Locum Tenens Staffing Market Outlook:

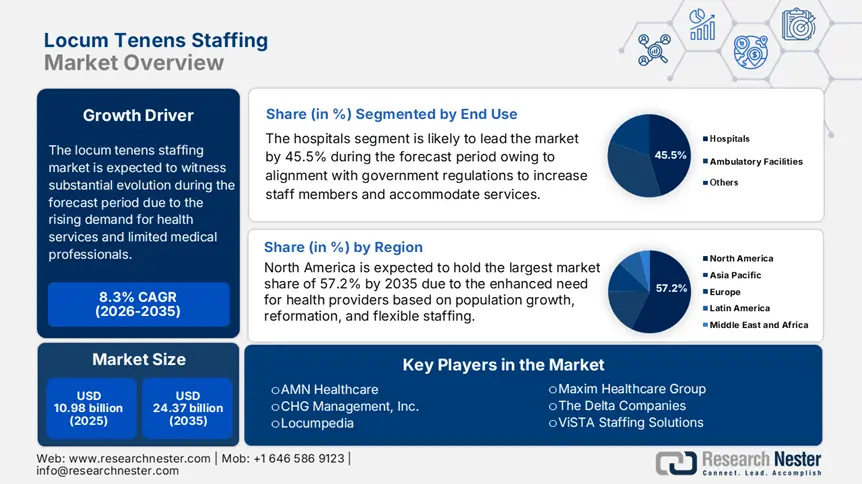

Locum Tenens Staffing Market size was over USD 10.98 billion in 2025 and is projected to reach USD 24.37 billion by 2035, growing at around 8.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of locum tenens staffing is evaluated at USD 11.8 billion.

Locum tenens staffing is cost-effective and an immediate solution to address gaps in the healthcare sector internationally. According to the December 2024 SIA article, the U.S. underwent a huge surge in health expenditure with a valuation of USD 4.8 trillion in 2023, which was expected to grow at 5.6%, ultimately resulting in USD 7.7 trillion. Therefore, locum tenens providers ensure care services while diminishing the unnecessary burden. They also ensure swift adaptability to evolving staffing requirements and fluctuating patient volumes, thus effectively driving and amplifying the market globally.

The locum tenens staffing market is subjected to expansion owing to underequipped hospitals with limited healthcare professionals. However, this concept has been applied by the Centers for Medicare and Medicaid Services to signify the importance of a fee-for-time compensation arrangement. This denotes that a substitute physician delivers services in place of the regular physician and the regular physician can bill medicare facilities for those services provided. As per the 2023 NLM article, the payer’s pricing to undertake locum services is USD 400 based on the hourly rate in comparison to regular employees, whose hourly rate is USD 225 and onboarding rate is USD 50,000, hence a positive outlook for market development.

Key Locum Tenens Staffing Market Insights Summary:

Regional Highlights:

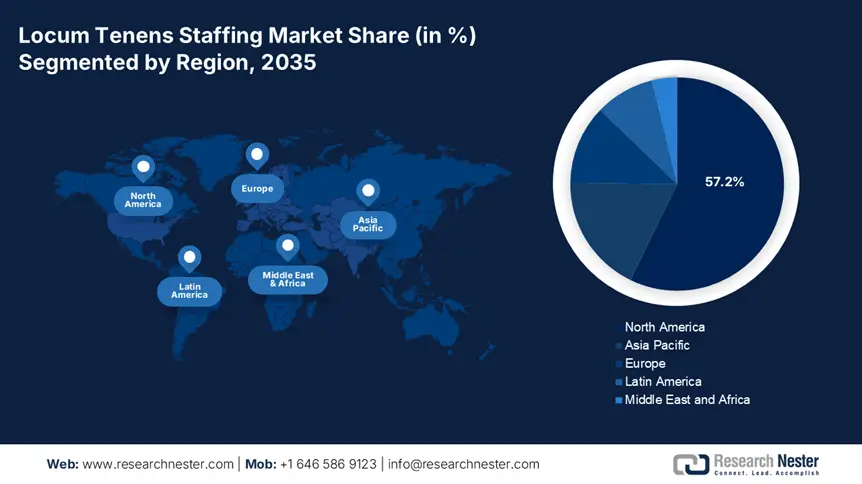

- North America dominates the Locum Tenens Staffing Market with a 57.2% share, driven by rising demand for healthcare professionals and workforce support platforms, sustaining leadership through 2026–2035.

- The Asia Pacific region is poised for the fastest growth in the Locum Tenens Staffing Market from 2026 to 2035, driven by the growing elderly population increasing demand for medical staff.

Segment Insights:

- The Physicians segment is expected to have a substantial impact with CAGR growth by 2035, propelled by high demand for specialized physicians and supportive policy changes like the Physician Pathway Act.

- Hospitals segment are expected to achieve a 45.5% share by 2035, propelled by the broad range of healthcare services driving demand for specialized locum tenens staff.

Key Growth Trends:

- Escalation in the healthcare sector

- Rising adoption of telemedicine

Major Challenges:

- Risk in employment

- Changes in policies and regulations

- Key Players: AMN Healthcare, Aya Healthcare, Inc., CHG Management, Inc., Locumpedia.

Global Locum Tenens Staffing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.98 billion

- 2026 Market Size: USD 11.8 billion

- Projected Market Size: USD 24.37 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (57.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Locum Tenens Staffing Market Growth Drivers and Challenges:

Growth Drivers

- Escalation in the healthcare sector: The significant rise of chronic disorders is boosting the need for healthcare services along with well-trained and educated professionals, which is a positive outlook for the locum tenens staffing market globally. According to the December 2024 World Economic Forum statistical report, the healthcare sector is expected to grow by 44% with a revenue of USD 5.1 trillion internationally. The rise in healthcare investments as well as development is also positively impacting the need for medical professionals, catering to the upliftment of the market.

- Rising adoption of telemedicine: The incorporation of digitalization in healthcare has resulted in the progression of telehealth services, which is yet another growth driver for the locum tenens staffing market internationally. This health service is beneficial for patients to undergo services at home or in remote locations.

Challenges

- Risk in employment: The ambiguity and the occupation hazard are constantly linked to locum tenens staffing resolutions due to its momentary filling of unfilled places for steady healthcare professionals, thereby restraining the progress of the locum tenens staffing market. In addition, locum tenens staffing employees are less compensated in comparison to consistent employees, so they are remunerated based on operating hours, which tend to vacillate the income as per the demand or shift every month. Also, unbalanced work plans hinder work-life equilibrium and financial uniformity, eventually creating a challenge for the market to expand.

- Changes in policies and regulations: Obstacles such as increased complexity, compliance hurdles, and the necessity to implement evolving standards are caused owing to modifications in health regulatory policies, thus a negative impact on the locum tenens staffing market. The continuous evolution based on ongoing research and development ensures the need for professionals to stay up-to-date with innovative medical solutions. Additionally, providers need to track and maintain reports regarding quality metrics which is resource-intensive and time-consuming, thereby a challenge for market upliftment.

Locum Tenens Staffing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 10.98 billion |

|

Forecast Year Market Size (2035) |

USD 24.37 billion |

|

Regional Scope |

|

Locum Tenens Staffing Market Segmentation:

End use (Hospitals, Ambulatory Facilities)

Based on the end use segment, the hospitals segment is set to hold locum tenens staffing market share of more than 45.5% by 2035. Hospitals offer several healthcare amenities such as surgeries, general treatment, specialty care, and others that drive the demand for the specialized workforce, which in turn is a driving factor for the segment’s growth. Besides, case management is a healthcare process that requires professional assistance to provide support services to patients. As per the August 2023 NLM article, 5% of emergency division patients constitute 30% to 50% of appointments and these patients may ineffectively get the opportunity to encounter their healthcare and related desires on their own, thus driving the importance of hospitals.

Type (Physicians, Surgeons, Nurses, Anesthesiologist, Radiologist)

The physicians segment is expected to influence the locum tenens staffing market at a substantial rate during the forecast timeline. Physicians are the most specialized, trained, and educated in the countless areas of specific skills that make them extremely superior and commanded professionals in the healthcare industry. Niskanen Center Organization in its March 2025 article notified that the Massachusetts governor signed the Physician Pathway Act (PPA), allowing international physicians to practice medicine. Almost 40% of the state’s physicians practice in Suffolk County, comprising 11% of the state’s population, thereby driving the segment’s growth.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Specialty |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Locum Tenens Staffing Market Regional Analysis:

North America Market Analysis

North America in locum tenens staffing market is anticipated to hold more than 57.2% revenue share by 2035. The region is subjected to the growing need for specialty doctors, general physicians, nurses, and other hospital staff, all of which contribute to the expansion of the market. The April 2024 AACN Organization report stated that the region comprises approximately 4.7 million registered nurses, out of which 89% are employed. On the other hand, as per the July 2024 AMA Organization report, the job satisfaction of physicians increased from 68% to 72.1%, thus maintaining their commitment to the well-being of patients in the region.

The locum tenens staffing market in the U.S. has been gaining traction due to the introduction of various platforms by organizations to provide their support to the market. For instance, in March 2024, Jackson Healthcare notified the launch of Venn, the latest addition of highly focused healthcare staffing, search, and technology companies. This is focused on assisting healthcare organizations of all sizes to gain all-inclusive prominence in their workforces to better plan, manage, and heighten physician and advanced practice provider (APP) staffing across their operations. Therefore, with such a contribution by the company, the market is expected to effectively develop in the country.

The aspect of governmental support is bolstering the locum tenens staffing market in Canada. As per the Government of Canada's March 2025 report, there has been an investment of USD 14.3 million to cater to the shortage of labor in the healthcare industry in the country. This investment has been announced by the Workforce Development and Labour which will be funded across four organizations through the Foreign Credential Recognition Program (FCRP). This will ensure internationally educated health professionals (IEHPs) enter the workforce to reduce critical labour strains and guarantee that hospitals and medical centres are staffed with the talent they need to deliver quality services, thus driving market expansion.

APAC Market Statistics

The locum tenens staffing market in APAC is the fastest-growing region and is expected to observe significant development during the forecast timeline. The rise in the geriatric population in the region is estimated to contribute to the growth rate of numerous diseases and determine the demand for healthcare facilities and professionals. The 2025 WHO report stated that the proportion of aged people, especially in the South-East Asia region will increase to 13.7% by 2030 and 20.3% by 2050. Therefore, this will eventually result in a huge demand for healthcare professionals to cater to growing disorders both in public and private medical facilities.

The evolution of the locum tenens staffing market in India is determined by augmented demand for healthcare services and the government's acknowledgment of its role in addressing healthcare access issues. According to the 2025 Ministry of Health and Family Welfare report, the Directorate General of Health Services (DGHS) and the National Health Authority are two administrative departments to provide technical advice regarding public and medical health matters. These also implement India’s flagship public health insurance/assurance scheme Ayushman Bharat - Pradhan Mantri Jan Arogya Yojana and also manage the technical framework as well as the implementation of the National Digital Health Mission.

The locum tenens staffing market in China is gaining exposure, attributed by the enlargement of the private healthcare sector and the prerequisite to staff novel facilities in the country. Private hospitals outnumbered public facilities with high outpatient visits and hospitalization increasing the per-patient expenditure. As per the July 2024 Fidelity International article, healthcare spending in the country is expected to reach USD 2 trillion yearly by 2035. Also, the development of innovative and generic drugs is initiated with the evolution of clinical research organizations readily making contributions in the country, which in turn is positively driving the market.

Key Locum Tenens Staffing Market Players:

- AMN Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aya Healthcare, Inc.

- Barton Associates

- CHG Management, Inc.

- Locumsmart

- Locumpedia

- locumTenens.com

- Maxim Healthcare Group

- Medicus Healthcare Solutions

- The Delta Companies

- ViSTA Staffing Solutions

- Weatherby Healthcare

- 1840 & Company

The locum tenens staffing market is highly fragmented with the rising aging population and the necessity for mobile health based on which a few smaller competitors are entering the industry. In addition, strategies such as mergers and acquisitions, partnerships, and investment are readily driving the growth of companies. For instance, in November 2022, Barton Associates was acquired by H.I.G Capital to support its continued growth trajectory into 2023. Barton is the fourth largest locum staffing organization in the healthcare industry with more than 800 employees across 10 office locations and is exclusively positioned to supervise healthcare facilities to ease the scarcity of medical providers in 2023 and beyond, thereby driving the locum tenens staffing market growth.

Here's the list of some key players:

Recent Developments

- In September 2024, 1840 & Company proudly declared the launch of its latest healthcare staffing vertical. This addressed perilous staffing needs within the healthcare sector, offering wide-ranging local staffing solutions for locum tenens, per diem nurses, and allied health professionals, alongside traditional outsourcing services such as medical billing, coding, and data entry.

- In February 2020, CHG Healthcare notified the acquisition of Locumsmart to create the most complete staffing solution in the locum tenens industry. This was possible with CHG’s high-touch, people-first approach and industry-leading physician staffing capabilities coupled with Locumsmart’s high-tech workflow and tools.

- Report ID: 7366

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Locum Tenens Staffing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.