Migraine Nasal Spray Market Outlook:

Migraine Nasal Spray Market size was valued at USD 574.2 million in 2025 and is projected to reach USD 1.07 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., 2026 2035. In 2026, the industry size of the migraine nasal spray is estimated at USD 611.8 million.

The market is growing extensively on account of continued innovations in drug classes such as CGRP receptor antagonists, improvements in intranasal delivery technologies, and growing patient demand for non-oral treatment solutions. Testifying this, the article published by the National Institute of Health in July 2024 revealed that migraine affects around 12% of the total world’s population, wherein higher occurrence is registered in women up to 17% when compared to men, around 6% thereby positively impacting market progression.

Furthermore, the aspect of payer-driven factors, including formulary placement, negotiated discounts, and patient cost-sharing structures, is also an influential factor for this landscape. In this regard, the Association of Migraine Disorders in October 2023 revealed that healthcare costs, prescription drugs, and productivity losses due to migraine are around USD 36 billion annually in the U.S. alone. Hence, such instances underscore the necessity for timely access to reduce both medical expenses and workplace productivity losses.

Key Migraine Nasal Spray Market Insights Summary:

Regional Highlights:

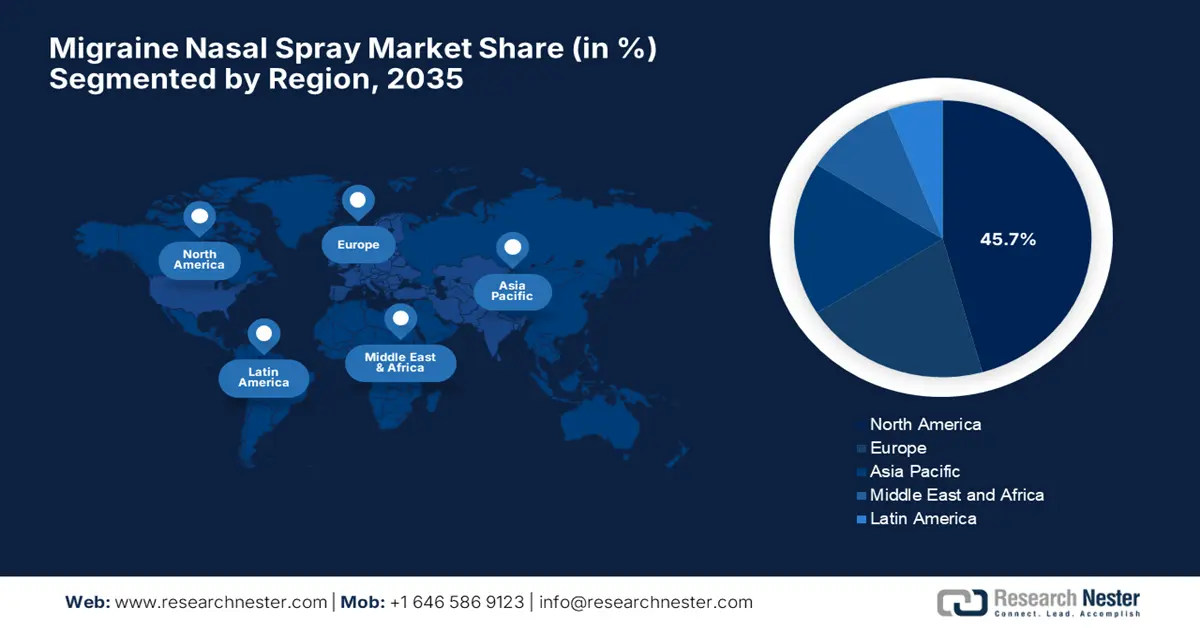

- North America is projected to hold the largest 45.7% share of the migraine nasal spray market by 2035, owing to supportive payer reimbursement frameworks and accelerated U.S. FDA approval processes.

- Asia Pacific is expected to witness the fastest expansion through 2035, stimulated by the rising prevalence of neurological disorders and improving urban healthcare accessibility.

Segment Insights:

- The acute treatment segment is anticipated to account for 72.3% share of the migraine nasal spray market by 2035, propelled by the urgent need to alleviate migraine attacks rapidly and restore patient functionality.

- The retail pharmacies segment is projected to secure 55.7% market share by 2035, fueled by the growing integration of retail outlets into national healthcare supply chains enhancing access to essential medicines.

Key Growth Trends:

- Advancements in drug formulations and delivery technologies

- Increasing preference for non-oral and fast-acting therapies

Major Challenges:

- High development costs and regulatory hurdles

Key Players: Pfizer Inc., GlaxoSmithKline plc (GSK), Eli Lilly and Company, Novartis AG, Teva Pharmaceutical Industries Ltd., Hikma Pharmaceuticals PLC, Dr. Reddy's Laboratories Ltd., Sun Pharmaceutical Industries Ltd., Cipla Limited, Mylan N.V. (Part of Viatris), Aurobindo Pharma Limited, Amneal Pharmaceuticals, Inc., Lupin Limited, Ajanta Pharma Limited, Bausch Health Companies Inc., Upsher-Smith Laboratories, LLC, Cadila Healthcare Ltd. (Zydus), Endo International plc, Takeda Pharmaceutical Company Limited, ASML Holdings N.V.

Global Migraine Nasal Spray Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 574.2 million

- 2026 Market Size: USD 611.8 million

- Projected Market Size: USD 1.07 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Australia, Brazil, Mexico

Last updated on : 26 September, 2025

Migraine Nasal Spray Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in drug formulations and delivery technologies: The aspect of treatment efficacy and patient experience due to such factors caters to wider adoption of migraine nasal spray industry internationally. For instance, in July 2025, Aptar Pharma notified that it had launched its Freepod nasal spray pump, which is made with 52% bio-based feedstock, marking its first delivery system using renewable materials globally. Besides, the pump, used with Haleon’s Otrivin brand, combines with a mass balance-produced bottle to achieve 60% circular material content for the full device.

- Increasing preference for non-oral and fast-acting therapies: Since most migraine patients suffer from nausea and vomiting, this can limit the effectiveness of oral medications; therefore, there is a growing preference for rapid-onset treatments. According to an NIH article published in July, there has been a strong patient and physician preference for oral drug delivery platforms, wherein surveys and clinical trials showed that most patients, including those on frequent injections, prefer oral alternatives despite potentially increased dosing frequency.

- Emergence of CGRP antagonist therapies: The introduction and approval of migraine-specific nasal sprays targeting pathways such as the calcitonin gene-related peptide receptor have opened new avenues for effective treatment in this field. In October 2022, Pfizer announced that it had finalized its USD 11.6 billion acquisition of Biohaven Pharmaceuticals, acquiring its breakthrough CGRP portfolio, including NURTEC ODT (rimegepant), a dual-use therapy that is approved for both acute and preventive migraine treatment.

Global Prevalence of Headache Disorders (2021)

|

Parameter |

Statistic / Information |

|

Global population affected |

Approximately 40% (3.1 billion people in 2021) |

|

Gender prevalence |

More common in females than in males |

|

Ranking among neurological conditions |

Top 3 for most age groups (from age 5 to 80) |

|

Geographic distribution |

Worldwide, it affects all races, income levels, and regions. |

Source: WHO

Health Care Costs & Quality of Life in U.S Migraine Patients Vs Non-Migraine Patients from a 2 Year Study

|

Parameter |

Detail |

Non-Migraine Patients |

|

Marginal Total Health Care Expenditures |

USD 6,078.56 higher (95% CI: USD 4,618.45 – USD 8,141.34) |

Baseline |

|

Physical Component Summary (PCS) Score |

39.79 |

42.15 |

|

Mental Component Summary (MCS) Score |

46.63 |

49.95 |

|

Adjusted PCS Score Difference |

2.14 units lower (95% CI: 1.17 - 4.55) |

- |

|

Adjusted MCS Score Difference |

3.19 units lower (95% CI: 2.51 - 6.07) |

- |

|

Key Cost Driver |

Prescription drugs account for nearly half of the overall cost. |

- |

Source: JMCP, 2024

Challenges

- High development costs and regulatory hurdles: This is one of the major challenges in the market, creating hesitation among small-scale manufacturers to make investments in this field. The factors such as substantial investment in research, clinical trials, and regulatory approvals, safety, efficacy, and consistent delivery performance have caused an ultimate delay to exclusive product innovations.

Migraine Nasal Spray Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 574.2 million |

|

Forecast Year Market Size (2035) |

USD 1.07 billion |

|

Regional Scope |

|

Migraine Nasal Spray Market Segmentation:

Treatment Segment Analysis

Based on treatment, the acute treatment segment is projected to garner the largest revenue share of 72.3% in the migraine nasal spray market during the forecast period. The dominance of this segment is the immediate and high unmet need to diminish migraine attacks after they start restoring patient function. Also, the fast-acting nature of nasal sprays is highly essential for acute care, which is constantly fostering a favorable business environment for the migraine nasal spray industry.

Distribution Channel Segment Analysis

In terms of the distribution channel, the retail pharmacies segment is projected to attain a lucrative share of 55.7% in the market by the end of 2035. In July 2022, GH Supply Chain noted that Retail pharmacies are playing an increasingly vital role in medicine access across low- and middle-income countries, often filling critical gaps left by under-resourced public healthcare systems. As highlighted by the MTaPS program, incorporating retail pharmacies into national supply chains can enhance access to essential medicines, particularly where government distribution falls short.

Drug Class Segment Analysis

Based on drug class, the CGRP antagonist segment is anticipated to capture a significant share of 48.5% in the migraine nasal spray market during the discussed timeframe. The growth in the segment originates from its superior efficacy and targeted mechanism when compared to fewer cardiovascular contractions when compared to triptans. In August 2025, Teva Pharmaceuticals Industries reported that the U.S. FDA approved an expanded indication for its AJOVY (fremanezumab-vfrm), making it the first anti-CGRP treatment approved for preventive use in children and adolescents with episodic migraine.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Treatment |

|

|

Distribution Channel |

|

|

Drug Class |

|

|

Type |

|

|

Patient Type |

|

|

Formulation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Migraine Nasal Spray Market - Regional Analysis

North America Market Insights

North America is predicted to garner the highest share of 45.7% by the end of 2035, owing to the payer reimbursement policies and fast-track U.S. FDA approvals. In March 2023, Vistagen was granted a U.S. patent for PH80, its investigational pherine-based nasal spray for the treatment of migraine, extending protection through at least 2040. The firm also underscored that PH80 offers a novel, non-systemic mechanism of action targeting the olfactory bulb and related brain pathways, hence suitable for overall market growth.

The U.S. is augmenting its leadership in the regional migraine nasal spray market, effectively propelled by increasing funding grants and a supportive regulatory environment. In 2024, the Headache & Migraine Competitive Grant Program reported that it allocates funds to innovative projects to improve migraine and headache care, thereby enhancing diagnosis, treatment, safety, and equity, excluding lab research and clinical trials. It also stated that in 2024, it awarded up to USD 250,000 for two-year projects, hence providing an encouraging opportunity for pioneers.

The market in Canada is witnessing astounding growth, bolstered by the burgeoning prevalence of migraine, government healthcare investments, and growing awareness of preventive healthcare. In this regard, in June 2025, Pfizer Canada, together with Migraine Canada and Migraine Quebec, reported that it had launched the second year of the Out of Office for Migraine Awareness campaign during Migraine Awareness Month, i.e., June. It also stated that the initiative encourages workplaces in the country to use an out-of-office alert for four hours, the typical duration of a migraine, to raise awareness and reduce stigma.

Funding and Economic Impact Data on Migraine Research and Care in the U.S

|

Metric |

Amount |

Notes |

|

NIH total budget (2023) |

Nearly USD 48 billion |

Total NIH budget for 2023 |

|

NIH funding for headache disorder research |

USD 59 million |

Allocated in 2023 |

|

Cap on indirect costs by NIH |

15% |

New policy limit on indirect costs |

|

Previous indirect costs by some universities |

Over 50% |

Used to negotiate for indirect costs |

|

The cost to the US economy from migraine. |

USD 78 billion |

Annual healthcare and lost productivity costs |

Source: MSC

APAC Market Insights

Asia Pacific is set to register the fastest growth in the migraine nasal spray market during the analyzed timeframe. The rapid upliftment is readily facilitated by neurological disease burdens and urban healthcare access. In December 2024, ARS Pharmaceuticals announced that its licensing partners in China, Japan, and Australia have filed for regulatory approval of neffy (epinephrine nasal spray) 2 mg in their respective countries, which offers a needle-free, easy-to-use, and compact alternative with a long shelf life for Type I allergic reactions, including anaphylaxis, which can cause a migraine.

China is gaining enhanced traction in the regional market owing to the increasing healthcare investments, rising awareness of migraine disorders, and the adoption of advanced treatment solutions. The urban pollution in cities and cases of stress escalation have also propelled the sale of migraine nasal sprays amongst the population. Besides, the market also benefits from the increasing volume of the patient population and emerging reimbursement policies; hence, all of these factors will responsibly uplift the market growth in the country.

India has become the target landscape for most investors involved in the migraine nasal spray market due to the increasing awareness about migraine as a serious health condition and the expanding healthcare infrastructure. For instance, in May 2023, Dr. Reddy’s Labs received approval from CDSCO to manufacture and market Sumatriptan Nasal Spray 10 mg/0.1 ml for the acute treatment of migraine attacks with or without aura, hence suitable for standard market growth.

Europe Market Insights

Europe in the migraine nasal spray market is expected to grow at a notable pace, extensively backed by a surge in diagnosis rates and an increasing aging population. The initiatives taken from the European Health Data Space have fueled the market access for launching novel formulations. In June 2023, Vistagen announced that the Patent Office in the region intends to grant a patent for its PH80 nasal spray, which is a rapid-onset investigational treatment for migraine, with protection extending to at least 2040, hence denoting a positive market outlook.

The market in Germany is also expected to grow significantly over the forecasted years, supported by government spending and favorable policies for the market players. Besides, the country’s decentralized models for healthcare are accelerating the reimbursement policies for advanced therapies. Further, the usage of telemedicine has also mushroomed in the post-pandemic era, bolstering the market growth, particularly in elderly patients.

In the UK, the National Health Service has expanded the facilities for medication for migraine treatment and increased collaborations between firms, which is readily bolstering success in the migraine nasal spray market. For instance, in January 2025, CNX Therapeutics expanded its European CNS portfolio by securing exclusive rights to market Sumatriptan Alginate Film, a novel migraine treatment, across major markets in the region, hence elevating the sector’s growth in the country.

Key Migraine Nasal Spray Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline plc (GSK)

- Eli Lilly and Company

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Hikma Pharmaceuticals PLC

- Dr. Reddy's Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Cipla Limited

- Mylan N.V. (Part of Viatris)

- Aurobindo Pharma Limited

- Amneal Pharmaceuticals, Inc.

- Lupin Limited

- Ajanta Pharma Limited

- Bausch Health Companies Inc.

- Upsher-Smith Laboratories, LLC

- Cadila Healthcare Ltd. (Zydus)

- Endo International plc

- Takeda Pharmaceutical Company Limited

- ASML Holdings N.V.

The global market for migraine nasal spray is extremely consolidated, wherein the top five players, such as Pfizer, GSK, Eli Lilly, and Teva, have captured the dominant revenue shares. The competency in this landscape emerges from R&D focused on next-generation CGRP antagonists and improved delivery systems for faster efficacy. Besides, the established organizations in this sector are facing strong competition from generic manufacturers such as Hikma and Dr. Reddy’s, owing to the affordability aspects.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In April 2025, Satsuma Pharmaceuticals notified that it received the U.S. FDA approval of Atzumi, which is the first and only dihydroergotamine nasal powder for the acute treatment of migraine in adults, delivered via a compact, user-friendly device.

- In March 2023, Pfizer reported that it received the U.S. FDA clearance for its ZAVZPRET (zavegepant) as the first and only CGRP receptor antagonist nasal spray for acute migraine treatment in adults.

- Report ID: 4059

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Migraine Nasal Spray Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.