GLOBAL MILITARY RADAR SYSTEMS MARKET

- INTRODUCTION

1.1. MARKET DEFINITION

1.2. MARKET SEGMENTATION

1.3. PRODUCT OVERVIEW

- ASSUMPTIONS AND ABBREVIATIONS

- RESEARCH METHODOLOGY

3.1. RESEARCH OBJECTIVE

3.2. SECOBDARY RESEARCH

3.3. PRIMARY RESEARCH

- EXECUTIVE SUMMARY - GLOBAL MILITARY RADAR SYSTEMS MARKET

- REGULATORY LANDSCAPE

- ANALYSIS OF MARKET DYNAMICS

6.1. GROWTH DRIVERS

6.2. KEY TRENDS

- KEY MARKET OPPORTUNITIES

- MAJOR ROADBLOCKS FOR THE MARKET GROWTH

- INDUSTRY RISK ANALYSIS

9.1. DEMAND RISK ANALYSIS

9.2. SUPPLY RISK ANALYSIS

- GLOBAL MILITARY RADAR SYSTEMS MARKET OUTLOOK

10.1. MARKET SIZE AND FORECAST, 2018-2027

10.1.1. BY VALUE (USD MILLION)

10.2. GLOBAL MILITARY RADAR SYSTEMS MARKET SEGMENTATION, 2018-2027

10.2.1. BY PLATFORM

- AIR-BASED, 2018-2027F (USD MILLION)

- GROUND-BASED, 2018-2027F (USD MILLION)

- NAVAL-BASED, 2018-2027F (USD MILLION)

- SPACE-BASED, 2018-2027F (USD MILLION)

10.2.2. BY RANGE

- LONG, 2018-2027F (USD MILLION)

- MEDIUM, 2018-2027F (USD MILLION)

- SHORT, 2018-2027F (USD MILLION)

- VERY SHORT, 2018-2027F (USD MILLION)

10.2.3. BY APPLICATION

- AIR-BORNE SURVEILLANCE, 2018-2027F (USD MILLION)

- AIR & MISSILE DEFENSE, 2018-2027F (USD MILLION)

- WEAPON GUIDANCE SYSTEMS, 2018-2027F (USD MILLION)

- GROUND SURVEILLANCE & INTRUDER DETECTION, 2018-2027F (USD MILLION)

- OTHERS, 2018-2027F (USD MILLION)

10.2.4. BY BAND TYPE

- VHF & UHF-BAND, 2018-2027F (USD MILLION)

- L, S, & C-BAND, 2018-2027F (USD MILLION)

- X-BAND, 2018-2027F (USD MILLION)

- KU, K, & KA-BAND, 2018-2027F (USD MILLION)

10.2.5. BY REGION

10.2.5.1. NORTH AMERICA MILITARY RADAR SYSTEMS MARKET, 2018-2027F (USD MILLION)

10.2.5.1.1. MARKET OVERVIEW

10.2.5.1.2. MARKET SIZE, 2018-2027F (USD MILLION)

10.2.5.1.3. ASSESSMENT OF MACROECONOMIC FACTORS

10.2.5.1.4. COUNTRY-WISE MILITARY SPENDING BY THE GOVERNMENTS (DEFENSE AUTHORITIES)

10.2.5.1.5. MARKET SEGMENTATION

- BY PLATFORM

- AIR-BASED, 2018-2027F (USD MILLION)

- GROUND-BASED, 2018-2027F (USD MILLION)

- NAVAL-BASED, 2018-2027F (USD MILLION)

- SPACE-BASED, 2018-2027F (USD MILLION)

- BY RANGE

- LONG, 2018-2027F (USD MILLION)

- MEDIUM, 2018-2027F (USD MILLION)

- SHORT, 2018-2027F (USD MILLION)

- VERY SHORT, 2018-2027F (USD MILLION)

- BY APPLICATION

- AIR-BORNE SURVEILLANCE, 2018-2027F (USD MILLION)

- AIR & MISSILE DEFENSE, 2018-2027F (USD MILLION)

- WEAPON GUIDANCE SYSTEMS, 2018-2027F (USD MILLION)

- GROUND SURVEILLANCE & INTRUDER DETECTION, 2018-2027F (USD MILLION)

- OTHERS, 2018-2027F (USD MILLION)

- BY BAND TYPE

- VHF & UHF-BAND, 2018-2027F (USD MILLION)

- L, S, & C-BAND, 2018-2027F (USD MILLION)

- X-BAND, 2018-2027F (USD MILLION)

- KU, K, & KA-BAND, 2018-2027F (USD MILLION)

- BY COUNTRY

- US, 2018-2027F (USD MILLION)

- CANADA, 2018-2027F (USD MILLION)

10.2.5.2. EUROPE MILITARY RADAR SYSTEMS MARKET, 2018-2027F (USD MILLION)

10.2.5.2.1. MARKET OVERVIEW

10.2.5.2.2. MARKET SIZE, 2018-2027F (USD MILLION)

10.2.5.2.3. ASSESSMENT OF MACROECONOMIC FACTORS

10.2.5.2.4. COUNTRY-WISE MILITARY SPENDING BY THE GOVERNMENTS (DEFENSE AUTHORITIES)

10.2.5.2.5. MARKET SEGMENTATION

- BY PLATFORM

- AIR-BASED, 2018-2027F (USD MILLION)

- GROUND-BASED, 2018-2027F (USD MILLION)

- NAVAL-BASED, 2018-2027F (USD MILLION)

- SPACE-BASED, 2018-2027F (USD MILLION)

- BY RANGE

- LONG, 2018-2027F (USD MILLION)

- MEDIUM, 2018-2027F (USD MILLION)

- SHORT, 2018-2027F (USD MILLION)

- VERY SHORT, 2018-2027F (USD MILLION)

- BY APPLICATION

- AIR-BORNE SURVEILLANCE, 2018-2027F (USD MILLION)

- AIR & MISSILE DEFENSE, 2018-2027F (USD MILLION)

- WEAPON GUIDANCE SYSTEMS, 2018-2027F (USD MILLION)

- GROUND SURVEILLANCE & INTRUDER DETECTION, 2018-2027F (USD MILLION)

- OTHERS, 2018-2027F (USD MILLION)

- BY BAND TYPE

- VHF & UHF-BAND, 2018-2027F (USD MILLION)

- L, S, & C-BAND, 2018-2027F (USD MILLION)

- X-BAND, 2018-2027F (USD MILLION)

- KU, K, & KA-BAND, 2018-2027F (USD MILLION)

- BY COUNTRY

- UK, 2018-2027F (USD MILLION)

- GERMANY, 2018-2027F (USD MILLION)

- ITALY, 2018-2027F (USD MILLION)

- FRANCE, 2018-2027F (USD MILLION)

- SPAIN, 2018-2027F (USD MILLION)

- RUSSIA, 2018-2027F (USD MILLION)

- REST OF EUROPE, 2018-2027F (USD MILLION)

10.2.5.3. ASIA PACIFIC MILITARY RADAR SYSTEMS MARKET, 2018-2027F (USD MILLION)

10.2.5.3.1. MARKET OVERVIEW

10.2.5.3.2. MARKET SIZE, 2018-2027F (USD MILLION)

10.2.5.3.3. ASSESSMENT OF MACROECONOMIC FACTORS

10.2.5.3.4. COUNTRY-WISE MILITARY SPENDING BY THE GOVERNMENTS (DEFENSE AUTHORITIES)

10.2.5.3.5. MARKET SEGMENTATION

- BY PLATFORM

- AIR-BASED, 2018-2027F (USD MILLION)

- GROUND-BASED, 2018-2027F (USD MILLION)

- NAVAL-BASED, 2018-2027F (USD MILLION)

- SPACE-BASED, 2018-2027F (USD MILLION)

- BY RANGE

- LONG, 2018-2027F (USD MILLION)

- MEDIUM, 2018-2027F (USD MILLION)

- SHORT, 2018-2027F (USD MILLION)

- VERY SHORT, 2018-2027F (USD MILLION)

- BY APPLICATION

- AIR-BORNE SURVEILLANCE, 2018-2027F (USD MILLION)

- AIR & MISSILE DEFENSE, 2018-2027F (USD MILLION)

- WEAPON GUIDANCE SYSTEMS, 2018-2027F (USD MILLION)

- GROUND SURVEILLANCE & INTRUDER DETECTION, 2018-2027F (USD MILLION)

- OTHERS, 2018-2027F (USD MILLION)

- BY BAND TYPE

- VHF & UHF-BAND, 2018-2027F (USD MILLION)

- L, S, & C-BAND, 2018-2027F (USD MILLION)

- X-BAND, 2018-2027F (USD MILLION)

- KU, K, & KA-BAND, 2018-2027F (USD MILLION)

- BY COUNTRY

- CHINA, 2018-2027F (USD MILLION)

- INDIA, 2018-2027F (USD MILLION)

- JAPAN, 2018-2027F (USD MILLION)

- SOUTH KOREA, 2018-2027F (USD MILLION)

- INDONESIA, 2018-2027F (USD MILLION)

- AUSTRALIA, 2018-2027F (USD MILLION)

- REST OF ASIA PACIFIC, 2018-2027F (USD MILLION)

10.2.5.4. LATIN AMERICA MILITARY RADAR SYSTEMS MARKET, 2018-2027F (USD MILLION)

10.2.5.4.1. MARKET OVERVIEW

10.2.5.4.2. MARKET SIZE, 2018-2027F (USD MILLION)

10.2.5.4.3. ASSESSMENT OF MACROECONOMIC FACTORS

10.2.5.4.4. COUNTRY-WISE MILITARY SPENDING BY THE GOVERNMENTS (DEFENSE AUTHORITIES)

10.2.5.4.5. MARKET SEGMENTATION

- BY PLATFORM

- AIR-BASED, 2018-2027F (USD MILLION)

- GROUND-BASED, 2018-2027F (USD MILLION)

- NAVAL-BASED, 2018-2027F (USD MILLION)

- SPACE-BASED, 2018-2027F (USD MILLION)

- BY RANGE

- LONG, 2018-2027F (USD MILLION)

- MEDIUM, 2018-2027F (USD MILLION)

- SHORT, 2018-2027F (USD MILLION)

- VERY SHORT, 2018-2027F (USD MILLION)

- BY APPLICATION

- AIR-BORNE SURVEILLANCE, 2018-2027F (USD MILLION)

- AIR & MISSILE DEFENSE, 2018-2027F (USD MILLION)

- WEAPON GUIDANCE SYSTEMS, 2018-2027F (USD MILLION)

- GROUND SURVEILLANCE & INTRUDER DETECTION, 2018-2027F (USD MILLION)

- OTHERS, 2018-2027F (USD MILLION)

- BY BAND TYPE

- VHF & UHF-BAND, 2018-2027F (USD MILLION)

- L, S, & C-BAND, 2018-2027F (USD MILLION)

- X-BAND, 2018-2027F (USD MILLION)

- KU, K, & KA-BAND, 2018-2027F (USD MILLION)

- BY COUNTRY

- BRAZIL, 2018-2027F (USD MILLION)

- MEXICO, 2018-2027F (USD MILLION)

- REST OF LATIN AMERICA, 2018-2027F (USD MILLION)

10.2.5.5. MIDDLE EAST & AFRICA MILITARY RADAR SYSTEMS MARKET, 2018-2027F (USD MILLION)

10.2.5.5.1. MARKET OVERVIEW

10.2.5.5.2. MARKET SIZE, 2018-2027F (USD MILLION)

10.2.5.5.3. ASSESSMENT OF MACROECONOMIC FACTORS

10.2.5.5.4. COUNTRY-WISE MILITARY SPENDING BY THE GOVERNMENTS (DEFENSE AUTHORITIES)

10.2.5.5.5. MARKET SEGMENTATION

- BY PLATFORM

- AIR-BASED, 2018-2027F (USD MILLION)

- GROUND-BASED, 2018-2027F (USD MILLION)

- NAVAL-BASED, 2018-2027F (USD MILLION)

- SPACE-BASED, 2018-2027F (USD MILLION)

- BY RANGE

- LONG, 2018-2027F (USD MILLION)

- MEDIUM, 2018-2027F (USD MILLION)

- SHORT, 2018-2027F (USD MILLION)

- VERY SHORT, 2018-2027F (USD MILLION)

- BY APPLICATION

- AIR-BORNE SURVEILLANCE, 2018-2027F (USD MILLION)

- AIR & MISSILE DEFENSE, 2018-2027F (USD MILLION)

- WEAPON GUIDANCE SYSTEMS, 2018-2027F (USD MILLION)

- GROUND SURVEILLANCE & INTRUDER DETECTION, 2018-2027F (USD MILLION)

- OTHERS, 2018-2027F (USD MILLION)

- BY BAND TYPE

- VHF & UHF-BAND, 2018-2027F (USD MILLION)

- L, S, & C-BAND, 2018-2027F (USD MILLION)

- X-BAND, 2018-2027F (USD MILLION)

- KU, K, & KA-BAND, 2018-2027F (USD MILLION)

- BY COUNTRY

- ISRAEL, 2018-2027F (USD MILLION)

- SAUDI ARABIA, 2018-2027F (USD MILLION)

- UAE, 2018-2027F (USD MILLION)

- SOUTH AFRICA, 2018-2027F (USD MILLION)

- REST OF MIDDLE EAST & AFRICA, 2018-2027F (USD MILLION)

- COMPETITIVE LANDSCAPE

11.1. DETAILED OVERVIEW

11.2. ASSESSMENT OF KEY OFFERINGS

11.3. ANALYSIS OF GROWTH STRATEGIES

11.4. EXHAUSTIVE ANALYSIS ON KEY FINACIAL INDICATORS

11.5. COMPANY PROFILES

11.5.1. LOCKHEED MARTIN CORPORATION

11.5.2. NORTHROP GRUMMAN CORPORATION

11.5.3. THALES GROUP

11.5.4. LEONARDO S.P.A.

11.5.5. SAAB AB

11.5.6. ELBIT SYSTEMS LTD.

11.5.7. BAE SYSTEMS

11.5.8. L3HARRIS TECHNOLOGIES, INC.

11.5.9. RAYTHEON COMPANY

11.5.10. IAI

11.5.11. ASELSAN

11.6 OTHER PROMINENT PLAYERS

11.5.12. HENSOLDT

11.5.13. TERMA

11.5.14. BHARAT ELECTRONICS LIMITED

11.5.15. INDRA

- STRATEGIC RECOMMENDATIONS

- INVESTMENT OPPORTUNITIES IN THE MARKET

- GEOGRAPHICAL OPPORTUNITIES

- LUCRATIVE COMPETITIVE OPPORTUNITIES

Military Radar Systems Market Outlook:

Military Radar Systems Market size was over USD 70.72 billion in 2025 and is estimated to reach USD 170.37 billion by the end of 2035, expanding at a CAGR of 8.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of military radar systems is estimated at USD 76.67 billion.

The primary factor driving the growth of the market is the increased investment of countries towards advancing their weapons and defence because of the rising threat of terrorism across the globe. Countries such as the USA, Russia and India are rapidly expanding their defence systems, leveraging the global technological development. The rising geopolitical tension has further pushed the countries to adopt modernised military radar systems that can effectively detect threats through air, land and water, enabling broader security measures for the country. Drones, hypersonic missiles and aerial vehicles often are miniatured which travels soundless and may challenge traditional military radar systems to detect such threats.

Advanced radar systems are capable of determining the object orientation, including the relative speed, size and type of threat. The U.S. Department of War, in December 2025, announced an investment of USD 18.5 million to strengthen the production capacity of silicon crystals, which are employed in optical lenses to detect both long-range and short-range targets. The military radar systems depend on optical lenses to generate pictures of the objects. This indicates a strong demand for optical lenses within the military radar systems market, expanding the market potential. In January 2026, the Defence Research and Development Organisation published a document claiming the strength of its indigenous AESA radar systems, equipped in Tejas fighter aircraft. The agency is planning for integration in various other fighter aircraft to enhance threat detection and focus on precision navigation.

Key Military Radar Systems Market Insights Summary:

Regional Highlights:

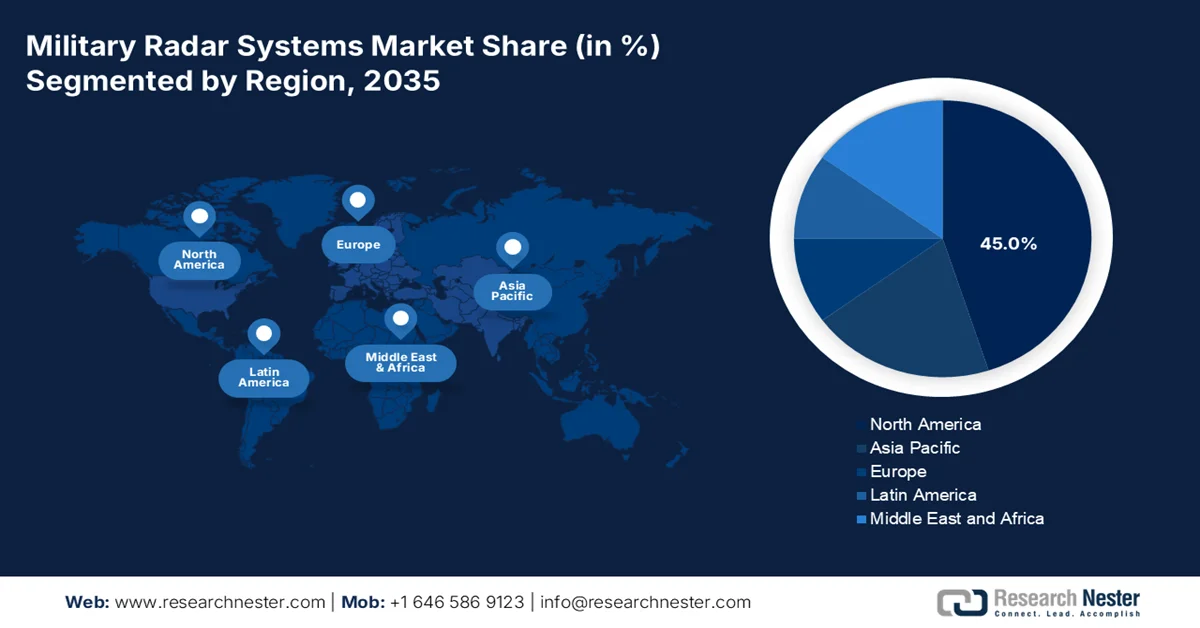

- The North America military radar systems market is projected to command a dominant 45% share by 2035, strengthened by sustained defense modernization investments and intensive R&D initiatives aimed at countering evolving terrorism threats.

- Asia Pacific is anticipated to secure the second-largest share by 2035, supported by expanding domestic production of sensors and semiconductor components amid rising geopolitical tensions.

Segment Insights:

- Airborne Segment: In the military radar systems market, the airborne segment is forecast to account for a leading 35% share by 2035, underpinned by widespread deployment across fighter jets and UAVs for high-precision airspace threat detection.

- 3D Radar System Segment: The 3D radar system segment is expected to register the highest share by 2035, driven by its capability to simultaneously track elevation, azimuth, and speed of multiple small and fast-moving targets.

Key Growth Trends:

- Modernisation of defence equipment

- Increasing demand for multi-function radars

Major Challenges:

- High development cost

- Supply chain constraints

Key Players: Thales Group (France), Lockheed Martin (U.S.), Raytheon Technologies (U.S.), Leonardo S.p.A. (Italy), Northrop Grumman (U.S.), BAE Systems (United Kingdom), Rheinmetall AG (Germany), Elbit Systems (Israel), Hensoldt (Germany), Saab AB (Sweden)

Global Military Radar Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 70.72 billion

- 2026 Market Size: USD 76.67 billion

- Projected Market Size: USD 170.37 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Russia, United Kingdom, France

- Emerging Countries: India, Japan, South Korea, Israel, Australia

Last updated on : 10 February, 2026

Military Radar Systems - Growth Drivers and Challenges

Growth Drivers

- Modernisation of defence equipment: Globally, countries are upgrading their defence equipments and technologies to meet the rising threat. The upgrade includes iteration in weaponry, surveillance, and radar systems that help minimise threats. AESA radars are widely being adopted by the regions as it provides precision and detailed information on a radar object, enhancing the defence decision-making. Countries such as China and the U.S. have rapidly updated their miliary system because of ongoing tension between the two countries. The Asian countries have leveraged the opportunity and advanced their military equipment, including radar systems, which significantly help in detecting threats and engaging targets with precision. The consistent tension between the two countries and their innovative development of the radar systems has significantly enhanced the growth of the market.

- Increasing demand for multi-function radars: Multi-function radars are also high in demand because of their capabilities in scanning a 60 degree angle, while tracking all the meteorological threats and assessing non-cooperative flights, which helps in enhancing the safety and surveillance of the airspace, land and water. After the integration of AI, radar systems are now backed by data and real-time tracking, enabling better synthesis of information. AI allows military radar systems to determine the threat level of an object, enabling better assessment and elimination. SPY-7 is one of the most advanced radar technology development by Lockheed Martin, with the potential to detect, track and launch ballistic missiles to engage multiple targets simultaneously. The SPY-7 can be integrated with other radars and platforms seamlessly that can be used remotely and manually. These advanced radars and their demand from countries across the globe are amplifying the growth of the market.

- Demand for autonomous systems: Demand for drones and unmanned UAVs has increased, leading to adoption in military radar systems, which are used to maintain strong surveillance that enhances the precision and quality of threat detection. The unmanned vehicles heavily depend on the radar systems that determine the target object's speed and location, enhancing defence precision. Systems such as AESA are developed to detect threats in the air, sea and land, enhancing the adoption in military aircraft, ships and ground weapons. India, China and Russia are massively investing in unmanned vehicles and aerial surveillance that utilises military radar systems because of rising threats from terrorism and asset damage. The growing innovation towards unmanned drones and UAVs has significantly increased the scope of the military radar systems market and propelled its growth.

Challenges

- High development cost: The cost of producing advanced military radar systems is often high, leading to limited adoption in the market. The complexity associated with the AESA and phased array technologies demands significant investment for research. The cost associated with the manufacturing often hinders the steady growth of the market, as certain countries may not be able to afford these systems. Defence agencies often have to rely on alternative radar systems, which are not as effective as modern ones.

- Supply chain constraints: Complex electronic materials, chips and sensors are subject to availability, which restricts the defence agencies from adopting military radar systems. The complexity of procuring the raw materials leads to a barrier in the adoption of the military radar systems market, thereby declining the growth. The demand from countries such as the U.S. and Russia is always high, which often reflects in a supply shortage for other countries, which further lowers the adoption.

Military Radar Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 70.72 billion |

|

Forecast Year Market Size (2035) |

USD 170.37 billion |

|

Regional Scope |

|

Military Radar Systems Market Segmentation:

Platform Segment Analysis

The airborne segment is expected hold the largest share of 35% by the end of 2035, owing to the large-scale use in fighter jets and unmanned aerial vehicles, which demand precision in detection and threat elimination. Aircraft such as F-35 Fighter and Typhoon are equipped with AESA radar system which can decode the location, speed and image of the threat, enabling better decision-making. Surveillance through drones and UAVs has increased, especially in countries such as the U.S., leading to a steady growth of the segment while expanding the market of military radar systems. Threat within the airspace has significantly increased, which is further propelling the growth of the segment, resulting in enhanced adoption of radar systems.

Dimension Segment Analysis

The 3D radar system is anticipated to hold the largest share by the end of 2035 due to the capability of determining elevation, azimuth and speed. The segment is also capable of detecting small objects, such as drones and UAVs, with accuracy. AESA systems employ 3D technology to measure various parameters and engage multiple threats at a time. Air and naval fleets employ the 3D technology that seamlessly provides information and data regarding the threat object. 3D radars are highly capable of detecting real time imageries while costing less than other segments, leading to wider adoption in the market.

Range Segment Analysis

The long-range radar systems segment is anticipated to hold the largest share in the market owing to their inclusion in long-range missile deployment. The long-range radars are also potentially useful in threat detection, enabling the war agencies to prepare for counterattacks. Long-range radar systems are engaged on the naval ships and submarines, which detect threats from long distances, enabling their wider adoption. The long-range military radar systems are capable of measuring a 250 to 1500 kms radius with early detection of drones and UAV systems, enabling greater preventive measures. The advancement of countries in nuclear power has driven the long-range segment further that is enhancing military radar systems.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Platform |

|

|

Component |

|

|

Dimensions |

|

|

Frequency |

|

|

Range |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Military Radar Systems Market - Regional Analysis

North America Market Insights

North America military radar systems market is expected to hold a market share of 45% by the end of the forecast period, owing to the large-scale investment in defence equipment and modernising them in order to stay ahead of the emerging terrorism. With the growing concern regarding the safety of the citizens and their assets, the war agencies are promoting the use of super-advanced ballistic missiles that demand sensors and radars to function effectively, boosting the growth of the market. The region is dominated by intense R&D, enabling the defence agencies to develop and manufacture modern defence equipment, which is fueling the growth of military radar systems in the region.

The U.S. has stepped up massively to modernise the defence systems to strengthen the naval fleet and fighter jets. It has developed AESA systems that are employed in fighter jets to enhance target detection and are widely used in stealth operations. The radar system is also quite potential to resist the network jamming and penetrating the coordinates. The SPY-6 radar systems are yet another major system used in U.S. Navy destroyers capable of detecting long and short-range missiles. The consistent investment and R&D within the defence equipment have supported the growth of the U.S. market.

Canada military radar systems market covers a large part of the Arctic, and under the sovereignty efforts, which demand active surveillance, within the region. The Canadian Air Force has integrated new radar systems that seamlessly detect threats and supports in long range missile launches. The Arctic and Northern regions are highly prone to threats, demanding the use of ultra-modern military systems. Canada has employed CP-140 Aurora aircraft that carries advanced radars and enhance the surveillance and counterattack measures, ensuring safety and security within the airspace.

APAC Market Insights

APAC is anticipated to hold a second position by the end of 2035, owing to the large-scale production of chips and sensors that are essential components for military radar system enhance the domestic production. The rising threat levels in certain countries have further propelled the growth of military radar systems. The geopolitical tension between the Asia Pacific and North America is a further driving factor, enhancing the market potential for military radar systems. The rising electronic manufacturing within the region is supporting the growth of new-age sensors and chips that can detect threats at an early stage, amplifying the Asia Pacific military radar systems market.

China military radar systems market is home to a high-tech long-range radar system known as Type 345 and 346, which can be integrated into multiple platforms, enhancing its use across the fighter ships and aircraft. The JY-27A is also quite promising in detecting missiles at an early stage and providing the agencies with an advanced countering measure. Moreover, the low cost of component manufacturing has further enabled the country to strengthen the market. A strong supply chain in the country has enhanced trade, where global manufacturers are relying on Chinese components to produce effective and cost-efficient products.

India’s tension in terms of terrorism is escalating with the passing time, leading to the adoption of various equipment and military radar systems, which enhance the defence measures. According to PIB. In March 2025, the Ministry of Defence declared a capital acquisition with BEL for the procurement of Low-level Transportable Radar, LLTR, worth Rs 2,906 crore. India is advancing anti-drone equipment that can effectively eliminate the rising threat. The rising investment from the government and inclusion of war budgets within financial planning assures the dynamic and innovative defence systems, hence, boosting the India military radar systems market.

Europe Market Insights

Europe market for military radar systems is influenced by NATO's decisions. The agency decides and looks after the defence equipment and the military systems for its member countries, which significantly enhances the market for military radar systems. The demand is further being pushed by the EU regulation, which encourages the defence agencies to advance their equipment and systems to stay competitive and minimise threats from modern-day attacks. The region has developed its own Ground Master 400, capable of detecting missiles and other objects from a far distance. The capability of detecting multiple targets simultaneously has enhanced the scope of Europe market.

Germany has accelerated the use of MEADS (Medium Extension Air Defence System), a multifunctional radar that can detect ballistic missiles and drones, enhancing the safety and security of the airspace. The country has also installed Smart L radar, which is capable of long-range surveillance and missile defence capabilities, with an aim to strengthen the naval and maritime forces. Germany military radar systems market has also employed AESA systems for ground-based missile detection systems, which can detect and assess the missiles and their dimensions, enhancing the market scope for military radar systems.

The UK holds one of the most sophisticated defence agencies, demanding ultra-modern equipment for its naval and fighter jet fleet. It has adopted the Type 1045 radar systems, which are developed in an AESA system and are capable of detecting electronic warfare. The target detection capability of the radar system surpasses any other technology as it detects low-flying objects effectively. The UK, being a country with a large population and multiple industries, is often a target for which the need for advanced radar systems is high and therefore the UK market is expanding rapidly.

Key Military Radar Systems Market Players:

- Thales Group (France)

- Lockheed Martin (U.S.)

- Raytheon Technologies (U.S)

- Leonardo S.p.A. (Italy)

- Northrop Grumman (U.S.)

- BAE Systems (United Kingdom)

- Rheinmetall AG (Germany)

- Elbit Systems (Israel)

- Hensoldt (Germany)

- Saab AB (Sweden)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thales Group: The business is one of the pioneers in the aerospace and defence equipment, with a strong focus on military radar systems. The business specialises in air defence and missile defence, and is one of the core developers of phased array radar systems. The business has a global footprint with services across major countries, where it sells radars and other defence equipment.

- Lockheed Martin: One of the largest defence contractors across the globe, also a key player in the manufacturing and development of radar systems such as AESA. The business had made significant innovations within the air and missile defence systems, enhancing its position in the global competitiveness. Apart from manufacturing aircraft and its components, the business is also engaged in space missions where they develop rocket and propulsion systems.

- Raytheon Technologies: The business is a major player in the missile and air threat detection system, which has developed products for various platforms, including naval and fighter aircraft fleets. The business has a global footprint, where it served major countries with its products. Pratt and Whitney, a subsidiary of Raytheon Technologies, manufactures next-generation propulsion systems aimed towards enhancing fuel efficiency and performance.

- Leonardo S.p.A.: An Italian aerospace and defence organization that has a strong focus on military radar systems and target tracking devices. The modularity and scalability of the radar systems of the business enhance the safety and precision in threat detection. Apart from radars and communication technologies, the business is also a leading manufacturer of security systems and devices.

- BAE Systems: A prominent player in the global defence equipment market that provides and develops radar systems for naval, air and ground support. It has also supported multiple space programs through its ultra-modern radar systems. The business is also a leader in cyber defence, where it serves as an intelligence agency that ensures the safety and security of the nation at the ground level.

The players operating in the global military radar systems market are expected to face intense competition during the forecast timeline. The market is associated with both established key players and new entrants. However, the market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialised manufacturers maintain a competitive landscape in the market. Key players in the market are significantly supported by the governments for research and innovation.

Corporate Landscape of Military Radar Systems Market:

Recent Developments

- In January 2026, RTX Raytheon was awarded a USD 197 million contract for Poland's airborne reconnaissance system. The contract includes 6 different reconnaissance pods, embedded with AI and machine learning, that will further enhance the capabilities of the radars.

- In October 2025, the Thales Group announced the launch of AURORE as a part of the ARES program aiming to watch the satellites and debris in low orbit from the earth.

- Report ID: 2303

- Published Date: Feb 10, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Military Radar Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.