Lubricant Anti-wear Agents Market Outlook:

Lubricant Anti-wear Agents Market size was valued at USD 1.54 billion in 2025 and is likely to cross USD 2.17 billion by 2035, registering more than 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lubricant anti-wear agents is assessed at USD 1.59 billion.

The burgeoning demand for lubricant anti-wear agents is intricately tied to the rapid expansion of the global automotive industry. As the automotive sector continues to experience sustained growth, the need for effective lubrication solutions becomes paramount, driving the demand for anti-wear agents. The automotive industry, a cornerstone of economic development, has witnessed an upward trajectory in production and sales. The burgeoning middle class in emerging economies, coupled with urbanization trends, has led to a surge in vehicle ownership. Moreover, the continual push for innovation in the automotive sector, including the rise of electric and hybrid vehicles, has further spurred production volumes. According to a report, global motor vehicle production reached approximately 77 million units in 2020.

As the automotive industry continues to evolve, with a notable shift towards electric and hybrid vehicles, the demand for specialized lubricant formulations is expected to rise. Anti-wear agents tailored for the unique requirements of electric propulsion systems are likely to emerge as a focal point for research and development, presenting new avenues for market expansion. Lubricant additives are chemical compounds added to lubricating oils and greases to enhance their performance and provide specific properties. Anti-wear agents, also known as anti-wear additives, are a type of lubricant additive designed to reduce friction and-wear between moving surfaces in machinery and engines.

Key Lubricant Anti-wear Agents Market Insights Summary:

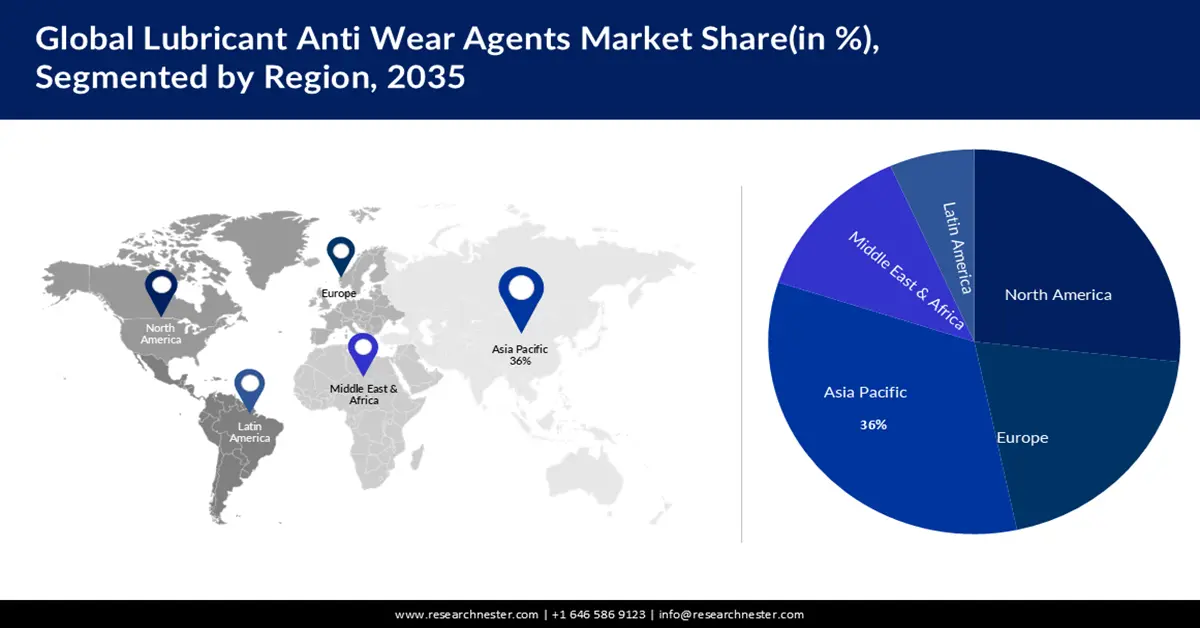

Regional Highlights:

- Asia Pacific lubricant anti-wear agents market achieves a 36% share by 2035, attributed to a rising middle-class population, increased consumer spending, and demand for lubricant anti-wear agents.

- North America market will hold the second largest share by 2035, driven by the robust automotive industry and high demand for lubricants containing anti-wear agents.

Segment Insights:

- The phosphorus-based anti-wear agents segment in the lubricant anti-wear agents market is anticipated to hold a 62% share by 2035, driven by compatibility with synthetic lubricants and demand for high performance.

- The automotive segment in the lubricant anti-wear agents market is forecasted to maintain a significant share by 2035, fueled by emission norms and the need for engine efficiency improvements.

Key Growth Trends:

- Industrial Machinery Expansion Driving Demand

- Expansion of Construction Activities

Major Challenges:

- Environmental Regulations and Sustainability

- Shift to Electric and Hybrid Vehicles

Key Players: Exxon Mobil Corporation, Royal Dutch Shell plc, Chevron Corporation, BP plc (British Petroleum), BASF SE, The Lubrizol Corporation.

Global Lubricant Anti-wear Agents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.54 billion

- 2026 Market Size: USD 1.59 billion

- Projected Market Size: USD 2.17 billion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Lubricant Anti-wear Agents Market Growth Drivers and Challenges:

Growth Drivers

- Industrial Machinery Expansion Driving Demand: The expansion of industrial machinery across diverse sectors contributes significantly to the demand for lubricant anti-wear agents. Industries such as manufacturing, construction, and energy rely on heavy machinery to optimize production processes. According to the International Organization of Motor Vehicle Manufacturers (OICA), global industrial production reached over 74 million units in 2020, showcasing the extensive use of machinery. The continuous growth in industrial activities substantiates the need for effective lubrication, boosting the market for anti-wear agents. Industrial machinery, characterized by high loads and intricate mechanical components, demands robust lubrication solutions. Anti-wear agents play a crucial role in reducing friction and preventing-wear in gears, bearings, and other crucial parts of industrial machinery, ensuring optimal performance and longevity.

- Expansion of Construction Activities: The growth in construction activities worldwide fuels the demand for lubricant anti-wear agents. Construction machinery, including excavators, bulldozers, and cranes, operates under demanding conditions, necessitating effective lubrication for optimal performance and durability. The continuous expansion of construction activities underlines the ongoing demand for robust lubrication solutions in the construction machinery sector. Construction machinery faces challenges such as heavy loads, high temperatures, and variable operating conditions. Lubricant anti-wear agents offer protection against-wear and friction, enhancing the reliability and longevity of critical components in construction equipment.

- Technological Advancements in Lubricant Formulations: Continuous advancements in lubricant formulations, driven by research and development, contribute to the growth of the market. Innovations in additive technology led to the creation of more effective and specialized anti-wear agents tailored to diverse industrial applications. Technological breakthroughs enable the formulation of anti-wear agents with enhanced performance characteristics, including improved thermal stability, reduced environmental impact, and compatibility with modern machinery. The adoption of these advanced lubrication solutions contributes to the overall growth of the lubricant anti-wear agents market.

Challenges

- Environmental Regulations and Sustainability: Increasingly stringent environmental regulations necessitate the development of lubricant anti-wear agents that comply with evolving standards. Balancing performance requirements with environmentally friendly formulations poses a challenge for manufacturers. Compliance with regulations can lead to reformulation efforts, affecting the overall cost and performance of anti-wear agents. However, meeting sustainability goals can also present opportunities for innovation. The growing adoption of electric and hybrid vehicles reduces the reliance on traditional internal combustion engines, impacting the demand for lubricants, including anti-wear agents, in the automotive sector.

- Shift to Electric and Hybrid Vehicles

- Technological Barriers in Machinery

Lubricant Anti-wear Agents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 1.54 billion |

|

Forecast Year Market Size (2035) |

USD 2.17 billion |

|

Regional Scope |

|

Lubricant Anti-wear Agents Market Segmentation:

Type Segment Analysis

The phosphorus-based anti-wear agents segment is estimated to hold 62% share of the global lubricant anti-wear agents market in the year 2035. The advancements in synthetic lubricants, driven by the need for higher performance and extended service intervals, contribute to the growth of phosphorus-based anti-wear agents. These agents are compatible with synthetic base oils and offer enhanced performance characteristics. The global industry for synthetic lubricants is expected to witness substantial growth around 4.5% by 2025. This indicates the increasing preference for synthetic lubricants in various applications. Phosphorus-based anti-wear agents, when incorporated into synthetic lubricants, enhance their anti-wear and extreme-pressure properties. This synergy contributes to the overall performance of synthetic lubricants, making them suitable for demanding applications across industries. As the market for synthetic lubricants expands, so does the demand for phosphorus-based anti-wear agents.

End User Segment Analysis

The automotive segment in the lubricant anti-wear agents market is expected to garner a significant share in the year 2035. The implementation of stricter emission standards and the pursuit of fuel efficiency drive innovations in engine design. Lubricant anti-wear agents contribute to these efforts by reducing friction and improving overall engine efficiency. Various regions, including the European Union and the United States, have implemented stringent emission standards, such as Euro 6 and Tier 3, to limit pollutants from vehicle exhaust. To meet stringent emission standards and improve fuel efficiency, automotive manufacturers focus on optimizing engine designs. Lubricant anti-wear agents become integral in this context, providing the necessary lubrication to minimize friction and enhance the efficiency of internal combustion engines. The growing emphasis on emission reduction and fuel efficiency propels the demand for these specialized additives. The growth of the automotive segment within the market is driven by the rising global vehicle ownership, the globalization of automotive manufacturing, and stricter emission standards with fuel efficiency requirements.

Our in-depth analysis of the global lubricant anti-wear agents market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lubricant Anti-wear Agents Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to dominate majority revenue share of 36% by 2035. The rising middle-class population in the Asia Pacific region correlates with increased consumer spending, including on automobiles and durable goods. This consumer-driven demand for products and services further drives the need for lubricant anti-wear agents. The Asian Development Outlook by the Asian Development Bank (ADB) indicates a substantial increase in middle-class households in the Asia Pacific, contributing to increased consumer spending. As more individuals in the region achieve middle-class status, there is a surge in the purchase of vehicles, machinery, and consumer goods. Lubricant anti-wear agents play a crucial role in ensuring the optimal performance and durability of these products, thus aligning with the growth in consumer spending.

North American Market Insights

The lubricant anti-wear agents market in the North America region is projected to hold the second largest share during the forecast period. The North American region boasts a robust automotive industry with a substantial vehicle fleet. The continuous growth of this industry is a primary driver for the demand for lubricant anti-wear agents, as these additives are essential for maintaining the performance and longevity of vehicle engines. According to the International Organization of Motor Vehicle Manufacturers (OICA), the United States alone produced over 11 million motor vehicles in 2019, showcasing the significant scale of automotive manufacturing in the region. The expansive automotive industry in North America translates to a high demand for lubricants, including those containing anti-wear agents. As vehicles form a substantial part of the region's transportation system, the need for effective lubrication to ensure optimal engine performance becomes crucial, driving the growth of the market .

Lubricant Anti-wear Agents Market Players:

- Exxon Mobil Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Royal Dutch Shell plc

- Chevron Corporation

- BP plc (British Petroleum)

- BASF SE

- The Lubrizol Corporation

- Croda International Plc

- Clariant AG

- Afton Chemical Corporation

- Evonik Industries AG

Recent Developments

- Shell successfully acquired Savion, a leading US developer of utility-scale solar and energy storage projects. This acquisition significantly expands Shell's renewable energy portfolio in the crucial North American market and strengthens its commitment to clean energy transition.

- Shell partnered with Eneco, a leading Dutch energy company, to develop, build, and operate green hydrogen production facilities and refueling stations in the Netherlands. This collaboration aims to accelerate the adoption of green hydrogen as a clean fuel source in the country.

- Report ID: 5581

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lubricant Anti-wear Agents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.