F

- Aluminum , Market Value (USD Million), and CAGR, 2020-2036F

- Semi Conductor, Market Value (USD Million), and CAGR, 2020-2036F

- Automotive, , Market Value (USD Million), and CAGR, 2020-2036F

- Others, , Market Value (USD Million), and CAGR, 2020-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2020-2036F

- By Type

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Needle Coke Market Outlook:

Needle Coke Market size is valued at USD 5.53 billion in 2025 and is expected to grow to USD 13.03 billion by 2036, registering a CAGR of 7.68% during the forecast period, i.e., 2026-2036. In 2026, the industry size of needle coke is estimated at USD 6.21 billion.

The primary growth driver of the global needle coke market is the rapid expansion of the electric vehicle (EV) industry, which directly increases demand for high-purity graphite materials used in lithium-ion battery anodes. According to the International Energy Agency, global electric car sales exceeded 17 million in 2024, representing more than 20 % of all new car sales worldwide and a year-on-year growth of over 25%. Needle coke is essential for producing synthetic graphite anodes, which enhance battery energy density, charging efficiency, and cycle life—key performance factors for EV adoption. As EV production scales, so does needle coke consumption, with battery applications becoming one of the fastest-growing segments of the market alongside traditional uses such as graphite electrodes for steelmaking. Supportive clean-energy policies and rising EV penetration further reinforce this trend, positioning electrification of transport as the foremost catalyst for needle coke demand.

Key Needle Coke Market Insights Summary:

Regional Highlights:

- Asia Pacific Excluding Japan is projected to account for 26.24% share by 2036 in the needle coke market, supported by expanding electric vehicle adoption, rapid industrialization, and rising demand for pure carbon steel in commercial construction, stimulating graphite electrode consumption.

- Europe is expected to record 7.38% growth through the forecast period, underpinned by sustainability-led steelmaking policies and accelerated adoption of electric arc furnaces to reduce carbon intensity.

Segment Insights:

- The petroleum-based segment is anticipated to dominate the needle coke market with a 66.16% share by 2036, reinforced by its critical role in producing high-performance graphite electrodes for electric arc furnaces and electric vehicle applications.

- The premium grade needle coke segment is forecast to secure 63.96% share by 2036, attributed to rising utilization of high-purity carbon materials in steel manufacturing and advanced battery technologies.

Key Growth Trends:

- Growth in electric arc furnace steelmaking

- Rapid industrialization and infrastructure development

Major Challenges:

- Raw material price volatility

- High energy intensity

Key Players: Sumitomo Corporation, Asbury Carbons, Mitsubishi Chemicals, DYM Resources, ENEOS Materials Corporation, GrafTech International, and Graphite India Limited.

Global Needle Coke Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.53 billion

- 2026 Market Size: USD 6.21 billion

- Projected Market Size: USD 13.03 billion by 2036

- Growth Forecasts: 7.68% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific Excluding Japan (26.24% Share by 2036)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Thailand

Last updated on : 7 January, 2026

Needle Coke Market - Growth Drivers and Challenges

Growth Drivers

- Growth in electric arc furnace steelmaking: Growth in electric arc furnace (EAF) steelmaking strongly drives the needle coke market because needle coke is the key raw material for graphite electrodes, which are essential to EAF operations. As more steelmakers shift from traditional blast furnaces to EAFs for environmental and efficiency reasons, demand for graphite electrodes and, therefore, needle coke increases. In 2024, EAFs accounted for about 29 % of global crude steel production, up from previous years, reflecting this ongoing transition in the industry. Every ton of steel produced in an EAF requires roughly 2.0–2.5 kg of graphite electrodes, with ultra-high-power electrodes becoming increasingly preferred for modern furnaces. As EAF capacity expands globally with hundreds of EAF units in operation and new capacity under development, the consumption of needle coke for electrode manufacture rises in tandem. This trend is reinforced by industry decarbonization goals that favor EAF steelmaking for its lower carbon footprint and greater scrap utilization, making it a key driver of needle coke market growth.

- Rapid industrialization and infrastructure development: As emerging economies expand their construction of highways, rail networks, bridges, and urban buildings, overall steel consumption rises, leading steel producers to increase production capacity. Graphite electrodes are essential for electric arc furnace (EAF) steelmaking, a method increasingly adopted for its energy efficiency and lower emissions, and this process relies on high-quality needle coke as a feedstock. Infrastructure-led economic growth in regions such as the Asia-Pacific has supported higher steel output and electrode demand, accounting for a large share of needle coke use. As global steel production continues its upward trend alongside expanding industrial bases, needle coke consumption for steelmaking applications is expected to grow in alignment with these broader development patterns.

- Technological advancements: Modern refining and coking technologies, such as optimized delayed coking, hydrocracking, and advanced feedstock preprocessing, allow producers to yield needle coke with higher carbon content, lower sulfur and ash levels, and more uniform microstructures, meeting the stringent specifications of both graphite electrode and battery anode manufacturers. Automation, real-time monitoring, and sophisticated process controls help reduce production variability and energy use while boosting overall output efficiency. These innovations also support the development of premium and specialty needle coke grades, broadening their use in emerging applications like high-performance batteries and advanced materials. As producers invest in R&D and modernized plants, the market benefits from greater product consistency and the ability to meet rapidly evolving end-use requirements.

Challenges

- Raw material price volatility: The prices of the raw materials vary greatly, which is creating a barrier to the adoption of needle coke. Coal tar and decant oil contribute significantly to the production cost. The prices of coal and crude oil are sensitive and fluctuate often, resulting in price hikes. Producers are considering waste-derived alternatives that will reduce the dependency on these fluctuating-priced raw materials. The strategic sourcing is enhancing the long-term competitiveness of the manufacturers as the prices of needle coke are reduced.

- High energy intensity: The calcination and graphitization of needle coke requires high temperature, which increases the energy costs substantially, resulting in higher costs for the producers. The rising control of the government over the stringent environmental concerns has limited producers from using electricity sustainably, which is further pressuring them to maintain energy-efficient manufacturing, increasing the cost of the businesses. Governments are globally pressuring manufacturers to limit electricity and adopt natural sources of power to conserve electricity and reduce reliance on fossil fuels.

Needle Coke Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2036 |

|

CAGR |

7.68% |

|

Base Year Market Size (2025) |

USD 5.53 billion |

|

Forecast Year Market Size (2036) |

USD 13.03 billion |

|

Regional Scope |

|

Needle Coke Market Segmentation:

Type Segment Analysis

The petroleum-based segment is poised for the largest needle coke market share of 66.16% in 2036, owing to its uses in the manufacturing of graphite electrodes, which are then employed in the electric arc furnaces. The segment is also expected to grow by a CAGR of 7.72% during the forecast period 2026-2036. The demand for high-quality electrodes for electric arc furnaces and EVs is directly contributing to the growth of the market. The coal-based needle coke is widely used because of the cost efficiency factors and is churned through an effective decarbonization process, which creates minimal environmental damage. The adoption of low-cost feedstock and growing sodium-ion batteries is enhancing demand for the coal-based segment.

Grade Value Segment Analysis

The premium grade needle coke will hold the largest market share in 2036 of 63.96% owing to the production and usage of high-purity carbon material. The optimized delayed coking and controlled calcination ensure uniform crystalline alignment and maintain graphitization efficiency. The premium needle coke employs petroleum feedstocks that improve the electrical performance. The demand from steel manufacturing and battery technologies is making the segment a strong metallurgical component. The super premium segment will also have substantial growth of 8% from 2026-2036 because of its high-purity high performance carbon material.

Application Segment Analysis

The electrode segment will hold the largest market share of 84.17% in 2036, owing to the rise in the use of the component in electric vehicles. Electrodes are high in thermal conductivity and ensure consistent performance. Needle coke electrodes are also used in the manufacturing of non-ferrous metals such as magnesium and aluminum. The ultra-high power electric furnace is also amplifying the market expansion as it requires high-performance electrodes. The segment is furthermore expected to witness the highest growth of 7.76% from 2026 to 2036 because of the rising adoption of lithium-ion batteries in electric vehicles.

Our in-depth analysis of the global needle coke market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Grade Value |

|

|

Application |

|

|

End Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Needle Coke Market - Regional Analysis

Asia Pacific Excluding Japan Market Insight

The market in the Asia Pacific Excluding Japan is experiencing moderate growth of electric vehicles, and is expected to hold a market share of 26.24% in 2036. The brands have penetrated deeper into the market and maintain a competitive edge through strategic pricing. The industrialization in the region is fast, with commercial spaces emerging frequently. This drives the demand for pure carbon steel for the construction of buildings and warehouses, which is impacting the growth of the needle coke market in the Asia Pacific Excluding Japan market.

India is seeing growth in steel production, which is fueling the growth of graphite electrodes. The electric arc furnace is also a widely adopted furnace method that enables faster steel production and minimizes carbon emissions. Being a developing nation, the focus is on cost-effective steel making, which can be achieved through EAF. India is pushing the buyers towards green vehicles to curb the pollution levels, which is propelling the growth beyond steel. As per the World Steel Association, the crude steel production of India reached 149.6 million tons in 2024, showing the strong demand for EAF-based steel in structural use.

China is home to key EV automotive manufacturers such as BYD, which have mastered electric vehicle production. The demand for their innovative vehicles has seen a hike, leading to higher usage of graphite electrodes. The electrical spare market of Japan is also quite booming, driven by the stable supply chain, which is pushing manufacturers to produce cost-effective electrodes to export to other countries. The cost-effective development of these materials is enhancing the market of needle coke in China.

Europe Market Insights

Europe accounted for a market share of 24% of the global needle coke market in 2025, driven by sustainability and environmental protection strategies, which have supported the growth of the needle coke market. The market in Europe is expected to grow by 7.38%. Europe has also subsidized the adoption of the electric arc furnace in order to minimize carbonization caused by the traditional furnace. In April 2025, Tata Steel announced the opening of a USD 1.5 billion electric arc furnace in its UK site taking help of the UK government, and is also planning to start operations by 2027. Europe’s shift towards EAF steelmaking is driving a significant growth in the region.

The UK has a huge adoption of electric vehicles, which is enhancing the market growth and is propelling its expansion. Electric vehicles use a large number of electrodes that power the vehicles through the battery system. The rising adoption of EVs in the UK is directly impacting the growth of the electrode industry. Industrialization in the country is growing at a rapid pace, which is further demanding high-strength steel in the development of structures and buildings. This has significantly increased the demand for EAF steel as it is stronger than other varieties of steel, ensuring higher adoption. The UK market is led by Tata Steel and British Steel, who have pioneered the EAF-based steel manufacturing and dominate the market.

Germany holds a strong steel manufacturing ecosystem with strong demand from the government to ensure decarbonization. This has pushed manufacturers across Germany to produce high-performance steel using electric arc furnacing, employing graphite electrodes in order to curb the pollution levels. Germany is adapting to EV culture quite fast, owing to the sustainability aspect, for which the government has subsidized the cost to a great extent, which is again fuelling the growth of the needle coke market of Germany.

North America Insights

The region held 23% of the global needle coke market share in 2025 owing to the rise in electric vehicles, which employ graphite electrodes. The urbanization in the regional countries has demanded durable and high tensile steel materials, which is fueling the market expansion. Robust manufacturing and development in the electric arc furnace have further developed a strong market demand for needle coke because of high performance in graphite electrodes, which use the component as a raw material. North America is projected to reach a market valuation of USD 3,163.85 million by the end of the forecast period

The U.S. holds a substantial market for needle coke because of the rise in the adoption of EVs among the population. The government's push towards green vehicles and strategies to minimize carbon emissions has led to subsidized prices of electric vehicles, which is fueling the market growth. The same measure is also forcing the domestic steel manufacturers to minimize emissions and adopt the electric arc furnace, which operates on electricity.

Canada also has a well-established market in terms of the needle coke market because of a huge rise in the. The market in Canada is also fueled by the growth of lithium-ion batteries, which employ graphite electrodes to power the vehicles. This has expanded the market scope of the needle coke market in Canada. Urbanization is also growing at a fast pace in the country, which is fueling the demand for EAF steel to build strong and durable structural homes, impacting the growth of the needle coke market.

Key Needle Coke Market Players:

- Asbury Carbons (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DYM Resources (Germany)

- ENEOS Materials Corporation (Japan)

- GrafTech International (U.S.)

- Graphite India Limited (India)

- Hebei Fangke New Material Technology Co., LTD (China)

- Hebei Yukuang New Material Technology Co., LTD. (China)

- Jilin Carbon New Material Co., Ltd. (China)

- Mitsubishi Chemical Corporation (Japan)

- Phillips 66 Company (U.S.)

- Sojitz JECT Corporation (Japan)

- Sumitomo Corporation (Japan)

- Asbury carbons, with more than 130 years of experience, the business sells carbon and graphite products such as petroleum cokes. The firm owns more than 10 facility centers with offices located globally. The average revenue of the business varies between USD 50-60 million.

- Mitsubishi Chemical is a chemical conglomerate based in Japan, operating with more than 63,522 employees globally. The firm operates in more than 43 regions. The business widens its portfolio into industrial materials and chemicals. The strong R&D and innovation have earned the business a strategic position

- Philip 66 Company, headquartered in the U.S., the firm is one of the largest energy manufacturing companies. The firm holds around 13,000 employees globally who have specifically focused on renewables and emerging energy. The firm primarily processes gasoline and aviation fuel, along with petrochemical and plastic production.

- Sumitomo Corporation is diversified into transportation and machinery, chemical and petrochemical, and consumer living. The firm holds more than 83,000 employees across the globe with footprints in more than 64 countries. The business has also diversified into transportation, construction, media, and agriculture.

Below is the list of the key players operating in the global needle coke market:

Players operating in the global needle coke market are expected to face intense competition over the forecast period. The needle coke market comprises a mix of well-established participants and emerging entrants, resulting in a moderately fragmented competitive landscape. While established players benefit from scale and long-term customer relationships, new entrants are increasing competitive pressure by introducing alternative supply sources and specialized products, thereby limiting revenue concentration among major companies. Specialized manufacturers continue to play a critical role, particularly in the production of high-purity and application-specific needle coke grades. Additionally, leading market players receive strong governmental support for research, development, and innovation, which helps them enhance product quality, improve production efficiency, and maintain competitiveness in a rapidly evolving needle coke market.

Corporate Landscape of the Global Needle Coke Market:

Recent Developments

- In August 2025, Sumitomo Corporation invested in a satellite data analytics company called Ursa Space System to expand the business towards commercial data. The investment is a signed memorandum demonstrating high-level partnerships that will advance the capabilities of Sumitomo in terms of AI-based decision-making.

- In December 2025, Mitsubishi Chemicals introduced its bio-engineered plastic that which was used in the instrument panel for Honda’s new electric vehicle which showing the adoption of green material in the automotive sector. DURABIO is a plastic that is derived from plant isosorbide.

- Report ID: 3390

- Published Date: Jan 07, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Needle Coke Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.