- Market Definition

- Definition

- Market Segmentation

- Assumptions and Acronyms

- Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Executive Summary – Global Liposome Drug Delivery Market

- Market Dynamics

- Drivers

- Challenges

- Trends

- Opportunities

- Pipeline Analysis

- Clinically Marketed Liposome Drugs

- Regulatory Scenario Assessment

- Analysis on Lipid Nanoparticles

- Competitive Landscape

- Market Share Analysis, 2021

- Company Profiles

- Pharmaceutical Formulation Manufacturers

- Spectrum Pharmaceuticals, Inc.

- Gilead Sciences, Inc.

- Celsion Corporation

- Ipsen Pharma

- Pacira Pharmaceuticals, Inc.

- Novartis AG

- CordenPharma International

- FUJIFILM Toyama Chemical Co., Ltd.

- Takeda Pharmaceutical Company Limited

- Johnson & Johnson Services, Inc.

- Astellas Pharma Inc.

- Elan Pharmaceuticals (Perrigo Company plc)

- Merrimack Pharmaceuticals, Inc.

- Janssen Pharmaceuticals, Inc.

- Raw Material Manufacturers

- NIPPON FINE CHEMICAL CO., LTD.

- Sonic Biochem Extractions Pvt. Ltd.

- Croda International Plc

- Lipoid GmbH

- Hashimoto Electronic Industry Co., LTD

- Pharmaceutical Formulation Manufacturers

- Global Liposome Drug Delivery Market

- Market Overview

- Market Size (2023-2036)

- Market Segmentation by:

- Product

- Liposomal Doxorubicin, 2023-2036F (USD Million)

- Liposomal Paclitaxel, 2023-2036F (USD Million)

- Liposomal Amphotericin, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- Technology

- Stealth Liposome Technology, 2023-2036F (USD Million)

- Non-PEGylated Liposome Technology, 2023-2036F (USD Million)

- DepoFoam Liposome Technology, 2023-2036F (USD Million)

- Application

- Fungal Diseases, 2023-2036F (USD Million)

- Pain Management, 2023-2036F (USD Million)

- Cancer Therapy, 2023-2036F (USD Million)

- Viral Vaccines, 2023-2036F (USD Million)

- Photodynamic Therapy, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- Region

- North America, 2023-2036F (USD Million)

- Europe, 2023-2036F (USD Million)

- Asia Pacific, 2023-2036F (USD Million)

- Latin America, 2023-2036F (USD Million)

- Middle East & Africa, 2023-2036F (USD Million)

- Product

- North America Liposome Drug Delivery Market

- Market Overview

- Market Size (2023-2036)

- Market Segmentation by:

- Product

- Liposomal Doxorubicin, 2023-2036F (USD Million)

- Liposomal Paclitaxel, 2023-2036F (USD Million)

- Liposomal Amphotericin, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- Technology

- Stealth Liposome Technology, 2023-2036F (USD Million)

- Non-PEGylated Liposome Technology, 2023-2036F (USD Million)

- DepoFoam Liposome Technology, 2023-2036F (USD Million)

- Application

- Fungal Diseases, 2023-2036F (USD Million)

- Pain Management, 2023-2036F (USD Million)

- Cancer Therapy, 2023-2036F (USD Million)

- Viral Vaccines, 2023-2036F (USD Million)

- Photodynamic Therapy, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- Country

- United States, 2023-2036F (USD Million)

- Canada, 2023-2036F (USD Million)

- Product

- Europe Liposome Drug Delivery Market

- Market Overview

- Market Size (2023-2036)

- Market Segmentation by:

- Product

- Technology

- Application

- Country

- Germany, 2023-2036F (USD Million)

- United Kingdom, 2023-2036F (USD Million)

- France, 2023-2036F (USD Million)

- Italy, 2023-2036F (USD Million)

- Spain, 2023-2036F (USD Million)

- Rest of Europe, 2023-2036F (USD Million)

- Asia Pacific Liposome Drug Delivery Market

- Market Overview

- Market Size (2023-2036)

- Market Segmentation by:

- Product

- Technology

- Application

- Country

- China, 2023-2036F (USD Million)

- India, 2023-2036F (USD Million)

- Japan, 2023-2036F (USD Million)

- Australia, 2023-2036F (USD Million)

- New Zealand, 2023-2036F (USD Million)

- Rest of APAC, 2023-2036F (USD Million)

- Latin America Liposome Drug Delivery Market

- Market Overview

- Market Size (2023-2036)

- Market Segmentation by:

- Product

- Technology

- Application

- Country

- Brazil, 2023-2036F (USD Million)

- Mexico, 2023-2036F (USD Million)

- Rest of LATAM, 2023-2036F (USD Million)

- Middle East & Africa Liposome Drug Delivery Market

- Market Overview

- Market Size (2023-2036)

- Market Segmentation by:

- Product

- Technology

- Application

- Country

- GCC, 2023-2036F (USD Million)

- South Africa, 2023-2036F (USD Million)

- Rest of MEA, 2023-2036F (USD Million)

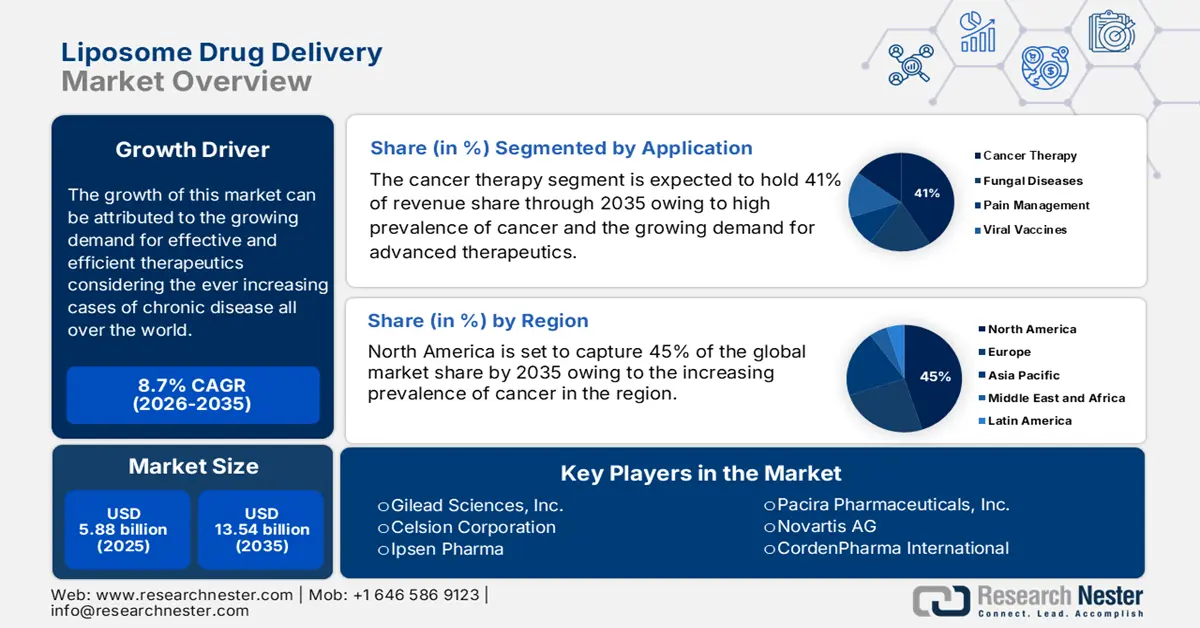

Liposome Drug Delivery Market Outlook:

Liposome Drug Delivery Market size was valued at USD 5.88 billion in 2025 and is set to exceed USD 13.54 billion by 2035, expanding at over 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of liposome drug delivery is estimated at USD 6.34 billion.

According to the WHO 2021, non-communicable diseases (NCDs) killed no less than 43 million people in the same year which corresponds to 75% of non-pandemic-related deaths globally.18 million people out of that were aged below 70 years, 82% of which were from the low- and middle-income countries. Cardiovascular diseases accounted for 19 million NCD deaths, followed by 10 million deaths caused by cancer, 4 million by chronic respiratory diseases, and 2 million deaths due to diabetes. This rising prevalence of NCDs is driving the demand for liposomal drug delivery due to its ability to enhance drug effectiveness and reduce side effects.

Increasing advances in liposomal drug delivery methods owing to new investments and ongoing R&D activities, are driving the growth of the liposome drug delivery market further. For instance, in August 2024, Lupin Limited launched Doxorubicin Hydrochloride Liposome Injections 20 mg/10 mL (2 mg/mL) and 50 mg/25 mL (2 mg/mL) Single-Dose Vials in the U.S., after receiving approval for its ANDA from the FDA. Moreover, various government authorities have been seen offering funds and investments for the research and development activities of the liposome drug delivery market.

Key Liposome Drug Delivery Market Insights Summary:

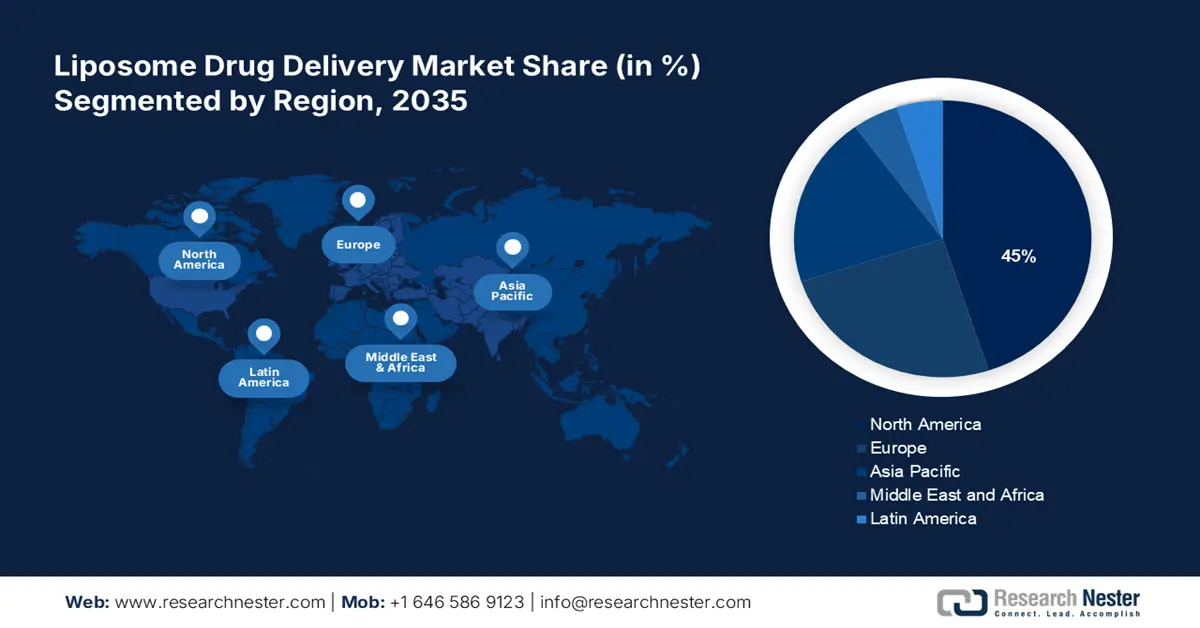

Regional Highlights:

- North America liposome drug delivery market will dominate over 45% share by 2035, attributed to rising cancer rates and increased government R&D initiatives.

- Europe market will capture the second largest share by 2035, fueled by rising chronic illnesses and demand for personalized medicines.

Segment Insights:

- The cancer therapy segment in the liposome drug delivery market is projected to achieve a 41% share by 2035, driven by the growing demand for advanced therapeutics.

- The liposomal doxorubicin segment in the liposome drug delivery market is expected to achieve a 38% share by 2035, attributed to its effectiveness in treating various cancers.

Key Growth Trends:

- Expanding opportunities through regulatory approvals

- Increased use of quality by design (QbD) over traditional methods

Major Challenges:

- Stability and shelf-life issues

- Limited drug loading capacity

Key Players: Spectrum Pharmaceuticals, Inc., Gilead Sciences, Inc., Celsion Corporation, Ipsen Pharma, Pacira Pharmaceuticals, Inc., Novartis AG, CordenPharma International, FUJIFILM Toyama Chemical Co., Ltd., Takeda Pharmaceutical Company Limited, Johnson & Johnson Services, Inc.

Global Liposome Drug Delivery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.88 billion

- 2026 Market Size: USD 6.34 billion

- Projected Market Size: USD 13.54 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Liposome Drug Delivery Market Growth Drivers and Challenges:

Growth Drivers

- Expanding opportunities through regulatory approvals: This is a key driver in the market as these approvals enhance credibility, expand market access, and accelerate commercialization. Regulatory approvals validate the safety, and quality of liposomal formulations, encouraging wider adoption in oncology, infectious diseases, and other therapeutic areas. In February 2024, approved irinotecan liposome with oxaliplatin, fluorouracil, and leucovorin, for the first-line treatment of metastatic pancreatic adenocarcinoma. As the FDA continues to support advanced drug delivery technologies, more companies are investing in the market leading to growth.

- Increased use of quality by design (QbD) over traditional methods: Owing to the popularity of rational-based methods like QbD over empirical and simulation-based techniques, procedures have been upgraded. In contrast to traditional techniques that rely on trial and error, QbD is based on a fact-based rational strategy that allows for superior decision-making. The popularity and application of the QbD approach are expected to propel market growth by improving cost efficiency and accelerating regulatory approvals.

Challenges

- Stability and shelf-life issues: The physical and chemical stability of this drug formulation can impact its shelf-life and therapeutic efficacy. Factors such as lipid oxidation, drug leakage, and aggregation can cause degradation over time, reducing effectiveness. Maintaining stability requires optimized storage conditions, such as low temperatures and specific pH levels, which increase logistical and cost burdens.

- Limited drug loading capacity: Liposomes have finite space for drug encapsulation, and some drugs exhibit poor solubility or instability within liposomal structures, limiting their therapeutic potential. This challenge affects the dose concentration, requiring higher administration volumes or frequent dosing. Hence, the interaction between lipids and drug molecules is crucial to maximizing the benefits of liposomal drug delivery.

Liposome Drug Delivery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 5.88 billion |

|

Forecast Year Market Size (2035) |

USD 13.54 billion |

|

Regional Scope |

|

Liposome Drug Delivery Market Segmentation:

Application Segment Analysis

The cancer therapy segment in the liposome drug delivery market is anticipated to hold the largest revenue share of 41% by the end of 2035. This can be attributed to the growing demand for advanced therapeutics. According to the WHO 2020, cancer is a leading cause of death globally, accounting for approximately 10 million deaths in 2020, which means nearly one out of every six deaths were due to cancer. Liposomal formulations enhance drug stability and improve tumor penetration making them highly preferable for treating various cancers, further boosting market expansion.

Product Segment Analysis

The liposomal doxorubicin segment is anticipated to hold a 38% share of the global liposome drug delivery market by the end of 2035. This segment growth is attributed to its effectiveness in treating various cancers, including breast cancer, ovarian cancer, and multiple myeloma. The American Cancer Society states that AML accounts for about 1 out of 3 leukemias in adults. It further states that about 22,010 acute myeloid leukemia (AML) cases are projected to be registered in the U.S. in 2025, with approximately 11,090 people dying from the disease. Doxorubicin is used for treating several blood cancers, including AML and Hodgkin's lymphoma. Additionally, improved manufacturing technologies and regulatory support for liposomal formulations contribute to its wider adoption.

Our in-depth analysis of the global liposome drug delivery market includes the following segments:

|

Product |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Liposome Drug Delivery Market Regional Analysis:

North American Market Insights

North America liposome drug delivery market is anticipated to dominate the majority revenue share of 45% by 2035. The growth of the region is attributed to the increasing prevalence of cancer in the region, followed by the surge in government initiatives that promote research and development for cancer drugs and drug delivery systems. According to the CDC, in the year 2021209,500 new lung cancers were reported and in 2022, 131,888 people died from lung cancer in the U.S. This has further given rise to the demand for liposome drug delivery advances in the country.

Canada is witnessing a growing demand for accurate oncology treatment, boosting liposome drug delivery growth. The country’s biopharmaceutical sector is investing in liposome technology to enhance drug efficacy and reduce side effects. Collaborations between research institutions, biotech firms, and global pharmaceutical companies are driving market expansion, while regulatory approvals and clinical advancements further support the adoption of liposome therapies.

Europe Market Insights

The liposome drug delivery market in Europe is projected to garner the second-largest revenue by the end of 2035. The rising incidence of chronic illnesses such as cancer and cardiovascular disease is majorly driving the market. In 2021, cancer was the second leading cause of death in Europe with 1.1 million deaths, which equated to 21.6 % of the total number of deaths in the region. The increasing personalized medicine demand and the need for improved drug efficacy and safety are further driving market growth.

The market in Germany is projected to garner the second-largest revenue in Europe during the forecast period. the country is a hub for biotechnology and nanomedicine innovation, with key players focusing on enhancing liposomal formulations for improved drug stability and efficacy. Furthermore, according to Eurostat 2021, more than 229,000 deaths occurred in Germany due to malignant neoplasms. The country’s liposome drug delivery market is also advancing cancer treatment by enhancing chemotherapy efficacy, reducing toxicity, and enabling targeted drug delivery for improved patient outcomes.

Liposome Drug Delivery Market Players:

-

Companies Dominating the Liposome Drug Delivery Landscape

Companies in the liposome drug delivery market adopt strategies such as product innovation, focusing on targeted drug delivery, nanotechnology integration, and novel lipid formulations to enhance efficacy. They form strategic partnerships with pharma firms, research institutions, and CDMOs to accelerate development and commercialization. Some of these players include:

- Spectrum Pharmaceuticals, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Gilead Sciences, Inc.

- Celsion Corporation

- Ipsen Pharma

- Pacira Pharmaceuticals, Inc.

- Novartis AG

- CordenPharma International

- FUJIFILM Toyama Chemical Co., Ltd.

- Takeda Pharmaceutical Company Limited

- Johnson & Johnson Services, Inc.

Recent Developments

- In June 2024, DuPont acquired Donatelle Plastics Incorporated, a medical device contract manufacturer specialized in the designing, developing, and manufacturing of medical components and devices, in the third quarter of 2024.

- In June 2022, Endo Ventures Limited (EVL), a subsidiary of Endo International plc, in agreement with Taiwan Liposome Company, Ltd. (TLC) commercialized a TLC product, TLC599, which is an injectable compound in Phase III development for the treatment of knee osteoarthritis knee pain.

- In January 2022, Pfizer and Acuitas Therapeutics signed a Development and Options Agreement. This gives Pfizer the option to license Aquinas lipid nanoparticle (LNP) technology non-exclusively for up to 10 vaccine targets or therapeutics development.

- Report ID: 4073

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Liposome Drug Delivery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.