Myopia Control Lens Market Outlook:

Myopia Control Lens Market size was over USD 1.79 billion in 2025 and is projected to reach USD 6.75 billion by 2035, witnessing around 14.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of myopia control lens is evaluated at USD 2.02 billion.

The market is a phenomenon, driven due to global increase in myopia prevalence with the correlation between lifestyle and digital screen usage. For instance, in July 2022, the National Library of Medicine unveiled that, in the pre-COVID-19 era, a varied incidence of 5 to 65% has been documented. Furthermore, the DES spectrum now includes vergence abnormalities and recent onset esotropia, and the prevalence of DES in children alone was increased to 50–60%. In addition, in march 2023, a study comprised of 1,298 (86%) of the 1,508 students, aged 8 to 14, who attempted DES questionnaire reported eye fatigue (53.3%), blurred vision (38.9%), and itchy or burning eyes (34.2%).

Moreover, advent of technologies such as defocus incorporated multiple segments (DIMS), highly aspherical lenslet target (H.A.L.T.), and double-focus optical designs were found to be clinically efficacious in inducing peripheral myopic defocus. For instance, in September 2024, children aged 4 to 16 with progressive myopia and spherical equivalent refraction ranging from -0.25 D to -8.00 D showed a noteworthy trend of myopia control using DIMS spectacle lenses. An interim analysis of the French study OPHTAMYOP demonstrated the effectiveness of DIMS lenses in a 6-year study in a Chinese-youngsters resulting in delayed progression of myopia by 52% and axial elongation by 62%.

The advances in the application of smart technology to lenses, such as ocular health monitoring, is an indicator of a shift in paradigm in the future toward myopia control. For instance, in September 2024, the new topography module for the Optovue Solix FullRange and Solix Essential OCT/OCT-A systems has been released, by Visionix USA. By combining topography with OCT and OCT-A, this feature turns the Optovue Solix systems into a multimodal solution for thorough eye assessments. The symbiotic relationship between research centers, business constituencies, and eye care practitioners serves as the basis for taking these drivers to innovative and clinically relevant myopia control solutions.

Key Myopia Control Lens (Plastic Lens) Market Insights Summary:

Regional Highlights:

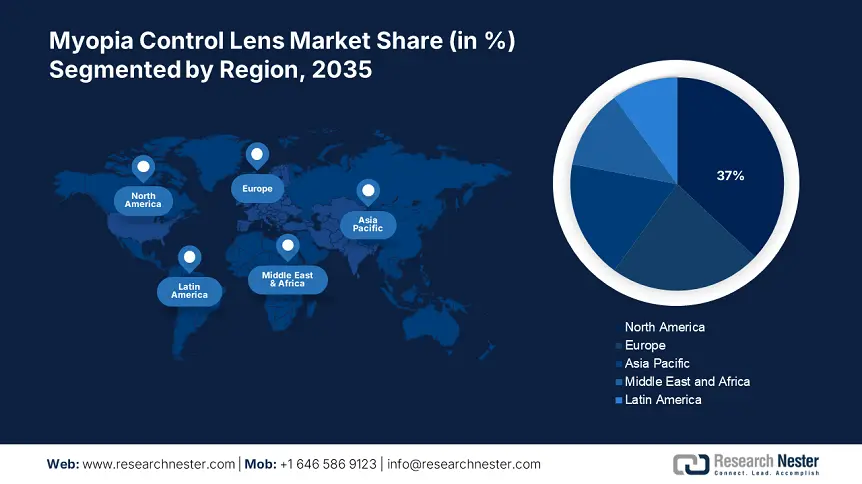

- North America dominates the Myopia Control Lens Market with a 37% share, driven by the growing need to prevent myopia progression and innovation in lens technology, ensuring robust growth through 2026–2035.

- Asia Pacific’s myopia control lens market is projected to grow rapidly by 2035, driven by proficient optometrists and the rise of online retail channels.

Segment Insights:

- Multifocal Contact Lenses segment are expected to secure more than 46.7% share by 2035, driven by their dual functionality in correcting vision and inhibiting myopia progression.

- The teenagers segment is expected to maintain a leading edge by 2035, fueled by fast myopia progression and proactive parental intervention among active teens.

Key Growth Trends:

- Rising prevalence of myopia

- Increasing awareness and early interventions

Major Challenges:

- Fitting complexity and expertise

- Supply chain and manufacturing capacity

- Key Players: CooperVision, Inc., Essilor International S.A., Bausch + Lomb, Johnson & Johnson Vision Care, Inc., and more.

Global Myopia Control Lens (Plastic Lens) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.79 billion

- 2026 Market Size: USD 2.02 billion

- Projected Market Size: USD 6.75 billion by 2035

- Growth Forecasts: 14.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Myopia Control Lens Market Growth Drivers and Challenges:

Growth Drivers

- Rising prevalence of myopia: The surging global incidence of myopia owing to the uninterrupted use of digital screens and decreased outdoor time, is a crucial force driving the market growth. For instance, in December 2021, as per the data revealed by the National Library of Medicine, by 2050, 52% (4949 million) and 10.0% (925 million) of the world's population would suffer from myopia and high myopia, respectively. Consequently, it is projected that by 2050, 52% of people worldwide will have myopia, up from 27% in 2010.

- Increasing awareness and early interventions: Increased recognition among parents and eye care providers of the potential threats from myopia is a catalyst for growth in the market. It stimulates proactive treatments with the use of advanced lenses to reduce the intensifying condition. For instance, in May 2022, the Association for Research in Vision and Ophthalmology (ARVO) held its annual meeting, with a new research title, Progression of myopia using novel myopia control (HAL) spectacle lenses. The development of myopia in 119 Vietnamese youngsters wearing HAL v/s single-vision lenses was compared in a one-year cross-over clinical experiment which became the basis for Essilor Stellest lenses, improving its invention.

Challenges

- Fitting complexity and expertise: The notable impediments to the myopia control lens (plastic lens) market are fitting difficulties and the requirement for special skills. Proper fitting is crucial to the effectiveness of these lenses in retarding myopia progression, needing exact measurements and a thorough knowledge of lens design and eye physiology. In addition, the growing number of myopia control lens designs with specific fitting needs contributes to the complexity and requires continuous professional education to deliver the best possible patient outcomes and effective integration of these innovative vision correction solutions.

- Supply chain and manufacturing capacity: Vulnerabilities in supply chains and limitations in manufacturing capacity are major challenges to the market. The technicality of these lenses, with built-in sophisticated optical designs for optimal myopia control, requires precise manufacturing and particular materials, which may potentially create production bottlenecks and extended lead times. Geopolitical tension, raw material supply chain disruptions, and rising world demand for these lenses can cause supply chain vulnerability to worsen, affecting timely delivery to practitioners and patients.

Myopia Control Lens Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.2% |

|

Base Year Market Size (2025) |

USD 1.79 billion |

|

Forecast Year Market Size (2035) |

USD 6.75 billion |

|

Regional Scope |

|

Myopia Control Lens Market Segmentation:

Lens Type (Orthokeratology (Ortho-k) Lenses, Multifocal Contact Lenses, Myopia Control Lenses)

By 2035, multifocal contact lenses segment is set to hold myopia control lens (plastic lens) market share of more than 46.7%, because of their two-in-one benefit, correcting vision and inhibiting myopia. In addition, features such as better comfort, oxygen permeability, greater add powers, and tailored peripheral curves enhance the defocus effect for greater applicability. For instance, in May 2024, in collaboration with EssilorLuxottica, Meta Connect unveiled its line of Ray-Ban Meta smart glasses. These glasses enhanced all of the original model's essential functions while incorporating brand-new features never found in a smart-glasses before. Thus, position them as a major solution against rising myopia prevalence.

Age Group (Teenagers, Adults)

In the myopia control lens (plastic lens) market, the teenagers segment has taken a leading edge fueled by the fast progression of myopia combined with heightened awareness and active parental intervention. For instance, in September 2023, the statistics by the HealthyChildren.org revealed that about 30% of teenagers, 9% of school-age children, and 5% of preschoolers are estimated to be impacted. Teenagers' active lifestyles and involvement in sports tend to prefer the convenience and safety of plastic lenses over conventional spectacles. For instance, it was revealed by the National Eye institute in December 2024 that, 9/10 sports-related eye injuries can be avoided by donning the proper protective eyewear.

Our in-depth analysis of the global market includes the following segments:

|

Lens Type |

|

|

Age Group |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Myopia Control Lens Market Regional Analysis:

North America Market Statistics

By the end of 2035, North America myopia control lens (plastic lens) market is poised to capture around 37% revenue share. The development of myopia control lenses is a response to the growing need to prevent the progression of myopia in the region. Furthermore, manufacturers use these lenses to advanced myopia management techniques while promoting eye health. Moreover, the regional players focus on innovating their state-of-the-art optical designs and materials to provide better efficacy in eye disorders.

The U.S. market has an environment characterized by manufacturers and practitioners who are investigating novel methods and technologies to create myopia control lenses that satisfy the unique needs of users. For instance, in June 2023, the FDA examined Vyluma Inc.'s new drug application for NVK002, a low-dose atropine eye drops without preservatives that treats myopia in children ages 3 to 17. This helps in rectifying the myopic visions amongst the children.

The myopia control lens (plastic lens) market in Canada is rapidly expanding owing to the extensive portfolios offered by company to cope up with the surging demand of the consumers. For instance, in October 2023, TOTAL30 Multifocal, the first and only monthly water gradient multifocal contact lens was introduced in Canada by Alcon. The lens's PRECISION PROFILE multifocal optical design enables users to see clearly and continuously at all distances, from close to distant.

Asia Pacific Market Analysis

The myopia control lens (plastic lens) market in Asia Pacific is projected to be the fastest-growing market during the stipulated timeframe. The proficiency and individualized treatment provided by optometrists in the region, helps in evaluating, recommending, and fitting myopia control lenses for patients of all ages. In addition, the distribution environment in the region has been completely transformed by the emergence of online retail channels, which allow customers to conveniently browse, buy, and receive myopia control lenses from the comfort of their homes.

At the forefront of pursuing growth in the market in India through strategic collaborations between companies. For instance, in February 2025, Maxivision Group invested USD 5 billion to expand operations in Maharashtra by purchasing Ojas Eye Hospitals in Mumbai. Through this collaboration, companies are expected to leverage their cutting-edge eye therapies such as robotic cataract surgery, 3D imaging, the flapless ELITA SILK method for vision correction and sophisticated eye treatment.

The myopia control lens (plastic lens) market in China is exponentially rising due to the company tactics of diversifying the footprints in the local market to establish and solidify their position int the ophthalmic care sector. For instance, in August 2024, Ocumension Therapeutics announced a deal with Alcon whereby Ocumension obtained the rights to market a range of Alcon's dry eye treatments and procedural drops in China, including both established and under development products. The deal also covered production, sales, and research and development (R&D) activities in China.

Key Myopia Control Lens Market Players:

- CooperVision, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Essilor International S.A.

- Bausch + Lomb

- Johnson & Johnson Vision Care, Inc.

- Euclid Systems Corporation

- Paragon Vision Sciences

The myopia control lens (plastic lens) market is quite competitive, comprising of many well-known companies vying for consumers' attention through employing strategies to expand their product lines and increase their market share. For instance, in November 2022, Alcon announced that it has successfully acquired Aerie Pharmaceuticals, Inc. With its expanding line of commercial products and development pipeline, this deal strengthened Alcon's position in the ophthalmic pharmaceutical market.

Here's the list of some key players:

Recent Developments

- In February 2024, SightGlass was granted a breakthrough designation for myopia-slowing eyeglasses by the FDA. The diffusion optics technology spectacle lenses from the company are intended to decrease the growth of childhood myopia.

- In November 2023, Shamir Optical Industry announced Shamir Optimee, a new myopia management spectacle lens, recognizing the huge and growing need for effective myopia management amongst child care.

- Report ID: 7562

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Myopia Control Lens (Plastic Lens) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.