Molded Interconnect Device Market Outlook:

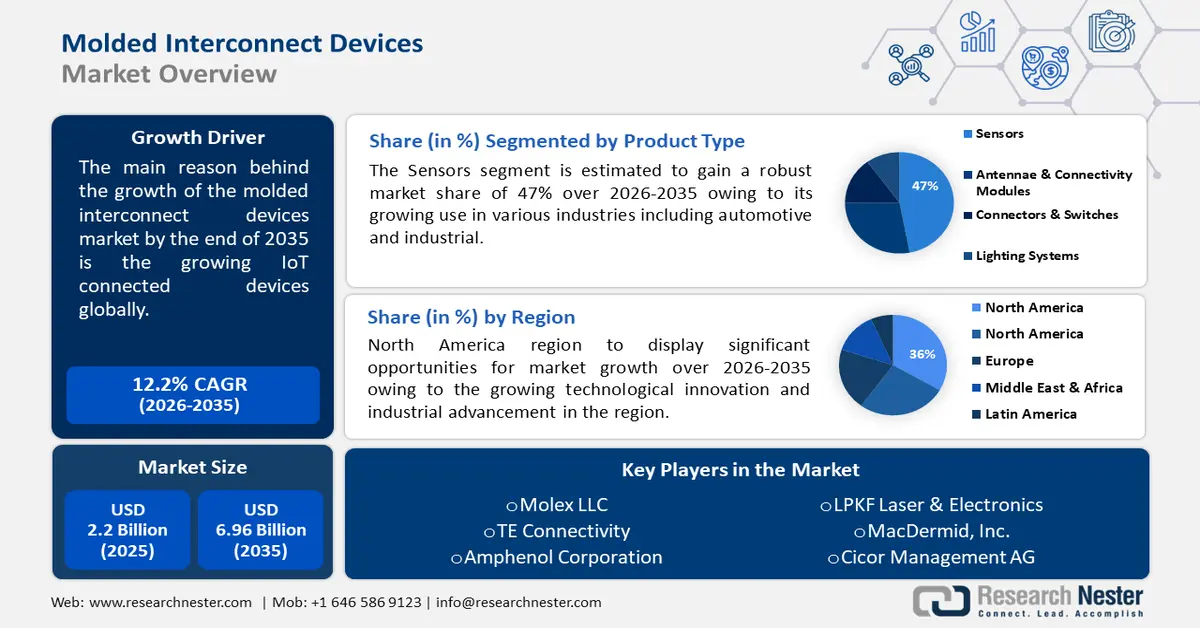

Molded Interconnect Device Market size was valued at USD 2.2 billion in 2025 and is set to exceed USD 6.96 billion by 2035, expanding at over 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of molded interconnect device is estimated at USD 2.44 billion.

The market is growing as a result of the growing connection of IoT to these devices. Molded interconnect devices (MIDs) are useful in this situation. MIDs make it possible to incorporate electrical parts straight into three-dimensional forms, leading to the development of more connected and compact smart gadgets.

Designers may enhance functionality, optimize space, and construct complicated geometries with MIDs. Numerous industries, including consumer electronics, aerospace, healthcare, and automotive, are seeing a rise in the use of this technology.

In addition to this, a factor that is believed to fuel the market growth of the MID market is an increase in technological advancements in manufacturing. Continuous advancements in manufacturing technologies, such as laser direct structuring (LDS) and 3D printing, have enhanced the production efficiency and flexibility of MIDs. These techniques enable rapid prototyping and customization, catering to diverse industry needs.

Key Molded Interconnect Device (MID) Market Insights Summary:

Regional Highlights:

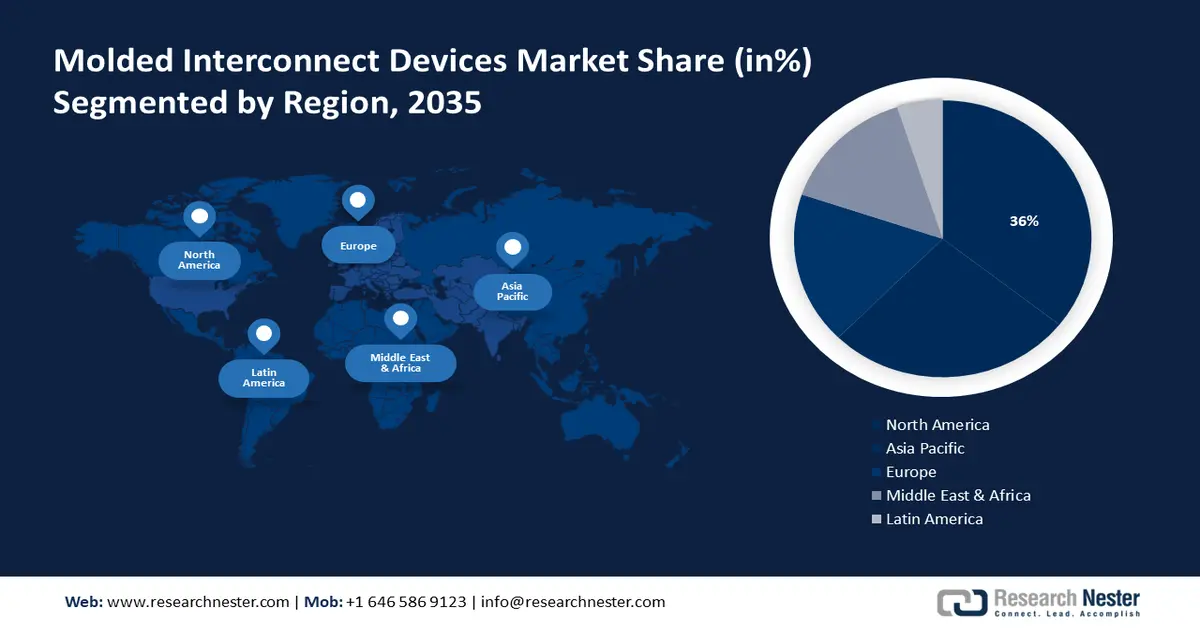

- The North America molded interconnect device (mid) market is expected to capture 36% share by 2035, fueled by technological innovation and industrial advancement.

- The Asia Pacific market will secure the second largest share by 2035, attributed to the expanding automotive industry and demand for compact electronics.

Segment Insights:

- The sensors segment in the molded interconnect device market is projected to hold a 47% share by 2035, driven by increasing use of MIDs in automotive and industrial sensor applications.

- The telecommunications & computing segment in the molded interconnect device market is expected to witness strong growth through 2035, driven by growing demand for advanced circuits enabling 5G communication.

Key Growth Trends:

- Rising trend of miniaturization products

- Evolution of consumer electronics

Major Challenges:

- Cost Considerations

- Lack of standardized protocols might hinder broader adoption, especially in industries with stringent regulatory requirements.

Key Players: Molex LLC, TE Connectivity, Amphenol Corporation, LPKF Laser & Electronics, MacDermid, Inc., Cicor Management AG, S2P Smart Plastic Product, Teprosa GmbH, DuPont, DSM Corporation.

Global Molded Interconnect Device (MID) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.2 billion

- 2026 Market Size: USD 2.44 billion

- Projected Market Size: USD 6.96 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Molded Interconnect Device Market Growth Drivers and Challenges:

Growth Drivers

-

Growing technological advancements in automotive industry - The automotive sector heavily relies on MIDs for various applications, such as automotive sensors, lighting, and control systems. As per estimates, it is anticipated that the global automotive sensor industry will surpass USD 55 billion by 2025. With the rise of electric vehicles (EVs), autonomous driving technology, and the need for more compact and lightweight components, MIDs are becoming increasingly indispensable in this sector.

-

Rising trend of miniaturization products - As electronic devices continue to shrink in size while increasing in functionality, there’s a growing demand for compact, MIDs that enable the integration of multiple functionalities into smaller spaces, aligning with the miniaturization trend.

- Evolution of consumer electronics - The demand for smaller, sleeker, and more functional consumer electric devices (smartphones, wearables, etc.) drives the need for MIDs. These devices require intricate circuitry and functional design integration, which MIDs facilitate efficiently. In total, the consumer electronics sector brought in around USD 987 billion in revenue in 2022. This propelled the MID market .

- Innovations in medical industry - The healthcare industry leverage MIDs for various applications, including wearable medical devices, monitoring systems, and implantable devices. The need for smaller, more reliable, and customized solutions in the medical field fuels the growth of MIDs. For instance, Pacemaker makers, including Boston Scientific and Medtronic, were among the first in the medical field to adopt C-MOS technology to integrate digital and analog signals into a single-chip device. This enhanced the device's analysis and control capabilities while decreasing its size and weight. Soon, chip design methods akin to those employed in the creation of compact, lightweight, and potent consumer and military goods were applied to the design of digital medical devices, ranging from defibrillators to stethoscopes. Since then, there has been an increased trend toward shrinking processor chips, instruments, connectors, probes, and sensors built into medical equipment, propelling the market’s growth.

Challenges

-

Cost Considerations- Initial setup costs for MID production can be significant due to the specialized equipment and technology required for manufacturing. This might make MIDs less cost-competitive, especially for smaller-scale productions or in industries with stringent cost considerations.

-

Maintaining high-quality standards and reliability across batches poses a challenge in molded interconnect device manufacturing.

- Lack of standardized protocols might hinder broader adoption, especially in industries with stringent regulatory requirements.

Molded Interconnect Device Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 2.2 billion |

|

Forecast Year Market Size (2035) |

USD 6.96 billion |

|

Regional Scope |

|

Molded Interconnect Device Market Segmentation:

Product Type Segment Analysis

In molded interconnect device market, sensors segment is poised to capture over 47% share by 2035. The segment's growth can be attributed to their growing use in various industries, including automotive and industrial. The use of temperature sensors, pressure sensors, and other types of sensors is extensive in industrial applications. In total, the sensor segment garnered USD 22.4 billion in 2022. In the automotive sector, sensors are used in adaptive cruise control systems and climate control-related applications.

Moreover, the increasing use of molded interconnect devices (MIDs) in these applications drives up the demand for MID sensors during the forecast period. The integration of sensors in these sectors is improving performance, efficiency, and safety. All these factors are cumulatively responsible for the market’s growth.

Application Segment Analysis

In molded interconnect device market, telecommunications and computing segment is estimated to account for more than 34% revenue share by the end of 2035. The strong need for sophisticated electronic circuits that enable the development of 5G devices with low signal loss is attributed to the segment's growth.

Electronic businesses, such as Cicor Group, have been working to create MID gear that uses liquid crystal polymers in order to facilitate the high-frequency transmission of 5G signals. 5G had 1.1 billion subscriptions worldwide as of June 2024; 125 million more had been added in just the first quarter. Thirty-five service providers have introduced 5G standalone (SA) networks, while about 240 service providers have built 5G networks. There are more than 700 5G smartphone models available to consumers as of early 2024; this has a prospective effect on the segment’s growth.

Our in-depth analysis of the global molded interconnect device (MID) market includes the following segments:

|

Product Type |

|

|

Application |

|

|

Process |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Molded Interconnect Device Market Regional Analysis:

North American Market Insights

By 2035, North America region is expected to capture over 36% molded interconnect device market share. The industry growth in the region is also expected on account of technological innovation and industrial advancement. With a strong presence in key sectors like automotive, healthcare, aerospace, and consumer electronics, the region showcases a robust demand for sophisticated, miniaturized, and integrated electronic solutions. The automotive industry, in particular, embraces MID technology for advanced functionalities in sensors, control systems, and compact electronic components, driving innovation within the sector.

Additionally, North America’s emphasis on technological prowess and R&D investments fosters the development of cutting-edge materials and manufacturing techniques crucial for MID production. Collaborations between leading tech firms, research institutions, and manufacturers fuel the region’s market growth, contributing to the creation of versatile and high-performance solutions.

APAC Market Insights

The molded interconnect device market Asia Pacific region will also encounter huge revenue growth during the forecast period and will hold the second position owing to the expanding automotive industry in the region. With a burgeoning demand for compact, multifunctional electronic components across diverse industries, including automotive, consumer electronics, healthcare, and telecommunications, the region witnesses significant MID adoption. Boasting robust manufacturing capabilities, countries like Japan, China, South Korea, and Taiwan spearhead MID development, leveraging advanced materials and cutting-edge manufacturing processes.

The automotive sector’s evolution towards electric and autonomous vehicles, coupled with the surge in demand for IoT devices and wearables, propel the market’s expansion. Further, collaborations between global players and local manufacturers, combined with a focus on sustainability and regulatory compliance, bolster the Asia Pacific- market’s growth trajectory, shaping it into a pivotal region for MID innovation and adoption.

Molded Interconnect Device Market Players:

- Molex LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TE Connectivity

- Amphenol Corporation

- LPKF Laser & Electronics

- MacDermid, Inc.

- Cicor Management AG

- S2P Smart Plastic Product

- Teprosa GmbH

- DuPont

- DSM Corporation

Recent Developments

- Molex, a global electronics pioneer and connectivity inventor, today announced a significant expansion of its global manufacturing footprint with the establishment of a new campus in Katowice, Poland. The facility's initial 23,000 square meters of manufacturing space will serve as a strategic central location to enable Phillips-Medisize, a Molex company, provide sophisticated medical devices on time, as well as electric car and electrification solutions to Molex clients.

- MacDermid Alpha Electronics Solutions will showcase their most recent product and technological developments at the Productronica tradeshow in Munich, Germany. The Electrolube brand's newly announced extremely thermally conductive thermal gap filler and new bio-based conformal coating will be among the show's standout products. The freshly introduced GF600 thermal gap filler has remarkable thermal performance (6.0W/m.K) and is intended to give higher stability than typical thermal interface materials. Electrolube's bio-coating, the first to market, comprises 75% bio-organic substance from renewable sources and is an eco-friendly breakthrough.

- Report ID: 5506

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.