- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- Novelic

- Infineon Technologies AG

- NXPSemiconductors

- Minew Group

- Texas Instruments Incorporated

- Fujitsu

- D3

- Asahi Kasei Microdevices Corporation

- Mistral Solutions Pvt. Ltd

- DALIAN IFLABEL TECHNOLOGY CO., LTD.

- Others

- Ongoing Technological Advancements

- Price Benchmarking

- Frequency Band Analysis

- SWOT Analysis

- Application Analysis

- Customer Centric Application Analysis of mmWave Radar

- RFIC Market Analysis Value (USD Million)

- RFIC Market Analysis Volume in (Million Units)

- Key RFIC Supplier Analysis

- Root Cause Analysis for MMWR Market

- Recent Developments Analysis

- Industry Risk Assessment

- Growth Outlook

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Volume (Million Units) Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2037, By

- Frequency Band, Value (USD Million), Volume (Million Units)

- 24GHz

- 60GHz

- 76/79GHz

- Component, Value (USD Million)

- Antennas

- Transceivers

- Power Amplifiers

- Others

- Distance, Value (USD Million)

- Short range radar (up to 100 meters)

- Medium range radar (up to 200 meters)

- Long range radar (over 200 meters)

- Sensory Fusion Configuration, Value (USD Million)

- Radar + Camera

- Radar + LIDAR

- Others

- Application, Value (USD Million)

- Smart Home

- Consumer Electronics

- Healthcare

- Security and Surveillance Radar

- Drones

- Construction Machinery/Agricultural Machinery

- Others

- Regional Synopsis Value (USD Million), Volume (Million Units), 2024-2037

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Frequency Band, Value (USD Million), Volume (Million Units)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Volume (Million Units), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Frequency Band, Value (USD Million), Volume (Million Units)

- 24GHz

- 60GHz

- 76/79GHz

- Component, Value (USD Million)

- Antennas

- Transceivers

- Power Amplifiers

- Others

- Distance, Value (USD Million)

- Short range radar (up to 100 meters)

- Medium range radar (up to 200 meters)

- Long range radar (over 200 meters)

- Sensory Fusion Configuration, Value (USD Million)

- Radar + Camera

- Radar + LIDAR

- Others

- Application, Value (USD Million)

- Smart Home

- Consumer Electronics

- Healthcare

- Security and Surveillance Radar

- Drones

- Construction Machinery/Agricultural Machinery

- Others

- Country Level Analysis

- U.S.

- Canada

- Frequency Band, Value (USD Million), Volume (Million Units)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Volume (Million Units), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Frequency Band, Value (USD Million), Volume (Million Units)

- 24GHz

- 60GHz

- 76/79GHz

- Component, Value (USD Million)

- Antennas

- Transceivers

- Power Amplifiers

- Others

- Distance, Value (USD Million)

- Short range radar (up to 100 meters)

- Medium range radar (up to 200 meters)

- Long range radar (over 200 meters)

- Sensory Fusion Configuration, Value (USD Million)

- Radar + Camera

- Radar + LIDAR

- Others

- Application, Value (USD Million)

- Smart Home

- Consumer Electronics

- Healthcare

- Security and Surveillance Radar

- Drones

- Construction Machinery/Agricultural Machinery

- Others

- Country Level Analysis

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Frequency Band, Value (USD Million), Volume (Million Units)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Volume (Million Units), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Frequency Band, Value (USD Million), Volume (Million Units)

- 24GHz

- 60GHz

- 76/79GHz

- Component, Value (USD Million)

- Antennas

- Transceivers

- Power Amplifiers

- Others

- Distance, Value (USD Million)

- Short range radar (up to 100 meters)

- Medium range radar (up to 200 meters)

- Long range radar (over 200 meters)

- Sensory Fusion Configuration, Value (USD Million)

- Radar + Camera

- Radar + LIDAR

- Others

- Application, Value (USD Million)

- Smart Home

- Consumer Electronics

- Healthcare

- Security and Surveillance Radar

- Drones

- Construction Machinery/Agricultural Machinery

- Others

- Country Level Analysis

- China

- Japan

- India

- Australia

- South Korea

- Vietnam

- Thailand

- Singapore

- Malaysia

- Rest of Asia Pacific

- Frequency Band, Value (USD Million), Volume (Million Units)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Volume (Million Units), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Frequency Band, Value (USD Million), Volume (Million Units)

- 24GHz

- 60GHz

- 76/79GHz

- Component, Value (USD Million)

- Antennas

- Transceivers

- Power Amplifiers

- Others

- Distance, Value (USD Million)

- Short range radar (up to 100 meters)

- Medium range radar (up to 200 meters)

- Long range radar (over 200 meters)

- Sensory Fusion Configuration, Value (USD Million)

- Radar + Camera

- Radar + LIDAR

- Others

- Application, Value (USD Million)

- Smart Home

- Consumer Electronics

- Healthcare

- Security and Surveillance Radar

- Drones

- Construction Machinery/Agricultural Machinery

- Others

- Country Level Analysis

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Frequency Band, Value (USD Million), Volume (Million Units)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Volume (Million Units), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Frequency Band, Value (USD Million), Volume (Million Units)

- 24GHz

- 60GHz

- 76/79GHz

- Component, Value (USD Million)

- Antennas

- Transceivers

- Power Amplifiers

- Others

- Distance, Value (USD Million)

- Short range radar (up to 100 meters)

- Medium range radar (up to 200 meters)

- Long range radar (over 200 meters)

- Sensory Fusion Configuration, Value (USD Million)

- Radar + Camera

- Radar + LIDAR

- Others

- Application, Value (USD Million)

- Smart Home

- Consumer Electronics

- Healthcare

- Security and Surveillance Radar

- Drones

- Construction Machinery/Agricultural Machinery

- Others

- Country Level Analysis

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Frequency Band, Value (USD Million), Volume (Million Units)

- Overview

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

"

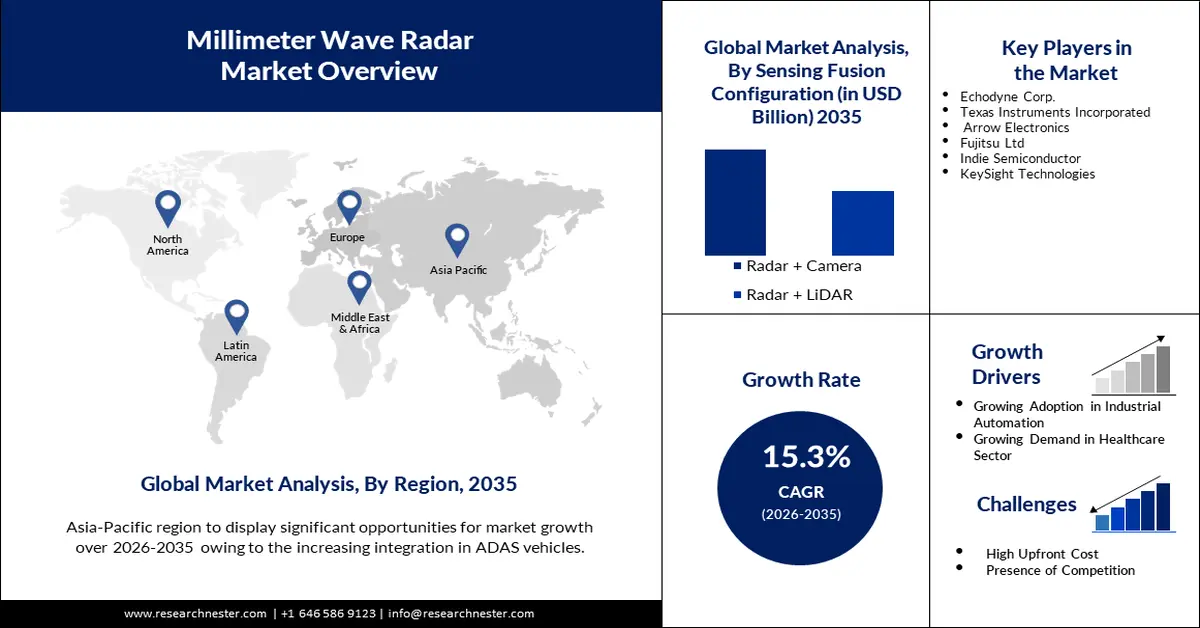

Millimeter Wave Radar Market Outlook:

Millimeter Wave Radar Market size was valued at USD 1.68 billion in 2025 and is expected to reach USD 6.98 billion by 2035, registering around 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of millimeter wave radar is evaluated at USD 1.91 billion.

The global market is witnessing strong growth, driven by rising demand for advanced driver-assistance systems (ADAS) in the automotive sector and increasing utilization in industrial automation. The technology enables high-resolution detection and enhanced accuracy, making it essential for applications requiring precision, such as autonomous vehicles and smart city infrastructures. An example of this can be seen in the collaboration of Keysight Technologies in March 2021 to establish a millimeter wave radar lab in Suzhou, China. This move promotes the development of technologies for autonomous driving and the better integration of mmWave radars into smart mobility solutions.

The government is also contributing to millimeter wave radar market growth through initiations. For instance, the U.S. Department of Transportation announced in August 2023 that it would provide radar technologies for highway safety improvement programs. This constitutes part of the expanded effort to mount mmWave radar systems in urban areas for enhanced safety, traffic flow management, and data collection in real time. Governments across the globe are also financing projects on mmWave to extend its application to telecommunications, defense, and public safety. This underlines the strategic importance of radar systems across sectors.

Key Millimeter Wave Radar Market Insights Summary:

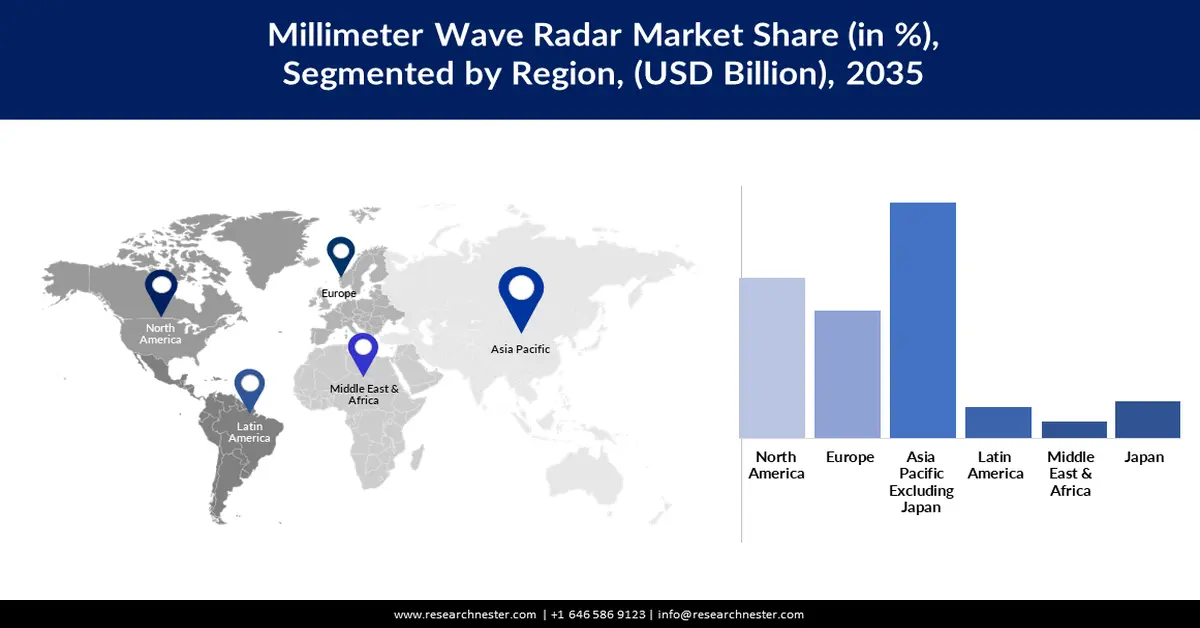

Regional Highlights:

- Asia Pacific millimeter wave radar market is anticipated to capture 48.70% share by 2035, driven by rapid urbanization and investments in digital infrastructure.

Segment Insights:

- The 76/79 ghz segment in the millimeter wave radar market is expected to hold a 45.80% share by 2035, fueled by the growing demand in the automotive sector for radar collision avoidance and lane-keeping.

- The radar + lidar segment in the millimeter wave radar market is forecasted to achieve a 45.5% share by 2035, attributed to enhanced detection capabilities and better object recognition in automotive applications.

Key Growth Trends:

- Expanding autonomous vehicle sector

- Rising applications in defense and security

Major Challenges:

- Environmental limitations

- Regulatory hurdles

Key Players: Novelic, Infineon Technologies AG, NXPSemiconductors, Minew Group, Texas Instruments Incorporated, Fujitsu, D3, Asahi Kasei Microdevices Corporation, Mistral Solutions Pvt. Ltd, DALIAN IFLABEL TECHNOLOGY CO., LTD.

Global Millimeter Wave Radar Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.68 billion

- 2026 Market Size: USD 1.91 billion

- Projected Market Size: USD 6.98 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Millimeter Wave Radar Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding autonomous vehicle sector: The adoption of rapid millimeter wave radar in autonomous vehicles is a key factor expected to drive global market growth. Radar technology provides the precise object detection and mapping required for safe and efficient autonomous driving. For example, in February 2021, Arrow Electronics and Jorjin Technologies launched a radar-sensing solution based on Infineon's XENSIV chip, enabling micro and macro motion detection. This innovation highlights the demand for radar technology that can adapt to varied driving conditions, accelerating adoption in the automotive sector.

-

Rising applications in defense and security: Millimeter wave radar technology finds increasing applications in defense and security due to its strong performance of detection amidst environmental variations. The focus on national security has created sizeable investments in this area. In October 2024, the U.S. Department of Defense awarded Raytheon Technologies a contract aimed at developing advanced millimeter wave radar systems with potential use in enhancing surveillance and reconnaissance operations.

- Increasing adoption in industrial automation: Applications of radar solutions using mmWave technology find increasing adoption in industries for areas like robotics, automation, and quality control. Aviat Networks, in January 2024, developed wireless connectivity and automation-related services in Indonesia together with PT Smartfren Telecom. These types of developments by companies reflect the speed at which radar is becoming an integral building block in industrial automation to facilitate real-time monitoring and operational efficiency.

Challenges

-

Environmental limitations: Environmental factors pose severe challenges to millimeter-wave radar systems, given the immense deterioration rain, fog, or even atmospheric conditions can cause to the quality of the signal and the range of effective detection. According to a report published by UC Davis in September 2023, more than a third of all failures in radar systems during adverse weather conditions were contributed by environmental interference, thus raising serious questions about reliability when these systems were in use for critical applications.

-

Regulatory hurdles: Spectrum allocation involves several regulatory challenges that may further discourage the growth of the millimeter wave radar market. Indeed, a number of delays are presented in the deployment of technologies through a balance by governments between technological advancement and public safety regulations. For example, in April 2024, the Federal Communications Commission (FCC) introduced new regulations aimed at subjecting all new millimeter wave technologies to wide testing and compliance checks before commercial deployment.

Millimeter Wave Radar Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 1.68 billion |

|

Forecast Year Market Size (2035) |

USD 6.98 billion |

|

Regional Scope |

|

Millimeter Wave Radar Market Segmentation:

Frequency Band Segment Analysis

Frequency band of 76/79 GHz segment is poised to hold millimeter wave radar market share of over 45.8% by the end of 2035. This band is preferred owing to its optimum suitability in automotive radar applications, especially in ADAS. Growth in this segment can be attributed to growing demand in the automotive sector for radar collision avoidance and lane keeping. For example, in February 2024, Ceragon launched its 76/79 GHz technology, embodied with high data rates and connectivity suitable for state-of-the-art automotive applications. This new technology enables seamless communication between vehicles and their surroundings, enhancing real-time situational awareness essential for autonomous navigation.

Sensing Fusion Configuration Segment Analysis

In millimeter wave radar market, Radar + LIDAR segment is likely to dominate revenue share of over 45.5% by 2035, due to the increase in enhanced detection capabilities over a wide range of automotive and industrial applications. A combination of radar with LIDAR better the recognition of objects and thus gives better depth perception, which is important in applications needing high accuracy. In July 2024, Sumitomo Electric presented its NEXUSEYE radar sensors for pedestrian detection. This product makes use of the fusion of radar and LIDAR technologies, hence showing its potential to enhance safety under critical conditions and drive the proliferation of these autonomous systems.

Our in-depth analysis of the global market includes the following segments:

|

Frequency Band |

|

|

Component |

|

|

Distance |

|

|

Sensing Fusion Configuration |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Millimeter Wave Radar Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific millimeter wave radar market is predicted to dominate revenue share of around 48.7% by the end of 2035. This is owing to rapid urbanization, increasing investments in digital infrastructure, and the rising population in countries such as India and China. Such factors add to the already steady deployment of 5G technology and smart city development as the determining factors. The increasing demand for affordable connectivity and automation in city infrastructure-especially in the automotive sector or telecommunication fields-relies on high-frequency radar systems that provide accurate data in real time.

Market growth in India is fueled by initiatives such as Digital India set up by the government to develop a strong digital framework. Moreover, in March 2024, Avant Technology announced an investment of USD 100 million in an AI-centric data center in India to further consolidate its local data processing and millimeter wave radar capabilities. This facility is expected to be fully operational by 2025, with a design to serve the automotive and telecommunications industries using state-of-the-art radar technologies, catering to the growing demand for high-speed, secure connectivity.

China also contributes a major share due to its massive manufacturing hubs and rapid technology development. Chuhang Technology has launched its new 60 GHz millimeter wave radar product suite at IAA Mobility 2023 in Germany for in-cabin sensing. This marked the first appearance on the international stage and reflected the impact companies in China are making in the radar market. The technology developed in partnership with emotion3D, aims to enhance driver monitoring systems with capabilities like drowsiness detection, underscoring China's leadership in automotive radar solutions and further solidifying its competitive position in Asia Pacific market.

North America Market Insights

North America millimeter wave radar market is projected to witness growth rate of around 26% from 2026 to 2035, owing to high demand for frequency bands in telecommunications, automotive, and military sectors. The U.S. and Canada are leading countries in the market due to their advanced technological infrastructure and further investment in 5G networks. Also, government initiatives and public-private partnerships for connectivity and smart infrastructure development in urban areas further boost the market growth.

The adoption of millimeter wave radar technology in the U.S. is driven by significant investment in 5G infrastructure and a strong emphasis on the development of autonomous vehicle technology. Furthermore, the market is defined by collaborations that have challenged the frontiers of telecommunications and radar. In December 2023, T-Mobile partnered with Qualcomm and Ericsson to achieve a record speed of 4.3 Gbps on the mmWave spectrum. This showcases the commitment of the country to offering modern telecommunications infrastructure using mmWave technology to satisfy the need for next-generation connectivity in urban and rural areas.

Canada also contributes to the growth of the North America mmWave radar market with its smart city development and advanced radar solutions for public safety. The country is also actively deploying radar technology in metropolitan infrastructures, with partnerships highlighting pedestrian safety and environmental resilience. Companies are developing sensors designed for correct pedestrian detection even in bad weather conditions, underlining Canada's commitment to using radar technology to improve citizens' safety and furthering smart city initiatives.

Millimeter Wave Radar Market Players:

- Novelic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Infineon Technologies AG

- NXPSemiconductors

- Minew Group

- Texas Instruments Incorporated

- Fujitsu

- D3

- Asahi Kasei Microdevices Corporation

- Mistral Solutions Pvt. Ltd

- DALIAN IFLABEL TECHNOLOGY CO., LTD.

Competition in the millimeter wave radar market is very high since there are a large number of global players who are competing and surviving based on their innovative capabilities and strategic partnerships. Some established companies in this market include Qualcomm, Ericsson, Fujitsu, Cisco, and Sumitomo Electric, all of which are rapidly investing in product development intending to meet the industry demand for radar technology in growth-oriented areas like automotive, telecommunication, and defense industries.

These companies also collaborate with government entities to drive technological advancements, reinforcing their market positions. For example, in January 2024, Suzhou-based Milliverse closed a Pre-A funding round led by Xinke Capital, raising significant funds to advance its 4D millimeter wave radar technology. This funding is expected to facilitate the development of high-resolution radar chips aimed at enhancing autonomous driving capabilities. Increased competition and investments in 4D radar imaging in China and other regions demonstrate the potential for growth in this market, along with current efforts by key leading players to maintain superiority in radar technology.

Here are some leading companies in the millimeter wave radar market:

Recent Developments

- In July 2024, Fujitsu Limited in partnership with Aeon Mall Co. Ltd., launched a pilot project using AI-powered millimeter-wave radar at Aeon Mall Ota. The system monitors incidents such as falls, misuse, and prolonged occupancy of inaccessible restrooms, enhancing safety and facility management.

- In February 2024, Infineon, FINGGAL LINK, and NEXTY Electronics announced a collaboration to develop an elderly safety monitoring system using 60 GHz millimeter-wave radar. This system enables non-contact monitoring of crucial health metrics like presence, respiration, heart rate, sleep patterns, and urinary incontinence, even through clothing.

- In January 2024, Texas Instruments introduced a new series of semiconductors to improve safety in the automotive sector. The AWR2544 77GHz mm-wave radar sensor chip supports advanced satellite radar systems, allowing for improved sensor fusion and decision-making in Advanced Driver Assistance Systems (ADAS).

- Report ID: 6145

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Millimeter Wave Radar Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.