Montan Wax Market Outlook:

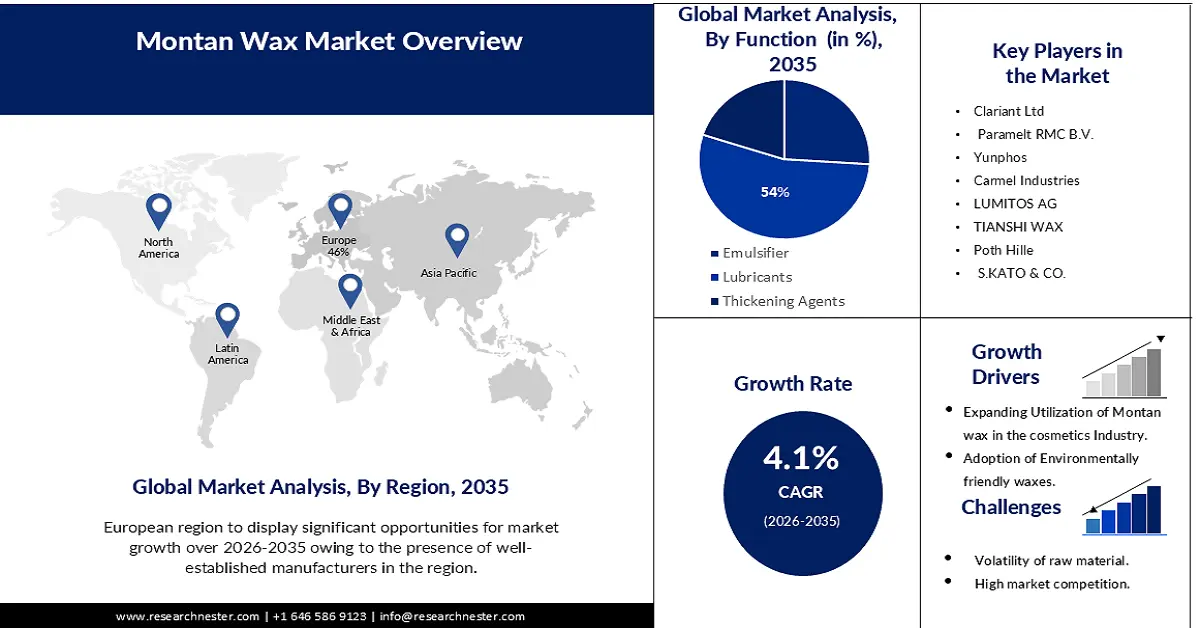

Montan Wax Market size was valued at USD 151.39 million in 2025 and is set to exceed USD 226.26 million by 2035, registering over 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of montan wax is estimated at USD 156.98 million.

The market is driven by the expanding need for montan wax in the personal care and cosmetics industry. Natural and non-toxic montan wax is primarily used to regulate the viscosity and consistency of various cosmetics and personal care compositions. Young audiences now have a greater desire for beauty and cosmetic products, which has enhanced the industry’s output of these goods. Montan wax is used for non-toxic structure makeup items like baby items, massage oils, lipsticks, and more. Additionally, the market demand for Montan wax is being driven by its durability and shine in cosmetic and personal care applications

Further, owing to its superior properties such as improvement in the flow properties and mold release, limited product loss, and improvement of product properties, the montan is substituting carnauba wax, and beeswax, among others. Additionally, the excellent physiochemical properties and cost-effectiveness of montan wax are propelling its demand across the globe.

Key Montan Wax Market Insights Summary:

Regional Highlights:

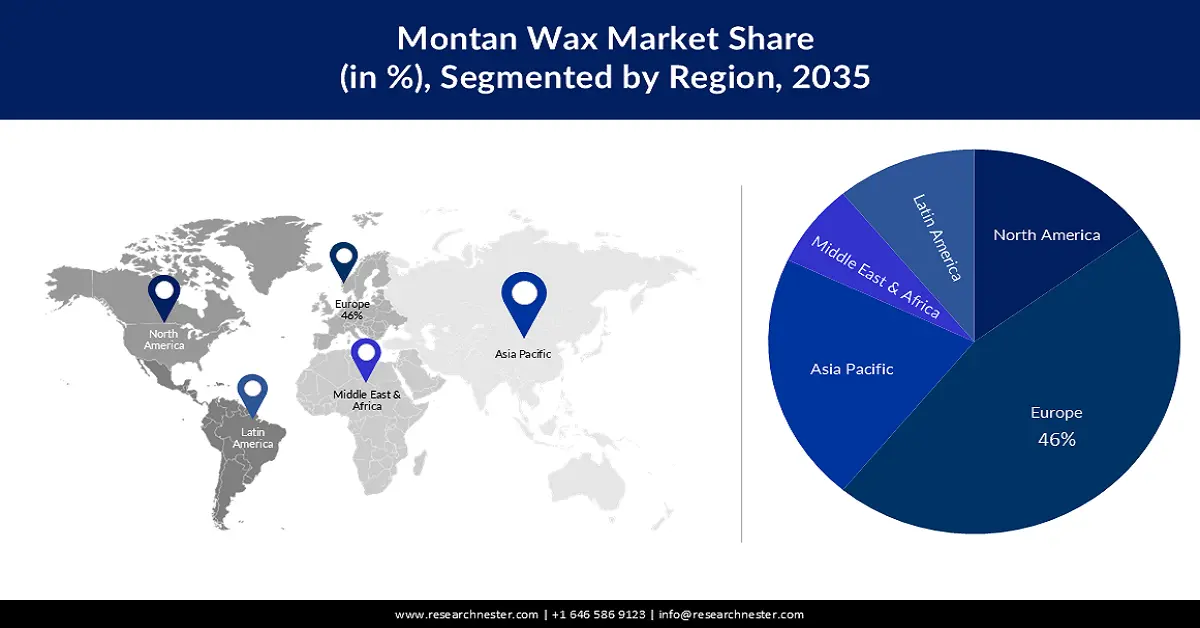

- By 2035, Europe is projected to secure a 46% share of the montan wax market, supported by well-established manufacturers and rising lubricant demand across expanding industrial activities.

- Asia Pacific is expected to record substantial growth through 2035, sustained by accelerating automotive production and increasing use of montan wax for fruit preservation.

Segment Insights:

- By 2035, the Lubricant segment in the montan wax market is anticipated to command a 54% share, driven by its ability to enhance surface quality, shine, and processing efficiency.

- The Food segment is set to hold the leading revenue share by 2035, owing to the rising need for fruit preservation and improved moisture-retention benefits.

Key Growth Trends:

- Growing Demand in the fruit industry

- Increasing usage of high quality coating

Major Challenges:

- Raw Material Shortage

- Stringent environmental regulations related to the extraction and use of montan wax.

Key Players: CALWAX, VÖLPKER SPEZIALPRODUKTE GMBH, Clariant Ltd, Paramelt RMC B.V., Yunphos, Carmel Industries, LUMITOS AG, TIANSHI WAX, Poth Hille, MP Gokyo Food & Chemical Co., Ltd.

Global Montan Wax Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 151.39 million

- 2026 Market Size: USD 156.98 million

- Projected Market Size: USD 226.26 million by 2035

- Growth Forecasts: 4.1%

Key Regional Dynamics:

- Largest Region: Europe (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Indonesia, Vietnam, Brazil, Mexico

Last updated on : 19 November, 2025

Montan Wax Market - Growth Drivers and Challenges

Growth Drivers

- Growing Demand in the fruit industry- The market for montan wax is expected to develop because of the increasing demand from fruit vendors worldwide, which is stimulating the industry. The usage of montan wax in food coatings, additives, and other fruit protection applications has increased due to the expansion of the food business. Fruits are kept protected, have a prolonged freshness, and don't lose water because of the montan wax. Furthermore, the global fruit merchants' increasing demand is expected to fuel the expansion of the montan wax market. The retail and food services sector generated some USD 1.78 trillion worth of revenue in 2019, the United States Department of Agriculture reports. This benefitted the market greatly. In addition, a montan acid ester is added to the protective layer of fruit, thus ensuring longer-lasting freshness and quality using Montan wax's name. The market will therefore be primarily driven by the increase in demand from fruit merchants and manufacturers, which creates favourable growth prospects for Montan Wax over the forecast period.

- Increasing usage of high-quality coating- Another factor that has led to revenue growth in the market is the demand for high-quality paints across various sectors. Montan wax is commonly used in industrial paints due to its superior binding properties and resistance to heat and moisture. The growing demand for high-performance coatings in sectors like automotive and aeronautics leads to revenue growth in the market.

- Demand for environment-friendly products- Montan has been deemed to be an eco-friendly alternative in comparison with chemically synthesized waxes. The demand for montan wax is projected to increase as consumers become more and more interested in environmentally friendly products. Moreover, the market's revenue is boosted by the increasing use of naturally derived waxes in sectors such as foodstuffs, cosmetics, and pharmaceuticals.

- Increasing Usage in Polishes and Coating- For the automotive and furniture sector, Montan wax is one of the most important ingredients for polishes and coatings. It is the most widely used product for automotive waxes and wood polishes due to its natural origin as well as its higher gloss and hardness.

Challenges

- Raw Material Shortage - The demand for montan wax is high as it is an affordable alternative to beeswax and carnauba wax. However, the market faces challenges as the raw materials for montan wax are facing shortages and depletion. The montan wax is made from lignite, bitumen, and resins. The bitumen used for making montan wax is facing shortages, along with rising prices for bitumen.

- Stringent environmental regulations related to the extraction and use of montan wax.

- Availability of alternate waxes with similar properties

Montan Wax Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 151.39 million |

|

Forecast Year Market Size (2035) |

USD 226.26 million |

|

Regional Scope |

|

Montan Wax Market Segmentation:

Function Segment Analysis

The lubricant segment in the montan wax market is anticipated to register the largest revenue during the forecast period, accounting for a market share of 54%. Montan waxes, among other things, are guaranteed to be PVC lubricants. It increases the quality and smoothness of the surface, as well as the shine of the finished product. In injection molding and other procedures that require a high melting speed, montenic ester is used as it helps reduce fluid viscosity. They demonstrate their beneficial lubricating characteristics, for example, in high-speed cable extrusion, particularly at the screw tips. All these admissible features are responsible for the market’s growth.

End-User Segment Analysis

Montan wax market from the food Segment is projected to hold the majority revenue share. The market is being driven by the preservation of fruits, which is majorly responsible for the segment's growth. It aids in reducing how quickly fruits lose water. When handling fruit, it is authorized for use as a food ingredient. The food sector uses montan wax to preserve the freshness of fruits. Growing demand for fruit merchants is the driving force behind the Montan wax industry. Other benefits of montan wax include minimal to non-existent product loss, and enhanced mold release and flow characteristics, and all of these factors support and propel the industry.

Our in-depth analysis of the global market includes the following segments:

|

Function |

|

|

Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Montan Wax Market - Regional Analysis

European Market Insights

Europe industry is predicted to hold largest revenue share of 46% by 2035, due to presence of well-established manufacturers in the region. The growth of this region is attributed to the presence of well-established manufacturers. Further, the cosmetics, adhesives, and coatings industries in Europe continue to rely on montan wax for its unique properties. Also, the use of montan wax as lubricant is prevalent in the region. Demand for lubricants in Europe is on the rise due to increasing industrial activities across various sectors. As the economy grows and the manufacturing sector expands, there is a greater need for lubricants to ensure the smooth function of machinery and equipment. Europe’s manufacturing sector is set to garner a revenue of USD 2.9 trillion. All these factors cumulatively are propelling the market’s growth.

APAC Market Insights

Asia Pacific montan wax market is estimated to hold a significant revenue share during the forecast period. This region is a major consumer of Montan Wax, with countries such as China and South Korea at the forefront of demand given their robust industry sectors. Montan waxes are used in the automobile sector for car polish, paint, and other vehicle care and protection applications. High growth in the market share of montan wax is being driven by an accelerating automotive industry in major developing countries such as China, India, and others. In addition, the increase in food consumption in APAC is driving up demand for montan wax to be used on fruit edible coating and additives preventing water loss and preserving freshness as a result of an increasing intake of fruits and vegetables. In this way, the montan wax industry will lead over the forecast period due to increasing vertical industries in APAC such as automotive, cosmetics, food, and others.

Montan Wax Market Players:

- ROMONTA Holding GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CALWAX

- VÖLPKER SPEZIALPRODUKTE GMBH

- Clariant Ltd

- Paramelt RMC B.V.

- Yunphos

- Carmel Industries

- LUMITOS AG

- TIANSHI WAX

- Poth Hille

Recent Developments

- September 2019- In the European region, Volpker Special Products GmbH announced that VOELPKER would become an official distributor of wax products. The Partnership's purpose is to maximize revenue.

- Report ID: 1006

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Montan Wax Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.