Low Noise Amplifiers Market Outlook:

Low Noise Amplifiers Market size was valued at USD 4.6 billion in 2025 and is projected to reach USD 17.5 billion by the end of 2035, rising at a CAGR of 14.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of low noise amplifiers is assessed at USD 5.34 billion.

The public sector demand for the low noise amplifiers market is driven by sustained government investment across defense, space, telecommunications infrastructure, and scientific research programs. In defense and aerospace, RF front-end performance is directly tied to radar sensitivity, electronic warfare capability, satellite communications, and secure sensing platforms. According to the U.S. Department of Defense report in March 2023, the sector continuously prioritizes the dominance of spectrum and sensor modernization. The report depicts that nearly USD 145 billion is allocated towards the research, development, testing, and evaluation, a part of which is directed towards the RF microwave and satellite payload electronics, which are used in the airborne naval and space-based systems.

Similarly, NASA's investment emphasize on the Earth observation satellite mission and deep space communications, where the low noise signal chains are important to mission reliability, driving the low noise amplifiers market. Similar priorities are reflected in Europe via publicly funded radio astronomy projects and ESA-funded satellite programs that need ultra-low noise receiver architecture for high sensitivity measurements. On the other hand, the National Telecommunications and Information Administration in January 2025 reports that the federal investment reached USD 65 billion under the infrastructure and broadband deployment, indirectly supporting the demand for the RF components integrated into network equipment. Further, the atmospheric sensing networks and the radio telescopes, the large-scale research facilities are supported by the National Science Foundation, which depends on the low noise amplification to extract the weak signals from the high interference environments.

Key Low Noise Amplifiers Market Insights Summary:

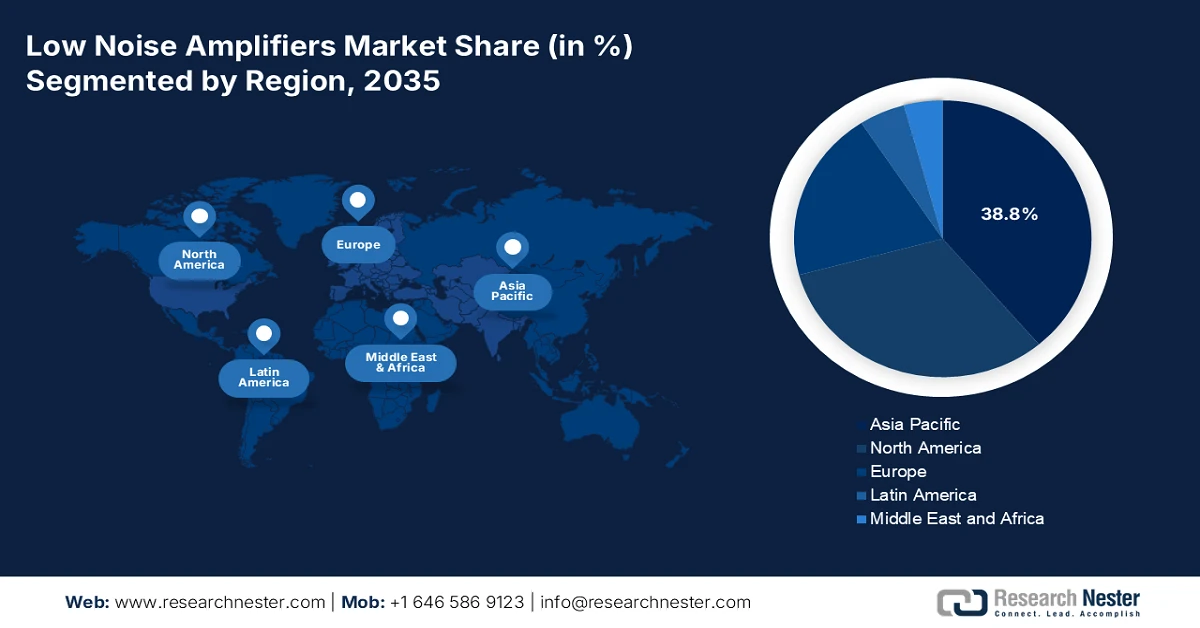

Regional Highlights:

- Asia Pacific is projected to capture a 38.8% revenue share by 2035 in the low noise amplifiers market, underpinned by large-scale 5G deployment, rising defense expenditures, and semiconductor self-sufficiency initiatives.

- North America is anticipated to expand at a CAGR of 8.5% during 2026–2035, supported by technology-intensive demand from telecommunications and defense modernization programs.

Segment Insights:

- The DC to 6 GHz segment is forecast to account for a 40.5% share by 2035 in the low noise amplifiers market, stimulated by the massive global rollout of mid-band 5G networks requiring high-volume, cost-effective LNAs.

- The telecommunications segment is expected to hold a significant share by 2035, reinforced by large-scale 5G network densification and sustained government-backed infrastructure expansion.

Key Growth Trends:

- Public funding for 5G/6G infrastructure deployment

- Rise in wireless technology

Major Challenges:

- High R&D and capital intensity

- Stringent performance and reliability standards

Key Players: Analog Devices Inc. (U.S.), Texas Instruments (U.S.), Qorvo (U.S.), MACOM Technology Solutions (U.S.), NXP Semiconductors (Netherlands), Infineon Technologies (Germany), STMicroelectronics (Switzerland), ON Semiconductor (U.S.), Microchip Technology (U.S.), Skyworks Solutions (U.S.), L3Harris Technologies (U.S.), Mitsubishi Electric (Japan), Toshiba (Japan), NEC Corporation (Japan), Sony Semiconductor Solutions (Japan), Rohde & Schwarz (Europe - Germany), Teledyne Technologies (U.S.), Anokiwave (U.S.), Mini-Circuits (U.S.), Samsung Electro-Mechanics (South Korea).

Global Low Noise Amplifiers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.6 billion

- 2026 Market Size: USD 5.34 billion

- Projected Market Size: USD 17.5 billion by 2035

- Growth Forecasts: 14.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.8% share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Mexico, Brazil, Indonesia

Last updated on : 28 January, 2026

Low Noise Amplifiers Market - Growth Drivers and Challenges

Growth Drivers

- Public funding for 5G/6G infrastructure deployment: The policy mandates and the government investment are stimulating the build-out of 5G and research into 6G networks that are more dependent on the low noise amplifiers market for the signal integrity. According to the Congress.gov report in November 2023, the U.S. Federal Communications’ 5G fund for rural America has allocated USD 9 billion to bring the access of 5G in the underserved areas, creating a direct long-term demand signal for telecommunication-grade LNAs in base stations and user equipment. Further, the European Commission’s Digital Decade policy program targets 5G coverage for all populated areas. This requires a massive investment in infrastructure that filters down to RF component suppliers. This public funding avoids risks in the private sector and ensures a sustained growth in the low noise amplifiers market aligned with these network standards.

- Rise in wireless technology: The advancements in wireless technology are the direct demand drivers in the low noise amplifiers market, as the next-gen networks require increasingly sensitive and interference-resilient RF front ends. The report from the U.S. National Science Foundation in August 2025 shows that nearly 17 million is allocated to make advancements in the next-generation wireless research. The funding amount targets the experimental wireless testbeds, sub-6 GHz and mmWave systems, open radio access networks (O-RAN), and advanced spectrum use. All of these components rely on the high-sensitivity RF receiver chains, where the low-noise amplifiers are a foundational component. As federally funded research transitions into commercial and government network deployments, LNA demand extends beyond laboratories into infrastructure-scale procurement.

- SWaP-driven miniaturization demand: Miniaturization and the compact design are increasingly shaping the demand in the low noise amplifiers market as the government-funded wireless space and defense programs aim to reduce the weight, size, and power in the sensing and communication platforms. The public investments in the next-gen wireless research supported by the National Science Foundation require highly integrated space-efficient RF front ends. In parallel, the European Space Agency and NASA support small satellite and payload miniaturization initiatives where power budgets and limited onboard space increase the significance of the compact LNAs without compromising sensitivity. As these publicly funded design transitions from the R&D to deployment, the LNA is adopted across the aerospace applications, satellite communications, and secure wireless infrastructure.

Challenges

- High R&D and capital intensity: Entering the low noise amplifiers (LNAs) market requires an immense investment in semiconductor fabrication, specialized personnel, and advanced simulation tools. Developing a competitive LNA for a new frequency band, such as the 6GHz, can take million and years. Established players in the market use their existing GaAs, and GaN has a capability built over decades. A new entrant cannot match this scale without significant venture capital or government backing, creating a financial barrier steep to prototyping and innovation.

- Stringent performance and reliability standards: The aerospace defense and medical applications are highly using the low noise amplifiers market solutions to meet the extreme reliability standards. Achieving the necessary qualification for radiation-hardened or mission-critical components involves robust and high-cost test cycles. The top companies invest in qualification labs to serve the automotive and industrial markets. A new supplier’s inability to immediately provide certified long-time components locks them out of these high-margin durable goods segments, limiting them to lower-revenue consumer markets.

Low Noise Amplifiers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.1% |

|

Base Year Market Size (2025) |

USD 4.6 billion |

|

Forecast Year Market Size (2035) |

USD 17.5 billion |

|

Regional Scope |

|

Low Noise Amplifiers Market Segmentation:

Frequency Segment Analysis

The DC to 6 GHz is dominating the segment and is expected to hold the share value of 40.5% by 2035 in the low noise amplifiers market. The segment encompasses the critical spectrum for 5G sub 6 GHz deployment, Wi Fi 6/6E/7. GPS and most legacy cellular bands. The massive global rollout of 5G networks, which heavily utilizes the mid-band frequencies, directly drives the demand for high volume cost effective LNAs in this range. A key driver is the report from the IEEE ComSoc in February 2025, highlighting the first C-band auction concluded in early 2021, which generated USD 94 billion in government revenue with the frequency between 3.98-4.2 GHz spectrum for 5G. This data relies heavily on RF front-end components, including low-noise amplifiers, to ensure signal integrity, coverage, and capacity.

Application Segment Analysis

Telecommunications is leading the segment and is expected to hold a significant share in the low noise amplifiers (LNAs) market. The LNAs are the foundational components in every 5G base station, small cell, and user equipment required to maintain signal integrity and range, mainly in the higher frequency bands. The scale of the deployment is immense, supported by the government policy. The report from the IBEF in August 2025 highlights that the number of India’s 5G subscribers reached 290 million in 2024, and this number is expected to surge by 2030. This growth translates directly into the densification of the 5G networks, requiring millions of base stations equipped with multiple high-performance low-noise amplifiers. Further, this rapid adoption ensures the trend in telecommunication demand and innovation in the market.

Material Segment Analysis

Gallium Arsenide remains as the leading sub-segment in the material segment due to its optimal balance of high frequency performance, low noise figure, and power efficiency essential for consumer electronics and telecom infrastructure. While the Gallium Nitride grows for high power applications, GaAs mature supply chain and continuous refinement make it the default choice for handsets and many RF front-end modules. The strategic importance of these compound semiconductors in the low noise amplifiers market is underscored by the U.S. government data on trade and production. According to the USGS January 2024 data, the import of gallium metal in 2023 reached USD 3 million, and the gallium arsenide was valued at USD 110 million, reflecting the sustained production demand driver by the sectors such as defense and 5G that rely on the components of GaAs.

Gallium Import Statistics

|

Metric |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Metal |

5,740 |

4,430 |

8,890 |

11,400 |

9,400 |

|

Gallium arsenide wafers (gross weight) |

289,000 |

208,000 |

306,000 |

424,000 |

150,000 |

Source: USGS January 2024

Our in-depth analysis of the low noise amplifiers (LNAs) market includes the following segments:

|

Segment |

Subsegments |

|

Material |

|

|

Frequency |

|

|

Architecture |

|

|

Packaging |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Low Noise Amplifiers Market - Regional Analysis

APAC Market Insights

The Asia Pacific low noise amplifiers market is the fastest growing and is expected to hold the revenue share of 38.8% by 2035. The market is driven by the robust consumer electronics manufacturing base, massive investments in telecommunications infrastructure, and expanding national defense budgets. The primary catalyst is the scale of the 5G deployment and research on 6G technologies, which China is leading in base station installations, and India is showing a vast subscriber growth. This telecom expansion creates an immense demand across the network stack. The government initiative programs are boosting the advanced RF component innovation. Geopolitical tensions are also driving the rise in defense spending on space systems, radar, and electronic warfare. The regional trend is the push for semiconductor self-sufficiency and investment to reduce import dependencies and secure the supply chain for critical components.

The rapid expansion of the digital network infrastructure and 5G network is the key driver demanding the low noise amplifiers market in China, which is an essential component in the base stations, small cells, and RF front-end modules. According to the People’s Republic of China data in December 2025, the Ministry of Industry and Information Technology revenues reached 1.61 trillion yuan, indicating a continued investment across the telecom equipment and network deployment. The report also indicates that China has installed nearly 4.83 million 5G base stations and reached 1.19 billion 5G users with over 65% penetration, increasing the RF receiver density per site. Ongoing rollout of 5G gigabit optical networks and IoT infrastructure elevates requirements for low noise, high linearity LNAs to support higher traffic loads, spectrum efficiency, and network reliability, reinforcing China as a major volume-driven LNA demand center.

India’s rapid expansion of the telecom infrastructure is driven by the strong foreign direct investment, and government-led reforms are directly supporting the demand for the low noise amplifiers market in India across the towers, base station and broadband networks. The data from Invest India in September 2022 shows that the telecom sector accounts for the 6.44% of the total FDI inflows, with the investments rising by 150% from USD 8.32 billion to USD 20.72 billion, surging the deployment of the network and cellular equipment that integrates the low noise amplifiers in the RF front ends. The tower expansion and large-scale 5G rollout, BharatNet optical fiber deployment, and the PM WANI public Wi Fi programs are increasing the RF receiver density nationwide. India is emerging as a high-volume growth market for low-noise energy efficiency LNAs supporting IoT, 5G, and broadband infrastructure.

North America Market Insights

The low noise amplifiers market in North America is the fastest growing and is expected to grow at a CAGR of 8.5% during the forecast period 2026 to 2035. The market is driven by the strong technology-led demand from the telecommunications and defense sectors. The primary driver of the market is the significant U.S. Department of Defense spending on modernization, which aims to prioritize the electromagnetic spectrum and next-gen communication systems, which directly propels the need for advanced and ruggedized LNAs in the radar and electronic applications. The regional trend is the transition from the supply chain resilience stimulated by the U.S. Science Act and CHIPS that incentivizes domestic production of compound semiconductors vital for next-gen LNA performance and security of supply.

The U.S. low noise amplifiers market is defined by significant modernization and infrastructure investment. The demand is further driven by the federally funded research and defense-led requirements for the wideband high-performance RF front ends. According to the NLM study in July 2023, the 2.0 GHz to 29.2 GHz wideband LNA design fabricated in a commercial 0.13 µm SiGe BiCMOS process reflects the technical direction favored by the U.S. government programs supporting the multi-band wireless radar and sensing applications. The study results indicate that the LNA has achieved a low noise of 4.16 dB and energy-efficient operation of 23.1 mW at 3.3 V, ideal for compact, wideband applications. Agencies' funding for the next-gen wireless testbed, spectrum sharing research, and radar modernization all of these require LNAs that are capable of multi-octave operation, low noise, and controlled power consumption.

The national sovereignty and connectivity imperatives are driving the Canada low noise amplifiers (LNAs) market. The report from the Government of Canada in July 2022 depicts that the USD 38.6 billion investment is in continental defense and NORAD modernization. This investment is a significant driver for the low noise amplifiers (LNAs) market, mainly in the aerospace radar and secure communications systems. The modernization of the Northern Approaches and Polar Over the Horizon Radar systems requires ultra-sensitive LNAs to detect faint signals from long range and hypersonic threats. Upgrades to the satellite communications NORAD Pathfinder system and satellite communications further increase the demand for the low noise RF front ends capable of operating reliably in remote environments. Further, the initiatives create a long term procurement opportunities for the LNAs optimized for the wideband operations, low noise figures, and compact energy-efficient design.

Canada Defense and NORAD Investments (FY22/23 to FY41/42)

|

Investment Area |

Funding (USD Billions) |

Purpose / Relevance to LNAs |

|

Surveillance Systems |

6.96 |

Northern and Polar Over-the-Horizon Radar, space-based sensors requiring ultra-low-noise amplifiers |

|

Command, Control & Communications |

4.13 |

Modernized digital radios, satellite communications, NORAD Pathfinder RF front ends |

|

Aerospace / Air Weapons |

6.38 |

Air-to-air missile systems and fighter radar systems using LNAs in receivers |

|

Infrastructure & Support |

15.68 |

Fighter bases, Arctic installations, refueling aircraft; radar and comms electronics integration |

|

Science & Technology |

4.23 |

Defence R&D for emerging RF/sensor tech, multi-band LNA development |

|

Internal Services |

1.18 |

Administrative support |

Source: Government of Canada July 2022

Europe Market Insights

The Europe low noise amplifiers (LNAs) market is shaped by the demand in sectors such as telecommunications modernization, aerospace, defense, and automotive innovation, aided by the EU-level funding initiatives. A primary growth driver is the EU’s push for digital connectivity, driven by the Digital Decade policy programme that aims for the gigabit and 5G coverage, necessitating the integration of advanced RF components and widespread network upgrades. The defense spending surges and is stimulated by the geopolitical shifts that are channeled towards the next-gen radar warfare secure satcom systems, all of which rely on the LNA's high performance. Further, the automotive industry is targeting autonomous driving propellign the demand via vehicle-to-everything communication and radar sensors.

The expanded commitment to the European Space Agency is a significant driver for the domestic Low Noise Amplifiers (LNAs) market in Germany, as space satellite and secure communication programs require high-performance RF front ends. According to the German Aerospace Center report in November 2025, the data indicates that the nation is contributing nearly 5.4 billion euros representing about 23% of ESA’s 22.1 billion euros budget, with allocations to lunar exploration, space science, satellite communication, navigation, space safety, and climate monitoring. The investment is exceeding 230 million euros in satellite communications, directly supporting the demand for the low noise and radiation-tolerant LNAs in payload ground stations. Further, the funding for defense-related space security strengthens the requirement for wideband high-reliability LNAs.

The low noise amplifiers (LNAs) market in the UK is experiencing robust growth driven by the escalating demand from the critical sectors such as telecommunications, defense, and satellite communications. The expansion of 5G infrastructure and the expanding space industry, including the satellite constellations are the primary drivers as LNAs are significant for improving the signal clarity in receivers. Government initiatives to strengthen the national connectivity and security further stimulate market investment. According to the UK Parliament March 2024 report, Ofcom, which is a telecoms regulator, has indicated that the 5G coverage in UK premises ranges from 85% to 93%. Further, the investment in the next-gen satellite networks and national defense modernization programs is creating a demand for high-performance LNAs.

Key Low Noise Amplifiers Market Players:

- Analog Devices Inc. (U.S.)

- Texas Instruments (U.S.)

- Qorvo (U.S.)

- MACOM Technology Solutions (U.S.)

- NXP Semiconductors (Netherlands)

- Infineon Technologies (Germany)

- STMicroelectronics (Switzerland)

- ON Semiconductor (U.S.)

- Microchip Technology (U.S.)

- Skyworks Solutions (U.S.)

- L3Harris Technologies (U.S.)

- Mitsubishi Electric (Japan)

- Toshiba (Japan)

- NEC Corporation (Japan)

- Sony Semiconductor Solutions (Japan)

- Rohde & Schwarz (Europe - Germany)

- Teledyne Technologies (U.S.)

- Anokiwave (U.S.)

- Mini-Circuits (U.S.)

- Samsung Electro-Mechanics (South Korea)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Analog Devices Inc. is a leading player in the low noise amplifiers (LNAs) market, using its deep expertise in high-performance analog and mixed signal ICs. The company strategically integrates its LNAs into advanced system solutions for healthcare instrumentation, communications infrastructure, and defense electronics. By focusing on ultra-low power consumption and high linearity in its design, ADI enable next gen portable and implantable devices. According to the 2024 annual report, the company has made a revenue of more than USD 9.4 billion.

- Texas Instruments maintains a commanding presence in the market via its expansive portfolio of high-performance analog semiconductors. Its strategic initiative centers on providing complete signal chain solutions where its ultra-low noise amplifiers are optimized to work seamlessly with its data converters and power management ICs. This integrated approach is supported by extensive design resources to develop an advanced system requiring a precise signal.

- Qorvo applies its core competency in the RF solutions to capture a significant share in the high-frequency segment of the low noise amplifiers (LNAs) market. The company’s strategic focus is on utilizing advanced compound semiconductor technologies such as GaAs and GaN to produce LNAs with superior noise figures and efficiency for 5G infrastructure, aerospace, and satellite communications. This technological leadership ensures reliable long-range wireless data links that are essential for high-quality data.

- MACOM Technology Solutions competes strategically in the low noise amplifiers (LNAs) market by targeting high-growth infrastructure and defense applications. The company differentiates itself via a broad product portfolio that spans frequency ranges from RF to microwave, utilizing both silicon and GaAs processes. The company focuses on enabling the backbone networks for the IoT-connected sector, providing amplification needed for signal transmission.

- NXP Semiconductor uses its strength in secure connectivity solutions to embed itself deeply within the market, mainly for automotive and IoT applications. A key strategic initiative is the integration of high-performance LNAs into its system-on-chip and module solutions for edge computing. This allows for local noise amplification of sensor signals. In 2024, the company made a revenue of USD 12.61 billion.

Here is a list of key players operating in the global low noise amplifiers (LNAs) market:

The competitive landscape of the low noise amplifiers (LNAs) market is characterized by intense rivalry and rapid technological innovation driven by the demand from 5G satellite communication and defense. The key players from the U.S. Japan and Europe dominate through significant R&D investment and proprietary semiconductor processes. Strategic initiative focuses on portfolio expansion for higher frequency bands, strategic acquisitions to boost the technological capabilities, and forging partnerships with major system integrators. For example, in May 2025, KippsDeSanto & Co. announced the sale of its client, Narda AcquisitionCo., Inc., a portfolio company of J.F. Lehman & Co., to Amphenol. Companies are also actively targeting the commercial space and IoT sectors to diversify beyond traditional defense and telecom revenue streams.

Corporate Landscape of the Low Noise Amplifiers (LNAs) Market:

Recent Developments

- In May 2025, Infineon Technologies introduced the BGM787U50, an integrated low noise amplifier (LNA) that operates from 600 to 960 MHz (low band) and 1400 to 2700 MHz (mid-low/mid-high band).

- In May 2024, Abracon introduces an all-new line of MMIC low noise amplifiers from 800 MHz to 10.5 GHz. Abracon’s MMIC LNAs are engineered to meet the demanding requirements of modern RF systems across the L/S/C/X frequency bands.

- In May 2024, Mini-Circuits, a leading global supplier of RF, microwave, and millimeter-wave components, announced that it had acquired the CATV amplifier business from Analog Devices.

- Report ID: 4360

- Published Date: Jan 28, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Low Noise Amplifiers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.