Muscle Relaxant Drugs Market Outlook:

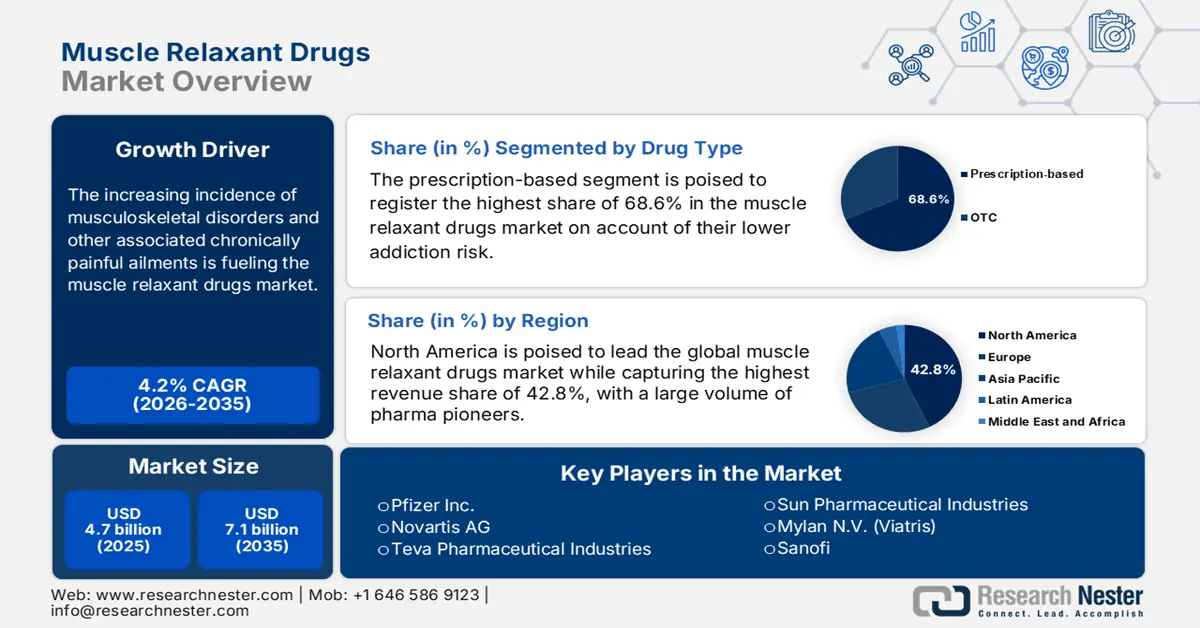

Muscle Relaxant Drugs Market size was over USD 4.7 billion in 2025 and is estimated to reach USD 7.1 billion by the end of 2035, expanding at a CAGR of 4.2% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of muscle relaxant drugs is estimated at USD 4.9 billion.

The market served more than 1.71 billion people suffering from musculoskeletal disorders across the globe, according to the World Health Organization (WHO) in July 2022. The increasing incidences of chronic pain conditions and rising aging populations around the globe are holding a stable consumer base for this sector. Furthermore, the sector's expansion is displayed via the increasing volume of global trade in muscle relaxants. In the same year, the U.S. and Germany were identified as the top importers of muscle relaxant drugs, respectively, as per the International Trade Commission (ITC).

In spite of the huge patient population, the muscle relaxant medication market continues to undergo limited uptake because of the continuing cost escalation in the supply chain. Specific NIH centers applicable to neuromuscular research garnered significant appropriations, e.g., the National Center for Advancing Translational Sciences (NCATS), USD 928 million, in favor of translational research involving neuromuscular diseases, based on MDA report in June 2024. On a trade basis, the U.S. is a net importer of muscle relaxant APIs and finished products, and major trading partners are India and European Union member states.

Key Muscle Relaxant Drugs Market Insights Summary:

Regional Highlights:

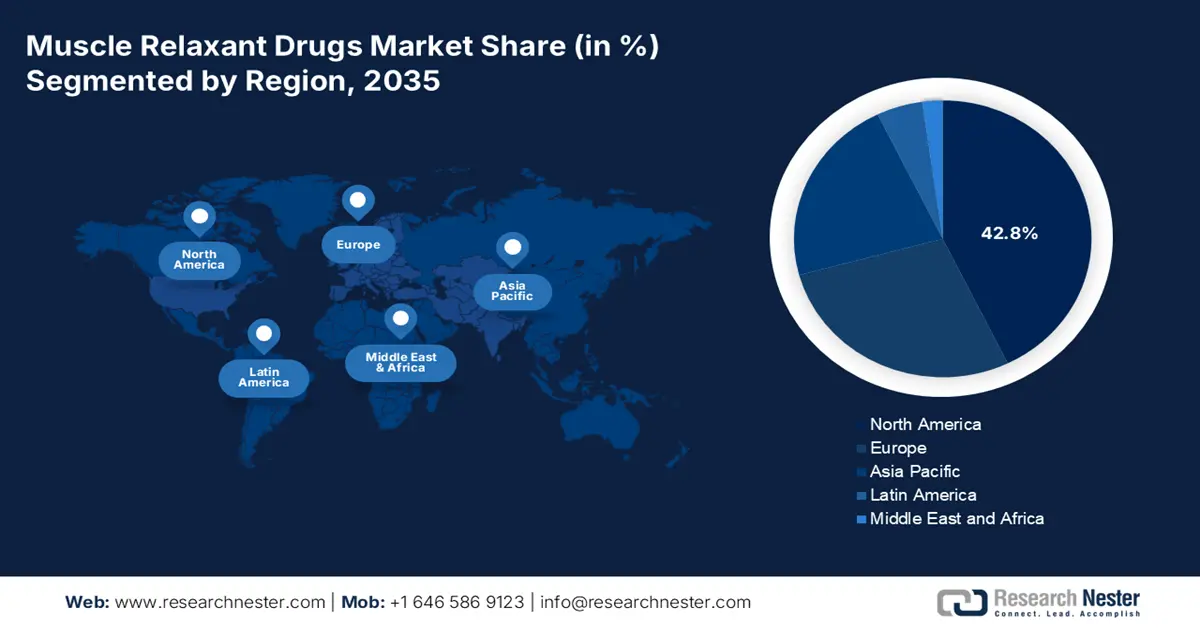

- North America is expected to hold the highest revenue share of 42.8% in the muscle relaxant drugs market during the analyzed tenure, driven by high prevalence of arthritis and spinal injuries, adequate reimbursement coverage, and concentrated finished drug production.

- Asia-Pacific is projected to be the fastest-growing region by 2035, fueled by rapidly aging populations, expanding healthcare access, rising R&D investment, and development of healthcare infrastructure.

Segment Insights:

- In the prescription-based segment, muscle relaxants are forecast to secure the highest share of 68.6% during the assessed period, reinforced by lower addiction risk and growing physician preference for non-benzodiazepine options.

- Within the application segment, hospital pharmacies are set to lead revenue generation, propelled by high-volume utilization, government subsidies, and reimbursement coverage for in-hospital prescriptions.

Key Growth Trends:

- Government healthcare expenditure and reimbursement policies

- Rising elderly populations and prevalence of chronic conditions

Major Challenges:

- Risks of losing brand values and reputation

- Robust regulatory approvals

Key Players: Novartis AG, Teva Pharmaceutical Industries, Sun Pharmaceutical Industries, Mylan N.V. (Viatris), Sanofi, Hikma Pharmaceuticals, Dr. Reddy’s Laboratories, Glenmark Pharmaceuticals, Lupin Limited, Aspen Pharmacare, STADA Arzneimittel, Cipla, Merck KGaA, Orion Corporation, Hanmi Pharmaceutical, Pharmaniaga Berhad, Eisai Co., Ltd., Takeda Pharmaceutical, Daiichi Sankyo, Otsuka Pharmaceutical, Mitsubishi Tanabe Pharma.

Global Muscle Relaxant Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest region: North America (42.8% share by 2035)

- Fastest growing region: Asia-Pacific

- Dominating countries: United States, Germany, France, United Kingdom, Japan

- Emerging countries: China, India, South Korea, Brazil, Australia

Last updated on : 25 September, 2025

Muscle Relaxant Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Government healthcare expenditure and reimbursement policies: Government spending is a key driver of market access. In the USA, prescription drug expenditure, including muscle relaxants, through Medicare Part D accounts for a substantial share of the market. Reimbursement rates and formulary positions have a direct impact on prescribing and product availability. For example, a change in the status of a drug on the Medicare formulary can instantly affect its market share, making engagement with public payers a essential strategy for manufacturers to ensure their products are covered and accessible to a large patient base.

- Rising elderly populations and prevalence of chronic conditions: The key driver of this market is growing geriatric population, as this group of the population is directly associated with musculoskeletal disorders and chronic pain. Lower back pain and spasticity caused by cerebrovascular accidents and other age-related conditions increase the addressable patient population. According to the WHO report of June 2023, the worldwide prevalence of lower back pain is 619 million, and it contributes significantly to the need for pharmacological management and drives volume-based prescribing trends in Europe and North America. This demographic trend provides a persistent and increasing pool of prospective patients.

- Gaps in distribution and accessibility: The unmet needs of patients from underserved regions highlight the demand for new opportunities in the market. As per the NLM report in February 2024, medication adherence states that adherence to long-term therapies, including those for chronic conditions is approximately 50%, demonstrating generally low compliance levels worldwide. On the other hand, the rural areas of India highlight critical distribution gaps, with patients receiving prescribed muscle relaxants, according to the WHO. Moreover, these unaddressed demographics contain the potential to create a sustainable consumer base for value-based medicines in this sector.

Prevalence of work-related musculoskeletal disorders (WMSDs) among workers

|

Condition |

Prevalence (%) |

|

WMSDs (Work-related Musculoskeletal Disorders) |

28.6 |

|

Neck |

15.0 |

|

Low back |

12.5 |

|

Shoulders |

11.2 |

|

Upper back |

7.1 |

|

Wrist |

6.3 |

|

Knee |

4.5 |

|

Leg |

4.1 |

|

Ankle |

3.9 |

|

Elbow |

2.8 |

Source: NLM, October 2023

Challenges

- Risks of losing brand values and reputation: The market often encounters issues regarding quality control, specifically in countries with limited resources. This can be testified by the WHO estimation, identifying associated products in Africa and Southeast Asia to be substandard. This occurrence of non-compliant counterfeit not only compromises patient safety but also undermines treatment efficacy and trust in pharmaceutical distributors. It also emphasizes how urgently these marketplaces require strong regulatory enactment and quality assurance measures.

- Robust regulatory approvals: Navigating the complex and lengthy regulatory pathways of agencies like the FDA and EMA is a primary hurdle. Extensive clinical trials providing evidence of both efficacy and acceptable safety profile, especially related to sedation and abuse liability, require a substantial investment of time and money. For instance, Japan's new drug regulations in 2022 that prioritize real-world evidence and post-market surveillance has slowed down product approvals, lengthening the time to market and raising development costs for new competitors.

Muscle Relaxant Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2024) |

USD 4.7 billion |

|

Forecast Year Market Size (2034) |

USD 7.1 billion |

|

Regional Scope |

|

Muscle Relaxant Drugs Market Segmentation:

Drug Type Segment Analysis

The prescription-based segment is poised to register the highest share of 68.6% in the market over the assessed period. These medications, specifically non-benzodiazepine, are gaining prominence in this sector on account of their lower addiction risk. As per the NLM report in June 2025, non-benzodiazepine muscle relaxants (MR) for acute low back pain (LBP) showed increased pain relief (Risk Ratio: 0.53, p<0.0001). As more clinical studies confirm their reduced sedation ability compared to benzodiazepines, a greater number of physicians are considering and suggesting muscle relaxants as a gold standard and safer long-term option for chronic pain management.

Distribution Channel Segment Analysis

The hospital pharmacies segment is poised to be positioned as the leading source of revenue generation from the field of application in the market throughout the discussed timeframe. Testifying to the same, the Centers for Disease Control and Prevention (CDC) revealed that around 50.7% of candidates undergoing interventional treatments require muscle relaxants during their recovery. This reflects the high-volume utilization of muscle relaxants in hospitals. Besides, the presence of government subsidies attracts both consumers and manufacturers to prioritize this segment. Testifying to the same, the Centers for Medicare & Medicaid Services (CMS) started providing reimbursement for 80.4% of in-hospital prescriptions.

Route of Administration Segment Analysis

Oral formulations are estimated to show dominance in the market by the end of 2035. The convenience and patient preference are the major factors behind the leadership. Widespread clinical acceptance of tablets and capsules for treating both acute and chronic conditions is also influencing pharma giants to invest more in this form of medication. As per the NLM report in August 2022, oral drugs such as cyclobenzaprine and baclofen account for the majority of skeletal muscle relaxant prescriptions; cyclobenzaprine accounts for 50% of muscle relaxant prescriptions Moreover, the oral drug delivery system remains the gold standard for outpatient treatment, which offers the option for cost-effective dosing without requiring medical supervision. These are cumulatively fostering a greater volume of users for this category.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Drug Type |

|

|

Application |

|

|

Distribution Channel |

|

|

Route of Administration |

|

|

Patient Demographics |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Muscle Relaxant Drugs Market - Regional Analysis

North America Market Insights

North America is dominating the global market and is expected to hold the highest revenue share of 42.8% during the analyzed tenure. As per the CDC report in February 2024, the prevalence of diagnosed arthritis in adults aged 18 and older was 18.9%, with women being 21.5% more likely to have arthritis compared to men, 16.1%. This demography was primarily attributed to the arthritis occurrence rate and a large volume of spinal injury cases, according to a CDC report. The region's dominance is also solidified by adequate reimbursement coverage and globally concentrated finished drug production.

The U.S. commands a strong dominance over the regional market on account of being the origin of revenue generation in North America. The rising population is the factor driving the demand for muscle relaxant medications. In the U.S., as per the PRB report in January 2024, 58 million people are aged above 65. Further, this population mostly suffers from various diseases, including strained muscles, back pain, and spasms, mainly those caused by spine injuries.

The Canada market is poised to hold a notable share in the region by 2035. The country's contribution to this merchandise is sourced from its universal healthcare coverage. Ontario's recent 2025 budget documents and Health Canada reports emphasize broad investments in healthcare, primary care, and hospital services, with total healthcare spending running into billions, such as USD 1.1 billion for hospitals in 2025–26 and multi-billion dollar allocations over the coming decade for infrastructure and services. This highlights the growing consumer base and need for supplier cultivation in Canada for this sector.

Age-Wise Percentage of People with Arthritis

|

Age |

Percentage |

|

18-34 |

3.6 |

|

35-49 |

11.5 |

|

50-64 |

29 |

|

65-74 |

44.0 |

|

75 and above |

53.9 |

Source: CDC, February 2024

APAC Market Insights

Asia Pacific is expected to become the fastest-growing region in the global muscle relaxant drugs market by the end of 2035. The rapidly aging populations and expanding healthcare access are the growth engines behind the region's accelerated propagation in this sector. Further, the rising R&D investment by governments and rapid healthcare infrastructure development are boosting the market. For example, in November 2022, Eisai announced its agreement to divest its rights for muscle relaxant Myonal to a subsidiary of DKSH Holding Ltd. in Asia. On the other hand, the rising prevalence of musculoskeletal disorders and surgical procedures in developing countries is further boosting the market.

China is the leading regional player in the pharmaceutical industry. The total pharmaceutical spending during 2022 amounted to 8,532.749 billion yuan, representing nearly 7.05% of overall health expenditures, with increasing emphasis on cost-saving outpatient and retail medications, according to the NLM article of September 2024. The nation's massive population is fueling consistent demand for medicine products, including non-opioid muscle relaxant medications. In 2023, NMPA continued strengthening oversight, with chemical pharmaceuticals classified as generics and successive approvals for new products, although the number of new generics varies in reports.

India is emerging as the epicenter of localized manufacturing and a large consumer base in the APAC muscle relaxant drugs market. Rheumatoid arthritis is driving the market based on the genetic and epigenetic factors. As per the NLM report in February 2025, the average annual medical expenditure for treating rheumatoid arthritis was 44,700 rupees (USD543). Moreover, the landscape is thriving on local API production, which has already reduced costs and is supporting the efforts to maintain affordability for mass populations.

Europe Market Insights

The Europe-based muscle relaxant drugs market is anticipated to augment the second-largest revenue share during the timeline between 2026 and 2035. The aging demographics and rise in neurological disorder incidences are setting a viable and sustainable demand for this sector. France holds the highest revenue share in this landscape by prioritizing cost-effective generics of health budget allocation, as reported by the National Authority for Health (HAS). The European Medicines Agency (EMA) also supported the region's consistent expansion by releasing fast-tracked clearances for non-opioid medicines.

Germany leads the Europe muscle relaxant drugs market with a considerable revenue share in the forecast period. The major factor driving this growth is the high prevalence of musculoskeletal disorders across age groups. As per the Frontiers report in 2025, 49% of people aged under 35 years to 68% of those over 50 years are experiencing musculoskeletal disorders. This growing disease burden, with robust healthcare infrastructure makes Germany hold the leading position in the market. Furthermore, ongoing clinical advancements and supportive reimbursement policies are expected to reinforce Germany’s dominance in the European market.

The UK holds the largest regional share in the Europe muscle relaxant drugs market. The country's significance in this sector is backed by adequate financial backing and ongoing innovations in formulations. For instance, the National Health Service (NHS) expanded its reimbursement coverage to prescriptions. In addition, in 2024, the National Institute for Health and Care Excellence (NICE) issued guidelines extending access to tizanidine ER, increasing the annual demand. In the same year, non-opioid use also rose from 2022, as per the Association of the British Pharmaceutical Industry (ABPI), the industry invested more in the development of novel relaxants.

Key Muscle Relaxant Drugs Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Teva Pharmaceutical Industries

- Sun Pharmaceutical Industries

- Mylan N.V. (Viatris)

- Sanofi

- Hikma Pharmaceuticals

- Dr. Reddy’s Laboratories

- Glenmark Pharmaceuticals

- Lupin Limited

- Aspen Pharmacare

- STADA Arzneimittel

- Cipla

- Merck KGaA

- Orion Corporation

- Hanmi Pharmaceutical

- Pharmaniaga Berhad

- Eisai Co., Ltd.

- Takeda Pharmaceutical

- Daiichi Sankyo

- Otsuka Pharmaceutical

- Mitsubishi Tanabe Pharma

The global commercial dynamics of the muscle relaxant drugs market are intensely consolidated, where Pfizer, Novartis, and Teva collectively control the larger revenue share. Such leaders maintain their proprietorship by focusing on non-opioid R&D and strategic expansion. On the other hand, generics developers in India, including Sun Pharma and Dr. Reddy’s, supply based on the emerging market needs, according to a WHO study. Moreover, their strategic operations consist of partnership formation and the acquisition of dedicated producers to leverage their own manufacturing capacity.

The cohort of such key players include:

Recent Developments

- In July 2024, Healio Rheumatology announced the FDA grant of fast-track designation to a sublingual tablet form of the muscle relaxant cyclobenzaprine hydrochloride for the management of fibromyalgia, according to a press release from the manufacturer.

- In January 2024, Unichem Laboratories Ltd. received marketing authorization approval for Ibuprofen, a paracetamol film-coated tablet, which is used as a muscle relaxant in the UK.

- Report ID: 486

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Muscle Relaxant Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.