Microdermabrasion Devices Market Outlook:

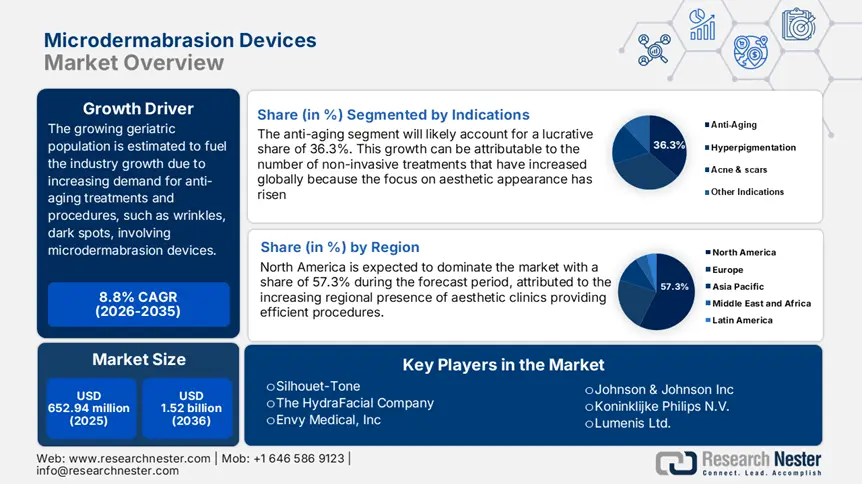

Microdermabrasion Devices Market size was valued at USD 652.94 million in 2025 and is likely to cross USD 1.52 billion by 2035, registering more than 8.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of microdermabrasion devices is assessed at USD 704.65 million.

The market demonstrates robust expansion, owing to the heightened patient demand for less invasive facial cosmetic procedures with maximum cutaneous rejuvenation and minimum convalescence, driving market progress. For instance, in February 2025, Cynosure Lutronic announced Health Canada Approval for XERF. It is a cutting-edge radio frequency gadget that will revolutionize skin tightening procedures, and a revolutionary non-invasive skin renewal therapy that tightens skin without the need for needles, numbing, or recovery time.

In addition, heightened consumer education about cutting-edge dermatologic therapy and further societal focus on maintaining a youthful visage, especially in a growing geriatric population, further propel the market. For instance, in February 2025, Crown Laboratories, Inc. announced the launch of Peptide Plump Collagen Cushion Cream, a revolutionary addition to its current peptide plump collection, under its premium skincare brand StriVectin. By combining state-of-the-art peptide technology, this creative skincare product addresses indications of aging, helps restore skin volume, and visibly smoothes the appearance of wrinkles.

Key Microdermabrasions Devices Market Insights Summary:

Regional Highlights:

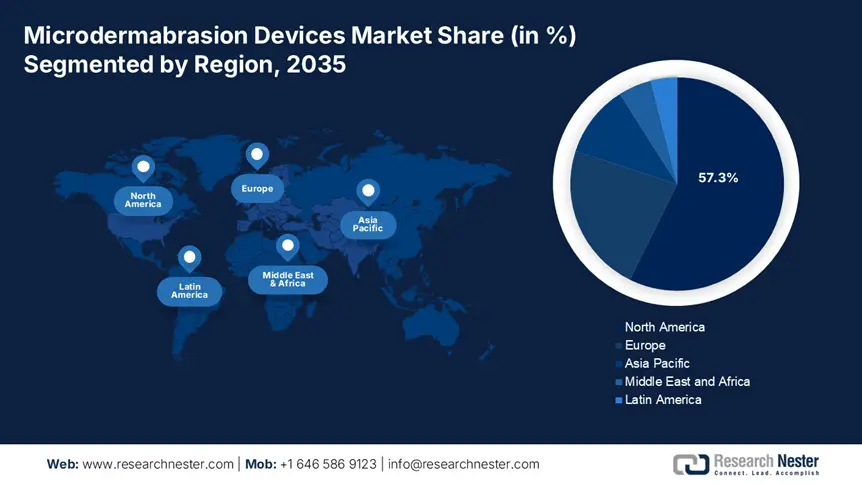

- North America dominates the Microdermabrasion Devices Market with a 57.3% share, fueled by demand for anti-aging products and non-invasive aesthetic treatments, supporting strong growth through 2035.

- The Asia Pacific region is poised for the fastest growth in the Microdermabrasion Devices Market from 2026 to 2035, driven by rising skin concerns like acne and hyperpigmentation, alongside medical tourism.

Segment Insights:

- Crystal Microdermabrasion Devices segment are projected to dominate the market from 2026 to 2035, driven by advanced AI integration and ultra-rapid self-healing capabilities enhancing performance and durability.

- The Anti-Aging segment of the Microdermabrasion Devices Market is expected to achieve a 36.3% share from 2026 to 2035, driven by the rising number of anti-aging and face rejuvenation procedures.

Key Growth Trends:

- Rising global prevalence of skin conditions

- Integration of synergistic technologies

Major Challenges:

- High cost of professional procedures and devices

- Potential side effects and risks

- Key Players: Johnson & Johnson Inc., Koninklijke Philips N.V., Lumenis Ltd, Advanced Microderm Inc., and more.

Global Microdermabrasions Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 652.94 million

- 2026 Market Size: USD 704.65 million

- Projected Market Size: USD 1.52 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (57.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, France, China

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 12 August, 2025

Microdermabrasion Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Rising global prevalence of skin conditions: The escalation in the global incidences of various dermatological conditions, ranging from acne and hyperpigmentation to photoaging, is driving the microdermabrasion devices market considerably. For instance, as per WHO statistics in March 2023, an estimated 1.8 billion people were afflicted with skin diseases, which is the most common cause of illness in tropical and resource-poor environments. In addition, as per AAD in February 2025, approximately 50 million Americans suffer from acne each year, making it the most prevalent skin ailment in the country. Between the ages of 12 and 24, over 85% of people have at least mild acne. Moreover, 10% of Americans suffer from atopic dermatitis.

- Integration of synergistic technologies: The market continues to grow, due to the synergistic combination of microdermabrasion modalities such as LED light or hydradermabrasion, so that multiple skin conditions are addressed at a single visit with improved overall outcome for the patients. For instance, in June 2022 2022, LightStim introduced Elipsa, their advancement in LED light therapy, which effortlessly combines with Syndeo, BeautyHealth's next-generation HydraFacial device. The new LightStim Elipsa improves treatment outcomes and the provider experience. These technologies fulfill the increasing need for non-surgical cosmetic treatment and customized skin therapy treatments, thus encouraging market growth.

Challenges

-

High cost of professional procedures and devices: The microdermabrasion devices market is deterred by the major obstacle of a high price being charged by professional-grade equipment. The advanced technology and robust engineering that go into the equipment, added to stringent regulatory demands and the necessity for highly skilled practitioners, make them costlier. High initial investment is intimidating for small skin clinics, independent aestheticians, and start-ups, respectively, in effect hindering their ability to offer microdermabrasion treatments. Consequently, microdermabrasion could be considered an expensive skin care treatment.

- Potential side effects and risks: The market also faces challenges concerning potential side effects and complications that need to be appropriately balanced by producers as well as consumers. Familiar short-term effects such as redness, swelling, bruising, and increased sensitivity of the skin post-treatment will deter people from opting for such treatments. Risks involve skin pigmentation (hyper- or hypopigmentation) and infection risk, and rarely, scarring, particularly if devices are used inappropriately or on unwanted skin. Additionally, pre-existing conditions like rosacea, eczema, or active infections restrict candidates from undergoing microdermabrasion, limiting the market size.

Microdermabrasion Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 652.94 million |

|

Forecast Year Market Size (2035) |

USD 1.52 billion |

|

Regional Scope |

|

Microdermabrasion Devices Market Segmentation:

Indications (Anti-Aging, Hyperpigmentation, Acne & scars)

Based on the indications, the anti-aging segment is expected to dominate in the microdermabrasion devices market, with 36.3%. This evolution is anticipated to be driven by the rising number of anti-aging and face rejuvenation cosmetic operations and procedures among adults. For instance, in September 2023, globally, the volume of face rejuvenation treatments rose by 10.0% in 2022 compared to 2021, according to data from the International Society of Aesthetic Plastic Surgery (ISAPS) study. Since the last survey, both surgical and non-surgical treatments have increased (16.7% and 7.2%, respectively), with non-surgical procedures showing a notable increase of 57.8% over the previous four years.

Type (Diamond Microdermabrasion Devices, Crystal Microdermabrasion Devices)

The crystal microdermabrasion devices segment is anticipated to dominate the microdermabrasion devices market throughout the projected timeframe due to the incorporation of advanced artificial intelligence with dependable performance in harsh environments, and ultra-rapid self-healing capabilities. For instance, in February 2025, by creating a brand-new self-healing electronic skin (E-Skin) that heals itself in seconds after damage, researchers at Terasaki Institute have made significant progress in wearable health technology. The scientists have demonstrated unparalleled progress in E-Skin technology in a study published in Science Advances, with an over 80% recovery rate.

Our in-depth analysis of the global market includes the following segments:

|

Treatment Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Microdermabrasion Devices Market Regional Analysis:

North America Market Statistics

The microdermabrasion device market in North America is expected to dominate during the forecast timeline, i.e., from 2026 to 2035, with a notable share of 57.3%, due to an aged population that seeks to use anti-aging products. It is further fueled by the rising popularity of non-invasive aesthetic treatments, accompanied by high disposable incomes and an extensively developed industry of beauty and wellness. Besides, the presence of leading players and continuous technological advancements in microdermabrasion devices also contributes to the regional dominant market share and consistent growth.

The U.S. microdermabrasion devices market is likely to unveil lucrative growth opportunities owing to the manufacturer's capabilities to cater to the needs of customers with their innovative products. For instance, in September 2024, Merz Aesthetics introduced Ultherapy PRIME, a noninvasive, FDA-approved medical aesthetics procedure that offered a customized and long-lasting skin lift in a single session with no recovery time. It has been acknowledged as the Gold Standard for nonsurgical lifting because of its extensive clinical data, proven mechanism of action (MOA), and high patient satisfaction.

The Canada microdermabrasion device market is exponentially increasing its footprint, owing to the investigational studies being conducted across the country to comprehend the efficacy of the beauty products. For instance, in January 2025, a report unveiled by the NIH stated that the Canada HARMONY study assessed the psychosocial effects and level of pleasure associated with comprehensive, multimodal aesthetic treatment of the face and submental region. All 58 patients involved in the study were treated with medical-grade skincare products, onabotulinumtoxin A, and hyaluronic acid (HA) fillers over 12 months. The change from baseline on the FACE-Q Satisfaction with Facial Appearance Scale was the main outcome measure.

Asia Pacific Market Analysis

The microdermabrasion devices market in Asia Pacific is likely to witness the fastest growth during the stipulated timeframe, owing to the dermatological disorders such as acne and hyperpigmentation, which are fueling demand for reliable treatments for rejuvenating the skin. In addition, increased obsession with acne-free skin and mounting aesthetic consciousness among women demographics, particularly, are major growth factors for the market. Furthermore, augmenting the low-cost procedures and the boom in medical tourism across the region further energize market expansion.

In India market is likely to witness robust growth owing to the presence and expansion of strong key players in the market. They tend to discover the reliable and effective technologies and products to withstand their market abilities and position. For instance, in October 2024, Bepanthen made its debut in India to address the country's pervasive dry skin issues. According to dermatologists, about 1 in 2 consumers in the general public have dry skin. The need for specialist skincare products is highlighted by the fact that 88% of dermatologists attribute skin flare-ups to environmental causes.

The China microdermabrasion devices market is likely to flourish at a fast pace during the forecasted timeline due to the development of cutting-edge technologies and a focus on innovation for minimally invasive procedures. For instance, in October 2024, at its cutting-edge China Innovation Labs in Shanghai, the Estée Lauder Companies (ELC) held its Scientific Advisory Board (SAB) Meeting on the science of night for skin recovery. To examine the most recent cutting-edge research on the scientific connections between sleep, circadian rhythm, and skin recovery, this SAB brought together top external scientists and dermatologists from Asia. To further understand the integration of these findings into the product development process, ELC also led a roundtable discussion with delegates as part of the SAB.

Key Microdermabrasion Devices Market Players:

- Johnson & Johnson Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer

- Koninklijke Philips N.V.

- Lumenis Ltd

- Advanced Microderm Inc.

- Silhouet-Tone

- The HydraFacial Company

- Envy Medical, Inc

- Dermaglow

- Skin for Life

- Altair Instruments

The competitive environment of the microdermabrasion devices market is characterized by its concentration on global expansions to strengthen its position in international markets. This improves the dermatology portfolio and microdermabrasion device production, forming the competitive landscape in the global market. For instance, in April 2023, Dior Beauty partnered with the Beauty Health Company, the parent company of the Hydrafacial brand. The goal of the partnership was to provide the Hydrafacial experience with a customized 90-minute facial treatment called the Dior powered by Hydrafacial.

Here's the list of some key players:

Recent Developments

- In April 2024, Allergan Aesthetics announced the introduction of two new SkinMedica medicines from the company that makes BOTOX Cosmetic. The SkinMedica Pore Purifying Gel Cleanser and SkinMedica Acne Clarifying Treatment are skincare innovations that offer individuals with acne-prone skin balanced, efficient care.

- In March 2023, Lumenis Ltd. introduced a new postoperative care solution, M22 medical wound dressing, in partnership with Bloomage Biotech. The substance aided in satisfying the postoperative repair requirements of individuals seeking aesthetics following laser therapy.

- Report ID: 7619

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Microdermabrasions Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.