Multiple System Atrophy Market Outlook:

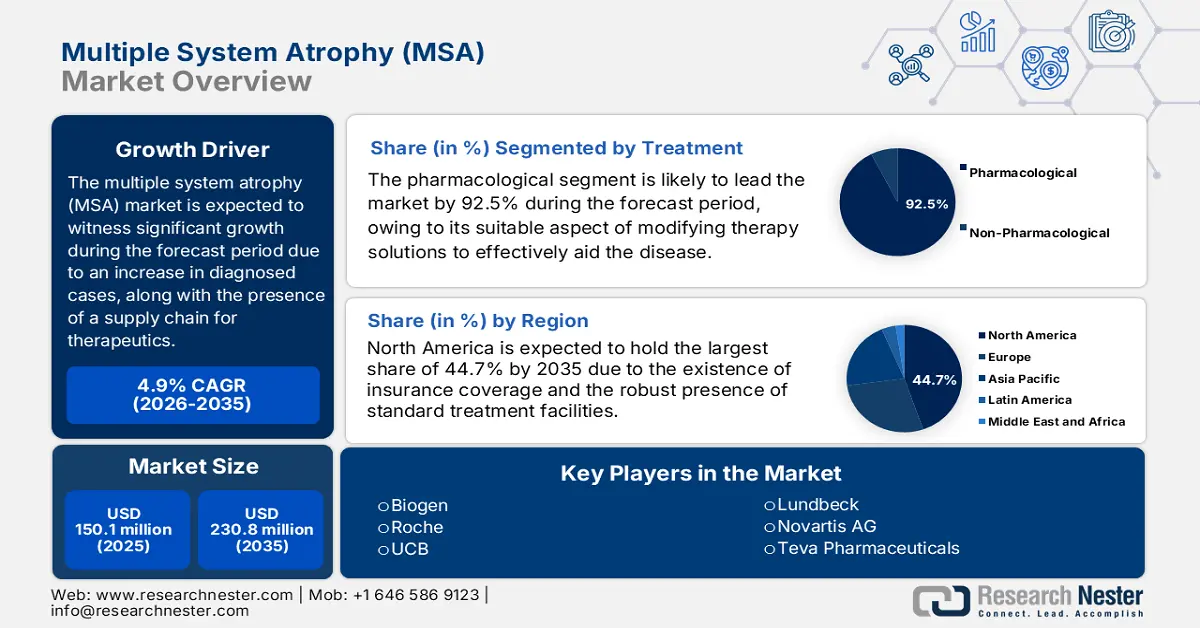

Multiple System Atrophy Market size was USD 150.1 million in 2025 and is anticipated to reach USD 230.8 million by the end of 2035, increasing at a CAGR of 4.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of multiple system atrophy is assessed at USD 157.4 million.

The rise in the international patient pool is the ultimate growth driver for the market. According to an article published by NLM in December 2023, the crude prevalence of MSA was 7.2 per 100,000, while there has been an increase in the U.S. to 41,122 people, from 12.4 per 100,000 population. Besides, for people with more than 2 MSA claims, the age-related and crude incidence have been 5.7 and 3.1 per 100,000 persons. On the other hand, the cumulative prevalence of MSA for patients over 30 years or older is 9.8 per 100,000 persons, which is deliberately uplifting the market’s demand globally.

Moreover, the aspect of the supply chain for MSA-based therapeutics comprising an inadequate number of active pharmaceutical ingredient (API) manufacturers, particularly in North America, is yet another factor for the multiple system atrophy market internationally. For instance, as per the April 2025 NLM article, API manufacturing for the market in Europe is effectively located in Asia, accounting for 56% of the supply, which is followed by 24% from West Europe and 12% from North America, and 8% from other nations. Besides, the existence of generic drugs, including fludrocortisone and levodopa, readily dominates the treatment procedure.

Key Multiple System Atrophy Market Insights Summary:

Regional Insights:

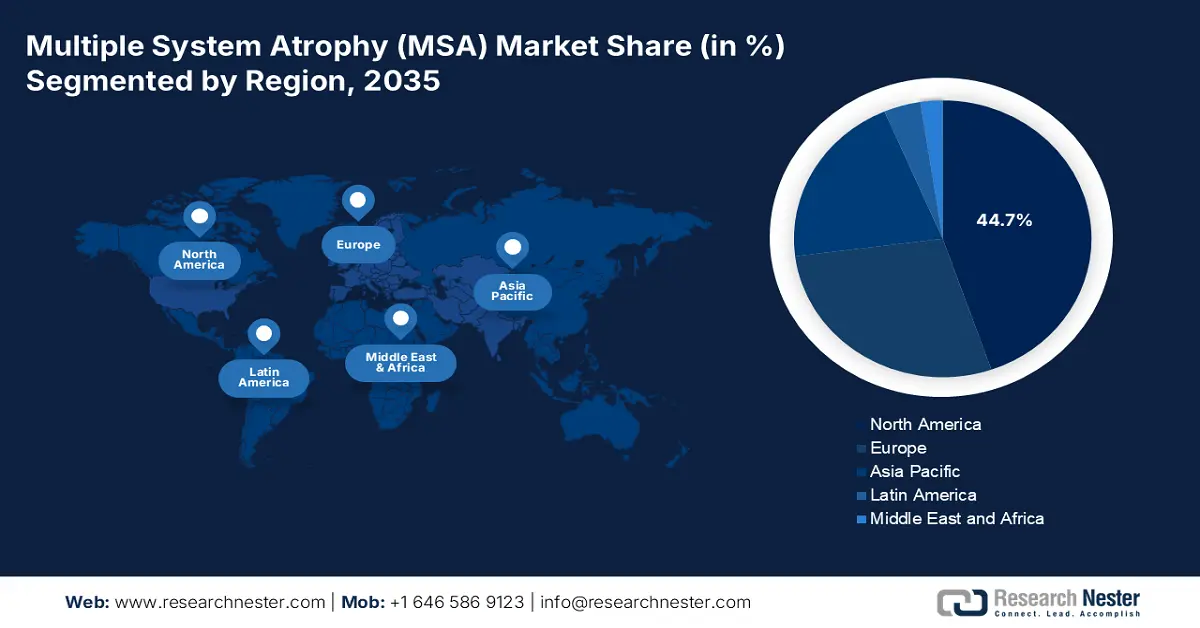

- North America is anticipated to dominate with 44.7% share by 2035, driven by advanced care infrastructure and robust Medicaid and Medicare coverage.

- Asia Pacific is poised to emerge as the fastest-growing region during the forecast period, fueled by optimization in diagnostics and an upsurge in the aging population.

Segment Insights:

- The pharmacological segment is projected to account for 92.5% share by 2035, owing to the absence of cleared disease-modifying therapy options.

- The disease-modifying therapies segment is expected to hold the second-largest share during the forecast period, impelled by addressing the underlying disease process rather than just managing symptoms.

Key Growth Trends:

- Quality optimization and cost-effective interventions

- An increase in disease occurrence and aging population

Major Challenges:

- Fragmentation in administrative policies

- Limitation in payer coverage for public healthcare

Key Players: Roche (Switzerland), UCB (Belgium), Lundbeck (Denmark), Teva Pharmaceuticals (Israel), Novartis (Switzerland), AbbVie (U.S.), Merck KGaA (Germany), Sanofi (France), AstraZeneca (UK), Sun Pharma (India), CSL Limited (Australia), Samsung Bioepis (South Korea), Hikma Pharmaceuticals (UK), Pharmaniaga (Malaysia).

Global Multiple System Atrophy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 150.1 million

- 2026 Market Size: USD 157.4 million

- Projected Market Size: USD 230.8 million by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: U.S., Germany, Japan, UK, France

- Emerging Countries: China, India, South Korea, Malaysia, Canada

Last updated on : 3 October, 2025

Multiple System Atrophy Market - Growth Drivers and Challenges

Growth Drivers

- Quality optimization and cost-effective interventions: Quality-of-care strategies are effectively reducing the economic load of MSA, while uplifting results, which is a suitable driver for uplifting the multiple system atrophy market globally. According to an article published by NLM in March 2024, the prevalence of MSA range from 1.9 in Gironde, 4.4 in London, and 3.4 in Iceland per 100,000 population. Therefore, to combat the spread, neuroimaging and radiotracer-based functional imaging technologies can readily support the MSA diagnosis, thus suitable for boosting the market’s development globally.

- An increase in disease occurrence and aging population: The international market’s patient pool is highly driven by advanced diagnostics and aging demographics. As per the August 2024 NLM article, the most common type of symptoms associated with the disease include, 96.7% of urinary dysfunction, followed by 43.3% of gait ataxia, and 33.3% of orthostatic symptoms. Therefore, to reduce these symptoms, artificial intelligence-based diagnostic tools, such as Lundbeck’s algorithm, have readily diminished misdiagnosis rates, thereby making it suitable for the market’s growth.

- Resilience and API sourcing in supply chain: The presence of administrative and geopolitical challenges is effectively reshaping the supply chain system in the market internationally. Besides, the FDA has denoted an increase in APIs for MSA, which originates from Europe and North America, thereby creating vulnerabilities to enhance manufacturing and production expenses. However, organizations are positively impacting suppliers, with the CDMO in South Korea providing global neurology APIs, while Teva in Israel is readily leveraging continuous manufacturing to diminish lead times.

Neurological Disease Risk Factors Boosting the Market (2023)

|

Regions/Risks |

Behavioral Risks |

Tobacco |

Smoking |

Alcohol Use |

Metabolic Risks |

High Fasting Plasma Glucose |

High body-mass index |

|

Australasia |

0.3 |

-1.1 |

-1.4 |

-1.0 |

1.6 |

1.4 |

1.9 |

|

Caribbean |

0.2 |

-0.5 |

-0.5 |

-0.5 |

1.0 |

0.8 |

1.4 |

|

Central Europe |

-0.4 |

-0.5 |

-0.5 |

-0.2 |

-0.8 |

1.0 |

0.8 |

|

Asia Pacific |

-0.4 |

-0.1 |

-0.1 |

-1.3 |

1.1 |

1 |

1.2 |

|

North America |

-0.1 |

-1.3 |

-1.3 |

0.1 |

1.2 |

2.3 |

0.8 |

|

North Africa and Middle East |

-0.4 |

-0.4 |

-0.4 |

-0.6 |

1.4 |

1.8 |

1.3 |

Source: NLM

Challenges

- Fragmentation in administrative policies: The lack of global regulatory harmonization has created expensive delays for drug producers in the multiple system atrophy market. For instance, expanded requirements have increased to manufacturing reforms, with the newest Annex 1 policies having imposed high compliance costs in Europe, especially for sterile injectable in 2023. However, developing countries have readily compounded this complexity, with the CDSCO in India constituting demanding domestic batch evaluation for imports, thus creating a huge bottleneck and effectively combating this risk to uplift the market’s exposure internationally.

- Limitation in payer coverage for public healthcare: Public payers proactively rationed MSA-specific treatments due to stringent budget allocations, which has caused a hindrance in the multiple system atrophy market. Besides, Medicaid services in the U.S. has effectively covered an estimated coverage of the FDA-based MSA therapies, thus readily focusing on affordable and prioritized generics, which includes levodopa, compared to the newest biologics. However, Neurocrine Biosciences combated this issue by integrating outcome-specific rebates by connecting payments to evaluative symptom enhancement, along with expanded coverage in half of Medicaid plans.

Multiple System Atrophy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 150.1 million |

|

Forecast Year Market Size (2035) |

USD 230.8 million |

|

Regional Scope |

|

Multiple System Atrophy Market Segmentation:

Treatment Segment Analysis

The pharmacological segment in the multiple system atrophy market is expected to account for the largest share of 92.5% by the end of 2035. The segment’s growth is highly attributed to the complete absence of cleared disease modifying therapy options for the disease. Besides, the present standard of care depends on off-label drugs to effectively manage the disorder’s critical and advanced symptoms. This readily includes midodrine for orthostatic hypotension, levodopa for parkinsonism, and different medications for issues, such as rigidity, sleep disorders, and urinary incontinence. Meanwhile, the increased expenses of these rare regimens, along with unmet requirements has solidified the segment’s intervention in the overall MSA market.

Drug Class Segment Analysis

Disease-modifying therapies segment in the market is predicted to cater to the second-largest share during the projected period. The segment’s development is highly fueled by successfully addressing the underlying disease process, which readily halted its overall progression, in comparison to managing symptoms. According to an article published by NLM in September 2025, the multiple sclerosis incidence has surged by 15.4%, denoting an increase from 210.5 to 243.1 per 100,000 population, thus suitable for the segment’s upliftment and effectively administering diseases.

Type Segment Analysis

The MSA-cerebellar (MSA-C) segment in the multiple system atrophy market is anticipated to constitute the third-largest share by the end of the forecast duration. The segment’s upliftment is highly driven by its atrophy, owing to the disease leading to significant motor control loss resulting in critical problems with movement, coordination, and balance. As per the January 2023 NLM article, the MSA pre-dominance among men and female accounts for 1.3:1 ratio, owing to its rareness and yearly incidence of 0.1 to 3.0 per 100,000, depending on geographic location and age criteria. Besides, abnormalities among traditional 1.5 MRI in patients with the disease tend to include lower brainstem atrophy, cerebellum, middle cerebellar peduncles.

Our in-depth analysis of the multiple system atrophy market includes the following segments:

|

Segments |

Subsegments |

|

Treatment |

|

|

Drug Class |

|

|

Type |

|

|

Route of Administration |

|

|

Distribution Channel |

|

|

Diagnosis |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Multiple System Atrophy Market - Regional Analysis

North America Market Insights

North America in the multiple system atrophy (MSA) market is expected to be the dominant region, with the highest share of 44.7% by the end of 2035. The U.S. is accounting for the majority of the region’s revenue, which is driven by the existence of advanced care infrastructure and strong Medicaid and Medicare coverage, while Canada is simultaneously contributing, which is backed by provincial healthcare funding. As per an article published by NLM in May 2024, a clinical study was conducted on 4,830 participants in the U.S., and 38.7% reported about their telehealth visit, which is also responsible for bolstering the market’s demand in the region.

U.S. MSA market is significantly growing, which is fueled by innovative neurology care hubs and an increase in Medicare and Medicaid expenditures. According to the June 2025 NIH report, there has been an investment of almost USD 48 billion in budget for medical research in the overall region. In addition, nearly 82% of NIH’s funding has been readily awarded for extramural research through 50,000 competitive grants, and 11% of the budget readily supports health and medical projects, which are conducted by almost 6,000 scientists, thereby suitable for the market’s upliftment in the country.

The multiple system atrophy (MSA) market in Canada is also experiencing sufficient development, which is fueled by federal policies for chronic diseases, along with the presence of provincial healthcare investments. As stated in the May 2024 Government of Canada article, USD 200 billion has been allocated for more than 10 years to successfully expand public healthcare. This includes legislation in the Budget Implementation Act 2024, guaranteeing a surge by 5% in Canada Health Transfer payments by the end of 2028. Besides, regional territories and provinces have also received USD 52.1 billion from the federal government, which is also positively impacting the MSA market growth.

APAC Market Insights

Asia Pacific is considered to emerge as the fastest-growing region in the multiple system atrophy (MSA) market during the forecast duration. The market’s upliftment is highly fueled by optimization in diagnostics and an upsurge in the aging population. Japan is leading with the majority of the region’s share, followed by China, owing to an increase in the yearly expenditure growth for rare disorders. India follows closely due to the presence of generic manufacturing which tends to reduce expenses. South Korea has initiated investments for AI diagnostics, while Malaysia has expanded tele-neurology, thus making it suitable for market upliftment in the region.

China’s multiple system atrophy market is gaining increased traction during the forecast period, highly attributed to a surge in the diagnosed patient pool, as well as the evolution in health and medical reforms. Besides, as per the July 2025 NLM article, there has been an upsurge in innovative drug applications from 688 to 2,298 as of 2023, denoting a 35.1% yearly growth. Additionally, there has also been an increase in investigational new drug applications from 627 to 1,918 in the same year, with a growth rate of 32.2%. On the contrary, the NMPA effectively approved 2,461 IND applications, along with 1,918 innovative drugs, thereby making them suitable for the market’s exposure.

The multiple system atrophy market in India is also witnessing development, which is effectively driven by an upsurge in the patient population, along with the generic drug dominance. Additionally, the aspect of government expenditure is also a huge driver for uplifting the market in the country. For instance, as per the January 2025 PIB report, there has been a generous increase in the government healthcare expenditure from 29.0% to 48.0% by the end of 2022. This resulted in Ayushman Yojana diminishing out-of-pocket expenses and saving more than Rs. 1.2 Lakh Crore (approximately USD 14.4 billion), thus bolstering the market’s development.

Innovative Drug Growth and Population Distribution Driving the Market in the Asia Pacific

|

China (Growth in Innovative Drugs) |

India (Population Development) |

|||

|

Years |

Application and Approval |

Years |

Age Range |

Growth % |

|

2019 |

688 and 627 |

2020 |

0-14, 15-64, over 65 years |

26.3, 67.0, 6.7 |

|

2020 |

1,016 and 943 |

2021 |

0-14, 15-64, over 65 years |

25.9, 67.2, 6.8 |

|

2021 |

1,821 and 1,559 |

2022 |

0-14, 15-64, over 65 years |

25.5, 67.5, 6.9 |

|

2022 |

1,733 and 1,615 |

2023 |

0-14, 15-64, over 65 years |

25.2, 67.7, 7.0 |

|

2023 |

2,298 and 1,918 |

2024 |

0-14, 15-64, over 65 years |

24.8, 68.0, 7.1 |

|

- |

- |

2025 |

0-14, 15-64, over 65 years |

24.5, 68.3, 7.2 |

Sources: NLM; APAC Med

Europe Market Insights

Europe market is regarded to account for a considerable share by the end of the projected duration, which is effectively propelled by the presence of centralized health and medical systems and a rise in the aging population. Germany is leading the region, with the majority of the revenue share, which is driven by yearly expenditure on MSA therapies, along with the presence of specialized neurology centers. This is followed by the UK, with NHS budget allocation for MSA care. Furthermore, France has also made its contribution by prioritizing early diagnosis and investing in its overall health budget, thus suitable for uplifting the market in the region.

The multiple system atrophy (MSA) market in Germany is readily dominating the region, which is propelled by an increase in the annual spending on treatments and diagnosis. As stated in the November 2023 ISPOR Organization data report, an additional discount of 20% has been provided in the G-Bas list of combination products including €10,000 for manufacturing expenses and €15,000 for industrial expenses for drug development. Besides, in the case of over 20% vial wastage for patients, manufacturers are bound to make payment for the wastage, thus suitable for boosting the MSA market in the country.

The multiple system atrophy (MSA) market in the UK is gaining increased exposure which is backed by NHS provision of its neurology budget, accounting for generous amount. As per an article published by the UK Government in June 2025, the Chancellor has readily declared £29 billion investment, with the intention of rebuilding the National Health Service. This further includes, latest investment of £10 billion on digital and technological transformation, while the Chancellor also confirmed £11 billion in defense to ensure suitable security to the organization, which is essential for bolstering the market in the country.

2022 Healthcare Expenditure in Europe

|

Countries |

% of GDP |

|

Austria |

11.1 |

|

Belgium |

10.7 |

|

France |

11.8 |

|

Germany |

12.6 |

|

Italy |

9.0 |

|

Netherlands |

10.1 |

|

Spain |

9.7 |

|

Poland |

6.4 |

Source: World Bank Organization

Key Multiple System Atrophy Market Players:

- Biogen (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roche (Switzerland)

- UCB (Belgium)

- Lundbeck (Denmark)

- Teva Pharmaceuticals (Israel)

- Novartis (Switzerland)

- AbbVie (U.S.)

- Merck KGaA (Germany)

- Sanofi (France)

- AstraZeneca (UK)

- Sun Pharma (India)

- CSL Limited (Australia)

- Samsung Bioepis (South Korea)

- Hikma Pharmaceuticals (UK)

- Pharmaniaga (Malaysia)

The international market is effectively fragmentated and united, with the presence of notable players, such as Biogen, catering to an estimated share of the market, followed by Roche, grabbing a considerable share. This has deliberately been possible with their focus on alpha-synuclein inhibitors and diagnostics. Besides, UCB and Lundbeck are also readily dominating the overall market with the offering of symptomatic care solutions, followed by Teva and Sun Pharma, prioritizing cost-effective generics. Meanwhile, government-specific partnerships, AI-based collaborations, emerging market extension, and biomarker-based research and development are other suitable drivers of the market.

Here is a list of key players operating in the MSA market:

Recent Developments

- In September 2025, Teva Pharmaceuticals declared that the U.S. FDA has readily granted the fast-track designation for the organization’s investigational therapy emrusolmin for aiding MSA.

- In September 2025, AskBio Inc. notified the completion of enrollment for REGENERATE MSA-101, its Phase 1 clinical trial of AB-105, which is an investigational gene therapy that are successfully developed for treating MSA-parkinsonian type.

- In February 2025, Lundbeck’s amlenetug, which is a notable treatment option for targeting MSA has received the FDA’s fast-track designation, and also initiated MASCOT, which is a phase III clinical trial to ensure efficiency and safety.

- Report ID: 3440

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Multiple System Atrophy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.