Medical Clothing Market Outlook:

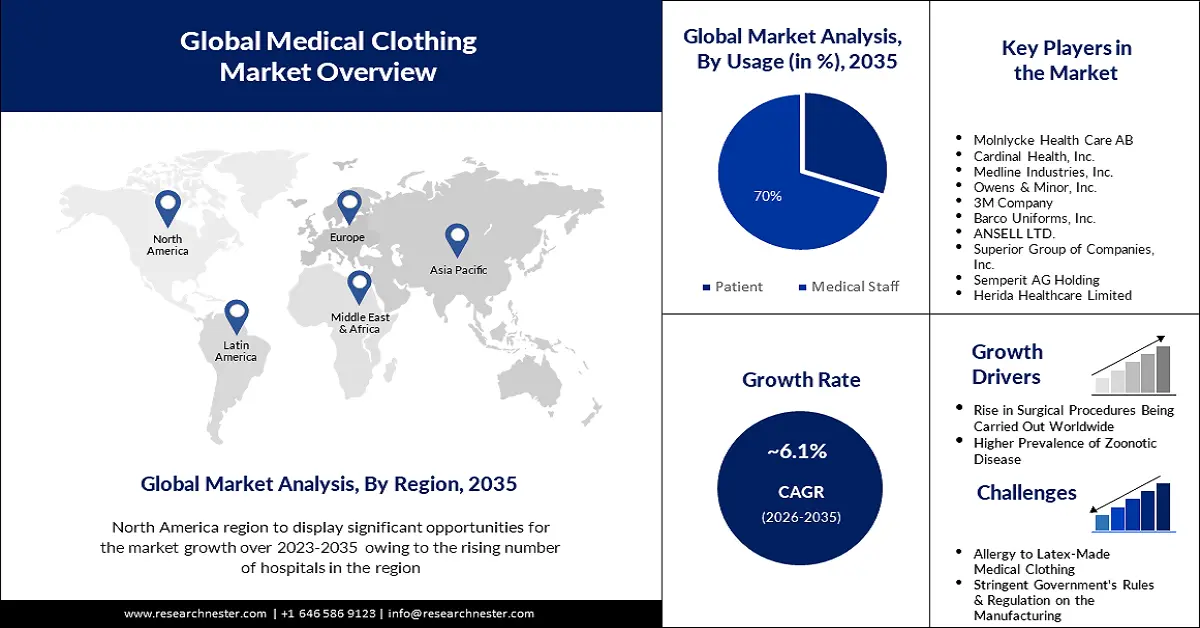

Medical Clothing Market size was valued at USD 125.65 Billion in 2025 and is expected to reach USD 227.15 Billion by 2035, registering around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical clothing is evaluated at USD 132.55 Billion.

The growth of the market can primarily be ascribed to the increasing number of surgical cases all around the world. There is a surge in cases of cancer, metabolic, and cardiovascular diseases, and road traffic injuries leading to increased requirement for surgical services. According, to the National Institutes of Health in 2020, a staggering 310 million major surgeries were performed each year.

Also, the advent of the pandemic in 2019 propelled the demand for medical clothing, particularly, face protection masks, gloves, gowns, etc. The pandemic has ingrained the importance of using medical clothing to avoid viral or bacterial transmissions. In December 2023, the National Institutes of Health revealed a meta-analysis showing that the chances of contracting COVID-19 infections were 0.49 times lesser in the people who wore masks.

Key Medical Clothing Market Insights Summary:

Regional Highlights:

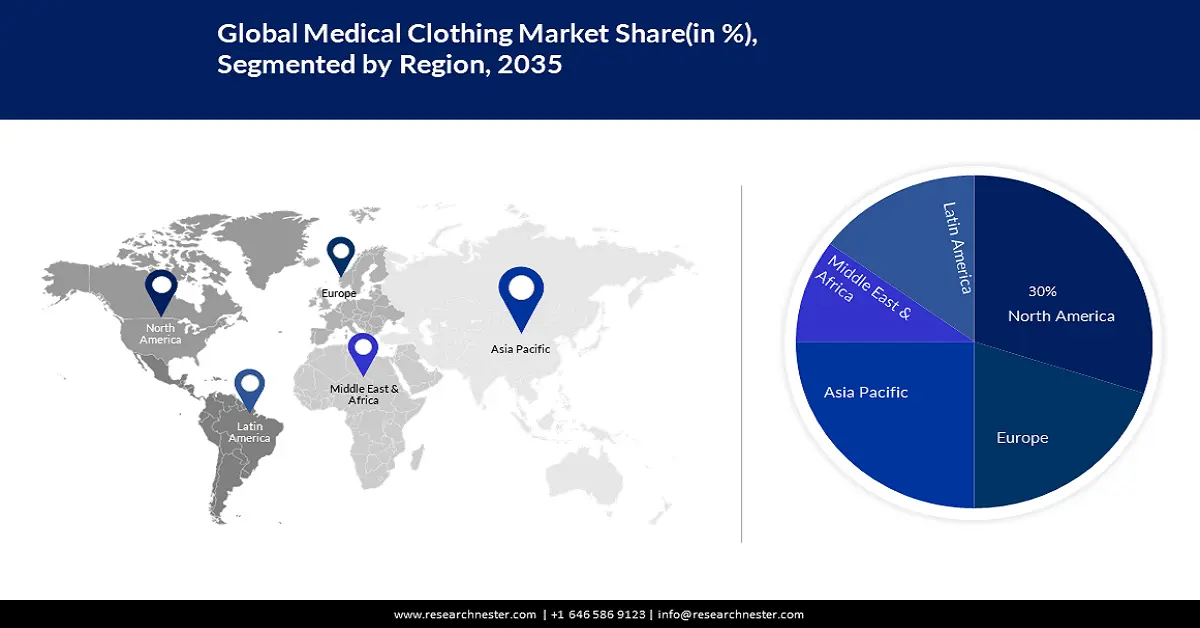

- The North America medical clothing market is predicted to capture 30% share by 2035, fueled by developed healthcare infrastructure and rising hospital numbers.

- The Asia Pacific market will achieve significant growth from 2026 to 2035, driven by rising population and growing demand for healthcare clothing.

Segment Insights:

- The medical staff usage segment in the medical clothing market is expected to secure a 70% share by 2035, driven by rapid hospital construction and the increasing healthcare workforce globally.

- The face protection segment in the medical clothing market market will capture a significant 40% share, fueled by the COVID-19 pandemic increasing the demand for face masks and medical protective gear, forecast year 2035.

Key Growth Trends:

- High prevalence of zoonotic diseases

- Rising investment and expenditure on healthcare

Major Challenges:

- Lack of skilled professionals

- Stringent regulatory policies

Key Players: Molnlycke Health Care AB, Key PerformanceIndicatorsCardinal Health, Inc., Medline Industries, Inc., Owens & Minor, Inc., 3M Company, Barco Uniforms, Inc., ANSELL LTD., Superior Group of Companies, Inc., Semperit AG Holding, Herida Healthcare Limited.

Global Medical Clothing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 125.65 Billion

- 2026 Market Size: USD 132.55 Billion

- Projected Market Size: USD 227.15 Billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 10 September, 2025

Medical Clothing Market Growth Drivers and Challenges:

Growth Drivers:

- High prevalence of zoonotic diseases: Ebola virus, avian flu, salmonellosis, COVID-19, etc. are some of the most dangerous zoonotic diseases affecting the entire globe. According to data released by the World Health Organization in 2020, there are over 200 known types of zoonotic diseases. Additionally, Affinity, a London-based disease forecasting company conducted risk modeling and suggested that there are 27.5% chance of another COVID-like pandemic in the coming years. Governments all across the globe are focusing on pandemic preparedness fueling the medical clothing market expansion.

- Rising investment and expenditure on healthcare: The surge in healthcare expenditure has accelerated the manufacturing of medical clothing at a rapid pace to facilitate their use at every healthcare facility. According to the World Economic Forum in 2021, global expenditure on health reached USD 9.8 trillion, registering 10.3% of the worldwide GDP. The rising investment in healthcare helps establish a robust infrastructure for the population. Hence, the higher investment and expenditure on healthcare is driving the growth of the market.

- Rising instances of hospital-acquired infections: A good quality medical clothing is important for preventing HAIs. Researchers suggest that clothing can be a conveyor for the infection. For instance, the Association for Professionals in Infection Control stated that 65% of the time nurses and doctors pick up the bacteria while leaning over a patient with MRSA (Methicillin-Resistant Staphylococcus Aures). Also, a report published by the World Health Organization in 2023, estimated that every year 136 million incidences of hospital-related antibiotic-resistant infections occur globally. To avoid these infections, hospitals are giving utmost importance to using medical clothing while interacting with patients.

Challenges:

- Lack of skilled professionals: A lack of skilled medical staff is anticipated to push the population further away from using medical clothing. The absence of proper training and investments by the hospitals is a major growth-restricting factor for the medical clothing market.

- Stringent regulatory policies: There are strict norms associated with making medical clothing and manufacturers are required to adhere to these norms. Due to this, market players are apprehensive about investing in or expanding the medical clothing market.

Medical Clothing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 125.65 Billion |

|

Forecast Year Market Size (2035) |

USD 227.15 Billion |

|

Regional Scope |

|

Medical Clothing Market Segmentation:

Product Segment Analysis

The face protection segment in the medical clothing market is projected to grow at a share of about 40% by the end of 2035. The growth of the segment can be accounted for the rising cases of COVID-19 that have prompted people to use face masks to prevent the infection from reaching their bodies. Moreover, doctors and nurses were constantly in need of face protection and medical clothes while treating patients. According to UNICEF, to support the countries, more than 400 ‘million medical masks were supplied by UNICEF in 2020. Furthermore, every ‘month around 129 billion disposable masks are used worldwide.

Usage Segment Analysis

The medical staff segment in the medical clothing market is poised to generate a share of approximately 70% over the forecast period. Hospitals are being manufactured at a rapid pace worldwide which has spurred the requirement for a huge medical workforce. For instance, as per the reported data, there will be around 10 million health workers working the healthcare facilities by 2030, especially in low- and lower-middle-income countries.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Usage |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Clothing Market Regional Analysis:

North America Market Insights

The medical clothing market in North America is poised to hold a share of 30% by the end of 2035. The market's growth can be ascribed to the presence of developed healthcare infrastructure in the region. As the number of hospitals rises, it also expands the size of medical staff, which results in a higher demand for medical clothing. Additionally, there is a presence of a huge number of market players in the region, pushing forward the growth of the market.

The medical clothing market in the U.S. is projected to garner remarkable revenue share due to its presence in the fastest-growing healthcare sector in the world. According to the Centers for Diseases Control and Prevention, in 2024, the U.S. healthcare system employed over 22 million workers. Key market players are advancing in fabric technology and various other innovations. For instance, market players are designing biodegradable and comfortable medical clothing.

Canada medical clothing is also burgeoning as healthcare facilities are expanding and evolving in the region. According to data published by the Government of Canada, more than 1.6 million people work in the healthcare sector of Canada and many more will be required in the coming years. Also, the country’s healthcare system is dynamic and promptly adopts ultra-modern technologies. Market players are launching a premium range of lab coats, scrub suits, medical apparel, etc.

Asia Pacific Market Insights

The market for Asia Pacific medical clothing is slated to grow significantly through 2035, due to its growing population is a prominent growth driving factor. According to the United Nations Populations Fund the Asia and the Pacific region is home to 4.3 billion people. It also states that by 2050, the number of people of 60 and older years will more than double, that is, 1.3 billion. These factors illustrate that region has as huge consumer base for the medical clothing market. Various market players are bringing innovative cost-efficient products for patients as well as healthcare staff.

In India, the medical clothing market is projected to observe massive growth in the coming years. Some of the factors driving the market revenue growth are rising middle class income and increase in favorable government health policies. According to the Ministry of Commerce and Industry in India, India’s Union Budget during 2024-25 emphasized on revolutionizing healthcare sector by infusing USD 10.70 billion. Other than this, Indian healthcare sector is witnessing growth opportunities exhibiting 220% rise in 2024 in comparison to the last year.

The medical clothing market in China is also projected to witness remarkable CAGR owing to the rising demand for cost-effective and accessible healthcare services. There is a surge in awareness in people for hygiene and safety among the population. Since the outbreak of pandemic, wearing mask became a global phenomenon. For instance, data published by the National Institutes of Health, at least 20.3 billion disposable masks were consumed by people in China in March 2023.

Additionally, the market in Japan is also witnessing significant demand in near future due to early adoption of the Universal Health Coverage and rising emphasis on cleanliness among population. Also, the rising geriatric population in the country is fostering the medical clothing market in the region. According to the World Economic Forum in 2023, there are 36.23 million people over 65 years of age are living in Japan.

Medical Clothing Market Players:

- Molnlycke Health Care AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance

- Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cardinal Health, Inc.

- Medline Industries, Inc.

- Owens & Minor, Inc.

- 3M Company

- Barco Uniforms, Inc.

- ANSELL LTD.

- Superior Group of Companies, Inc.

- Semperit AG Holding

- Herida Healthcare Limited

Recent Developments

- In March 2022, Owens & Minor, Inc. announced the acquisition of Apria, Inc. with cash on hand to enhance the services to be provided at hospitals and home bases hospital services. The acquisition took place to enhance portfolios of company’s products for patients with chronic and non-chronic conditions and to enlarge the distribution model along with advance product delivery.

- In March 2024, Swiss Precision Active Inc. introduced innovative medical copper active fabric with unique blend of 55% organic cotton, 40% embedded copper poly, and 5% of spandex. The medical apparel is setting new standards for comfort, sustainability, and performance.

- Report ID: 4543

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Clothing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.