N-Vinylformamide Market Outlook:

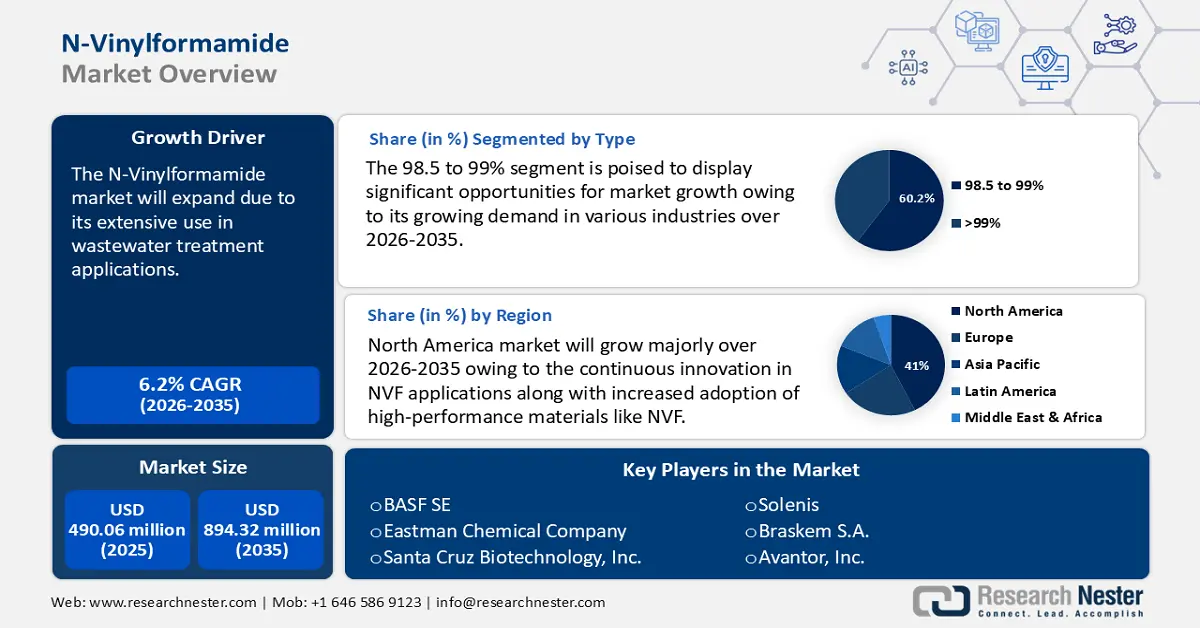

N-Vinylformamide Market size was over USD 490.06 million in 2025 and is projected to reach USD 894.32 million by 2035, witnessing around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of n-vinylformamide is evaluated at USD 517.41 million.

The N-vinylformamide market is witnessing significant growth due to its widespread application in wastewater treatment. The increasing health risks associated with industrial water use have necessitated the urgent need for the remediation of water resources. According to the UN Environment Program, the water quality of the world's rivers, lakes, and groundwater remains unknown, putting nearly 3 billion people at risk for illness. Moreover, environmental and climatic changes have adversely affected water quality on a global scale. This decline in water quality has been exacerbated by urbanization. N-vinylformamide can be utilized in various processed forms for multiple applications, including water treatment and agricultural irrigation.

N-vinylformamide (NVF) is a versatile monomer used in water treatment applications ascribable to its ability to form water-soluble polymers and copolymers with excellent flocculation and absorption properties. NVF-based polymers are highly effective in removing suspended particles, organic matter, and heavy metals from wastewater. These polymers are often used as coagulants of flocculants in municipal and industrial wastewater treatment processes. Their biodegradability and low toxicity make NVF-based solutions, environmentally friendly, aligning with stricter environmental regulations.

Furthermore, advances in manufacturing technologies have streamlined the production processes of NVF, leading to cost reductions and competitive pricing. This has enabled NVF to become viable for diverse applications. Additionally, the growing focus on bulk production and economies of scale has further driven down prices, making NVF an attractive choice for manufacturers seeking high-performance polymers. Company-wise pricing for N-vinylformamide is as follows:

|

Company |

Product |

Quantity |

Price |

Year |

|

AK Scientific |

N-Vinylformmide (stabilized with BHT) |

25 grams |

USD 63 |

2021 |

|

American Custom Chemicals Corporation |

N-Vinylformamide 95.00% |

1 gram |

USD 638.1 |

2021 |

|

TCI Chemical |

N-Vinylformamide (stabilized with BHT) >96.0% (GC) |

25 grams |

USD 28 |

2024 |

|

Sigma-Aldrich |

N-Vinylformamide 98% |

500ml |

USD 152 |

2024 |

Key N-Vinylformamide Market Insights Summary:

Regional Highlights:

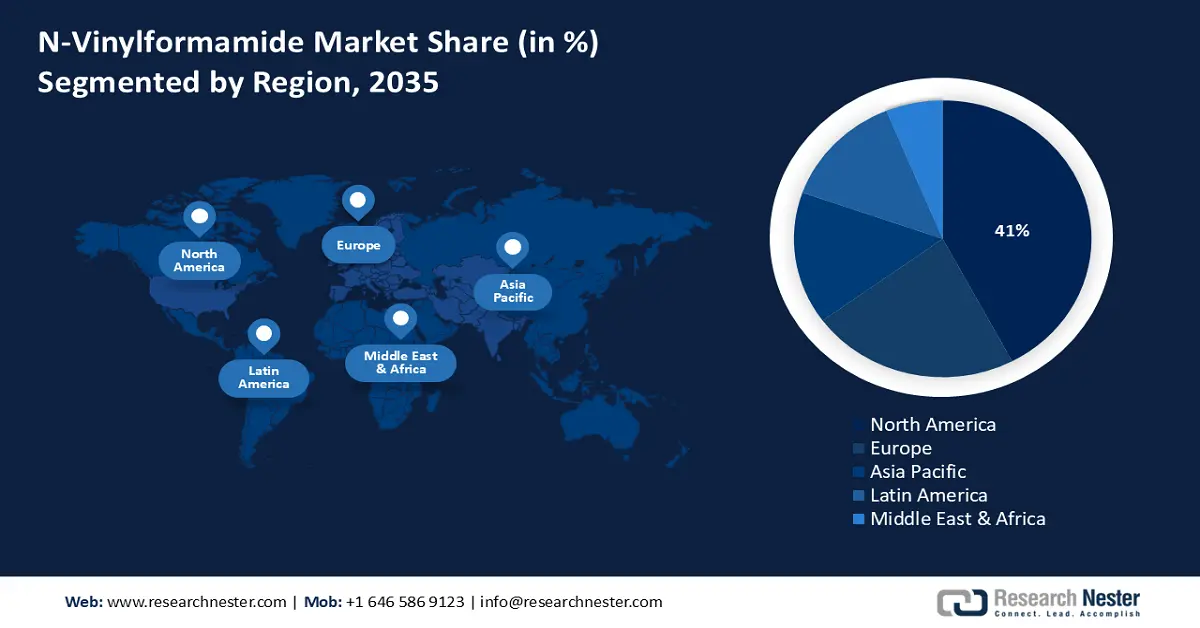

- By 2035, North America is set to command over 41% revenue share in the N-vinylformamide market, underpinned by its strong emphasis on research and development.

- Through 2026-2035, Europe is expected to expand at a notable pace, fueled by increasing use of high-purity N-vinylformamide across industrial applications.

Segment Insights:

- By 2035, the 98.5 to 99% segment is projected to hold over 60.2% share in the N-vinylformamide market, propelled by its growing demand in various industries.

- During 2026-2035, the water treatment segment is anticipated to secure a significant share, supported by rising adoption of water-soluble polymers.

Key Growth Trends:

- Growing application in diverse sectors

- Increasing demand for lithium ion batteries

Major Challenges:

- Fluctuating raw material prices

- Environmental concerns and stringent laws

Key Players: BASF SE, Eastman Chemical Company, Santa Cruz Biotechnology, Inc., Solenis, Braskem S.A., DuPont de Nemours, Inc., Sigma-Aldrich Corporation, Avantor, Inc., Angene International Limited, Alfa Aesar.

Global N-Vinylformamide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 490.06 million

- 2026 Market Size: USD 517.41 million

- Projected Market Size: USD 894.32 million by 2035

- Growth Forecasts: 6.2%

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Vietnam, Indonesia, Mexico

Last updated on : 2 December, 2025

N-Vinylformamide Market - Growth Drivers and Challenges

Growth Drivers

-

Growing application in diverse sectors: N-vinylformamide (NVF) finds applications in the pharmaceutical industry primarily as a precursor for creating advanced polymeric materials that are biocompatible and water-soluble. Polymers derived from NVF, such as poly(N-vinylformamide) and its hydrolyzed form, polyvinylamine, are used in drug delivery systems due to their ability to form hydrogels, encapsulate active pharmaceutical ingredients, and provide controlled drug release. Additionally, NVF-based polymers are employed as binders and excipients in tablet formulations, enhancing the stability and solubility of drugs. Their low toxicity and ability to form tailored functional groups make NVF derivatives valuable for pharmaceutical applications, including targeted therapies and biomedical devices.

Moreover, N-vinylformamide is also used to manufacture adhesives and coatings, improving the end product's bond strength, water resistance, and longevity. The N-vinylformamide market has been steadily expanding attributed to its growing need for high-performance adhesives in various industries, including electronics, construction, and the automotive sector. Additionally, as manufacturers seek creative ways to comply with more stringent environmental requirements, the market is further stimulated by the emergence of eco-friendly coatings and adhesives, which are pushed by sustainability trends. - Increasing demand for lithium-ion batteries: As lithium-ion battery (LIB) technology advances materials like NVM that enhance performance, safety, and sustainability will see rising demand. This makes NVF an increasingly important component of the battery materials supply chain. LIBs exhibit superior gravimetric and volumetric energy densities compared to other rechargeable energy systems, and their rapid proliferation is primarily driven by increasing energy demands. According to the International Energy Agency (IEA), the electricity demand is predicted to increase more quickly worldwide, averaging 3.4% per year until 2026. A stronger economic outlook will fuel the gains by accelerating the increase of power demand in both developed and emerging nations. The advantages of LIBs extend to applications in stationary off-peak energy storage systems, electric vehicles (EVs), and portable electronic devices, promoting enhanced safety and prolonged cycle life.

Recently, polymers derived from acrylamide, which are acknowledged as hazardous and potentially carcinogenic, are being considered for replacement by NVF-based polymers. Poly(N-vinylformamide) (PNVF) has emerged as an innovative, bio-derived binder for anode materials composed of nanostructured carbon aerogels within the realm of LIB research. Notably, empirical studies have featured the utilization of PNVF in conjunction with the cathode material lithium iron phosphate (LiFePO4, LFP).

Furthermore, molecular dynamics simulations have been employed to examine the influence of PNVF on lithium-ion transport at the interface between the liquid electrolyte and the LFP cathode. According to existing literature, PNVF demonstrates a heightened affinity for lithium ions due to the polar side chains imparted by the formamide groups. This characteristic enables PNVF to disrupt the electric double layer, thereby enhancing the mobility of lithium ions adjacent to the LFP surface and reducing the overall resistance of the cells.

Challenges

-

Fluctuating raw material prices: Acetylene and formamide are the main raw materials required to make N-vinylformamide, and their costs vary regularly as a result of supply-demand imbalances, geopolitical concerns, and other macroeconomic variables. It is anticipated that N-vinylformamide market participants will face major obstacles in terms of cost optimization and profitability as a result of this pricing volatility.

- Environmental concerns and stringent laws: Regulators have imposed severe restrictions and guidelines on the use of some substances, such as NVF, because of potential health and environmental risks. These regulations seek to safeguard customers and the surroundings. Producers find it challenging to comply with these regulations since they call for more testing, documentation, and product reformulation. Additionally, sustainability and eco-friendly decisions are becoming crucial in several sectors, including the chemical industry. Therefore, these factors are restraining the N-vinylformamide market growth.

N-Vinylformamide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 490.06 million |

|

Forecast Year Market Size (2035) |

USD 894.32 million |

|

Regional Scope |

|

N-Vinylformamide Market Segmentation:

Type Segment Analysis

98.5 to 99% segment is poised to hold more than 60.2% N-vinylformamide market share by 2035. The market growth can be attributed to its growing demand in various industries. The high-purity grade is particularly popular for its excellent reactivity and stability, making it a preferred choice for applications such as polymerization, adhesives, and coatings. Moreover, the increasing focus on sustainable and eco-friendly products is expected to further boost the 98.5-99% NVF, as it offers a unique combination of performance and eco-friendliness.

Application Segment Analysis

The water treatment segment in N-vinylformamide market will garner a significant share during the assessed period. N-vinylformamide is the most basic in the n-vinylformide family and is a water-soluble polymer. It is a colorless liquid that dissolves in the majority of common solvents, including chloroform, methanol, and ethanol. Along with other oligomers, monomers, and functional polymers, it is also a precursor to amine and amide functional polymers. High reactivity in polymerization, reactive amine functional polymers or oligomers, and subsequent hydrolysis to cationic are among the compound's appealing toxicological and physical characteristics. Over the past few years, a lot of research has been done on the use of water-soluble polymers, like n-vinylformamide, in turbulent drag reduction.

Our in-depth analysis of the global n-vinylformamide market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

N-Vinylformamide Market - Regional Analysis

North America Market Insights

North America in N-vinylformamide market is set to capture over 41% revenue share by 2035. The region’s strong emphasis on research and development fosters continuous innovation in NVF applications. This focus on technological advancements enables the development of new and improved products, enhancing NVF’s utility and market demand. North America's rigorous quality and environmental standards drive industries to adopt high-performance materials like NVF, which meet compliance requirements and contribute to sustainable practices.

In the U.S., the increasing demand for water-based coatings with low volatile organic compound (VOC) content is boosting the need for water-based coatings. NVF serves as a key ingredient in these coatings owing to its excellent film-forming properties, low toxicity, and environmental compatibility. Moreover, its growing use in developing drugs for conditions such as cancer and cardiovascular diseases is escalating the N-vinylformamide market growth. The growing prevalence of these health conditions coupled with ongoing research and development efforts in the pharmaceutical industry will expand the N-vinylformamide market in the country. The U.S. Centers for Disease Control and Prevention reported that 1,777,566 new cases of cancer were reported in the U.S. in 2021. In 2022, 608,366 Americans lost their lives to cancer.

Europe Market Insights

Europe N-vinylformamide market is expected to grow at a significant rate during the projected period. The market is proliferating in the region due to the increasing use of high-purity grade n-vinylformamide in various industries, including paint and coating, paper, and water treatment. The region's growing demand for eco-friendly goods and packaging will have a beneficial effect on the paper industry and thereby boost N-vinylformamide market expansion.

Furthermore, in the UK, growing demand for personal care products like hair sprays and gels due to their film-forming properties and non-tacky nature, aligning with consumer preferences for high-quality personal care items. Approximately USD 8.9 billion were spent on personal care in the fourth quarter of 2023. Therefore, the surging sales of these products will accelerate the N-vinylformamide market growth. Also, the country’s adhesives sector is expanding, driven by demand from the construction, automotive, and packaging industries.

N-Vinylformamide Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eastman Chemical Company

- Santa Cruz Biotechnology, Inc.

- Solenis

- Braskem S.A.

- DuPont de Nemours, Inc.

- Sigma-Aldrich Corporation

- Avantor, Inc.

- Angene International Limited

- Alfa Aesar

Key players in the N-vinylformamide market are thriving by using advanced production technologies, expanding their product portfolios, and targeting high-growth industries such as adhesives, coatings, and water treatment. Companies are focusing on innovation to improve the purity and performance of NVF for diverse applications, while strategic collaboration and partnerships are aiding in penetrating untapped markets. Robust investments in research and development, along with an emphasis on meeting regulatory standards, are further bolstering their competitive advantage.

Recent Developments

- In February 2024, Eastman announced a long-term deal with Nord Pal Plast SA, a subsidiary of Dentis Group, a major Italian multinational firm that specializes in the collection and mechanical recycling of PET packaging waste. Dentis Recycling will offer Eastman 30,000 metric tons of rejected PET post-consumer trash annually through mechanical recycling operations in France (Nord Pal Plast SA), Spain (PET COMPAÑÍA PARA SU RECICLADO), and Italy (Dentis Recycling Italy Srl).

- In October 2023, BASF began production in its cutting-edge Superabsorbents Excellence Center at the Verbund plant in Antwerp, Belgium. The USD 26.03 million investment demonstrates the company's clear commitment to the hygiene industry as a crucial component of the acrylics value chain.

- Report ID: 7090

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

N-Vinylformamide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.