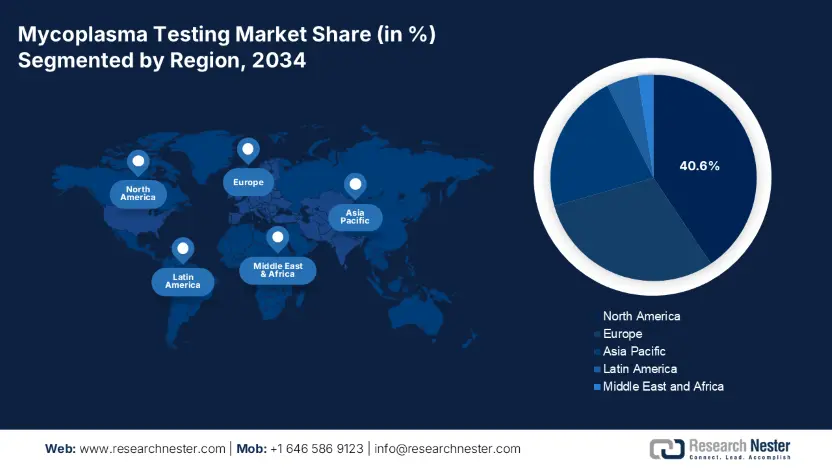

Mycoplasma Testing Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 40.6% in the mycoplasma testing market during the analyzed timeline. The region is strongly backed by its stringent regulatory framework and substantial biotech R&D investments in this sector. Besides, the enlarging patient pool is also a propeller of biopharma production, which ultimately benefits the landscape. As evidence, in 2024, the NIH revealed that North America consists of approximately an annual 500.4 thousand patient population, who rely on cell and gene therapies that require mandatory mycoplasma screening. Furthermore, due to being the global epicenter of automated detection system manufacturing, the region is highly focused on bringing innovation in this field through advanced robotics and AI-driven quality control.

The U.S. leads the regional mycoplasma testing market, which is pledged to stringent FDA policies (21 CFR 610.30) mandating biologics testing. With a $5.4 billion fund allocated to support compliance efforts, the country secured a stable cash inflow in this category, according to the 2023 CDC report. Besides, from 2020 to 2024, Medicare increased spending on these solutions by 15.3%, totaling $800.7 million, to provide financial backing for qPCR assessments for older residents, as unveiled by the Centers for Medicare & Medicaid Services (CMS). Following the same, in 2024, Medicaid also dedicated $1.5 billion to enable access to an additional 10.8% of patients.

Canada is also poised to augment robust growth in the market on account of provincial government allocations. For instance, in 2023, Health Canada allocated $3.5 billion to support nationwide diagnostic initiatives, as per the Canadian Institute for Health Information (CIHI). Besides, from 2021 to 2024, the governing body of Ontario is also boosting adoption in this sector by reaching 200.4 thousand patients with expanded testing access. Furthermore, in 2024, the Public Health Agency of Canada (PHAC) enacted new mandates regarding rigorous screening for cell therapies, which accelerated demand in this category, as reported by the PHAC.

APAC Market Insights

Asia Pacific is poised to become the fastest-growing region in the mycoplasma testing market by the end of 2034, while exhibiting an 11.8% CAGR. The booming biopharmaceutical industry, stringent regulatory mandates, and increasing infectious disease burdens are collectively establishing a sustainable consumer base for this sector. As evidence, the PMDA enacted strict GMP compliance across Japan, with the allocation of 12.6% of its healthcare budget to mycoplasma testing. Besides, the Ministry of Food and Drug Safety (MFDS) of South Korea also supports this cohort by fast-tracking approvals. Moreover, the National Pharmaceutical Regulatory Agency (NPRA) invested $200.6 million in laboratory upgrades, boosting cash inflow in this sector.

China dominates the Asia Pacific mycoplasma testing market with an estimated 45.4% revenue share by 2034. The country's augmentation in this field is primarily stimulated by the stringent biologics and vaccine testing mandates from the National Medical Products Administration (NMPA). Additionally, the government of China allocated $5.5 billion in funding for this category. The country's global significance is further established by its dominance over supplies, accounting for approximately 28.7% of global mycoplasma testing raw materials.

India is emerging as the growth engine of the APAC mycoplasma testing market with a 15.6% CAGR. Its accelerated propagation in this sector is supported by robust local vaccine production and the strict testing guidelines from the Central Drugs Standard Control Organisation (CDSCO). With a potential to acquire 18.6% regional revenue share by 2034, the country’s expanding biopharmaceutical sector and active pharmaceutical ingredient (API) manufacturing further drive demand in this sector. Moreover, evidencing the presence of a large patient pool, in 2023 alone, 2.7 million eligible patients were treated by mycoplasma-tested medicine.

Government Investments & Policies (2024-2025)

|

Country |

Government Initiative / Policy |

Budget/Funding (Million) |

Key Impact |

|

Australia |

National Health Priority (Diagnostics Expansion) |

$40.5 (projected) |

Aimed at doubling testing capacity for biopharma |

|

South Korea |

Ministry of SMEs Start-up Grants |

$18.8 |

Boosted 10 local mycoplasma testing startups |

|

Malaysia |

MOH National Lab Modernization Initiative |

$20.3 (allocated) |

Upgrading 5 regional labs with automated test systems |

Source: TGA, MFDS, and NPRA

Europe Market Insights

The Europe mycoplasma testing market is expected to grow at an 8.1% CAGR under the influence of the strict GMP compliance and increasing biopharmaceutical R&D investments. France leads the landscape with a €2.1 billion budget allocation in 2023 and National Authority for Health (HAS) reimbursement policies. On the other hand, in 2024, the Health Data Space invested €2.8 billion to standardize testing protocols. Moreover, such regulatory and financial support reinforce the region’s position as the second-largest shareholder in the global market.

Germany is poised to maintain dominance over the Europe mycoplasma testing market with a predicted 30.8% share by 2034. The country's position is consolidated by €4.6 billion in federal funding for biopharmaceutical testing, as unveiled by the Federal Ministry of Health (BMG). Besides, more than 503 laboratories operating across the nation now use EMA-compliant PCR kits, which have already reduced false negatives by 20.8%. Further, to support self-sufficiency, Thermo Fisher set its aim to produce 50.5 million tests every year till 2026 with its Leipzig plant, helping the company attain 15.4% market share in Europe.

The UK is expected to command a 25.4% regional share in the Europe market till the end of 2034. The country is highly supported by government financial backing and the emergence of contractual pharma operations. As evidence of the stable capital influx, in 2023, the National Health Service (NHS) invested £2.9 billion in diagnostics. The country is further pledged to a 30.6% surge in CRO outsourcing, as per the Association of the British Pharmaceutical Industry (ABPI). Moreover, in 2024, the Medicines and Healthcare products Regulatory Agency (MHRA) fast-tracked clearances for more than 12 tests, indicating the country's significance as both a source of regulatory support and an innovation hub.

Country-wise Government Provinces (2024-2025)

|

Country |

Government Initiative / Policy |

Budget/Funding (Million) |

Key Impact |

|

Spain |

National Biopharma Strategy |

€40.3 (allocated) |

Includes mycoplasma testing mandates for cell therapies |

|

Italy |

Ministry of Health GMP Enforcement Program |

€20.7 |

Strengthened QC requirements for biologics manufacturers |

|

Russia |

Eurasian Economic Union (EAEU) Standardization |

~$27.5 |

Harmonized testing protocols with CIS countries |

Source: AEMPS, AIFA, and Minzdrav.gov