MFTPaaS Market Outlook:

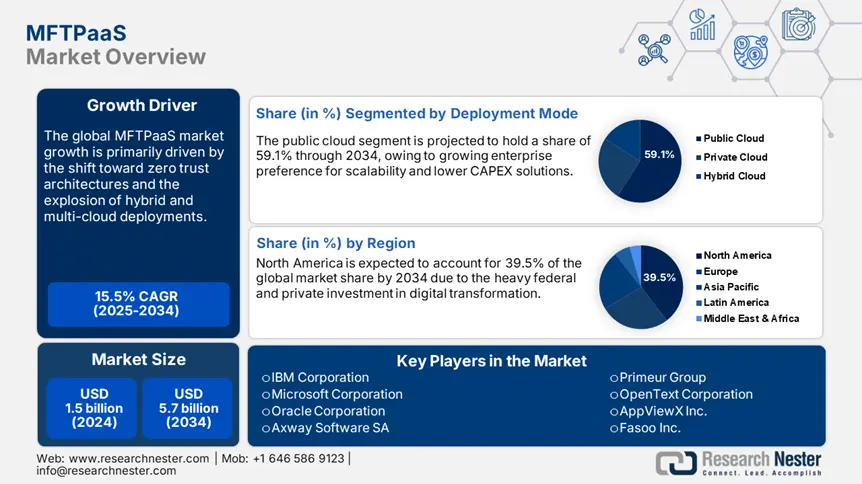

MFTPaaS Market size was valued at USD 1.5 billion in 2024 and is projected to reach USD 5.7 billion by the end of 2034, rising at a CAGR of 15.5% during the forecast period, from, 2025-2034. In 2025, the industry size of MFTPaaS is estimated at USD 1.7 billion.

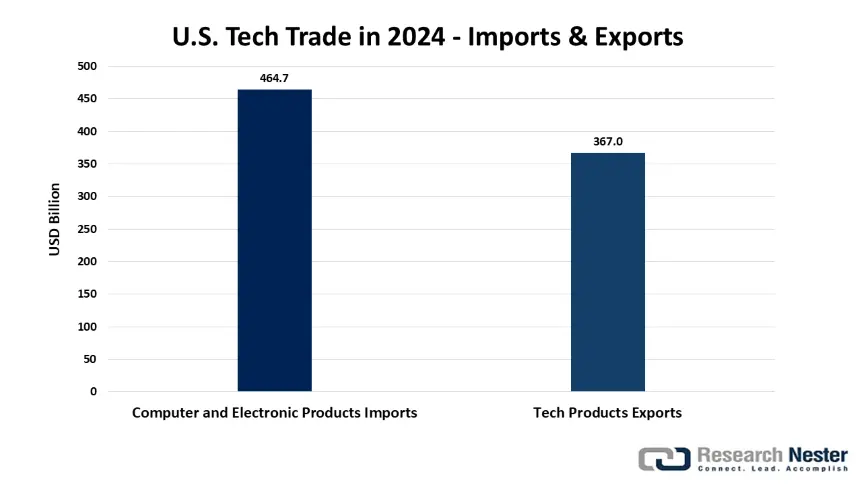

The trade of managed file transfer platform as a service (MFTPaaS) solutions is dependent on the complex supply chain of network equipment, advanced encryption software, and secure storage hardware. According to the U.S. Census Bureau, in 2024, the U.S. imported USD 464.7 billion worth of computer and electronic products, a significant share tied to the cloud systems and security hardware that power MFTPaaS platforms. Semiconductors, crucial for edge computing and encryption, made up more than USD 78 billion of those imports, mostly sourced from Taiwan and South Korea. The same source also states that the U.S. exported USD 367 billion in tech products, reflecting a consistent trade imbalance in tech components needed for these platforms.

North America and Europe are heavily reliant on Asia Pacific for critical parts such as printed circuit boards and specialized microcontrollers. This dependency creates risks for MFTPaaS providers, as disruptions in the supply of these components have the potential to impact their ability to deliver reliable services. Thus, to avoid the vulnerability of the MFTPaaS supply chain, manufacturers are expected to diversify sourcing, invest in resilient infrastructure, and plan for potential disruptions.

MFTPaaS Market - Growth Drivers and Challenges

Growth Drivers

- Shift toward zero trust architectures (ZTA): The protection of sensitive data, such as personal information (PII) and health records (PHI), has become critical due to the increasing cyber threats. Considering this, businesses, especially in regulated industries, are moving to zero-trust file transfer models. A 63.5% YoY rise in enterprise transitions to Zero Trust File Transfer models was reported in 2024, where every access request is thoroughly and continuously checked, per the European Union Agency for Cybersecurity (ENISA).

Furthermore, this trend is directly boosting the demand for MFTPaaS solutions that feature context-aware policies and multi-factor authentication. In the U.S., the Department of Homeland Security’s Zero Trust guidance for vendors is also pushing MFTPaaS adoption among federal contractors. Some vendors are integrating dynamic policy engines and user behavior analytics to remain competitive in the MFTPaaS market.

- Explosion of hybrid and multi-cloud deployments: The demand for cloud-native file transfer platforms is expected to be driven by businesses' increasing shift toward hybrid cloud strategies. Nearly 85.5% of enterprises are expected to adopt a cloud-first principle by the end of 2025. Many companies are introducing multi-cloud connectors with high-speed parallel file transfer capabilities. These solutions are highly demanded by multinational firms with disparate data centers and remote operations. The developed and developing economies are both expected to drive the sales of hybrid and multi-cloud MFTPaaS solutions, based on local requirements.

Challenges

- High cybersecurity compliance costs: MFTPaaS platforms require rigorous certifications for commercialization across the world. The compliance cost of cybersecurity certificates increases the burden on the budgets of manufacturers. Cybersecurity compliance costs exceed USD 179,000 annually, as per the U.S. Small Business Administration. This huge price deters small and medium-sized companies from expanding their operations. The National Association of Insurance Commissioners’ (NAIC) Cyber Report reveals that cyber insurance premiums grew by 14.5% in 2024, straining financials. The need for large capital for operational expenditure on security is limiting innovation and competitiveness.

- Lack of infrastructure readiness in emerging markets: Reliable data centers, high-speed connectivity, and low-latency networks are prime conditions for effective MFTPaaS deployment. All these lack in developing economies, which deters companies from employing regional expansion strategies. The study by the World Bank discloses that only 38.5% of enterprises in Africa have access to stable broadband for enterprise-grade cloud services. The unavailability of digital infrastructure and low budgets for public sector modernization lower the sales of MFTPaaS solutions in price-sensitive markets.

MFTPaaS Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

15.5% |

|

Base Year Market Size (2024) |

USD 1.5 billion |

|

Forecast Year Market Size (2034) |

USD 5.7 billion |

|

Regional Scope |

|

MFTPaaS Market Segmentation:

Deployment Mode Segment Analysis

The public cloud segment is projected to account for 59.1% of the global MFTPaaS market share by 2034. The public cloud is most sought after, owing to the growing enterprise preference for scalability and lower CAPEX solutions. Public cloud services enable more agile data governance and centralized control over encryption keys and identity management, per the U.S. National Institute of Standards and Technology (NIST). Such recommendations are directly accelerating the sales of public cloud solutions. Also, the boom in government investments for public cloud transitions is pushing the demand for cloud-native MFTPaaS offerings globally.

Industry Vertical Segment Analysis

The BFSI segment is expected to capture 30.5% of the global market share throughout the forecast period, owing to strict data security requirements and real-time transaction needs. The compliance obligations under laws such as GLBA, SOX, and PSD2 are also contributing to the sales of MFTPaaS solutions. The European Union Agency for Cybersecurity highlighted secure managed file transfer as a top priority for financial services in its 2024 sector threat report. Such studies are increasing the trade of managed file transfer platform-as-a-service solutions. Many institutions are also investing in AI-enabled MFTPaaS to handle high-volume encrypted data exchange across cross-border financial operations.

Our in-depth analysis of the global MFTPaaS market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Mode |

|

|

Industry Vertical |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

MFTPaaS Market - Regional Analysis

North America Market Insights

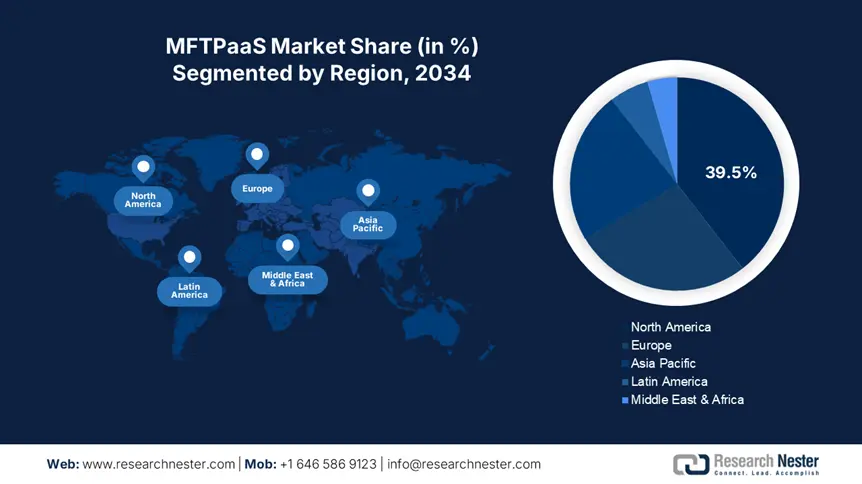

The North America MFTPaaS market is anticipated to hold 39.5% of the global revenue share through 2034, owing to heavy federal and private investment in digital transformation. The advanced cloud infrastructure and robust cybersecurity frameworks are projected to boost the application of MFTPaaS solutions. Furthermore, the NTIA’s BEAD Program and the FCC’s Affordable Connectivity Program are set to promote the adoption of secure cloud services, including MFTPaaS, across both urban and underserved communities. The strong presence of advanced wireless connectivity networks is also contributing to the increasing sales of MFTPaaS solutions.

In the U.S., the demand for MFTPaaS solutions is poised to increase at a high pace due to the hefty federal ICT spending and aggressive public-private partnerships. The regulatory pressure on secure data exchange is expected to amplify the adoption of MFTPaaS systems. In 2024, the U.S. allocated USD 13.5 billion to cybersecurity initiatives, which led to public sector upgrades in managed file workflows. The federal broadband expansion and cybersecurity modernization under BEAD and the Digital Equity Act are also expected to double the revenues of key players in the coming years. The public cloud shift is also a major factor driving the sales of MFTPaaS.

Europe Market Insights

The Europe MFTPaaS market is estimated to capture 27.1% of the global revenue share throughout the study period. The strict data protection laws and cross-border enterprise collaborations are projected to accelerate the production and commercialization of MFTPaaS. The regulatory forces like GDPR, when combined with national digitalization strategies, compel enterprises across banking, healthcare, and telecom sectors to prioritize secure file exchange infrastructure, which increases the adoption of MFTPaaS solutions. Germany, France, and the U.K. are holding leading positions in the EU market, owing to their hefty investments in AI-integrated and zero-trust architecture-based MFTPaaS solutions.

The sales of MFTPaaS systems in Germany are driven by massive public ICT investments and aggressive digitalization. The Federal Ministry for Digital and Transport (BMDV) has earmarked more than €3.3 billion for cloud infrastructure and cybersecurity modernization under its Digital Strategy 2025, which is likely to boost the trade of MFTPaaS systems in the coming years. The German e-Health Act and Onlinezugangsgesetz (Online Access Act) mandated cloud-based MFT integration across more than 495 public services, which resulted in a 42.5% YoY rise in MFTPaaS procurement contracts in 2023. Currently, more than 74.5% of enterprises use managed cloud platforms for secure data transfer.

Country-Specific Insights

|

Country |

2023 MFTPaaS Budget Allocation |

2020 MFTPaaS Budget Allocation |

2024 Market Size (€ Billion) |

Growth Rate (2021-2024) |

|

United Kingdom |

7.5% of the digital infra budget |

4.3% |

€1.2 billion |

+41.5% |

|

Germany |

8.2% of the ICT budget |

5.8% |

€1.5 billion |

+39.3% |

|

France |

6.9% of the ICT budget |

5.9% |

€1.1 billion |

+35.7% |

APAC Market Insights

The Asia Pacific MFTPaaS market is expected to increase at a CAGR of 15.5% between 2025 and 2034, owing to a swift rise in enterprise cloud adoption. The compliance-led digital transformation and rising cybersecurity investments are expected to fuel the sales of MFTPaaS solutions in the years ahead. The push for sovereign data frameworks and real-time file transfer in public services is also contributing to the increasing sales of MFTPaaS systems. China, Japan, India, and South Korea are leading the trade of MFTPaaS solutions. The public-private investment partnerships are further propelling the production and commercialization of MFTPaaS solutions.

The China MFTPaaS market is set to be driven by robust industrial digitalization and sovereign cloud policies. The massive SME base integration of secure file transfer systems is also supporting the MFTPaaS market growth. The National Medical Products Administration (NMPA) funded more than ¥3.3 billion to upgrade pharmaceutical data exchange protocols using encrypted managed file transfer in 2023. This funding aligned with the country’s push under the 14th Five-Year Plan for National Drug Safety and Informatization, which emphasizes encrypted data interoperability between pharma companies and government platforms via managed file transfer (MFT) frameworks.

Country-Specific Insights

|

Country |

Govt. Spending on MFTPaaS (2023) |

MFTPaaS Adopting Orgs (2023) |

|

Japan |

¥43.6B (health + ICT) |

1.2M |

|

India |

₹19.9B/year |

3.0M |

|

Malaysia |

+95.5% funding (2013-23) |

0.73M |

|

South Korea |

₩422B |

421K |

Key MFTPaaS Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- Oracle Corporation

- Axway Software SA

- Progress Software Corporation

- GlobalSCAPE

- SEEBURGER AG

- Coviant Software

- JSCAPE LLC

- Primeur Group

- OpenText Corporation

- AppViewX Inc.

- Fasoo Inc.

- Covata Ltd

The global MFTPaaS market is characterized by the presence of gigantic companies and the increasing emergence of new players. The industry giants are earning high profits owing to their advanced cloud platforms and global data center networks. The hefty investments in technological advancements are also poised to double their revenues in the coming years. Some of the companies are focusing on merger & acquisition strategies to upgrade their product offerings. They are also entering developing markets to expand their manufacturing operations and leverage from untapped opportunities.

Here is a list of key players operating in the global MFTPaaS market:

Recent Developments

- In April 2024, IBM Corporation introduced an enhanced version of Aspera on Cloud. This platform is integrated with AI-based transfer routing and real-time threat detection features.

- In February 2024, Axway launched new multi-cloud orchestration capabilities for its Amplify MFT platform. This solution allows clients to manage file transfers across AWS, Azure, and on-prem systems from a unified dashboard.

- In January 2024, Microsoft Azure unveiled its AI-optimized MFT module that uses predictive analytics to pre-schedule high-volume transfers. This solution also reduces latency by 32.5% and bandwidth costs by 15.5%.

- Report ID: 3957

- Published Date: Jul 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

MFTPaaS Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert