Magnetic Sensor Market Outlook:

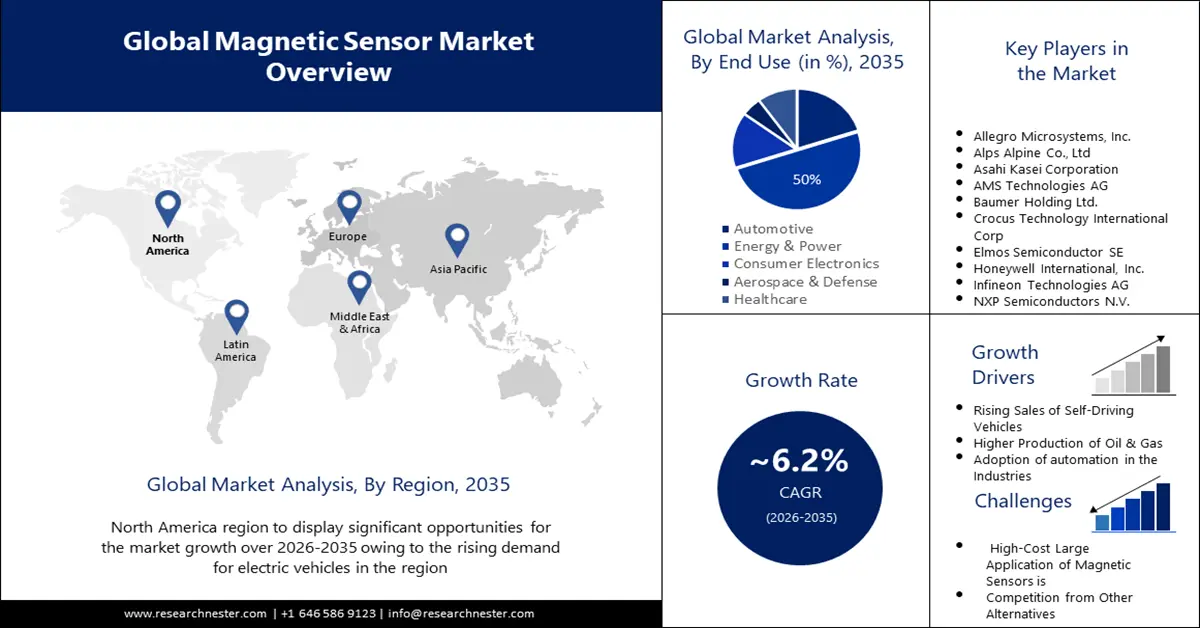

Magnetic Sensor Market size was valued at USD 4.3 billion in 2025 and is set to exceed USD 7.85 billion by 2035, expanding at over 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of magnetic sensor is estimated at USD 4.54 billion.

The growth of the market can be attributed to the demand for electric vehicles. The sensors are critical in identifying leakage currents that can enter the battery through the IC-CPD and then generate a Type A residual current. Despite supply chain delays and the ongoing Covid-19 epidemic, according to the International Energy Agency, global electric car sales set a new high in 2021. Sales nearly doubled to 6.6 million in comparison to 2020, increasing the total number of electric vehicles on the road to 16.5 million.

In addition to these, factors that are believed to fuel the market growth of magnetic sensors include the rising demand for automated machines in factories and the higher adoption of robots. Magnetic sensors are used in these machines for various applications, such as motion control, robotics, and precise positioning. On the other hand, the development of new materials and technologies for magnetic sensors, such as tunneling magnetoresistance (TMR), and giant magnetoresistance (GMR) is also expected to drive magnetic sensor market growth. China's manufacturers are turning to automation to update production lines while also preparing for fewer, more skilled labor. Chinese manufacturers, such as Midea, have already embraced automation to drastically cut the number of humans required.

Key Magnetic Sensor Market Insights Summary:

Regional Highlights:

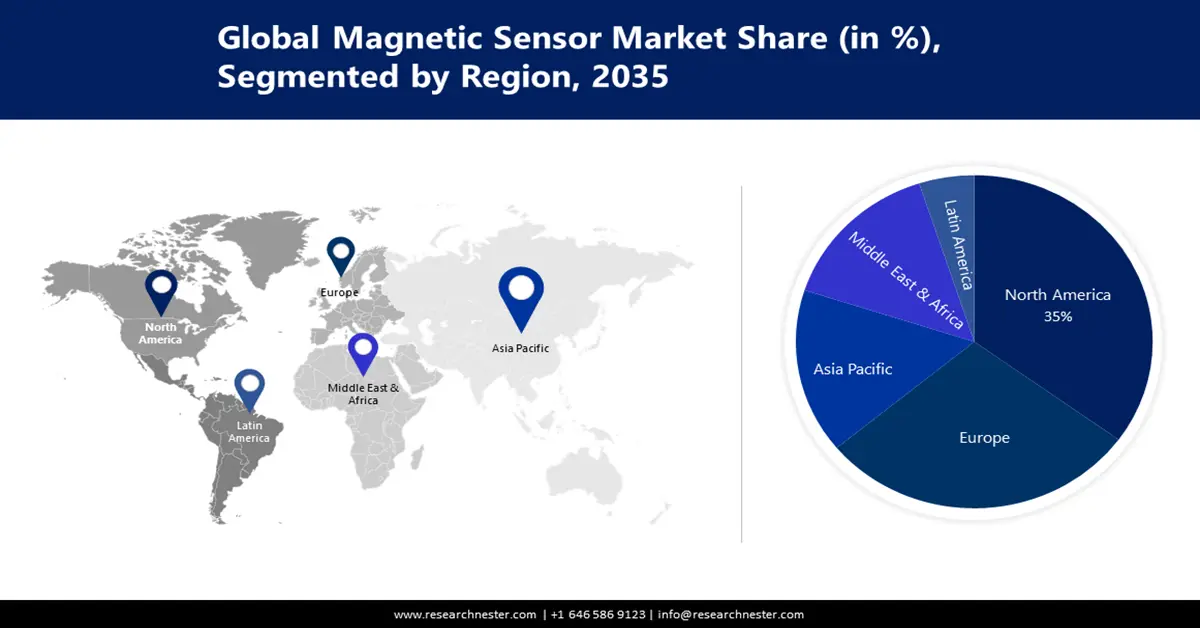

- The North America magnetic sensor market is projected to capture a 35% share by 2035, driven by increasing demand for self-driven vehicles, rising automation in industries, and rising demand for crude oil.

- The Europe market is expected to secure a 29% share by 2035, attributed to growing number of applications needing accurate measurement and detection of magnetic fields, and increased adoption of electric vehicles.

Segment Insights:

- The energy & power segment in the magnetic sensor market is forecasted to secure a 38% share by 2035, driven by increased energy demand from expanding middle classes and rising energy consumption.

- The hall effect segment in the magnetic sensor market is expected to achieve significant share by 2035, driven by their reasonable price, ease of integration, and reliability in sensing applications.

Key Growth Trends:

- Growing Popularity of Autonomous Vehicles

- Rising Automation Across the Industries

Major Challenges:

- Presence of Alternative Technologies

- The Sensors are influenced by environment

Key Players: Allegro Microsystems, Inc., Alps Alpine Co., Ltd., Asahi Kasei Corporation, AMS Technologies AG, Baumer Holding AG, Crocus Technology International, Corp., Elmos Semiconductor SE, Honeywell International, Inc, Infineon Technologies AG, NXP Semiconductors N.V.

Global Magnetic Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.3 billion

- 2026 Market Size: USD 4.54 billion

- Projected Market Size: USD 7.85 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 10 September, 2025

Magnetic Sensor Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Popularity of Autonomous Vehicles – Aside from steering, the sensor may detect position for a range of other automotive applications, such as pedals, controls, and gearbox shifters. There are presently over 30 million automated automobiles on the road worldwide.

-

Rising Automation Across the Industries– Magnets are employed to assess the precision and accuracy of the robots' motor motions. According to the International Federation of Robotics' new World Robotics 2020 Industrial Robots research, there are now around 2.7 million industrial robots working in industries all over the world, a 12% increase. In 2019, 373,000 units were shipped internationally.

- Increasing Production of Oil and Gas – Nuclear magnetic resonance can assist oil and gas businesses in understanding both the permeability and porosity of rocks. This affects whether or not a well is acceptable for a specific location. Global oil demand is projected to grow by 1.9 million barrels per day in 2023, reaching a record 101.7 million barrels per day, with China accounting for over half of the increase following the easing of the Covid limitations.

- Growing Demand for Medical Equipment– Magnetic field sensors can be used to reliably determine the relative location of medical equipment components. There are around 50,000 MR machines in use worldwide. Every year, around 5,000 pieces of MR imaging equipment are sold worldwide.

- Rising Demand for Consumer Electronics– Without needing direct contact between the sensor and the target, magnetic sensors are employed in electronic items to determine speed, speed and direction, position, alignment, proximity, or rotational position. Refrigerator sales in the world resumed in 2021, with yearly sales exceeding 236 million units by 2025. Furthermore, approximately 215 million refrigerators are sold globally each year.

Challenges

-

Presence of Alternative Technologies – There are various other sensors in the magnetic sensor market, such as acoustic sensors, capacitive sensors, and optical sensors. These sensors have various advantages, such as better accuracy, high resolution, and much lower consumption of power.

-

The Sensors are influenced by environment

- Cost of Per Unit in High Application is Really High

Magnetic Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 4.3 billion |

|

Forecast Year Market Size (2035) |

USD 7.85 billion |

|

Regional Scope |

|

Magnetic Sensor Market Segmentation:

End-user Segment Analysis

The global magnetic sensor market is segmented and analyzed for demand and supply by end use into automotive, consumer electronics, industrial, aerospace & defense, healthcare, and energy & power. Out of the six end users of magnetic sensor, the energy & power segment is estimated to gain the largest market share of about 38% in the year 2035. In oil fields, nuclear and other power plants, as well as solar and wind energy applications, magnetic sensors monitor the position or speed of moving components. The sensors can be utilized for energy and water saving via intelligent, open/close door detection, fluid levels, and contactless sensing. For instance, global demand is expected to exceed approximately 660 quadrillions Btu in 2050, representing around a 15% increase over 2021, reflecting a larger population and greater income. Moreover, strong middle-class expansion in developing countries boosts energy demand by approximately 35%.

Technology Segment Analysis

The global magnetic sensor market is also segmented and analyzed for demand and supply by technology into hall effect, anisotropic magento resistance (AMR), and giant magneto resistance (GMR). Amongst these three segments, the hall effect segment is expected to garner a significant share in the year 2035. The growth of the segment is expected on the account of their reasonable price, ease of integration, and lack of interference from complex biomedical samples. Hall effect sensors are used to monitor mechanical system variables such as proximity, speed, and displacement. It is one of the most common speed-sensing technology. They are quite dependable. Provide electrical angles and outputs that can be pre-programmed and provide high-speed operation. Hall Effect sensors do not wear out; thus they have an extended shelf life and, in the case of two-part technology, a virtually endless life. They are quite dependable.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Technology |

|

|

By End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Magnetic Sensor Market Regional Analysis:

North American Market Insights

The magnetic sensor market in North America is projected to be the largest with a share of about 35% by the end of 2035. The growth of the market can be attributed majorly to the increasing demand for self-driven vehicles followed by rising automation in the industries. It is projected that by 2030, there will be around 21 million autonomous cars in use in the United States. Moreover, the share of businesses that have fully automated at least one function has increased more slowly, rising from 29% in 2018 to 31% in 2020. On the other hand, the rising demand for crude oil is also expected to drive the market growth. US crude oil production is expected to reach an average of around 12 million barrels per day in 2022 and 12.4 million barrels per day in 2023, exceeding the record high achieved in 2019.

Europe Market Insights

The European magnetic sensor market is estimated to be the second largest, registering a share of about 29% by the end of 2035. The growth of the market can be attributed majorly to the growing number of applications that need accurate measurement and detection of magnetic fields. The increased adoption of electric vehicle in has fueled the demand for magnetic sensors, as these vehicles rely heavily on precise sensing of magnetic fields for battery management and motor control. Battery electric vehicle (BEV) sales in Europe set records in 2022, accounting for around 12% of the overall market share, up from around 9% in 2021 and nearly 2% in 2019. In addition to this, Germany, in particular, sold around 200,000 units. France came in second with around 62,000 units sold, and Sweden came in third with 37,000 registered sales.

APAC Market Insights

Asia Pacific region is projected to observe substantial growth through 2035. The growth of the market can be attributed majorly to the rising demand for energy. In 2022, the power demand in India increased by almost 8%, or roughly double the rate of the entire Asia Pacific region, reaching more than 149.7 terawatt-hours. Moreover, demand increased 10% year on year in the first two months of 2023. On the other hand, China's power consumption increased by around 4% year on year to 8,600 TWh in 2022. On the other hand, the region is also witnessing a rise in infrastructure development, particularly in the area of transportation and energy. Hence, the demand for magnetic sensors is rising in various applications in these sectors, such as railway signaling, wind turbines, and others.

Magnetic Sensor Market Players:

- Allegro Microsystems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alps Alpine Co., Ltd.

- Asahi Kasei Corporation

- AMS Technologies AG

- Baumer Holding AG

- Crocus Technology International, Corp.

- Elmos Semiconductor SE

- Honeywell International, Inc

- Infineon Technologies AG

- NXP Semiconductors N.V.

Recent Developments

- Infineon Technologies AG has announced to add a new AMR-based angle sensor to its sensor range, with the goal of providing excellent accuracy in low magnetic fields. The XENSIV TLE109A16 product line is intended to meet the demand for extremely precise, quick, and cost-effective angle measurement

- Allegro Microsystems, Inc. announced tha launch of A31316 3D Hall-effect position sensor, the latest addition to the company’s 3DMAG™ line of 3D sensors. This new sensor is suitable for automotive safety and advanced driver assistance systems (ADAS) applications that demand a significant amount of adaptability and dependable performance in harsh environments, such as powertrain and chassis applications

- Report ID: 4866

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Magnetic Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.