Myoglobin Market Outlook:

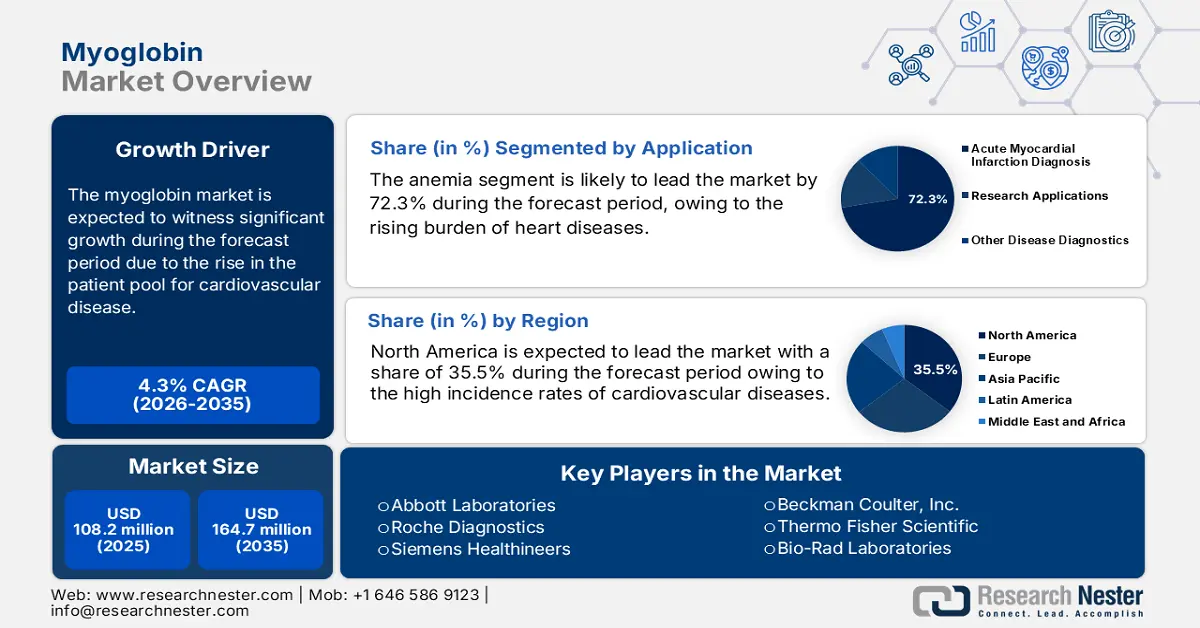

Myoglobin Market size was valued at USD 108.2 million in 2025 and is projected to reach USD 164.7 million by the end of 2035, rising at a CAGR of 4.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of myoglobin is assessed at USD 112.8 million.

The patient population driving the demand for myoglobin testing is defined by the high prevalence of cardiovascular disorders. Cardiovascular diseases account for the highest numbers of fatalities worldwide, with the World Health Organization report in 2025 estimating that they claim 17.9 million lives annually. These high numbers of patients require urgent diagnostic tools in emergency and clinical care environments, supporting demand for cardiac biomarkers. The myoglobin immunoassay supply. chain is elaborate and globalized, with international trade of specialized raw materials.

Investment in research, development, and deployment (RDD) for the sector goes mainly into improving assay performance and integration into automated laboratory systems. Cardiovascular research funding by both public and private sources underlies biomarker discovery and validation. For example, the AHA Journal in July 2025 approximated that in 2024, the AHA funded over 1800 active research awards, which covered almost USD 500 million, part of which sponsors the creation of better diagnostic methods. Deployment is strongly driven by health policy and reimbursement frameworks.

Key Myoglobin Market Insights Summary:

Regional Highlights:

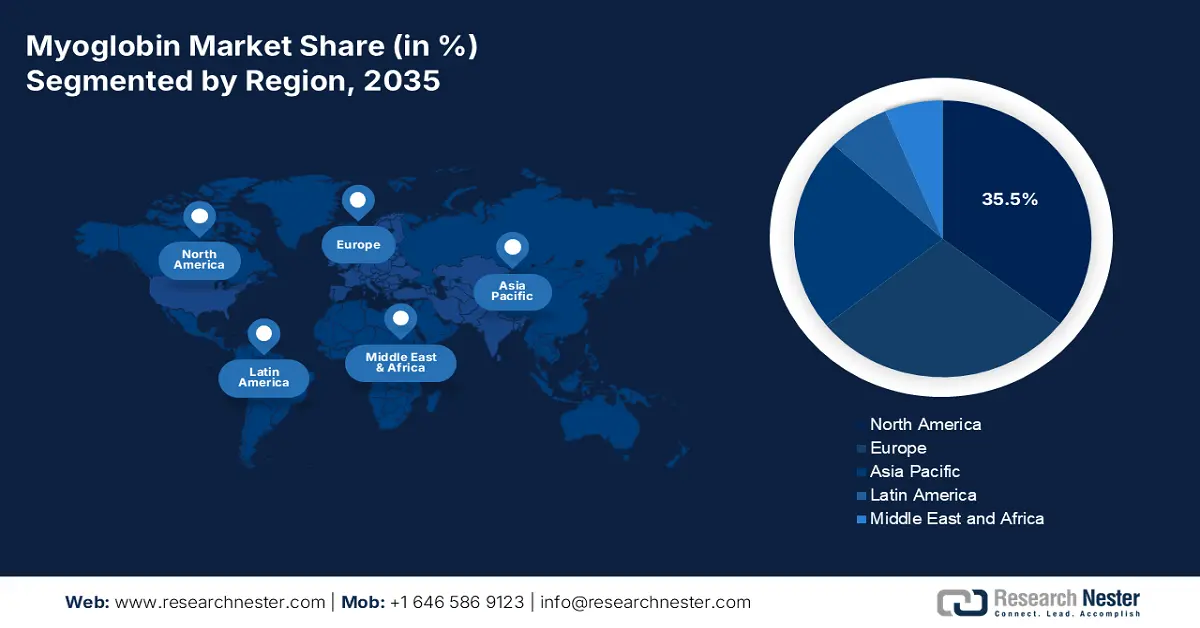

- The North America myoglobin market is anticipated to command a 35.5% share by 2035, owing to the growing prevalence of cardiovascular diseases, robust healthcare infrastructure, and the rapid adoption of advanced diagnostic technologies across clinical settings.

- The Asia Pacific market is expected to witness the fastest growth through 2026–2035, propelled by the increasing geriatric population, higher incidence of hypertension and diabetes, and expanding collaborations between global diagnostic firms and local manufacturers.

Segment Insights:

- The acute myocardial infarction diagnosis segment of the myoglobin marketis projected to account for 72.3% of the total share by 2035, propelled by the rising global incidence of cardiovascular diseases and the biomarker’s rapid release post-injury, enhancing early cardiac detection.

- The hospitals and clinics segment is anticipated to dominate the end-user landscape by 2035, fueled by the surge in emergency cardiac cases and the growing integration of rapid diagnostic testing within intensive care and emergency departments.

Key Growth Trends:

- Integration into multi marker cardiac panels

- Rise in aging global demographics

Major Challenges:

- Pricing and reimbursement pressure

- Technological transition to high-sensitivity troponin

Key Players: Abbott Laboratories (US), Roche Diagnostics (Switzerland), Siemens Healthineers (Germany), Beckman Coulter, Inc. (US), Thermo Fisher Scientific (US), Bio-Rad Laboratories (US), Merck KGaA (Germany), PerkinElmer, Inc. (US), Abcam plc (UK), Becton, Dickinson and Company (US), Agilent Technologies (US), Sysmex Corporation (Japan), Randox Laboratories (UK), Tosoh Corporation (Japan), Ortho Clinical Diagnostics (US), DiaSorin S.p.A. (Italy), Sekisui Diagnostics (US/Japan), BioVision, Inc. (US), Hytest Ltd. (Finland), LifeSpan BioSciences, Inc. (US)

Global Myoglobin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 108.2 million

- 2026 Market Size: USD 112.8 million

- Projected Market Size: USD 164.7 million by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, China, Japan, Germany

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 22 October, 2025

Myoglobin Market - Growth Drivers and Challenges

Growth Drivers

- Integration into multi marker cardiac panels: The standalone use of the myoglobin are declining and the future demand relies on the integration into multi marker cardiac panels. These panels include troponin and CK-MB provide a more diagnostic picture. For manufacturers, the strategic insight is to bundle myoglobin with other essential tests rather than marketing it individually. For manufacturers, the strategic insight is to bundle myoglobin with other essential tests rather than marketing it individually. This technique adds value for clinical laboratories looking for efficiency, consolidated testing menus and ensures myoglobin remains a significant component of the cardiac diagnostic workflow.

- Rise in aging global demographics: Aging populations across North America, Europe, and Asia show an influential demographic driver. The risk of acute coronary syndromes is higher elderly population. As per the PRB figures of January 2024, 58 million U.S. people are over the age of 65. This population growth directly expands the patient pool risks, increasing the number of patients experiencing chest pain and needing cardiac biomarker testing. This pattern assures a continued, long-term need for such diagnostic devices as myoglobin in healthcare systems that treat older populations.

- High global burden of cardiovascular diseases: The primary driver for myoglobin testing is the rising cases of cardiovascular disease, mainly in acute myocardial infarction. The WHO report in July 2025 depicts that 85% of the deaths are due to heart attack and stroke. This rising occurrence creates a consistent, underpinning demand for rapid diagnostic biomarkers in emergency setting. While high-sensitivity troponin is the gold standard, myoglobin retains utility in early rule-out protocols due to its rapid release kinetics, ensuring its place in the cardiac biomarker panel for the foreseeable future, given this significant disease burden.

Prevalence of Cardiovascular Disease in Various Regions

|

Region |

Age-Standardized Prevalence of CVD (2021) |

|

America |

7.7% |

|

Africa |

7.9% |

|

Europe |

7.8 |

|

South East Asia |

7.1 |

|

Western Pacific |

6.7 |

Source: NLM February 2025

Challenges

- Pricing and reimbursement pressure: The greatest challenges for producers of myoglobin tests is the extreme pressure on prices from government and private insurers. Reimbursement levels for diagnostic tests tend to be low and are subject to cutbacks, compressing profit margins for suppliers. It becomes difficult to recoup the costs of development and manufacturing. To survive under such fiscal constraints, big players in the diagnostic service industry have to compete with enormous scale and efficiency.

- Technological transition to high-sensitivity troponin: The cardiac event diagnostic landscape is being revolutionized by increased use of high-sensitivity troponin assays. The new tests are currently the biomarker of choice in global clinical guidelines for diagnosing myocardial infarction because of better clinical performance. As a result, firms that provide myoglobin as a single test have a declining market. To stay competitive, manufacturers are compelled to invest in research and development to create integrated test panels that combine multiple cardiac markers, including myoglobin and high-sensitivity troponin, which requires significant additional investment.

Myoglobin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 108.2 million |

|

Forecast Year Market Size (2035) |

USD 164.7 million |

|

Regional Scope |

|

Myoglobin Market Segmentation:

Application Segment Analysis

Acute myocardial infarction diagnosis leads the segment and is expected to hold the share value of 72.3% by 2035. The segment is driven by the global burden of cardiovascular diseases. As per the NLM study in September 2023, acute myocardial infarction is the top cause of death, with 1 million deaths occurring in the U.S. The advantage of Myoglobin is its rapid release into the bloodstream post-injury, making it a valuable early marker, mainly in the multi-marker cardiac panels.

End user Segment Analysis

Hospitals and clinics are dominating the end user segment as they are the initial point of contact for patients presenting with acute cardiac conditions such as AMI. The demand for 24/7 presence of fast diagnostic testing in emergency rooms and intensive care units compels this segment's leadership. The February 2024 NLM study illustrates that 11 million visits annually are for chest pain, which requires instant biomarker testing. This high patient volume, coupled with the trend toward consolidated cardiac care pathways within hospital systems, ensures consistent demand for myoglobin testing in this setting.

Test Type Segment Analysis

Immunoassays lead the segment due to their high specificity, suitability and sensitivity for automation in high throughput clinical laboratories. Their integration in the centralized laboratory system makes way for rapid and quantitative myoglobin measurement that is critical for emergency cardiac care. Standardized immunoassays for cardiac biomarkers are crucial as they provide precise and similar results in various medical institutions, highlighting their status as the clinical gold standard.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Test Type |

|

|

Application |

|

|

End user |

|

|

Product |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Myoglobin Market - Regional Analysis

North America Market Insights

North America is leading the myoglobin market and will continue to capture the market share of 35.5% by 2035. The region is governed by high incidence rates of cardiovascular diseases, well-established healthcare facilities, and early adoption of diagnostic technologies. According to the NLM survey in February 2025, cardiovascular disease incidence in the area was 781 per 100,000 men versus 568 per 100,000 women in 2021. This increasing case is one of the major trends in incorporating myoglobin testing in overall cardiac panels in point-of-care settings to accelerate diagnosis.

The U.S. market is dominating the region and holds the highest share by 2035. The nation is driven by the high burden of cardiovascular disease and advanced diagnostic protocols. According to the CDC report in June 2024, 696,000 people in the U.S. died due to heart disease, which is the leading cause of death and creating a sustained demand for cardiac biomarkers. The American Heart Association emphasizes the critical importance of early detection, with myoglobin serving as an early indicator of myocardial infarction.

The Canada myoglobin market is defined by the universal healthcare system that standardizes the cardiac treatment protocols and ensures consistent uptake of biomarker testing. The country is fueled by the increased aging population and rising prevalence of cardiovascular risk factors. According to the report by Heart & Stroke in February 2025, the cost of heart disease and stroke exceeds USD 21.2 billion and USD 3.6 billion annually, highlighting the economic urgency for effective diagnostics. The rising heart diseases prioritize troponin to recognize the role of multi-marker strategies in specific clinical scenarios, which has led to the integration of myoglobin in the diagnostic centers.

Prevalence of Cardiovascular Disease

|

Metric |

U.S. |

Canada |

|

Cardiovascular Disease Deaths |

919,032 people died, ~1 in 3 deaths |

1 in 12 people |

|

Heart Attack Incidence |

About 805,000 people per year |

9 in 10 people |

Source: CDC October 2024, Heart and Stroke 2025, Government of Canada July 2022

APAC Market Insights

The Asia Pacific is the fastest growing region in the myoglobin market and is driven by the rising burden of cardiovascular disease and significant healthcare infrastructure improvements. The major drivers of the region include rising geriatric populations and increased hypertension and diabetes rates. As per the American College of Cardiology data in June 2021, the number of deaths due to cardiovascular disease is 10.8 million in Asia. Further, the strategic partnerships between international diagnostic giants and local manufacturers are expanding market access and affordability.

Japan's market is developed, with a high level of diagnostic infrastructure and care. The demand is led by the elderly population, with more than 36.23 million over the age of 65, according to World Economic Forum statistics in September 2023. Public expenditure via the universal health insurance system provides broad access to cardiac biomarker testing. A key initiative is the promotion of efficient diagnostic pathways to manage rising healthcare costs for age-related diseases, solidifying consistent market demand for established tests like myoglobin.

China dominates the myoglobin market in the region and is fueled by the massive healthcare investment by the government and the rising cardiovascular disease burden. The Healthy China 2030 program focuses on increasing life expectancy and enhancing the medical services, directly boosting the diagnostics market. According to the NLM study in June 2023, there are an estimated 330 million patients with cardiovascular disease. This rising case creates an immense market demand. Further, the market size is expanding due to the advancements in hospital capabilities. The government spending is aimed at early screening and prevention, which directly increases the cardiac biomarker tests.

Europe Market Insights

Europe is the second largest market and is driven by the advaced healthcare systems and strong regulatory frameworks. The growth of the market is primarily driven by the rising heart diseases and adoption of standardized clinincal guidelines for early diagnosis of acute myocardial infarction. Further, CVD cases in the region creates a consistent demand for cardiac biomarkers. A key trend is the integration of myoglobin into multi-marker cardiac panels alongside troponin and CK-MB, despite the rising dominance of high-sensitivity troponin testing.

The UK myoglobin market ranks third in Europe by size, with a robust public healthcare sector fueling standardized diagnostic practices. Demand is supported by a high and increasing burden of cardiovascular disease. The British Heart Foundation report in August 2025 illustrates that approximately 7.6 million individuals in the UK have heart or circulatory diseases, which makes them continually require cardiac biomarkers. In addition, use of myoglobin is integrated in pathology and emergency care services specifically for rapid chest pain assessment under National Institute for Health and Care Excellence guidance.

Germany is leading the market in Europe and is driven by its advanced healthcare infrastructure and high healthcare expenditure. The German Federal Statistical Office states that the circulatory disease is the leading cause of death in the country, accounting significant portion of hospitalizations. This high disease prevalence demands the market. The market is guided by robust standards set by the Federal Joint Committee (G-BA), which influences diagnostic reimbursement and protocols. Further, the high penetration of automated immunoassay systems in hospital laboratories, facilitates the efficient use of myoglobin within multi-marker cardiac panels for fast and accurate diagnosis.

Key Myoglobin Market Players:

- Abbott Laboratories (US)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roche Diagnostics (Switzerland)

- Siemens Healthineers (Germany)

- Beckman Coulter, Inc. (US)

- Thermo Fisher Scientific (US)

- Bio-Rad Laboratories (US)

- Merck KGaA (Germany)

- PerkinElmer, Inc. (US)

- Abcam plc (UK)

- Becton, Dickinson and Company (US)

- Agilent Technologies (US)

- Sysmex Corporation (Japan)

- Randox Laboratories (UK)

- Tosoh Corporation (Japan)

- Ortho Clinical Diagnostics (US)

- DiaSorin S.p.A. (Italy)

- Sekisui Diagnostics (US/Japan)

- BioVision, Inc. (US)

- Hytest Ltd. (Finland)

- LifeSpan BioSciences, Inc. (US)

- Abbott Laboratories is a dominant force in the market, with a significant focus on cardiac biomarkers. The company has made USD 42 billion in worldwide sales in 2024, highlighting the demand of the products. The company fuses myoglobin testing into high-throughput ARCHITECT and Alinity CI systems, offering quick results for the early assessment of acute myocardial infarction. Its strategic advancements lie in the development Point-of-Care and multi-marker panels testing platform, such as the i-STAT system.

- Roche Diagnostics leverages its extensive diagnostics portfolio to maintain a leading position in the cardiac biomarker segment, including the myoglobin market. Its immunoassay system, such as cobas and Elecsys, provides precise and quantitative myoglobin measurements that are used in ruling out early-stage heart attacks. The company mainly focuses on high-efficiency automation with the development of combined cardiac protocols, which include myoglobin.

- Siemens Healthineers is one of the leading diagnostic solutions providing robust myoglobin assays on its ADVIA Centaur and Atellica IM analyzers. The platform is developed for delivering reliable cardiac marker results to aid in the early detection of acute coronary syndromes. The company's primary advancement is its commitment to digitalization and workflow integration.

- Beckman Coulter specializes in diagnostic automation and has a strong offering in the cardiac marker space, which includes myoglobin testing on its UniCel DxC and Access immunoassay systems. The company is centered on advancing the clinical utility via assay standardization and reliability. A notable advancement is the aim of developing a streamlined reflex testing protocol. This enables laboratories to proceed automatically from a myoglobin test to more specific cardiac troponin assays based on predefined rules.

- Thermo Fisher Scientific aids the myoglobin market primarily via its leading position in offering high-quality immunoassay reagents, antibodies, and clinical diagnostics components to the research institutions and other manufacturers. The company’s revenue in 2024 was USD 42.88 billion. It aims to supply the critical raw materials that are required for the development of sensitive and accurate myoglobin tests.

Here is a list of key players operating in the global market:

The market is driven by the major diagnostics corporations. The competitive landscape is defined by intense R&D focused on enhancing assay sensitivity and specificity for early cardiac injury detection. The market players are making strategic partnerships and acquisitions to broaden their geographic footprint and technological capabilities in other regions. Aligning with this, Ergo Bioscience partnered with Aethera Biotech in February 2023 to increase the production of animal-free myoglobin and casein. This partnership focuses on improving biotech production processes.

Corporate Landscape of the Myoglobin Market:

Recent Developments

- In June 2025, SERO announced the launch of Seronorm Cardiac Acute Lyo, which is a new lyophilized quality control material mainly designed to aid laboratories in acute cardiac diagnostics. It covers critical acute cardiac markers, such as Troponin I, Troponin T, CK-MB, and Myoglobin.

- In March 2025, V-Label GmbH announced the launch of F-Label certification, focusing on precision fermentation and animal-free production, which aligns closely with advancements in the market.

- In October 2024, Revo Foods and Paleo announced its partnership, backed by €2.2m in EU funding, to develop plant-based high-quality salmon alternatives containing precision-fermented myoglobin.

- Report ID: 4269

- Published Date: Oct 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Myoglobin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.