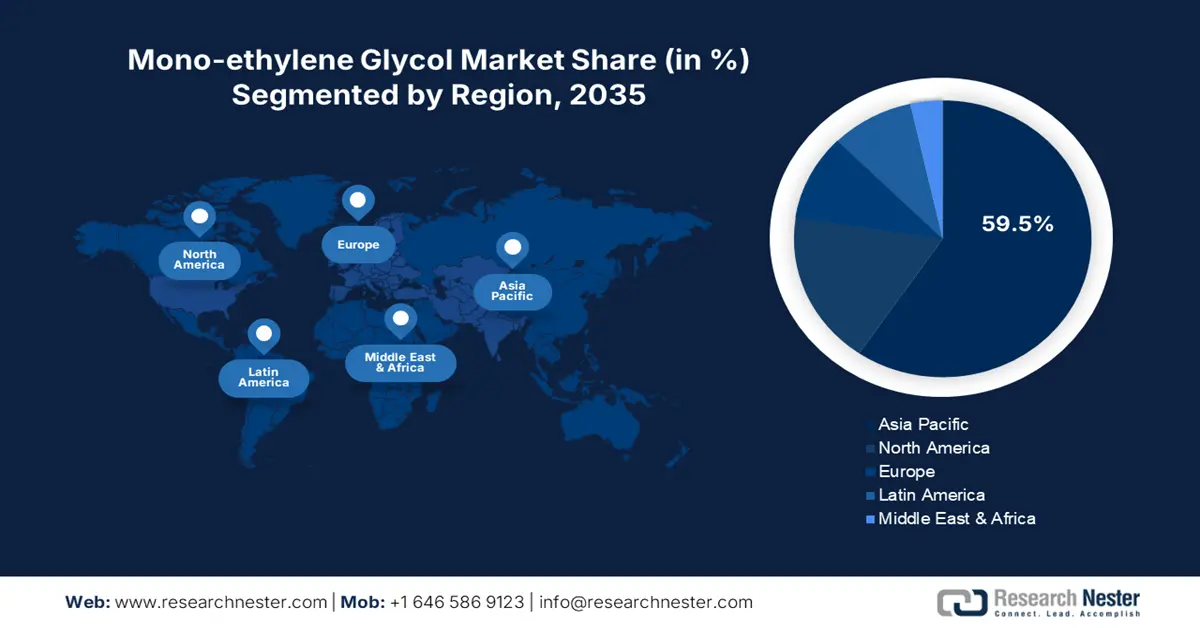

Monoethylene Glycol Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific monoethylene glycol market is anticipated to account for revenue share of around 59.5% by 2035. The swiftly expanding chemical sector is expected to create a lucrative environment for monoethylene glycol manufacturers. The increasing foreign direct investments, supportive government policies, and strong presence of end use industries are set to propel the sales of monoethylene glycol in the coming years. China, India, South Korea, and Japan hold dominating shares in the Asia Pacific monoethylene glycol market.

China being the robust producer of plastics is likely to positively fuel the sales of monoethylene glycol. The expanding production and commercialization of plastic products including PET are further propelling the consumption of monoethylene glycol. Research Nester’s study estimates that China’s production of plastic products was evaluated at 7.66 million metric tons in December 2024. Ongoing innovations and an increasing need for specialized materials are poised to propel the overall monoethylene glycol market growth in the years ahead.

India is the fastest-expanding market for electric vehicles owing to supportive government policies and emission regulations. Monoethylene glycol is finding extensive application in automotive coolants. The rise in EV registrations is estimated to propel the sales of monoethylene glycol in the coming years. For instance, the India Brand Equity Foundation (IBEF) study reveals that by 2030, the country is foreseen to become the largest EV market, increasing at a CAGR of 23.4%. The country’s electric vehicle sales rose by 20.8% to 1.3 million units in May 2024.

North America Market Insights

The North America monoethylene glycol market is estimated to rise at a robust pace by 2035. The fueling production of automobiles as heavy machinery is augmenting the consumption of monoethylene glycol in coolants and antifreeze solutions. The development in the food service sector is also amplifying the sales of monoethylene glycol in the region. The U.S. and Canada’s fueling construction activities are also driving the sales of monoethylene glycol. The booming need for specialized chemicals and materials is poised to uplift the revenues of monoethylene glycol producers in the years ahead.

The U.S. expanding industrial and construction activities focused on the use of heavy machinery are set to fuel the use of monoethylene glycol in coolant and antifreeze applications. For instance, in January 2025, the Federal Reserve Bank of St. Louis estimated that the producer price index of construction machinery manufacturing stood at 349.088. Furthermore, the U.S. Census Bureau states that over 1,483,000 residential buildings were permitted and 1,651,000 housing were completed in January 2025.

Canada’s increasing registrations of electric vehicles are driving the overall monoethylene glycol market growth. The report by Statistique Canada reveals that the number of zero-emission vehicles increased from 52,685 in the fourth quarter of 2023 to 75,363 in the third quarter of 2024. The strict emission regulations are fueling the sales of electric vehicles and subsequently the applications of monoethylene glycol in coolants and antifreeze. Furthermore, similar to the U.S., the increasing construction activities are further set to propel the consumption of monoethylene glycol in the country.