Microbiome Sequencing Market Outlook:

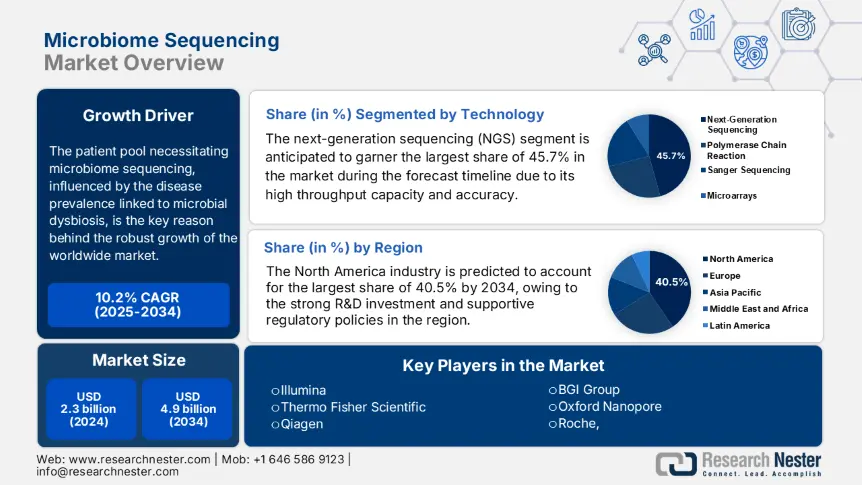

Microbiome Sequencing Market size was valued at USD 2.3 billion in 2024 and is projected to reach USD 4.9 billion by the end of 2034, rising at a CAGR of 10.2% during the forecast period, i.e., 2025-2034. In 2025, the industry size of microbiome sequencing is evaluated at USD 2.5 billion.

The patient pool necessitating microbiome sequencing, influenced by the disease prevalence linked to microbial dysbiosis, is the key reason behind the robust growth of the worldwide market. In this regard, the report from the National Institute of Health in 2024 revealed that 45.6% of autoimmune and metabolic disorders demonstrate microbiome involvement, wherein an estimated 20.5 million yearly patients undergo sequencing for diagnostic or therapeutic needs. The supply chain of microbiome sequencing can be characterized by the existence of specialized reagents, sequencing instruments, and bioinformatic tools, which are extensively sourced from the U.S., Germany, and China.

Furthermore, on the trade aspect, the U.S. International Trade Commission (USITC) in 2024 stated that there has been a 22.3% year-over-year increase in sequencing reagent imports in the tenure 2022 to 2024, wherein 75.5% of high-throughput sequencers were manufactured domestically. Besides the economic indicators, Producer Price Index (PPI) for sequencing reagents demonstrated an increase of 8.6% owing to the supply chain disruptions, whereas the Consumer Price Index (CPI) for clinical microbiome tests grew by 12.4% due to their heightened demand as of the U.S. Bureau of Labor Statistics 2024 report.

Microbiome Sequencing Market - Growth Drivers and Challenges

Growth Drivers

-

Advances in the next generation technologies: As advances progress, the growth in the market also expands at a rapid pace. Testifying to this, the NIH study states that AI-based metagenomics, such as its MG-RAST, reduces the analysis duration from weeks to hours, which is adopted by 70.6% of labs in the U.S. On the other hand, single-cell sequencing is currently identifying 95.6% of microbial strains, whereas it's only 60.7% with 16S RNA, as stated by the National Center for Biotechnology Information (NCBI).

-

Mutually beneficial partnerships: The pioneers and organizations in the market are readily implementing strategies to expand into the major revenue-generating nations. For instance, Illumina and the Mayo Clinic announced their partnership to sequence an estimated 1.5 million gut microbiomes by the end of 2026, thereby effectively boosting diagnostic accuracy by 60.5%. Simultaneously, Thermo Fisher made an investment of USD 500 million in portable sequencers with a prime focus on rural clinics based in India and Brazil.

-

Unaddressed demands in emerging markets: This is yet another driver allowing a profitable business environment in the market. As evidence Indian Council of Medical Research (ICMR) notes that 80.6% of IBS patients lack access in India, owing to the five times exacerbated costs when compared to other nations. Besides, in Japan Agency for Medical Research and Development (AMED) successfully fast-tracked 10 microbiome diagnostics, thereby addressing a 50.4% testing gap.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

2010 |

2015 |

2020 |

CAGR (2010-2020) |

|

The U.S. |

1.2 |

2.6 |

4.8 |

18.9% |

|

Germany |

0.6 |

1.3 |

2.1 |

19.9% |

|

France |

0.6 |

1.2 |

1.5 |

19.7% |

|

Spain |

0.5 |

0.9 |

0.9 |

21.7% |

|

Australia |

0.4 |

0.6 |

0.9 |

19.7% |

|

Japan |

0.7 |

1.3 |

2.3 |

17.9% |

|

India |

0.5 |

0.9 |

2.1 |

24.8% |

|

China |

0.7 |

2.1 |

4.3 |

23.3% |

Sources: NIH, Horizon 2020 Reports, MOST, ICMR, MHLW

Strategic Expansion Models Reshaping the Microbiome Sequencing Market

Feasibility Models for Market Expansion (2024-2030)

|

Region |

Strategy |

Revenue Impact |

Key Driver |

|

India |

Portable sequencer partnerships |

$150.6 million per year |

ICMR’s funding for rural clinics |

|

Germany |

AI-diagnostic reimbursement |

€300.8 million |

Digital Healthcare Act |

|

China |

Tier-2 hospital standardization |

$600.7 million |

MOST’s 2025 sequencing mandate |

|

U.S. |

Medicare oncology coverage |

$2.5 billion |

CMS 2024 liquid biopsy policy |

Sources: ICMR, BMG, MOST, CMS

Challenges

-

Confidentiality management: Despite its higher efficacy, the microbiome sequencing market experiences hurdles in the aspect of data privacy and GDPR compliance. In this regard, the EC states that in Europe General Data Protection Regulation imposes an exacerbated amount of €4.5 million per year in compliance costs for microbiome data handling. This makes it challenging for small-scale manufacturers. Therefore, Illumina embedded on-device encryption in its iSeq 100, which reduced the GDPR risks by a significant 40.7%.

-

Lack of skilled workforce: As advances continue to amplify, the microbiome sequencing market necessitates skilled professionals to operate the devices, which is quite a challenging factor in certain nations. As evidence, the World Health Organization survey in 2023 observed that 60.6% of gastroenterologists lack trust in these microbiological technologies due to the absence of standardization. Therefore, in 2024, Novogene conducted a clinician training program that increased test adoption by 35.5% in China.

Microbiome Sequencing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

10.2% |

|

Base Year Market Size (2024) |

USD 2.3 billion |

|

Forecast Year Market Size (2034) |

USD 4.9 billion |

|

Regional Scope |

|

Microbiome Sequencing Market Segmentation:

Technology Segment Analysis

The next-generation sequencing (NGS) segment is anticipated to garner the largest share of 45.7% in the microbiome sequencing market during the forecast timeline. The high throughput capacity, accuracy, and declining costs make this subtype dominant over this sector. Besides, these are ideal for large-scale microbiome studies wherein government initiatives such as the National Institute of Health’s Human Microbiome project significantly accelerate adoption. Also, the advancements in metagenomics and personalized medicine create an optimistic market opportunity.

Product Segment Analysis

The consumables segment is expected to attain a lucrative share of 38.5% in the microbiome sequencing market by the end of 2034. The growth in the segment originates from the heightened demand for sequencing kits, reagents, and sample preparation tools. Besides, there has been a rise in microbiome research funding, such as the EU’s Horizon 2020, and widespread clinical applications, reinforcing the consumables. Therefore, all of these aspects allow a steady cash influx, making the segment a strong revenue generator in this field.

Application Segment Analysis

The infectious disease diagnostics segment is predicted to grow at a considerable rate, with a share of 32.3% in the microbiome sequencing market during the discussed timeframe. The segment’s growth is attributed to the growing instances of antimicrobial resistance (AMR) and microbiome-based infections such as C. difficile. Besides, the study by the Centers for Disease Control and Prevention (CDC) revealed that microbiome sequencing is highly essential for outbreak tracking, hence positioning the segment at the forefront of boosting growth in the market.

Our in-depth analysis of the microbiome sequencing market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Product |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Microbiome Sequencing Market - Regional Analysis

North America Market Insights

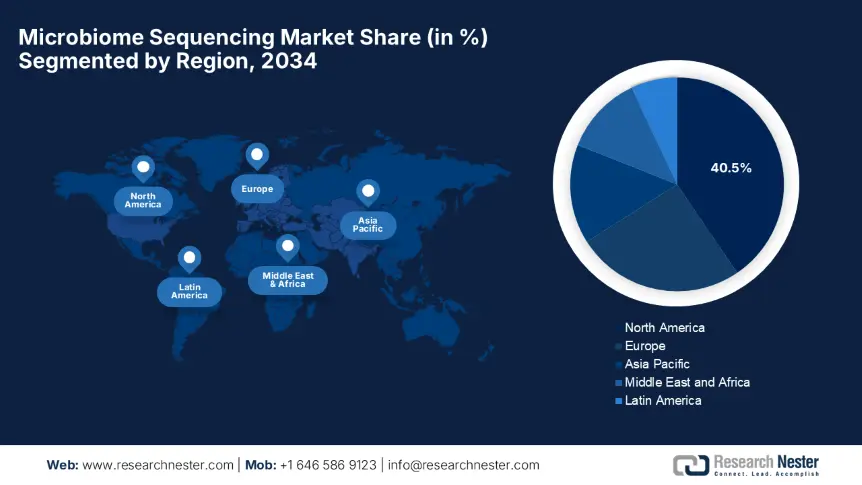

North America is projected to lead the microbiome sequencing market with a share of 40.5% during the forecast timeline. The proprietorship of the region is attributable to its advanced healthcare infrastructure, strong R&D investment, and supportive regulatory policies. Besides, the U.S. dominates, by grabbing an estimated 85.4% of the regional market, whereas Canada contributes to this growth, due to the existence of federal healthcare initiatives. In addition, NIH granted USD 5.3 billion in 2023, thus reinforcing North America’s position as the predominant leader in this landscape.

The U.S. is augmenting its dominance in the regional microbiome sequencing market on account of strong reimbursement policies. In this regard, the Centers for Disease Control and Prevention (CDC) in 2024 noted that it concentrates on microbiome-based infectious disease tracking, wherein USD 1.6 billion was allocated towards diagnostics. On the other hand, the country hosts substantial private sector investments with Illumina and Thermo Fisher accelerating NGS adoption. The precision medicine and oncology applications are on the surge, displaying a 15.4% year-over-year rise in terms of clinical trials.

There is an immense exposure for the microbiome sequencing market in Canada, extensively facilitated by the federal and provincial healthcare systems. Health Canada’s 2024 report stated that the federal funding surpassed USD 3.7 billion in 2023, whereas Ontario leads the market with 18.7% spending growth on microbiome therapies. The Public Health Agency of Canada (PHAC) also supports gut microbiome research for chronic diseases. Besides, the remarkable collaborations between academia and biotechnology firms drive innovation in this field.

APAC Market Insights

Asia Pacific is likely to grow at the fastest rate in the microbiome sequencing market owing to the rising instances of chronic diseases, government-funded genomic initiatives, and enhanced adoption of precision medicine. This landscape is dominated by China, closely followed by Japan and South Korea. Besides, the prominent countries such as India and Malaysia are portraying rapid progress, which is 20.5% yearly, with extensive support from infectious disease surveillance programs. In addition to AI integration, public-private partnerships and expanding reimbursement policies also support the region’s expansion in this field.

China is estimated to lead the overall region’s microbiome sequencing market due to the presence of its 14th Five-Year Plan, which dedicates USD 5.4 billion to microbiome research. The market displayed a 15.4% year-over-year increase, wherein 1.8 million patients were diagnosed through microbiome sequencing in 2023. Besides, the National Medical Products Administration (NMPA) in 2023 stated that its National Microbiome Initiative aims to sequence 10.6 million samples by the end of 2030, with a prime focus on gut oncology links. Also, 70.5% of the countries' hospitals are currently enabling microbiome diagnostics, hence making it suitable for standard market growth.

India is emerging in the microbiome sequencing market owing to its massive government funding and initiatives. The country’s government spending surpassed USD 2.1 billion in 2023, which marks an 18.7% up over the last decade, whereas the Microbiome for Human Health program concentrates on TB and IBD diagnostics, with services enabled to 2.7 million yearly patients. Besides, it also encourages public-private collaborations, due to which Tata Medical Center made an investment of USD 50.6 million in rural microbiome diagnostics. Furthermore, over 15 microbiome startups were launched in Bengaluru since 2022; hence, a positive market outlook.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

Australia |

National Health & Medical Research Council |

$150.9 |

2022 |

|

South Korea |

Bio-Health Innovation Strategy |

$200.6 |

2021 |

|

Malaysia |

12th Malaysia Plan (Healthcare Biotech) |

$30.5 |

2022 |

Sources: NHMRC, Korea.kr, EPU

Europe Market Insights

Europe in the microbiome sequencing market is showcasing steady progress facilitated by robust government funding, advanced healthcare systems, and strong academic-industry collaborations. In this regard, the European Medicines Agency in 2024 stated that its Health Data Space dedicated €2.9 billion for microbiome research, thereby accelerating precision medicine adoption. Meanwhile, the region witnesses increasing instances of chronic disease prevalence, wherein 20.5% of Europe’s healthcare budgets were earmarked towards microbiome diagnostics, hence indicating a positive market outlook.

The U.K. is maintaining its leadership in the regional microbiome sequencing market, backed by NHS adoption of microbiome diagnostics and Brexit-driven biotech incentives. The country’s Biobank is an asset for this landscape, which comprises over 510,000 microbiome datasets, making it a global hub for AI-based microbiome research, thereby accelerating precision medicine applications. Furthermore, post-Brexit regulatory agility has appreciably drawn the interest of private investors, with firms such as Eagle Genomics securing £50.6 million for AI-based microbiome analytics according to the Association of the British Pharmaceutical Industry (ABPI).

Germany in the microbiome sequencing market is vigorously gaining traction, supported by federal grants and its strong biotechnology & pharmaceutical ecosystem, accelerating drug development. The Federal Ministry of Health in 2024 stated that it assigned a total of €1.5 billion in microbiome R&D. On the other hand, the country has a National Decade Against Cancer initiative that deliberately prioritizes microbiome research, with €200.8 million dedicated to gut microbiome-cancer studies. In addition, the universal healthcare system in the country ensures a broad adoption of these diagnostics with clinical demand displaying a12.5% growth.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

France |

France 2030 Investment Plan |

$880.8 |

2021 |

|

Sweden |

SciLifeLab National Infrastructure |

$250.7 |

2023 |

|

Netherlands |

Dutch Microbiome Initiative |

$165.5 |

2022 |

Sources: Gouvernement.fr, SciLifeLab, Health~Holland

Key Microbiome Sequencing Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international microbiome sequencing market is extremely intensifying, with Illumina and Thermo Fisher dominating with the maximum revenue share by leveraging NGS technologies. Simultaneously, BGI Group and Oxford Nanopore are challenging by emphasizing cost-effective and portable solutions. On the other hand, collaborations, AI integration, and regional expansion are a few strategies undertaken by the pioneers to uplift the market. In this context, BGI Group expanded its labs to India and Malaysia, thereby enhancing its presence in the global dynamics.

Below is the list of some prominent players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Illumina |

U.S. |

22.8% |

NGS systems (NovaSeq, MiSeq), microbiome analysis tools |

|

Thermo Fisher Scientific |

U.S. |

18.6% |

Ion GeneStudio S5 systems, microbiome sequencing reagents |

|

Qiagen |

Germany |

12.3% |

Sample prep kits (QIAamp DNA Microbiome Kit), bioinformatics solutions |

|

BGI Group |

China |

10.5% |

MGISEQ platforms, large-scale microbiome genomics projects |

|

Oxford Nanopore |

UK |

8.7% |

Portable sequencers (MinION), real-time microbiome analysis |

|

Roche |

Switzerland |

xx% |

Sequencing systems (Genome Sequencer), clinical microbiome diagnostics |

|

Pacific Biosciences |

U.S. |

xx% |

HiFi sequencing for microbiome strain resolution |

|

LGC Biosearch Technologies |

U.S. |

xx% |

Custom microbiome sequencing probes, synthetic biology tools |

|

Agilent Technologies |

U.S. |

xx% |

Microarray-based microbiome profiling, bioinformatics software |

|

PerkinElmer |

U.S. |

xx% |

Microbiome biomarker discovery, high-throughput screening |

|

Microba Life Sciences |

Australia |

xx% |

Gut microbiome testing (Microba Insight™), AI-driven analysis |

|

ChunLab |

South Korea |

xx% |

EzBioCloud database, microbiome sequencing for personalized medicine |

|

Xcelris Labs |

India |

xx% |

Affordable NGS services, agricultural microbiome applications |

|

Vaiomer |

France |

xx% |

Microbiome biomarker discovery, clinical trial support |

|

MyBiotics |

Malaysia |

xx% |

Probiotic-microbiome interaction studies, Southeast Asia-focused research |

Below are the areas covered for each company in the market:

Recent Developments

- In March 2024, Illumina introduced the NovaSeq X Plus system, specifically optimized for high-throughput microbiome sequencing. The platform reduces turnaround time by 40.7% and cuts costs per sample to $200, making it accessible for clinical diagnostics.

- In January 2024, Oxford Nanopore integrated AI-powered real-time analysis into its MinION sequencer, enabling rapid pathogen identification in under 4 hours. Hospitals using the system reduced ICU admission times by 30.8%.

- Report ID: 7957

- Published Date: Jul 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Microbiome Sequencing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert