n-Butanol Market Outlook:

n-Butanol Market size was over USD 6.59 billion in 2025 and is anticipated to cross USD 11.58 billion by 2035, growing at more than 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of n-butanol is assessed at USD 6.93 billion.

The n-Butanol market is expanding due to rising demand across several industries, including paints, coatings, adhesives, sealants, inks, and solvent products. The market's growth will be shaped by rising consumption in the food and beverage industry as artificial flavor due to the increased demand for artificial flavorings, such as fruit, butter, rum, ice cream and ices, candy, whiskey, baked goods, and cordials. Increasing consumption of n-Butanol in butyl acrylate, butyl acetate, glycol ethers, direct solvents, and plasticizers due to the high demand in engineering plastics, marine coatings, automotive coatings, adhesives, and super absorbent polymers is anticipated to support the growth of the n-Butanol industry during the forecast period.

In August 2024, BASF and UPC Technology Corporation signed a Memorandum of Understanding (MoU), a significant step forward in their long-standing partnership. The alliance focuses on working together with plasticizer alcohols and phthalic and maleic anhydride catalysts. To meet UPC's quickly expanding market demands, particularly in South China, BASF supplied 2-Ethylhexanol (2-EH) and n-Butanol from the Oxo plant, which is scheduled to start up at the Zhanjiang Verbund site in 2025. With a wide range of production and operating facilities spread across, UPC is currently growing its product line and production capacity to satisfy its clients' changing demands.

Growing applications in several industries, such as printing, polymers, pyroxylin plastics, medicines, and herbicide esters, will accelerate n-Butanol's market penetration soon. The extensive use as diluents and reactants in the production of urea-formaldehyde and melamine-formaldehyde resins is expected to generate enormous growth potential in the years to come. The market for n-Butanol is expected to grow as a result of increased consumption of paints, coatings, varnishes, resins, and dyes brought on by rapid industrialization and rising disposable income.

Key n-Butanol Market Insights Summary:

Regional Highlights:

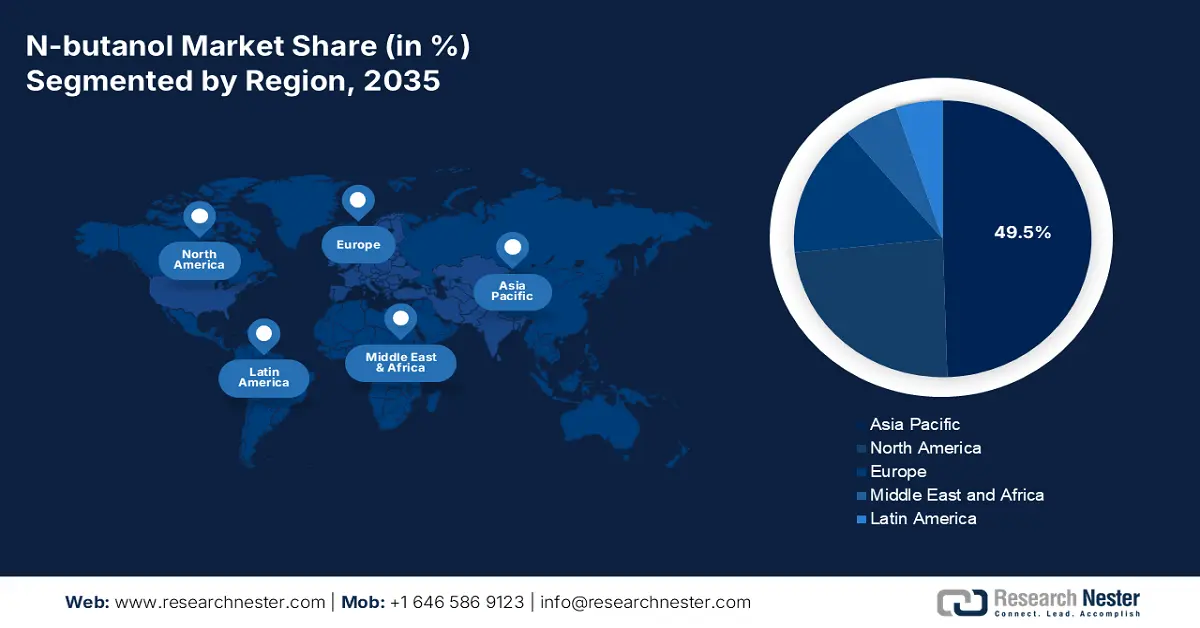

- Asia Pacific dominates the n-Butanol Market with a 49.5% share, propelled by rising demand, surge in chemical production, and industrialization, driving significant growth through 2026–2035.

- North America's n-Butanol Market is set for remarkable growth by 2035, driven by the growing chemical industry and surge in infrastructure projects.

Segment Insights:

- The Butyl Acrylate segment is projected to hold a 33.70% share by 2035, driven by its essential role in coatings, adhesives, and sealants.

- The Oxyhydrogenation of Propylene segment is poised for significant growth in the n-Butanol market from 2026 to 2035, driven by its efficiency and dominance in production processes.

Key Growth Trends:

- Growing demand for renewable fuel

- Increasing use in chemical production

Major Challenges:

- Volatility in raw material prices

- Stringent regulatory standards

- Key Players: Petroliam Nasional Berhad, OQ Chemicals GmbH, Formosa Plastics Corporation, U.S.A., MERCK KGAA, Anhui Shuguang Chemical Group, Vizag Chemical.

Global n-Butanol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.59 billion

- 2026 Market Size: USD 6.93 billion

- Projected Market Size: USD 11.58 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 12 August, 2025

n-Butanol Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for renewable fuel: n-Butanol is a renewable fuel derived from biomass such as corn, sugarcane, and wood. Since renewable fuels are safe and emit few greenhouse gases, the world has grown more aware of and interested in using them as a result of the growing trend of climate change. Among the greatest renewable fuels that may be substituted for gasoline and diesel is n-Butanol. The market for n-Butanol is expected to increase greatly in the future due to the rapidly increasing demand for renewable fuels.

- Increasing use in chemical production: n-Butanol is a kind of alcohol that has several industrial applications. The manufacturing of polymers, solvents, and medications is one of this chemical's most widespread applications. n-Butanol's market expansion is anticipated to be aided by its growing use in chemical production. Currently, the increasing demand for plastics and other chemical products, as well as the advancement of new technologies that facilitate the use of n-Butanol in chemical production, are some of the causes contributing to the increased use of this alcohol.

Challenges

- Volatility in raw material prices: The n-Butanol market is significantly hampered by the price volatility of raw materials. Since propylene and butane are feedstocks used to make n-Butanol, changes in their prices affect the cost of manufacturing. Market participants find it difficult to establish steady price structures as a result of this instability.

- Stringent regulatory standards: The market for n-Butanol is constrained by strict environmental and regulatory requirements. To maintain sustainable and environmentally friendly industrial processes, compliance with safety and environmental standards necessitates ongoing adaptation and technological investment. The manufacturing of n-Butanol becomes more complicated and expensive when these conditions are met.

n-Butanol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 6.59 billion |

|

Forecast Year Market Size (2035) |

USD 11.58 billion |

|

Regional Scope |

|

n-Butanol Market Segmentation:

Application (Butyl Acrylate, Butyl Acetate, Glycol Ethers, Direct Solvent, Plasticizers)

The butyl acrylate segment is projected to gain a 33.7% share through 2035. n-Butanol's dominance in applications as an essential part of coatings, adhesives, and sealants demonstrates its significance in the chemical environment.

Another significant n-Butanol market is butyl acetate, which is used as a solvent in sectors such as paints and coatings. n-Butanol's effectiveness and versatility account for its substantial market presence. A significant portion was accounted for by glycol ethers, which are used in solvents and cleaning goods. The importance of n-Butanol in the chemical industry is demonstrated by its production method.

Applications for Direct Solvents demonstrate how well n-Butanol dissolves a variety of compounds, making it useful in a range of industries. Its crucial function as a solvent is shown in its dominance in this market.

n-Butanol is essential for plasticizers, which increase the flexibility of polymers. The significant market share of n-Butanol in this application highlights how crucial it is to the polymer and plastics sectors.

Production Process (Oxyhydrogenation of Propylene, Butane Oxidation, and Fermentation of Biomass)

The oxyhydrogenation of propylene is anticipated to witness significant growth in the forecast period. This production process is preferred, as evidenced by its dominant position, which highlights its importance and effectiveness in the chemical sector.

n-Butanol was also produced via butane oxidation, which was noticeable. Its place in the market demonstrates the variety of methods used to synthesize n-Butanol to meet various industrial demands.

The n-Butanol market was influenced by the sustainable production method of fermentation of biomass. This approach demonstrated its applicability and matched the industry's growing emphasis on eco-friendly substitutes.

These production methods demonstrate the versatility of n-Butanol synthesis by providing a variety of choices to satisfy different industrial needs, ranging from sustainable biomass fermentation to efficiency-focused oxyhydrogenation.

Our in-depth analysis of the global n-Butanol market includes the following segments:

|

Application |

|

|

Production Process |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

n-Butanol Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific is expected to lead the n-Butanol market with a share of 49.5% during the forecast period. The market is highly driven by the rising demand and a surge in chemical production. Population growth and rising industrialization, particularly in emerging economies, have raised the need for n-Butanol in the textile and construction sectors. Applications for n-Butanol are growing in a variety of fields, including agriculture, chemistry, and pharmaceuticals. The increasing demand for shaving products, hygiene products, and other cosmetics due to rising urbanization and disposable income has aided in the personal care industry's adoption of n-Butanol. Due to its great compatibility and solubility, n-Butanol is used as a solvent, which has increased its sales in a variety of industries.

China leads from the forefront due to its enhanced research and development capabilities and high demand in the building and construction industry. In December 2024, the Ministry of Commerce of China declared that, with immediate effect, it will maintain anti-dumping charges on n-Butanol imports from the U.S., Malaysia, and the Taiwan region of China for an additional five years. The government concluded that eliminating the anti-dumping tariffs would probably cause dumping to resume or continue, which could harm China's local n-Butanol industry.

On the other side, in India, many manufacturers and suppliers offer n-Butanol, a common industrial solvent and chemical intermediate. Although its main usage is as a solvent in paints, coatings, and varnishes, it can also be used to make polymers, medications, and other products. The government decided to keep imposing anti-dumping duties of up to USD 149 on imports of a chemical used in sugar fermentation from Malaysia, Singapore, the US, and the European Union. According to a statement from the Directorate General of Trade Remedies (DGTR), normal butanol, also known as N-Butyl Alcohol, exported from the US, Malaysia, Singapore, South Africa, and the EU, was discovered to be "below normal value, thus establishing dumping of the same." According to the DGTR, the domestic industry continues to suffer material injury as a result of dumped imports, and anti-dumping duties on subject items imported from the subject countries must be continued.

North America Market Analysis

North America is expected to lead the n-Butanol market with a remarkable share during the forecast period. The market is highly driven by the growing chemical industry and a surge in infrastructure projects. The growing population and middle-class demography increased demand for chemicals, coatings, and pharmaceutical items, all of which heavily incorporate n-Butanol into their manufacturing processes. As environmental awareness has grown, so have regulations governing emissions, waste disposal, and worker safety. As a result, the region's n-Butanol business is implementing environmentally friendly production methods, concentrating on cutting emissions, and enhancing waste disposal. These actions meet legal requirements and support international sustainability objectives. To improve the sustainability of n-Butanol production and lessen its environmental impact, manufacturers are investigating cutting-edge technology. The business is concentrating on creating cutting-edge paints and coatings that perform better and have a smaller environmental impact.

The U.S. leads from the forefront as it serves as a solvent in paints, coatings, adhesives, and various chemical syntheses. It is also used as an intermediate in the production of other chemicals, such as butyl acrylates, butyl acetates, and glycol ethers. n-Butanol is an essential component in this industry since it dissolves resins, pigments, and other additives, allowing for the creation of premium paints and coatings with remarkable adherence, durability, and finish. The coatings industry's need for n-Butanol is expected to grow significantly as the demand for high-quality coatings across a range of applications continues to rise.

In Canada, n-Butanol is primarily used in the manufacture of paints, coatings, and other chemicals. The growth is driven by increasing needs across various industries, including pharmaceuticals, food and beverage, cleaning and polishing, and agrochemicals. The government's push for sustainable and electric mobility options, rising disposable incomes, and a growing middle class are all contributing to the automobile industry's explosive growth. n-Butanol is an important component in this industry since it is used in the manufacturing of coatings for automobile parts. These coatings offer durability and visual appeal, as well as resistance to corrosion and environmental influences. Its significance in the coatings industry is being further enhanced by the growing demand for coatings containing n-Butanol as the automobile sector expands and emphasizes sustainability and lowering carbon emissions.

Key n-Butanol Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow

- Eastman Chemical Company

- INEOS AG

- SABIC

- SASOL

- Petroliam Nasional Berhad

- OQ Chemicals GmbH

- Formosa Plastics Corporation, U.S.A.

- MERCK KGAA

- Anhui Shuguang Chemical Group

- Vizag Chemical

Leading n-Butanol firms are actively engaged in research and development to innovate and introduce new products to preserve a competitive advantage. The majority of the major firms are developing new production facilities locally as well as globally to strategically increase their geographic footprint. Long-term strategies for sustainable market growth include collaborations, production, expansion, distribution agreements, investment, new businesses, mergers, and acquisitions.

Recent Developments

- In July 2024, OQ Chemicals declared that the price of n-Butanol in North America, Europe, and Asia would rise by USD 110/MT. This choice was made in response to stable demand in industries such as construction and automotive, as well as feedstock price volatility, particularly with propylene. Following operational changes following the restart of production, the price increase was implemented.

- Report ID: 7650

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

n-Butanol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.