Nanogrid Market Outlook:

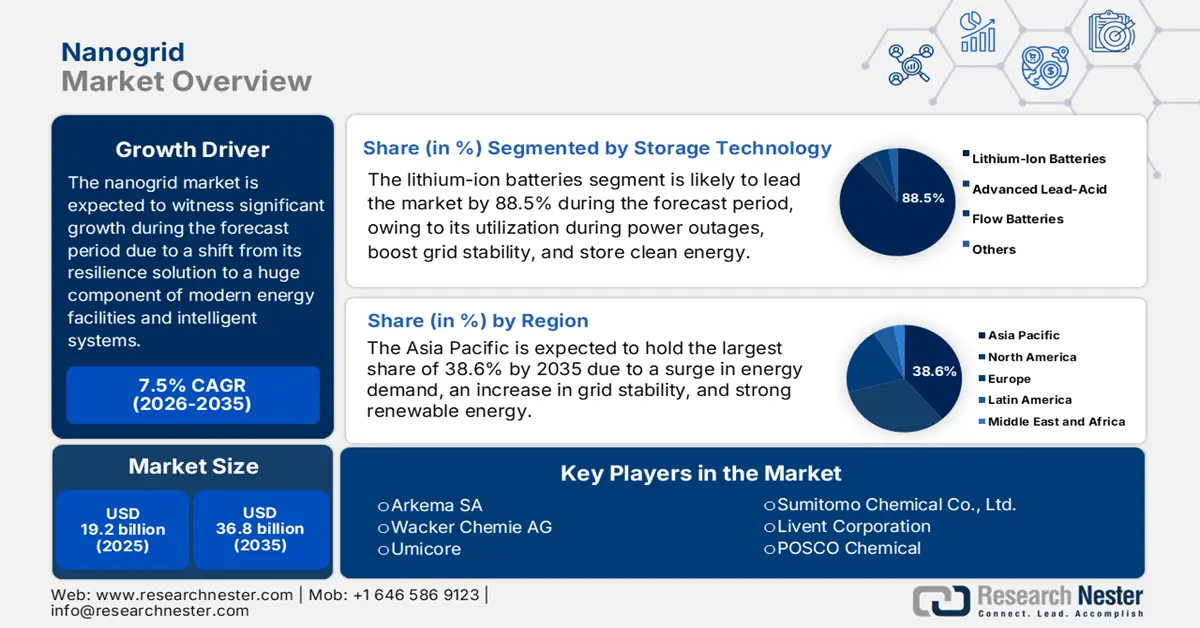

Nanogrid Market size was over USD 19.2 billion in 2025 and is estimated to reach USD 36.8 billion by the end of 2035, expanding at a CAGR of 7.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of nanogrid is estimated at USD 20.6 billion.

The global nanogrid market significantly represents the foundational layer of the decentralized energy transition, emerging from a niche resilience solution into a massive component of modernized energy architecture. The market’s growth is further characterized by small-scale and intelligent systems that manage, store, and generate power for defined clusters or single buildings. According to a data report published by the IEA Organization in 2025, building operations account for 30% of international finalized energy consumption, along with 26% of global energy-based emissions. Of this, 8% caters to direct emissions in buildings and 18% to indirect emissions from heat and electricity production utilized in buildings. Besides, there has been an increase in the building sector energy utilization by almost 1%. Moreover, the aspect of international carbon dioxide emissions from buildings is also responsible for expanding the nanogrid market globally.

Global Carbon Dioxide Buildings Emission Including Embodied (2022)

|

Building Type |

Emission % |

|

Direct Residential |

5.5 |

|

Indirect Residential |

11.0 |

|

Direct Non-Residential |

2.7 |

|

Indirect Non-Residential |

7.3 |

|

Buildings Construction Industry |

6.7 |

|

Other Construction Industry |

6.1 |

|

Other |

60.3 |

Source: IEA Organization

Furthermore, the software-based energy management, interoperability, along with standardization, a rise in energy as a service (EaaS), sector coupling, freindshoring, and supply chain localization are also responsible for bolstering the nanogrid market’s exposure. As per an article published by the IEA Organization in 2025, there has been a surge in the international energy demand by 2.2% as of 2024, denoting a suitable rapid rate than the yearly average of 1.3% as has been observed between 2013 and 2023. This has been possible, owing to extreme weather conditions, which have approximately added 0.3% to the 2.2% growth. In addition, the energy demand across different nations also continued to grow in the international economy, which extended by 3.2% as of 2024. Besides, the demand further grows based on different sources, which also uplifts the nanogrid market’s exposure.

Energy Demand Growth Share by Source (2024)

|

Source Name |

Growth % |

|

Renewables |

38 |

|

Natural Gas |

28 |

|

Coal |

15 |

|

Oil |

11 |

|

Nuclear |

8 |

Source: IEA Organization

Key Nanogrid Market Insights Summary:

Regional Highlights:

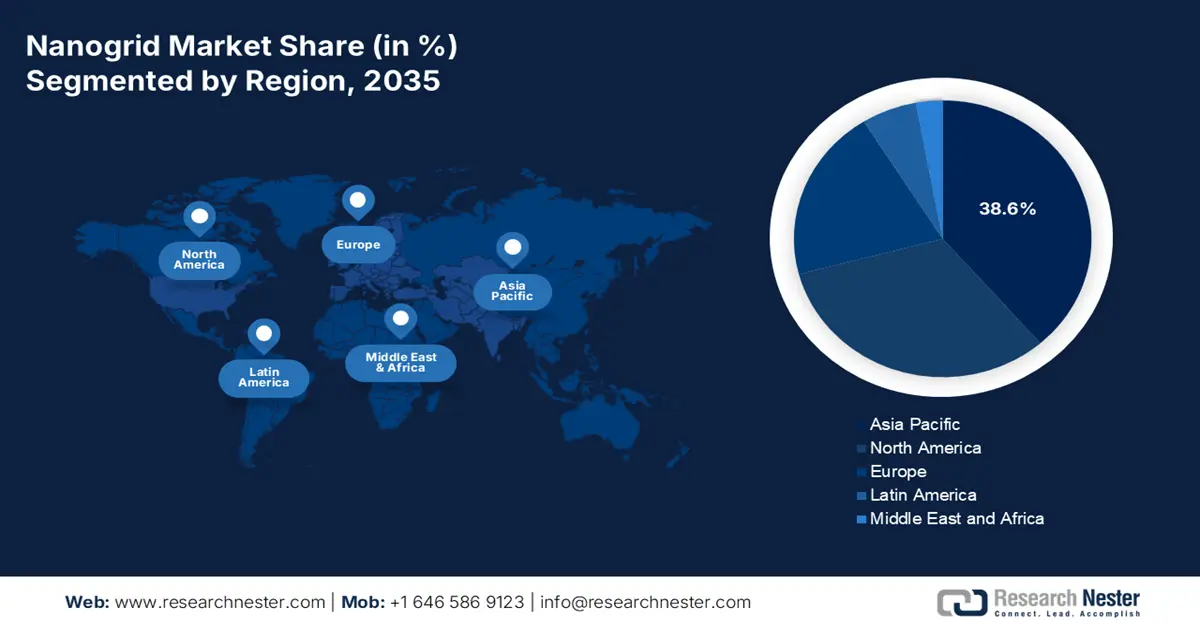

- By 2035, the Asia Pacific region in the nanogrid market is projected to secure a 38.6% share as its rise is fostered by escalating energy demand, widening grid instability, and ambitious renewable energy targets.

- By 2035, Europe is anticipated to witness the fastest pace of expansion as its advancement is supported by stringent regulatory mandates for energy security, industrial competitiveness, and decarbonization.

Segment Insights:

- By 2035, the lithium-ion batteries segment in the nanogrid market is projected to command an 88.5% share as its expansion is propelled by surging global need for reliable backup power, improved grid stability, and effective renewable energy storage.

- By 2035, the solar PV hybrid systems segment is expected to strengthen its traction as its growth is reinforced by the economic synergy of solar generation and storage enabled through hybridization.

Key Growth Trends:

- Increase in grid resilience

- Energy accessibility in emerging economies

Major Challenges:

- Outdated grid interconnection policies and regulatory uncertainty

- Deficits in technology interoperability and standardization

Key Players: BASF SE (Germany), Albemarle Corporation (U.S.), LG Chem Ltd. (South Korea), Samsung SDI Co., Ltd. (South Korea), Panasonic Holdings Corporation (Japan), DuPont de Nemours, Inc. (U.S.), Mitsubishi Chemical Group Corporation (Japan), SABIC (Saudi Arabia), Solvay SA (Belgium), Arkema SA (France), Wacker Chemie AG (Germany), Umicore (Belgium), Toray Industries, Inc. (Japan), Shin-Etsu Chemical Co., Ltd. (Japan), Sumitomo Chemical Co., Ltd. (Japan), Livent Corporation (U.S.), POSCO Chemical (South Korea), Tata Chemicals Limited (India), Piedmont Lithium Inc. (U.S.), Lotte Chemical Corporation (South Korea).

Global Nanogrid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.2 billion

- 2026 Market Size: USD 20.6 billion

- Projected Market Size: USD 36.8 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.6% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Australia, United Arab Emirates, Indonesia

Last updated on : 8 December, 2025

Nanogrid Market - Growth Drivers and Challenges

Growth Drivers

- Increase in grid resilience: The severity of climate-based grid outages and increasing frequency is considered the primary catalyst for the nanogrid market globally. Regarding this, the U.S. Department of Energy (DOE), along with additional grid operators, has highlighted aging infrastructure vulnerabilities, which have made power backup a necessity. According to the April 2024 Climate Central Organization report, of the overall power outages reported in the U.S., 80% took place due to extreme weather conditions. Besides, the majority of weather outages have been caused by 23% of winter storms, and 14% of hurricanes. Moreover, there have been 210 outages in Texas, which is followed by 157 in Michigan, 145 in California, 111 in North Carolina, and 88 in Ohio, thereby driving the market’s demand.

- Energy accessibility in emerging economies: The presence of non-existent or underdeveloped grid infrastructure across regions has paved the way for the nanogrid market to provide a rapid and more affordable way to ensure electrification. This is highly driven by developmental financing and government programs in comparison to an extended and centralized grid. As per an article published by the World Bank Organization in June 2025, nearly 92% of the global population currently has basic electricity accessibility. However, approximately 1.5 billion people from rural locations are devoid of access to clean cooking. Therefore, based on this, progress has been made by offering global financial flows to developing nations, amounting to USD 21.6 billion as of 2023, intended to support clean energy.

- Rise in clean energy: The majority of organizations are significantly investing in on-site clean energy as well as storage to cater to public environmental, social, and governance (ESG) targets. The purpose is to diminish Scope 2 emissions and ensure future-proof operations against stakeholder and regulatory pressures in relation to climate impact. According to the June 2025 World Bank Organization article, emerging nations are poised to make up nearly 2/3rd of the international electricity needs. In addition, over 73 million kilometers of power lines are required to be upgraded or added across developing countries by 2050. However, to meet this particular demand, the yearly investment in electricity generation is projected to be doubled by 2035 from USD 280 billion to USD 620 billion, thus suitable for bolstering the nanogrid market’s exposure.

Challenges

- Outdated grid interconnection policies and regulatory uncertainty: The regulatory and legal landscape for distributed energy resources, such as nanogrids, is frequently inconsistent, slow-moving, and fragmented. Hence, a primary roadblock is the interconnection process of connecting a nanogrid to the conventional utility grid. Besides, procedures can be cumbersome, expensive, and lengthy, with study and fees requirements designed for large-scale plants, which negatively impact the nanogrid market. Moreover, various jurisdictions within the nanogrid market are devoid of standard rules and comprise outright limitations on value-based grid services and bi-directional power flows that are offered by aggregated nanogrids.

- Deficits in technology interoperability and standardization: The absence of universal technical standards has created a huge gap in the nanogrid market, thereby restricting cost reduction, scalability, and seamless integration. In addition, the nanogrid market is effectively populated by a multitude of software platforms and hardware manufacturers that frequently operate on closed and proprietary protocols. This has resulted in vendor lock-in, wherein consumers are linked to a supplier for repairs or expansions, thus increasing long-lasting experts and diminishing flexibility. Furthermore, this also complicates the aggregation of diversified assets into virtual power plants. In addition, the lack of plug-and-play compatibility undermines system reliability, raises maintenance and installation expenses, and increases system design complexity.

Nanogrid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 19.2 billion |

|

Forecast Year Market Size (2035) |

USD 36.8 billion |

|

Regional Scope |

|

Nanogrid Market Segmentation:

Storage Technology Segment Analysis

The lithium-ion batteries segment, part of storage technology, is anticipated to garner the highest share of 88.5% in the nanogrid market by the end of 2035. The segment’s upliftment is highly fueled by its ability to provide backup power during outages, enhance grid stability, and store intermittent renewable energy. According to an article published by the IEA Organization in 2023, there has been a surge in automotive lithium-ion batteries by nearly 65% to 550 GWh as of 2022 from almost 330 GWh in the previous year. Besides, the battery’s demand in China is continuously increasing by more than 70%, while the demand has upsurged by 80% in the U.S. Besides, in Europe, the battery need has also increased to 127.7 GWh per year, while it is 40.3 GWh per year for other regions. Therefore, with this continuous growth in battery demand, there is a huge opportunity for the overall segment’s upliftment internationally.

Power Source Segment Analysis

Based on the power source, the solar PV hybrid systems segment in the nanogrid market is projected to cater to the nanogrid market during the forecast duration. The segment’s growth is highly attributed to the robust economic synergy between solar storage and generation. Besides, the aspect of hybridization enables temporal energy arbitrage by storing excess daytime production for utilization at night, during grid outages, and also during peak grid pricing periods. This particular configuration maximizes self-consumption of solar energy, significantly diminishing dependency on the utility grid and offering severe backup power. In addition, the segment’s growth is further escalated by streamlined installation and financing since the solar-plus-storage package has emerged as the standard offering, thereby making it suitable for the market’s exposure.

Connectivity Segment Analysis

The grid-connected sub-segment, which is part of the connectivity segment, is expected to cater to the third-highest share in the nanogrid market during the stipulated timeline. The sub-segment’s development is highly propelled by the provision of regular economic advantages and active participation in grid service while providing seamless and automatic backup power during outages. Additionally, this particular system’s value proposition is dual-mode functionality and is optimized for bill management by utilizing storage and on-site generation to perform peak shaving, as well as energy arbitrage. Besides, critically, when connected, these systems can feed surplus energy back to the grid where allowed, thereby creating a suitable bill credit or potential revenue stream, denoting an optimistic outlook for the overall segments growth.

Our in-depth analysis of the nanogrid market includes the following segments:

|

Segment |

Subsegments |

|

Storage Technology |

|

|

Power Source |

|

|

Connectivity |

|

|

Application |

|

|

End user |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nanogrid Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the nanogrid market is anticipated to hold the largest share of 38.6% by the end of 2035. The market’s upliftment in the region is primarily attributed to the huge demand for energy, a rise in grid instability, and robust renewable energy targets. In addition, energy accessibility in emerging nations, along with decarbonization and energy security in developed countries, are also fueling the market’s exposure in the region. According to an article published by the Asia Development Bank in April 2025, the aspect of clean energy investment in the region has grown by over 900%, and significantly reached USD 729.4 billion as of 2023, which comprises almost 45% of the international investment. Moreover, the People’s Republic of China (PRC) readily accounted for the maximum of this investment, based on which India, along with 7 other nations, has joined the PRC in exceeding renewables by 75% for the national energy capacity addition as of 2022.

China in the nanogrid market is growing significantly, owing to the unrivaled combination of central industrial policy, domestic necessity, and manufacturing scale. Besides, the Dual Carbon objective is considered the primary driver for the market, which has been significantly enforced through the National Development and Reform Commission (NDRC) support and provincial mandates. As stated in an article published by Ember Energy Organization in August 2025, wafers and cells currently cater for more than 40% of the country’s solar product exports as of 2025. Regarding this, cell expenses have readily lowered by 82% since 2022, owing to which pane costs have been reduced in recent years. Furthermore, continuous photosensitive devices and photovoltaic modules supply chain in the country and the overall region is also driving the market’s growth.

2023 Assembled Photovoltaic Modules and Photosensitive Devices Export and Import in the Asia Pacific

|

Countries |

Export (USD) |

Import (USD) |

|

China |

33.9 billion |

383 million |

|

India |

2.0 billion |

569,000 |

|

Japan |

1.3 billion |

387,000 |

|

Thailand |

664 million |

77.1 million |

|

Malaysia |

370 million |

120 million |

|

South Korea |

337 million |

2.1 million |

|

Vietnam |

170 million |

141 million |

|

Indonesia |

109 million |

2.6 million |

Source: OEC

India in the nanogrid market is also growing due to a rise in the electricity demand, critical grid deficiencies, and ambitious renewable targets. For instance, as stated in an article published by the PIB Government in April 2023, the country’s government has declared the plan to provide 50 GW of renewable energy capacity every year for the upcoming 5 years to reach the 500 GW target by the end of 2030. Additionally, the government has also invited bids to ensure connected renewable energy capacity, which comprises wind power capacity of nearly 10 GW per annum. Meanwhile, the country at present constitutes an overall renewable energy capacity of 168.9 GW, with almost 82 GW at different implementation stages, along with 41 GW under the tendering stage. This includes 10.7 GW bio power, 41.0 GW wind power, 51.7 GW hydro power, and 64.3 GW solar power, thereby making it suitable for fueling the market’s demand in the country.

Europe Market Insights

Europe in the nanogrid market is expected to emerge as the fastest-growing region during the projected period. The market’s development in the region is highly propelled by the presence of the regulatory mandate for energy security, industrial competitiveness, and decarbonization. According to the March 2025 Europe Council article, the regional climate law has successfully reached the objective of lowering emissions by almost 55% by the end of 2030 as a legalized obligation. In addition, countries in the region have integrated the newest legislation to gain this objective and ensure a regional climate-neutral by the end of 2050. Besides, the Environment Council has adopted a general strategy and reached a provincial deal of increasing emission reduction by 2030 across sectors, which are covered by 62% of ETS in comparison to 61% of target proposed by the Commission, thereby proliferating the market in the overall region.

Germany in the nanogrid market is gaining increased traction, owing to the potent convergence of ambitious policy, acute energy security demands, and industrial capability. Additionally, the energy transition initiative is considered the foundational driver, which is legally mandated by the Renewable Energy Sources Act (EEG). As per a report published by the Federal Ministry for Economic Affairs and Climate Action in 2023, the country’s newest federal government has readily proclaimed to ensure national action that is poised to overhaul the energy system by 2030 by covering 80% of electricity consumption. This is possible by providing almost 50% of the heating demand, and meanwhile, greenhouse gas emissions are expected to drop by 65%. Moreover, the renewable energy share is projected to increase by nearly 40% in energy consumption by the end of 2030, while the country is focused on improving energy efficiency by 36% to 39%, both of which are driving the market’s upliftment.

Poland in the nanogrid market is also developing due to the urgent requirement to shift away from the coal-based power system, and catering to the soaring need from reshoring sectors and gaining regional climate targets. Besides, as per an article published by the Europe Commission in December 2022, the Commission has readily adopted the overall 5 Polish operational programmes, along with Territorial Just Transition Plans (TJTPs), which are worth over €3.8 billion. These operate under the Just Transition Fund (JTF) for supporting climatic transition across coal regions, including Łódzkie, Lower Silesia, Wielkopolska, Małopolska, and Silesia. These particular regions receive the majority of the grant provision, and with a nearly €2.4 billion budget for West Małopolska and Silesia, this overall funding opportunity assists regional inhabitants and provides support, especially during the green economy transition with clean air and latest employment opportunities.

North America Market Insights

North America in the nanogrid market is predicted to witness steady and considerable growth by the end of the forecast duration. The market’s growth in the region is highly propelled by innovative regulatory frameworks, increased grid electricity expenses, and acute climate-based resilience demands. In addition, the modernization of the aging grid, along with federal policy and private investment, are also uplifting the market in the region. As per an article published by the U.S. Department of Energy (DOE) in October 2023, 70% of transmission lines are more than 25 years old and are readily approaching the end of their 50 to 80-year lifecycle. Besides, the DOE declared almost USD 3.5 billion for 58 projects across 44 states to effectively strengthen electric grid reliability and resilience across the U.S. These projects leveraged over USD 8 billion in private and federal investments as part of the Grid Resilience and Innovation Partnerships (GRIP) Program. Therefore, with such investments and developments, there is a huge growth opportunity for the market in the region.

The nanogrid market in the U.S. is gaining increased exposure, owing to budget allocation, federal expenditure, progressive manufacturing tax credits, decarbonization and industrial efficiency program, and the EPA’s sustainable materials program and green chemistry. Besides, as stated in a data report published by the U.S. Government Accountability Office in November 2024, OECD readily supports DOE offices and comprises 8 portfolios for 17 programs, comprising USD 8 billion for Regional Clean Hydrogen Hubs, USD 7.1 billion for Carbon Management, and USD 6.3 billion for Industrial Demonstrations. Therefore, these clean projects are suitable for lowering the risk of the latest technologies and permit additional and large-scale private investment, along with ensuring commercialization. Besides, generous funding from the DOE for energy demonstrations is also boosting the market in the country.

Standard DOE Funding for Clean Energy Demonstrations (2024)

|

Fund Type |

Fund Amount (USD) |

|

Distributed Energy Systems Demonstrations |

50 million |

|

Clean Energy Demonstration Program on Current and Former Mine Land |

500 million |

|

Long-Duration Energy Storage |

505 million |

|

Energy Improvements in Rural or Remote Areas |

1 billion |

|

Advanced Nuclear |

3.3 billion |

|

Industrial Demonstrations |

6.3 billion |

|

Carbon Management |

7 billion |

|

Regional Clean Hydrogen Hubs |

8 billion |

Source: U.S. Government Accountability Office

The nanogrid market in Canada is also growing due to indigenous energy sovereignty, remote communities, strict provincial building codes, carbon pricing, resilience to climate events, grid modernization, federal investment tax incentives, and leadership in digitalized grid innovation. According to an article published by the Government of Canada in June 2025, the Clean Energy for Rural and Remote Communities (CERRC) program, since its launch, has generously allocated USD 220 million for more than 8 years to diminish diesel reliance for power and heat in remote and indigenous communities in the country. In addition, the CERRC also received USD 233 million for more than 5 years through the domestic budget program. Besides, the NRCan’s Indigenous Off-Diesel approach readily supports 14 indigenous clean energy communities and has offered over USD 28 million for community-based clean energy planning, implementation, and engagement projects, thus suitable for the market’s upliftment in the country.

Key Nanogrid Market Players:

- BASF SE (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Albemarle Corporation (U.S.)

- LG Chem Ltd. (South Korea)

- Samsung SDI Co., Ltd. (South Korea)

- Panasonic Holdings Corporation (Japan)

- DuPont de Nemours, Inc. (U.S.)

- Mitsubishi Chemical Group Corporation (Japan)

- SABIC (Saudi Arabia)

- Solvay SA (Belgium)

- Arkema SA (France)

- Wacker Chemie AG (Germany)

- Umicore (Belgium)

- Toray Industries, Inc. (Japan)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

- Livent Corporation (U.S.)

- POSCO Chemical (South Korea)

- Tata Chemicals Limited (India)

- Piedmont Lithium Inc. (U.S.)

- Lotte Chemical Corporation (South Korea)

- BASF SE is an international leader in innovative battery materials and is a notable supplier of electrolytes and cathode active materials critical for lithium-ion batteries that are utilized in nanogrid energy storage systems. The organization readily invests heavily in cutting-edge chemistries, including solid-state batteries and nickel-rich NCM to boost energy density and safety for decentralized energy applications. Besides, as per its 2024 annual report, €65.3 billion in sales, €7.9 billion in EBITDA, along with 5.1% in ROCE.

- Albemarle Corporation is considered one of the world’s highest lithium producers and offers crucial raw material for lithium-ion batteries that has developed from the core of modernized nanogrid storage solutions. The firm’s tactical expansion of lithium refining capacity is essential for gaining the international supply chain and catering to the soaring need from the energy storage industry.

- LG Chem Ltd. is one of the dominant forces in the battery supply chain and a top producer of crucial components, such as electrolytes, separators, and cathode materials for high-performance energy storage systems. The organization’s vertical integration and increased focus on high-nickel NCMA cathode technology, which directly contributes to producing affordable, long-term, and powerful batteries for industrial and commercial nanogrids. Therefore, based on these and as stated in its 2025 annual report, the organization gathered KRW 48.9 trillion in revenue and KRW 916.8 billion in operating profit as of 2024.

- Samsung SDI Co., Ltd. is the foremost manufacturer of premium lithium-ion battery cells and readily packs specifically engineered for energy storage systems, which are significantly integrated into nanogrid functionality. Besides, its products are well-known for their increased energy density, long cycle life, and safety features, which make them a suitable choice for dependable residential and C&I nanogrid installations.

- Panasonic Holdings Corporation is regarded as a pioneer in battery technology for supplying high-quality lithium-ion cells, preferably its cylinder-based formats, which are comprehensively utilized in scalable and modular nanogrid storage solutions. The organization’s ongoing research and development readily focus on optimizing battery durability and charge efficiency, which are paramount for regular cycling demands for nanogrid applications.

Here is a list of key players operating in the global nanogrid market:

The worldwide nanogrid market is extremely consolidated and technological-driven, with competition centering on innovative materials for high-efficiency photovoltaics, power electronics, and energy storage. Notable strategies, such as strategic alliance formation with system integrators and automotive OEMs, significant investments in research and development for cutting-edge semiconductor materials and battery chemicals, and vertical integration to achieve severe mineral supplies, are fueling the market globally. Moreover, leading organizations are strongly making production capacity expansion, particularly in Asia, to leverage cost benefits and regional supply chains. For instance, in May 2025, Amber Kinetics and Kawasaki Heavy Industries Ltd. successfully signed an MOU for expanding their collaborative deal to promote KHI’s iVSG technology for offering resilience, stability, and reliability to modernize the power grid, which denotes a positive impact on the nanogrid market.

Corporate Landscape of the Nanogrid Market:

Recent Developments

- In June 2025, Worksport Ltd. confirmed the Fall 2025 commercial launch of its very own SOLIS & COR, which is a modular nanogrid system, after successfully executing notable engineering milestones, along with standard validation benchmarks for both systems.

- In December 2024, ERDC has significantly launched a next-generation hydrogen-powered small microgrid in New Mexico by partnering with the Directorate of Public Works (DPW) Environmental Division at WSMR, along with the U.S. Army Combat Capabilities Development Command.

- In January 2024, Hitachi Ltd., as well as the City of Iwamizawa in Hokkaido, introduced an evaluation with Iseki & Co., Ltd. to prove the localized production concept and renewable energy consumption by utilizing battery cycling and contributing to regional sectors.

- Report ID: 8281

- Published Date: Dec 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nanogrid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.