Linolenic Acid Market Outlook:

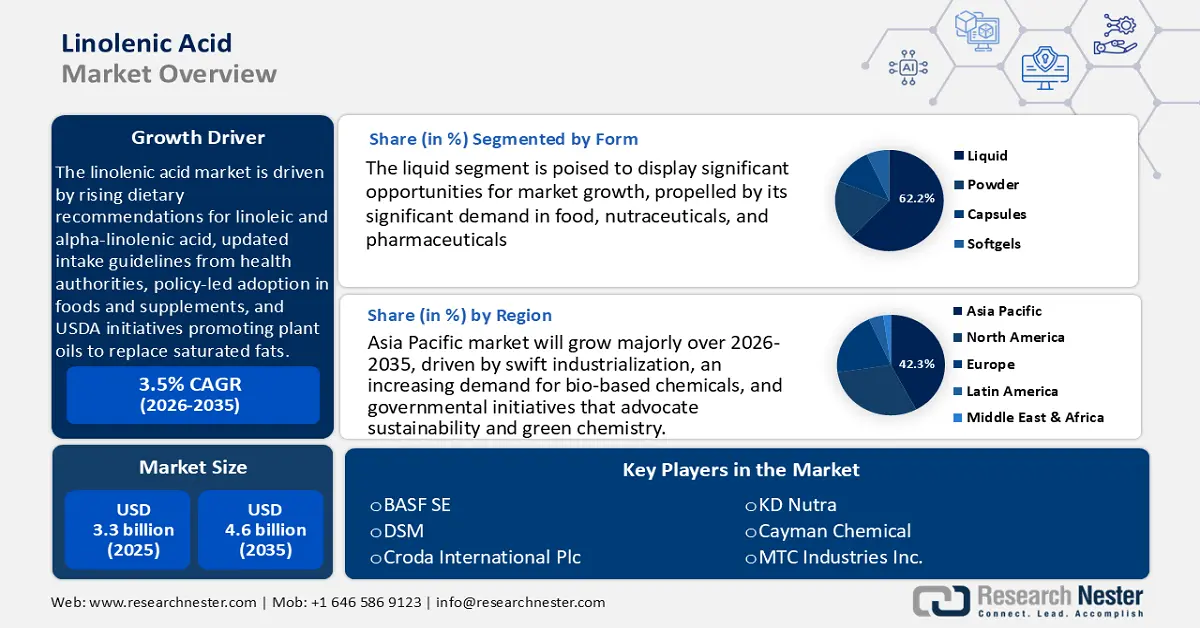

Linolenic Acid Market size was valued at USD 3.3 billion in 2025 and is projected to reach USD 4.6 billion by the end of 2035, rising at a CAGR of 3.5% during the forecast period, from 2026 to 2035. In 2026, the industry size of linolenic acid is assessed USD 3.8 billion.

The global linolenic acid market is expected to grow with an upward trend during the projected years, primarily driven by the heightened dietary recommendations for linoleic and alpha-linolenic acid, as acknowledged by health authorities in the U.S. and Canada. The Dietary Reference Intakes by the U.S. Institute of Medicine suggest that the Adequate Intake (AI) of linoleic acid is 17 grams/day in men and 12 grams/day in women aged 1950 years. In the case of alpha-linolenic acid, the AI amounts to 1.6 grams/day for men and 1.1 grams/day for women of the same age group. These values are related to the average intake levels that are seen to sustain nutritional adequacy. This adoption, driven by the policy of conventional foods and dietary supplements, has prompted changes in labeling standards and has stimulated product reformulations within the domestic market. Similarly, USDA initiatives promote the use of plant oils such as soybean and canola, which further support the transition in the supply chain from saturated fats to polyunsaturated fatty acids.

Raw materials such as soybean, canola, and linseed oils are experiencing volatility in the Producer Price Index (PPI). The Producer Price Index (PPI) of fatty acids (WPU061403991) was 215.418 (Dec 2007 = 100) in August 2025, which shows that the pricing of raw fatty acid materials has continued to increase. This increment in PPI is attributable to the rise in input cost of the supply chain, largely due to the growing demand for certain fatty acids like alpha-linolenic acid, which is largely applied in food, nutraceutical, and cosmetic products, as it has proven beneficial health-wise. This pressure on the demand is driving not only price increases but also an increase in linolenic acid market demand in sustainable production of fatty acids, as industries are moving towards using more plant-based, polyunsaturated fats such as linolenic acid. Global capacity is on the rise through the establishment of extraction facilities in North America and Europe, with assembly lines being set up next to oilseed crushing plants. Federal Research, Development, and Demonstration (RDD) funding supports USDA Agricultural Research Service (ARS) research focused on optimized seed varieties and processing, although specific investment amounts across these initiatives remain aggregated. For instance, the USDA, through its Agricultural Research Service (ARS), is coming up with new varieties of soybean that have equal amounts of linolenic and linoleic acid. It is also investing in the processing research (e.g., testing extrusion pressures/temperatures) in order to retain the health attributes of these varieties. ARS has gone so far as to construct a small soybean crushing plant in Crookston, Minnesota, used to process in batches. The trade volume is steadily increasing, with imports of oilseeds for local crushing and exports of refined acids primarily directed towards food and supplement manufacturers.