Metabolomics Market Outlook:

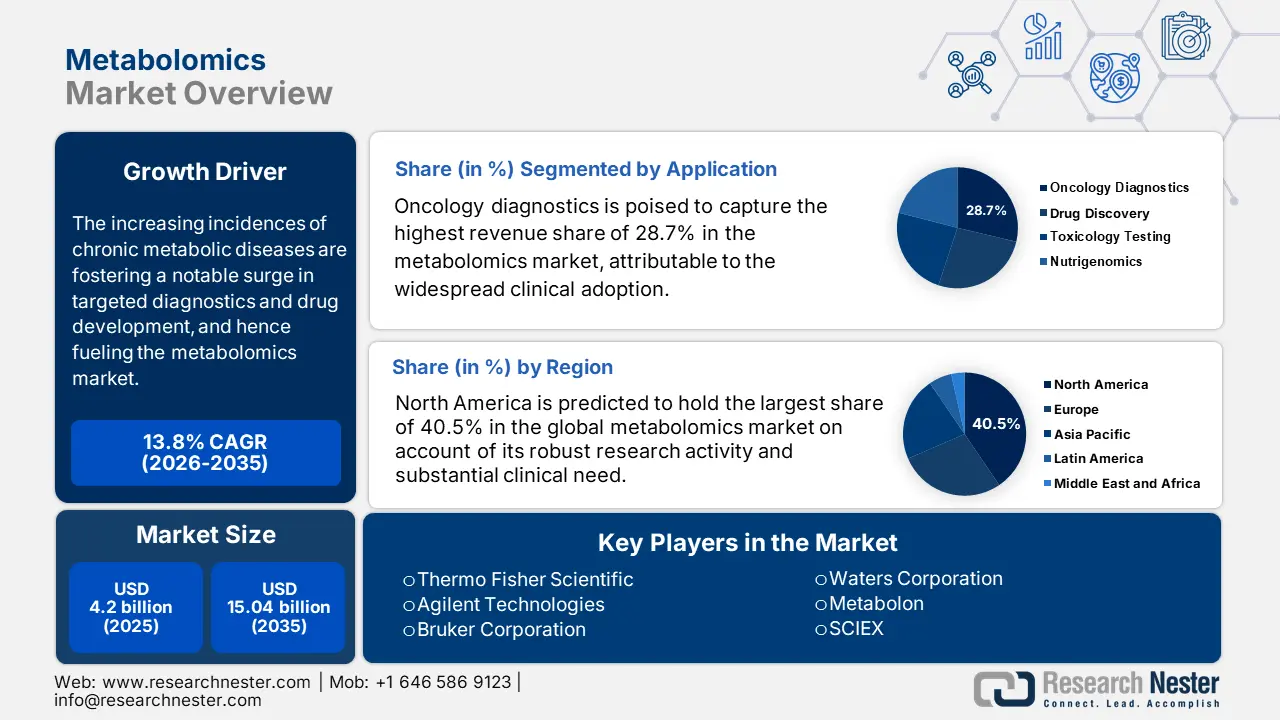

Metabolomics Market size was over USD 4.2 billion in 2025 and is estimated to reach USD 15.04 billion by the end of 2035, exhibiting a CAGR of 13.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of metabolomics is assessed at USD 4.7 billion.

The increasing incidence of chronic metabolic diseases is fostering a notable surge in targeted diagnostics and drug development, thereby fueling the market. The market is further driven by the behavioral risk factors such as harmful use of tobacco, physical inactivity, alcohol, and an unhealthy diet. As per the NLM article released in March 2024 states that the metabolic syndrome prevalence among men and women is 22% and 24%. These demographics highlight an expanding consumer base, resulting in a continuous rise in demand in this sector.

According to the Pfizer report in 2025, the overview of metabolic disorders depicts that the prevalence is mostly found in diabetic patients. Further, in the U.S. population, nearly 37.3 million people are suffering from metabolic disorders, which is 11.3% of the overall population. This metabolic syndrome increases the risk of cardiovascular diseases and stroke in patients also it is estimated that 1 in 3 adults has metabolic syndrome. Moreover, the rising patient pool indicates the need for innovation in drugs and robust R&D to address the errors in the metabolic process.

Key Metabolomics Market Insights Summary:

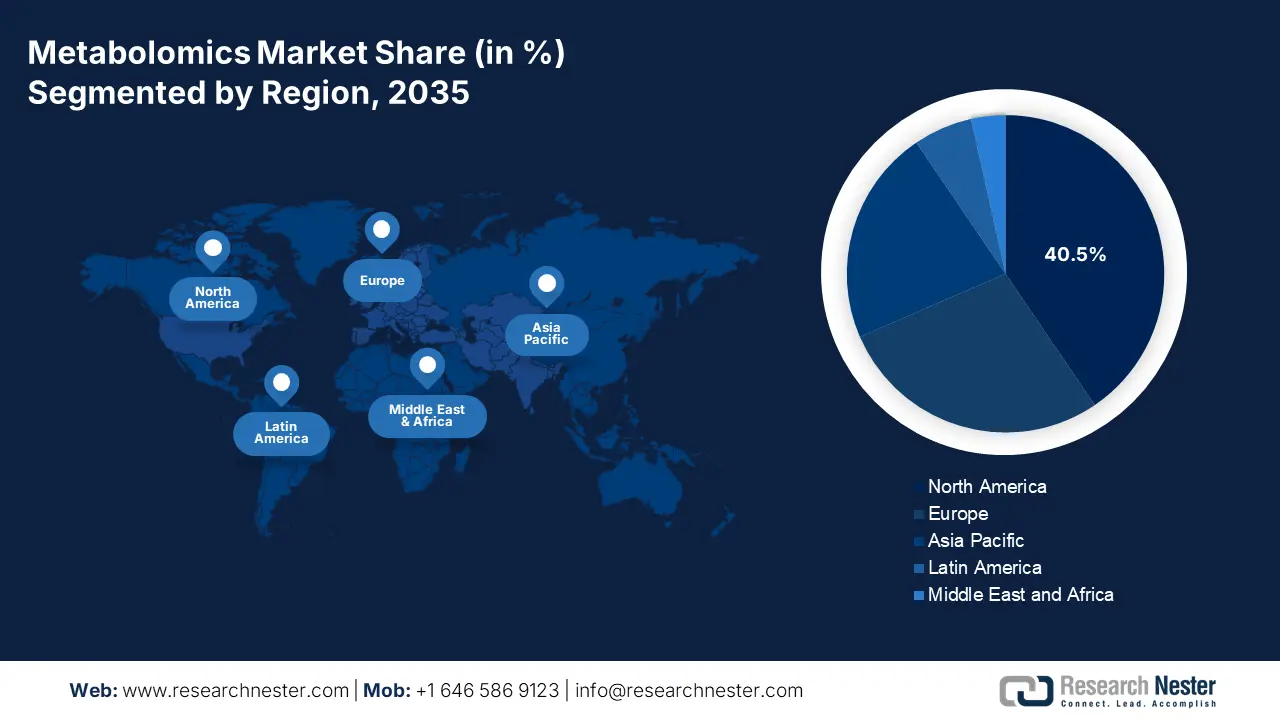

North America is projected to command the largest share of 40.5% in the global metabolomics market during the forecast period.

Asia Pacific is expected to emerge as the fastest-expanding region within the global market over the specified timeframe.

Europe is anticipated to demonstrate steady growth in the metabolomics market between 2026 and 2035.

The instruments segment is set to lead the market, capturing a 32.8% share by 2035.

Oncology diagnostics is forecasted to attain the highest revenue share of 28.7% in the metabolomics sector throughout the evaluated period.

Key Growth Trends:

- Worldwide emergence of precision medicine

- Investments in biomarker discovery

- Strategic commercial operations and expansion

Key Players:

- PerkinElmer (U.S.), Sciex (Danaher) (U.S.), Phenomenex (U.S.), MetaboAnalyst (Canada), BGI Group (China), ChromaCell Corporation (South Korea), Metabolomic Diagnostics (Ireland), Microba Life Sciences (Australia), Xcelris Labs (India).

Global Metabolomics Market Forecast and Regional Outlook:

2026 Market Size: USD 4.7 billion

2025 Market Size: USD 4.2 billion

Projected Market Size: USD 15.04 billion by 2035

Growth Forecasts: 13.8% CAGR (2026-2035)

Largest Region: North America

Fastest Growing Region: Asia Pacific

Last updated on : 22 August, 2025

Metabolomics Market - Growth Drivers and Challenges

Growth Drivers

- Worldwide emergence of precision medicine: The strong growth in the market is primarily attributable to the increased government and personal spending on targeted pharmaceuticals. NIH is the largest funder for biomedical research and allocated a budget of USD 47 billion in 2024 based on the NIH report released in April 2025, indicating the presence of a consistent capital influx in this sector, creating significant opportunities for future expansion. This investment further surges the innovation in advanced metabolomics tools and increases the collaborations between academic institutions and industry leaders. As a result, the sector is strongly positioned to offer innovative diagnostic and therapeutic solutions across the globe.

- Investments in biomarker discovery: Considering the clinical and economic benefits of extensive research, global pharma giants are increasingly participating and investing in revolutionary advancements in the market. As evidence, in 2024, Pfizer and Evotec collectively joined hands to empower drug development in France on metabolic and infectious diseases. In addition, the implementation of AI-powered platforms is propelling adoption in the sector by enhancing throughput and outcomes. According to the NLM article released in October 2024, AI significantly reduces the timeframe by 1-2 years and reduces the cost by 35% in new drug development.

- Strategic commercial operations and expansion: The market is experiencing a rapid transformation in strategic commercialization and consolidation, benefiting both pioneers and consumers. For instance, in 2025, Agilent Technologies is collaborating with Tata Institute of Fundamental Research to support Advanced Research Unit on Metabolism, Development, and Aging. On the other hand, Metabolon allocated USD 60 million to research and innovation in achieving precision medicine in metabolic. Moreover, these companies align perfectly with the key trend of securing intellectual property (IP) in the pharmaceutical industry, propelling adoption from biotech companies.

Biomarker-Driven Drug Approvals in Oncology

|

Year |

Drug |

Therapeutic Area |

Biomarker |

Labelling Sections |

|

2023 |

Abemaciclib |

Oncology |

ERBB2 (HER2) |

Indications and Usage, Adverse Reactions, Clinical Studies |

|

2024 |

Adagrasib |

Oncology |

KRAS |

Indications and Usage, Dosage and Administration, Adverse Reactions, Clinical Pharmacology, Clinical Studies |

|

2024 |

Alectinib |

Oncology |

ALK |

Indications and Usage, Dosage and Administration, Adverse Reactions, Clinical Pharmacology, Clinical Studies |

Source: FDA, June 2024

Software Tools for Metabolomics Data Analysis and Integration

|

Name |

Year |

Description |

|

Mzmine3 |

2022 |

MZmine3 builds on the success of MZmine 2 with many features focused on improving the user-friendly graphical |

|

MetaboAnalyst 5.0 |

2021 |

Comprehensive web-based tool for comprehensive metabolomics data analysis, interpretation, and integration with other omics data. |

|

LipidSig |

2021 |

Web-based tool for lipidomic data analysis |

Source: NLM, April 2022

Challenges

- Compliance-related hurdles and limitations: The delays due to the robust regulations are slowing down the market entry by surging the cost and restricting innovations in the market. For instance, in 2022, devices related to this sector have experienced a delay in approval due to the stringent validation requirements of the Pharmaceuticals and Medical Devices Agency (PMDA). On the other hand, the 2024 updates in the U.S. FDA rules for lab-developed tests (LDTs) has increased the compliance costs for metabolomics laboratories. These constraints are barriers to market entry and increasing operational expenses for companies across major landscapes.

Metabolomics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.8% |

|

Base Year Market Size (2025) |

USD 4.2 billion |

|

Forecast Year Market Size (2035) |

USD 15.04 billion |

|

Regional Scope |

|

Metabolomics Market Segmentation:

Product & Service Segment Analysis

The instruments segment is expected to dominate the market with a 32.8% share by the end of 2035. The critical role of this equipment in precision oncology and drug discovery is the primary reason behind the leadership. It is also supported by substantial funding and allocations from the governing bodies. According to NIH Common Fund Metabolomics Program data, federal investments in mass spectrometry system platforms have expanded core facility capacities in the U.S., enabling broader adoption in precision medicine.

Application Segment Analysis

Oncology diagnostics is projected to capture a revenue share of 28.7% in the market over the analyzed tenure. This dominance is due to oncology’s leading role in integrating metabolomics for biomarker discovery, prognosis, and treatment guidance. As per the NLM report released in April 2024 depicts that the new cancer cases in the U.S. reached 2,001,140 in 2024, surging the need for advanced diagnostics. Further, the approaches towards metabolomics are increasingly incorporated into cancer biomarker research programs, enhancing the precision of detection and accelerating the translation of laboratory findings into clinical oncology practice driving broader market adoption.

End user Segment Analysis

Pharmaceutical & biotech companies lead the end user segment and are estimated to hold the share value of 25.9% throughout the assessed period. This dominance can be displayed through the sector's heavy reliance on drug discovery, development, and personalized medicine applications for maximum revenue generation. Further market size of the pharma industry in India is expected to reach USD 450 billion by 2047, as stated in IBEF report in 2025, highlighting the need for biomarkers, optimizing therapeutic compounds, and enhancing clinical trial stratification, which ultimately enhances the capabilities of the pipeline. The substantial investments from pharma and biotech firms further continue to drive innovation and commercialization across this merchandise.

Our in-depth analysis of the global metabolomics market includes the following segments:

|

Segment |

Subsegments |

|

Product & Service |

|

|

Application |

|

|

End user |

|

|

Technology |

|

|

Disease Area |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Metabolomics Market - Regional Analysis

North America Market Insights

North America is the dominating region in the metabolomics market and is expected to hold the largest share of 40.5% by 2035. Substantial clinical need and robust research activity are the two foundational pillars of the region's proprietorship. As per the BMC article published in November 2024, 36.6% of the U.S. population suffers from metabolic syndrome. The enlarging population of obese and diabetic residents also contributes to the continuous expansion of the consumer base in North America. Furthermore, various clinical trials for associated medicines was observed in the region, which displayed the rapid penetration of this evaluation method into pharmaceutical R&D, as per the FDA.

The U.S. is poised to maintain its regional dominance with a 35% share of the global market by 2035. The country's significance in this sector is amplified by $4.8 billion federal funding for precision medicine, as per the NLM report in July 2025. Besides this funding, the prevalence of chronic diseases rises continuously, with 4 in 10 people in the U.S. affected by chronic disease and leading to the health care cost of USD 4.9 trillion, based on the CDC report announced in October 2024. Furthermore, innovation such as AI integration indicates the country's strong emphasis on innovation in this field.

Prevalence Diseases Driving Metabolomics Applications

|

Application Area |

U.S. Prevalence (2022–2025) |

Canada Prevalence (2022–2025) |

|

Cancer Metabolomics (relevant to overall cancer burden) |

18.1 million cancer survivors in 2022, projected to reach 26 million by 2040 |

1.5 million people living with cancer in 2022; |

|

Gut Microbiome Metabolomics (linked to digestive diseases) |

60 to 70 million people affected by digestive diseases annually |

20 million Canadians experience digestive health issues annually |

|

Nutritional Metabolomics (diet-related chronic diseases) |

2.5 billion adults have obesity in 2022 |

29.5% of adults are overweight |

APAC Market Insights

Asia Pacific is poised to become the fastest-growing region in the global metabolomics market over the discussed timeframe. The rapidly aging populations and increasing mortality and incidence rate of diabetes are creating a sustainable consumer base for this sector. In Asia Pacific nearly 697 million people are aged above 60 and this number is expected to reach 1.3 billion by 2050 by Asia Pacific Population and Development Report 2023. This rise increases the chronic disease rates and surges the growth of metabolomic market. Moreover, modernization of healthcare systems and improvements in accessibility are cumulatively making the region the epicenter of both globalization and innovation in this sector.

China dominates the Asia Pacific region and is poised to hold a share of 40.5% in the market by 2035. The country is backed by government investment, and propagation in this sector is further propelled by a rapidly expanding patient population. According to the Bayer Global report released in May 2025 states that the health spending by the China government is expected to increase to USD 2.5 trillion in 2035. Thus, the massive public funding and growing healthcare demand are collectively positioning China as both the largest and fastest-growing landscape for wide adoption and therapeutic applications.

Government Investments & Policies (2024)

|

Country |

Government Initiative / Policy |

Funding (Million) |

Key Focus Area |

|

Australia |

MTPConnect’s Metabolomics Roadmap |

$3.8 |

Industry-academia collaboration |

|

South Korea |

Next-Generation Metabolomics Platform Development |

$25.4 |

Portable MS systems |

|

Malaysia |

MyMetabolomics Hub Launch |

$6.6 |

Multi-omics integration |

Europe Market Insights

Europe is expected to witness a stable growth in the metabolomics market in the forecast period. The adoption of precision medicine, AI integration in biomarker discovery, and substantial government allocations are the major driving factors behind the region's persistent performance in this category. It also benefits from advanced R&D infrastructure in Germany and the UK. Moreover, 387 clinical trials were performed between 2021 and 2025 for metabolic disease. These trials surge the translational research, fostering the integration of metabolomics into clinical decision-making and therapeutic development.

Germany dominates the metabolomics market and is driven by rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases, and advancements in technology. As per the NLM report in January 2025, nearly 0.5% men and 50.1% women are suffering from metabolic disorders. Government funding is also supporting the nation's group of tech-driven efficiency gains, wherein the EFPIA spent €146 million in 2023 on cancer treatment, such as projects that incorporate metabolomics into diagnostics and treatment creation.

Key Metabolomics Market Players:

- Thermo Fisher Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Agilent Technologies

- Bruker Corporation

- Waters Corporation

- SCIEX

- Metabolon

- Biocrates Life Sciences

- LECO Corporation

- Bio-Rad Laboratories

- PerkinElmer

- Sciex (Danaher)

- Phenomenex

- MetaboAnalyst

- BGI Group

- ChromaCell Corporation

- Metabolomic Diagnostics

- Microba Life Sciences

- Xcelris Labs

- Shimadzu Corporation

- Human Metabolome Technologies

- JEOL Ltd.

- Hitachi High-Tech

- Sekisui Medical Co., Ltd.

The metabolomics market features intense competition, where leaders in the U.S., such as Thermo Fisher, Agilent, and Bruker, dominate through advanced MS technology and AI analytics. Employment of cost-effective assets and formation of partnerships are the key strategies of these key players that solidify their leadership in this sector. On the other hand, pioneers in Europe are maintaining their competency via the development of specialized kits, while firms in Asia are more focused on cost-efficient high-throughput solutions.

The cohort of top contenders includes:

Recent Developments

- In May 2025, Bruker launched timsMetabo, which is a 4D-Metabolomics mass spectrometer providing unprecedented sensitivity, separation power and annotation confidence for small molecules, and moreover enhanced by the novel TIMS ‘MoRE’ scan-mode.

- In September 2024, Trinity Biotech plc announced its acquisition on Metabolomics Diagnostics specialized in development of novel biomarkers. The deal is approximately $1.3 million with the consideration being in cash and the assumption of liabilities.

- Report ID: 515

- Published Date: Aug 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Metabolomics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.