Motorcycle Helmet Market Outlook:

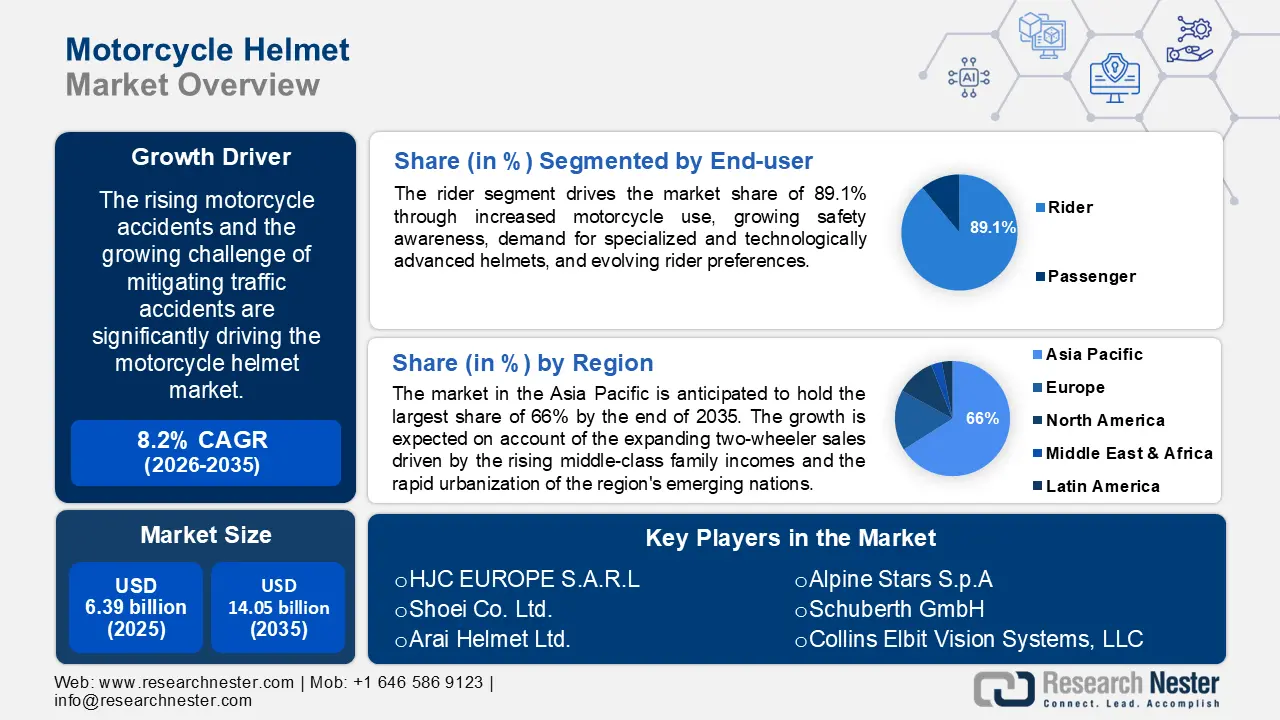

Motorcycle Helmet Market size was valued at USD 6.39 billion in 2025 and is set to exceed USD 14.05 billion by 2035, expanding at over 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of motorcycle helmet is estimated at USD 6.86 billion.

Rising motorcycle accidents and the growing challenge of mitigating traffic accidents are significantly driving the market. Motorcycle accident rates are rising, which has heightened emphasis on safety measures, including the use of advanced helmets. According to a 2023, World Health Organization (WHO) report approximately 1.19 million people die each year as a result of road traffic crashes. In response to accident statistics, regulations around helmet safety and standards are becoming stricter. This drives demand for helmets that comply with or exceed these new standards.

Moreover, understanding that helmets reduce the risk of severe injury or death encourages riders to prioritize helmet safety, thereby boosting demand. The National Highway Traffic Safety Administration (NHTSA) states that motorcycle helmets are estimated to be 37% effective in preventing fatal injuries to motorcycle operators and 41% effective for motorcycle passengers.

Key Motorcycle Helmet Market Insights Summary:

Regional Highlights:

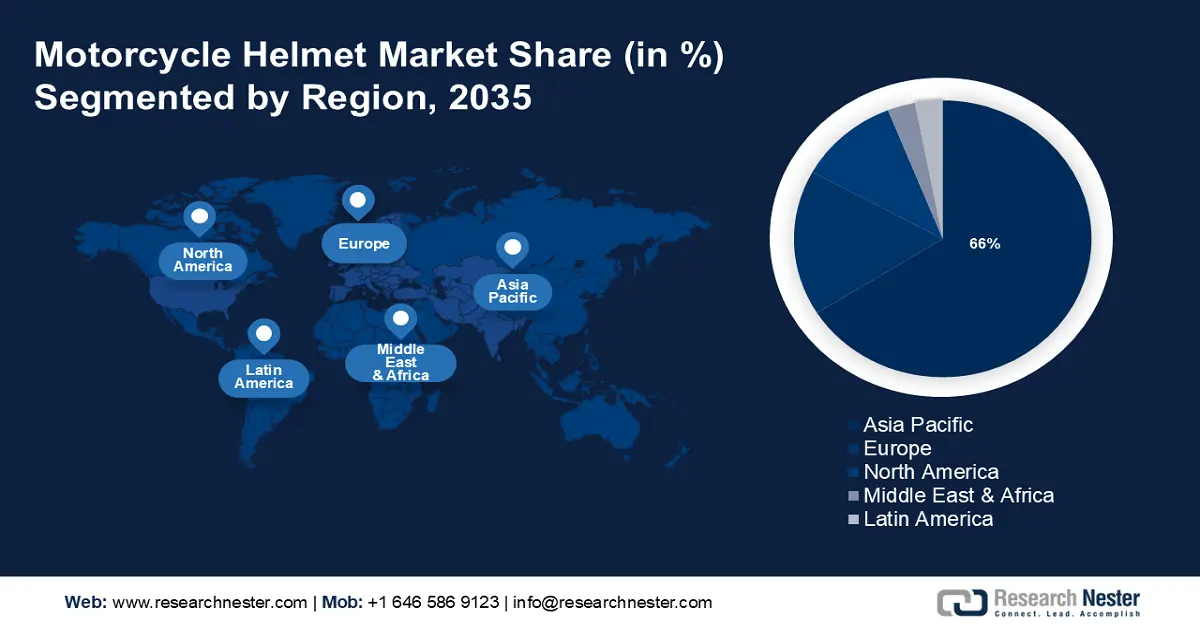

- The Asia Pacific motorcycle helmet market will dominate around 66% share by 2035, driven by rising two-wheeler sales and urbanization in emerging economies.

- The Europe market will exhibit enormous growth during the forecast timeline, driven by mandatory helmet laws and the trend of leisure cycling across the region.

Segment Insights:

- The rider segment in the motorcycle helmet market is expected to secure an 89.10% share by 2035, fueled by rising motorcycle use and growing demand for technologically advanced helmets.

- Full face segment in the motorcycle helmet market is forecasted to achieve 60.10% growth by the forecast year 2035, driven by superior safety, comfort, and protection offered by full-face helmets.

Key Growth Trends:

- Technological advancements

- Increased participation in motorcycle sports

Major Challenges:

- High costs

- Market saturation

Key Players: HJC EUROPE S.A.R.L, Shoei Co. Ltd, Arai Helmet Ltd., Alpine Stars S.p.A, Schuberth GmbH, Collins Elbit Vision Systems, LLC, BELL HELMET, Steelbird HI-tech India Ltd., STUDDS Accessories Limited, Royal Enfield.

Global Motorcycle Helmet Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.39 billion

- 2026 Market Size: USD 6.86 billion

- Projected Market Size: USD 14.05 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (66% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Italy

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Motorcycle Helmet Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements - Technological advancements are driving the market by enhancing safety, comfort, and functionality. Use of advanced materials like carbon fiber, Kevlar, and multi-density EPS (Expanded Polystyrene) liners enhances impact resistance and energy absorption. Multi-Directional Impact Protection System (MIPS), an improved safety technology, provides additional protection against rotational forces during crashes. Additional advanced safety features like in-built cameras and sensors, Bluetooth, GPS tracking, impact detection and alert systems, and augmented reality for hazard identification not only protect the wearer but also provide valuable data that can be used to improve safety protocols and procedures.

Moreover, many key players are actively developing and integrating advanced technologies into smart helmets, significantly expanding the market. For instance, JARVISH develops superior mass-market smart safety helmets, which include a built-in 2K HD action camera, a sensor that detects whether the helmet is on, an OGS surround HD sound system, a smart voice control system, a wireless charging module, and a HUD (Head-Up Display) that allows users to browse information while riding. - Increased participation in motorcycle sports - The rising popularity of motorcycle sports, including motocross, road racing, and adventure riding, has increased the need for specialized safety gear. Moreover, increased participation often attracts sponsorship deals and investments in motorcycle sports, which include promoting the use of high-quality safety gear like helmets. Major events and racing leagues promote smart helmet use and safety, influencing consumer preferences and boosting market demand. For instance, MIPS (and similar systems) will likely become compulsory in MotoGP helmets by 2027.

Challenges

- High costs - Advanced helmets with cutting-edge technology and materials are expensive. High costs may be beyond the limit of some consumers, which limits the overall market reach and reduces, potential sales volumes, particularly in regions with lower or average income levels.

- Market saturation - The market is highly competitive with numerous established brands and new entrants. This often leads to aggressive pricing strategies, reduced profit margins, and challenges for companies to differentiate their offerings. Moreover, shifting consumer preferences and trends can affect competition. Companies must continuously adapt to changing consumer demands, which can be challenging in a highly competitive market.

Motorcycle Helmet Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 6.39 billion |

|

Forecast Year Market Size (2035) |

USD 14.05 billion |

|

Regional Scope |

|

Motorcycle Helmet Market Segmentation:

End-user Segment Analysis

Rider segment is predicted to dominate over 89.1% motorcycle helmet market share by 2035. The segment drives the market through increased motorcycle use, growing safety awareness, demand for specialized and technologically advanced helmets, and evolving rider preferences. As per estimates, the motorcycle industry is estimated to reach USD 10.07 billion by 2029. Riders often seek helmets tailored to specific needs, such as racing helmets, adventure helmets, or helmets with integrated communication systems. This demand encourages manufacturers to develop and market specialized products.

Product Segment Analysis

By the end of 2035, full face segment is expected to account for more than 60.1% motorcycle helmet market share on account of the safety offered by full face helmets, which are composed of lightweight materials such as fiberglass-reinforced plastic and carbon fiber. It has been found that full-face motorcycle helmets offer 45.3% more safety than other available helmets. They provide total facial protection by covering the largest area of the head and also provide defense against weather-related hazards and debris while riding. Full-face motorcycle helmets are better than other helmet styles in terms of comfort and noise reduction as they let in the least amount of wind noise.

The open face helmets segment is anticipated to increase at a profitable rate in the coming years as they appear to be becoming increasingly popular among young people. Compared to bulky full-face helmets, open-face helmets are significantly lighter and allow one to hear what other riders and pillions are saying more clearly and converse with them more easily. In addition, the design of open face helmets provides a better ventilation system that might aid in keeping the rider's head cool even on warm days.

Distribution Channel Segment Analysis

The online segment is estimated to be the fastest-growing segment with a significant CAGR. Online platforms allow brands to reach a global audience beyond geographical limitations, increasing market access. Customers can easily compare products, read reviews, and make purchases from the comfort of their homes, enhancing user experience. Moreover, digital advertising and social media campaigns can target specific demographics and interests, effectively reaching motorcycle enthusiasts. E-commerce websites like Amazon and eBay have seen significant sales in motorcycle helmets.

Our in-depth analysis of the motorcycle helmet market includes the following segments:

|

Product |

|

|

End-user |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Motorcycle Helmet Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 66% by 2035. The growth is expected on account of the expanding two-wheeler sales driven by the rising middle-class family incomes and the rapid urbanization of the region's emerging nations. For instance, Asia accounts for more than 85% of global two-wheeler sales. Due to their excellent fuel efficiency and ease of use, two-wheeled scooters and motorcycles are being increasingly adopted by consumers. The rising adoption of motorcycles has led to an increase in demand for motorcycle helmets that satisfy safety requirements and rider preferences.

The motorcycle helmet market in China holds a substantial portion of the market due to the rising adoption of electric vehicles (EV). China is the world's largest manufacturer of EVs. The Chinese government has implemented stricter helmet laws to improve road safety. Mandatory helmet laws for all motorcyclists and e-bike riders have driven demand for helmets.

The market in India features a mix of domestic brands like Studds and Steelbird, and international brands such as Shoei and HJC that cater to a diverse range of price points and quality preferences.

European Market Insights

Europe will register enormous growth for the motorcycle helmet market during the forecast period owing to the increasing trend of leisure cycling, which is driven by the number of amazing mountain riding destinations. As a result, some EU nations have made wearing a quality riding helmet and any other protective gear mandatory, to improve a rider's comfort and safety.

Germany has made great strides in the field of road safety, leading to a higher demand for motorcycle helmets. For instance, more than 21,500 persons were injured in car accidents in Germany in 2023. Moreover, wearing a helmet is advised by the Federal Ministry of Transport and other organizations, particularly for kids and teenagers.

Since the 1970s, Italy has mandated all motorcycle riders, including passengers, to wear helmets while riding on public roadways. This is likely to help drive market expansion in the future years.

Motorcycle Helmet Market Players:

- Caberg S.p.a.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HJC EUROPE S.A.R.L

- Shoei Co. Ltd.

- Arai Helmet Ltd.

- Alpine Stars S.p.A

- Schuberth GmbH

- Collins Elbit Vision Systems, LLC

- BELL HELMET

- Steelbird HI-tech India Ltd.

- STUDDS Accessories Limited

- Royal Enfield

The motorcycle helmet market consists of many key players who are launching various strategic initiatives to expand their market position in the industry. It is predicted that the top five companies will control the majority of the market share by taking calculated risks, expanding, forming agreements, and participating in joint ventures.

Recent Developments

- In May 2024, Steelbird HI-tech India Ltd. announced a significant expansion and creation of a new facility to increase helmet production with the primary goal of selling more than 8 million helmets in 2024-2025.

- In February 2024, Collins Elbit Vision Systems, LLC together with Aerospace, and Elbit Systems of America delivered the 3,000th F-35 Gen III Helmet Mounted Display Systems (HMDS) to the Joint Strike Fighter to provide them easy access to crucial sensor, flight, and tactical data day or night.

- Report ID: 6303

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Motorcycle Helmet Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.