Methyl Salicylates Market Outlook:

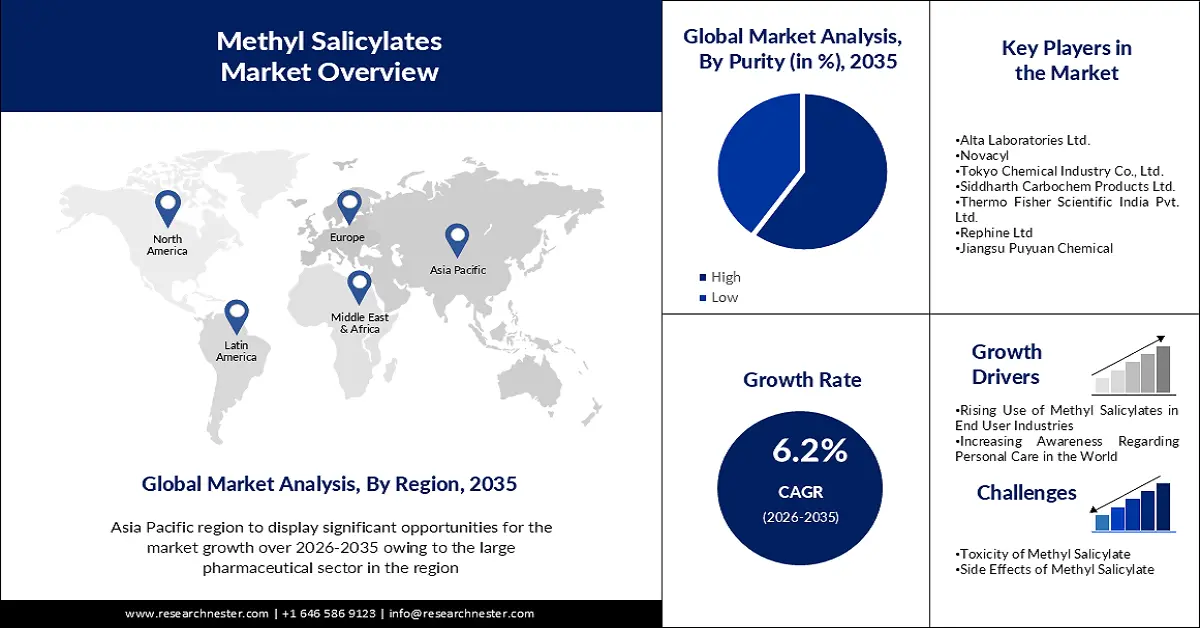

Methyl Salicylates Market size was valued at USD 248.27 million in 2025 and is expected to reach USD 453.07 million by 2035, expanding at around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of methyl salicylates is assessed at USD 262.12 million.

The growth of this market can be ascribed to the growing application of methyl salicylates in the pharmaceutical industry. Methyl salicylate use could be highly seen in pain relieving creams and tubes that offer relief to the deadly pain of arthritis or other serious aches. It is also used in medicines to treat joint and muscle pains. As per research, local analgesics for human and veterinary medicine consist of 12% – 20% of methyl salicylate in it.

Besides, its wide application in the pharmaceutical industry. Methyl salicylate utilization can also be seen in the food and beverage industry to add fragrance and flavor to food items. It is widely used as a flavoring agent in chewing gums, candies, and mints. This factor is driving the growth of methyl salicylate in the forecast period. As per the data, this flavoring agent is used in the food and beverage industry as an important additive.

Key Methyl Salicylates Market Insights Summary:

Regional Highlights:

- By 2035, the Asia Pacific region is projected to expand its share in the methyl salicylates market, supported by the rising hair and skin care industries and strong pharmaceutical production, impelled by high salicylic acid manufacturing.

- North America is expected to secure the largest share by 2035 in the methyl salicylates market, underpinned by increasing healthcare expenditure and intensified pharmaceutical R&D, owing to growing government investment in advanced medicines.

Segment Insights:

- The pharmaceutical segment is projected to command the largest share by 2035 in the methyl salicylates market, attributed to expanding medicinal applications and heightened demand for topical analgesics, fueled by growing health awareness.

- The high-level purity segment is estimated to hold the leading share by 2035, supported by its critical role in effective pain relief and homeopathic formulations, sustained by stringent purity requirements in pharmaceutical products.

Key Growth Trends:

- Rising Use of Methyl Salicylates in End User Industries

- Increasing Awareness Regarding Personal Care in the World

Major Challenges:

- Toxicity of Methyl Salicylate

- Side Effects of Methyl Salicylates

Key Players: Zhenjiang Gaopeng Pharmaceutical Co., Ltd., Alta Laboratories Ltd., Novacyl, Tokyo Chemical Industry Co., Ltd., Siddharth Carbochem Products Ltd., Thermo Fisher Scientific India Pvt. Ltd., Rephine Ltd, Jiangsu Puyuan Chemical, Nanjing Huajian Chemical, Shandong Longxin Chemical.

Global Methyl Salicylates Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 248.27 million

- 2026 Market Size: USD 262.12 million

- Projected Market Size: USD 453.07 million by 2035

- Growth Forecasts: 6.2%

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 19 November, 2025

Methyl Salicylates Market - Growth Drivers and Challenges

Growth Drivers

- Rising Use of Methyl Salicylates in End-User Industries – Methyl salicylate application can be seen in various end-user industries such as food & beverage, personal care, pharmaceuticals, and others. This is propelling the growth of the market in the forecast period. Based on end-use industries, methyl salicylate utilization can be seen as flavor additives in the fragrance and personal care industry.

- Increasing Awareness Regarding Personal Care in the World – Methyl salicylate application can be highly seen in the personal care industry which is expected to drive market growth in the forecast period. The global wellness economy was valued at USD 4.9 trillion in 2019 and then fell to USD 4.4 trillion in 2020, owing to the widespread impacts of the COVID-19 pandemic.

- Growing Pharmaceutical Industry – Methyl salicylate application can be seen widely in pain relieving medicines in order to offer relief to arthritis, joint, or muscle pain. For instance, in 2019, 11% of U.S. adults used one or more pain-relieving medicines in the past 30 days.

- Increasing Concern Regarding Hair and Skin – The market growth of methyl salicylate is driven by the hair and skincare industry. Methyl salicylate plays a major crucial role in the hair and skincare industry. Growing concern related to haircare and skincare is further driving the growth of this market. In 2020, the haircare and skincare segment held a 48% share of the market.

Challenges

- Toxicity of Methyl Salicylate – Certain side effects or toxicity of methyl salicylate might lead to health concerns such as irritation of the stomach lining, intoxication, and blistering of skin which may hamper the growth of the market.

- Side Effects of Methyl Salicylates

- Not Safe for Young Children

Methyl Salicylates Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 248.27 million |

|

Forecast Year Market Size (2035) |

USD 453.07 million |

|

Regional Scope |

|

Methyl Salicylates Market Segmentation:

Application Segment Analysis

The global methyl salicylates market is segmented and analyzed for demand and supply by application into pharmaceuticals, food & beverage, cosmetic & personal care, and others. Out of these, the pharmaceutical segment is anticipated to hold the largest market share in the forecast period. This can be attributed owing to the growing application of methyl salicylate in the pharmaceutical industry. Owing to the product's classification as a topical analgesic, it is frequently used in essential oil compositions and pain-relieving rubs to treat aches and pains like arthritis. In the upcoming years, it is anticipated that the demand for methyl salicylate will increase owing to the expansion of the pharmaceutical business as a result of numerous measures made by specific governmental authorities and the rise in consumer awareness of health. Moreover, methyl salicylate is employed in medicine to treat a variety of skin conditions, including psoriasis, acne, dandruff, and blemishes. In 2020, around 90 million people in the Asia Pacific region were affected by acne and other skin diseases.

Purity Segment Analysis

The global market is segmented and analyzed for demand and supply by purity into high and low. Out of which, the high-level purity segment is expected to account for the largest market share in the forecast period. Natural painkiller methyl salicylate is used to treat joint and muscular pain. High purity levels guarantee that the product is free of impurities and works well to relieve pain. Besides this, methyl salicylate is the most common and significant ingredient in the production of homeopathy medicines. For pharmaceutical and medical items, where purity levels need to be closely controlled, this kind of specification is crucial.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Purity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Methyl Salicylates Market - Regional Analysis

APAC Market Insights

The market in the Asia Pacific region is estimated to witness noteworthy growth over the forecast period. This can be attributed to the back of expansion of hair and skin care industries, and the high manufacturing of salicylic acid and related products in countries, namely China and India. For instance, Asia Pacific generated sales of more than 31% in the hair care industry in 2019. Also, methyl salicylate is widely used as an important ingredient in pain-relieving tubes and other pain-controlling medicines. Therefore, the pharmaceutical industry is driving the growth of this market in the Asia Pacific region. And China from the Asia Pacific region has one of the biggest pharmaceutical industries in the world.

North American Market Insights

North America industry is likely to hold largest revenue share by 2035, Moreover, the market in North America is anticipated to occupy the largest market share during the forecast period, which can be credited to the increasing healthcare expenditure, and a growing number of research & development activities in the pharmaceutical sector. In addition, the rising investment of government agencies for the development of enhanced medicines is also expected to fuel the progress of the market in the region. Also, a wide variety of hair care and skin care brands' presence can be seen in the North American region which is expected to be the reason behind the growth of this market.

Europe Market Insights

Similarly, the market in the Europe region is anticipated to grow significantly in the upcoming forecast period. This can be attributed owing to the growing presence of the skincare and hair care market in this region. Methyl salicylate is currently used as one of the most important ingredients for skin care, hair care, and personal hygiene products. It is used in essential oils and perfumes to add fragrance and flavor to it. Also, rising awareness and concern regarding taking care of skin and hair through social media and other platforms is also propelling the growth of this market. Besides, methyl salicylate is widely used in the manufacturing of drugs, ointments, pain relieving tubes, and medicines. These medicines are prescribed to people with joint pain, arthritis, or muscle pain problems. The pharmaceutical industry of the Europe region highly drives the growth of the methyl salicylate market. Also growing investment by the government and key market players in the region in the development of the pharmaceutical industry is expected to drive the growth of this market in the forecast period.

Methyl Salicylates Market Players:

- Zhenjiang Gaopeng Pharmaceutical Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alta Laboratories Ltd.

- Novacyl

- Tokyo Chemical Industry Co., Ltd.

- Siddharth Carbochem Products Ltd.

- Thermo Fisher Scientific India Pvt. Ltd.

- Rephine Ltd

- Jiangsu Puyuan Chemical

- Nanjing Huajian Chemical

- Shandong Longxin Chemical

Recent Developments

- A comprehensive range of modalities and platforms, including cell and gene therapies, oral solids, steriles, and biologics will be covered by Thermo Fisher Scientific's demonstration of its experience, innovations, and capabilities at CPHI Frankfurt in OCTOBER 2022.

- Seqens EDS offers a wide range of methyl salicylate grades further down the salicylic acid chain. Various phenol content ranges are searching for the active component that is best suited for the required formulation. Methyl Salicylate is produced in France by a company that is GMP certified and complies with food-grade standards in order to guarantee a steady supply with a big manufacturing capacity. They adhere to strict quality standards and are free from the Dimethyl sulfate procedure and particular sensory analyses, making our product the norm for the European Pharmacopeia.

- Report ID: 3209

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Methyl Salicylates Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.