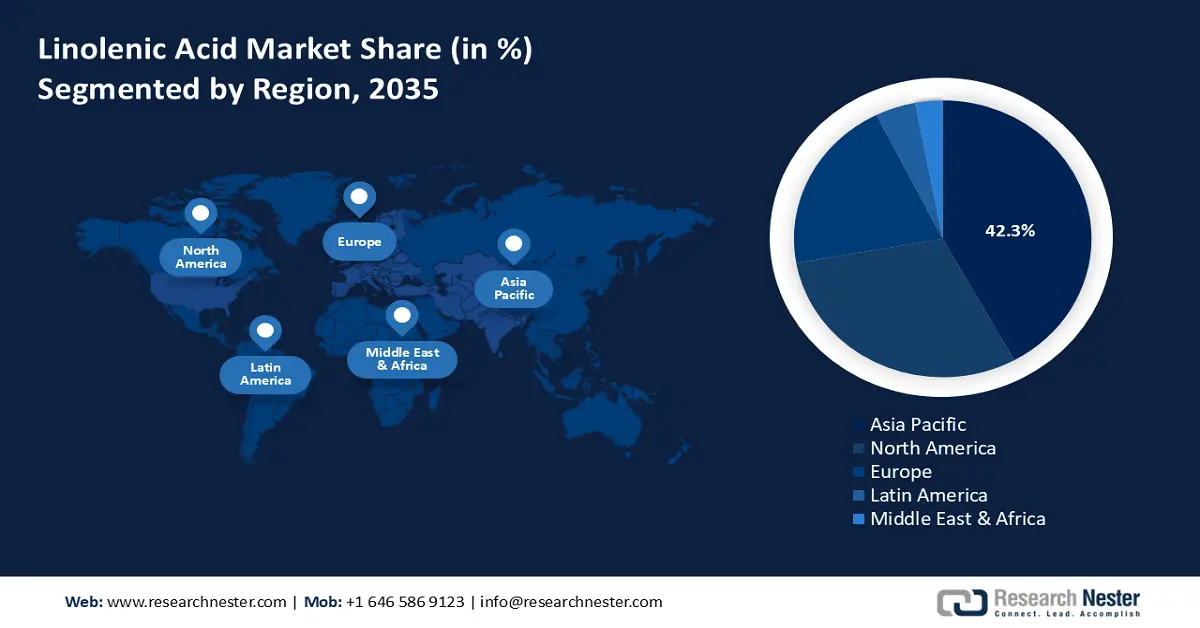

Linolenic Acid Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific region is anticipated to account for nearly 42.3% of the linolenic acid market revenue by the year 2035. The factors driving this growth include swift industrialization, an increasing demand for bio-based chemicals, and governmental initiatives that advocate sustainability and green chemistry. Enhanced research and development expenditures, along with regulatory backing in nations such as Japan and China, are propelling innovation and the uptake of linolenic acid products within the pharmaceutical, cosmetic, and food industries. Additionally, according to the World Integrated Trade Solution (WITS), the World Bank, Malaysia had exported around 7,439 tons (7,439,460 kg) of oleic, linoleic, and linolenic acids in 2023 with an export revenue of around USD 14.76 million exported in salts. Meanwhile, the imports of these acids to Indonesia were mostly imported by its neighbors, with India (450 tons) (1374980kg) and China (718 tons) (718251kg) among the top importers. These inter-business transactions are indicative of the intra-regional integration of demand and supply chains of bio-based fatty acids in the Asia Pacific as a result of the increasing industrial use of these products in the pharmaceutical, cosmetics, and food sectors.

China’s linolenic acid market is poised to lead the region, with the largest share by 2035, propelled by its extensive industrial infrastructure, significant government investment, and regulatory policies that promote innovations in green chemistry. This growth is further supported by strategic investments in sustainable chemical technologies and the incorporation of linolenic acid into the pharmaceutical and food industries. Furthermore, through bioengineering and sustainable agriculture, China has been able to achieve a lot in improving the production and accumulation of linoleic acid and alpha-linolenic acid. The genetic engineering of crops to enhance ALA content has become a significant solution to the enhancement of the nutritional value, and these sustainable methods enable environmentally-friendly production, which can meet the demands of the whole globe. The attempts demonstrate the high interest of the country in creating an eco-friendly and efficient way of making the necessary fatty acids, which helps the country to keep its leading position on the bio-based chemical market at the international level.

The linolenic acid market in India is likely to grow with the fastest CAGR over the forecast period from 2026 to 2035, owing to the growing health awareness and demand for omega-3 fatty acid supplements and functional foods. The increasing growth is stimulated by the high population of the nation, urbanization, and the increased disposable income, which enhances the consumption of fatty acids in the diet, such as alpha-linolenic acid (ALA). India is advantageous in the production of major raw materials like flaxseed and soybean oils domestically, as well as the rising imports to address the increasing linolenic acid market demands. As per the National Nutrition Monitoring Bureau and other authoritative agencies, the average visible fat intake in Indian families comes to around 15 grams per unit of consumption per day, which is less than the advised 20 grams. The dietary factors of the Indians consist of plant-based fats that are high in linoleic acid (n-6 PUFA) and extremely low in alpha-linolenic acid (n-3 PUFA), which is estimated at 20-50mg/day. This plays with an imbalance in fatty acids, and India has a double burden of malnutrition and non-communicable diseases, where 53% of deaths are because of NCDs. The rates of obesity have been on the rise, and the number of obese men has grown, increasing from 0.4 million to 9.8 million, and the number of obese women has grown from 0.8 million to 20 million. The distorted n-6/n-3 ratio and low overall fat consumption indicate that dietary balancing is necessary to enhance the health of the population.

North America Market Insights

The North American linolenic acid market is projected to account for 30.4% revenue share over the projected years. The growth drivers encompass a rising demand for bio-based chemicals within the pharmaceutical and food industries, bolstered by rigorous environmental regulations and governmental investments in sustainable technologies. Government initiatives that encourage sustainability and ensure chemical safety are driving linolenic acid market acceptance in multiple sectors. The use of plant-based oils that contain high levels of alpha-linolenic acid, such as soybean and flaxseed oils, has continued to rise in the North American region. This development goes in line with a wider nutritional reform towards healthier lipid profiles, driven by increasingly high consumer levels of awareness and dietary advice in favor of omega-3 fatty acids. Increased consumption of these oils has increased the intake of alpha-linolenic acid in the diet, which helps prevent cardiovascular disease and curb inflammation. In addition, according to the U.S Environmental Protection Agency (EPA), there are still ongoing regulatory incentive programs that encourage the production of bio-based chemicals, and this indirectly encourages the production and use of biobased fatty acids, such as linolenic acid, which will facilitate a greener chemical industry environment within North America.

U.S. linolenic acid market is expected to dominate the North American region by 2035, attributed to the crucial role played by governmental assistance in enhancing the linolenic acid market. Federal investment in chemical safety and innovation accounts for approximately 3.4% of the industrial innovation budget, fostering environmentally friendly manufacturing practices. Additionally, the American Chemistry Council (ACC) enhances the development of bio-based plastics by cutting the use of fossil-based substances and enhancing the application of recycled and renewable feeds. The principles of ACC encourage the responsible production of bio-based plastics to ensure that U.S. companies will achieve sustainability targets, such as the goal of making 100% of U.S. plastic packaging reusable, recyclable, or recoverable by 2040, and one that 30% of plastic packaging will contain recycled material by 2030. Similarly, the U.S BioPreferred Program, managed by the USDA, promotes federal agencies and businesses to acquire and utilize biobased products to encourage market demand and creativity. The voluntary labelling of the program and federal purchasing needs motivate the production and utilization of renewable and bio-based chemicals, including linolenic acid, which leads to expansion in the U.S. linolenic acid market via sustainable production and purchase plans. These initiatives enhance production efficiency, minimize environmental impact, and contribute to market expansion.

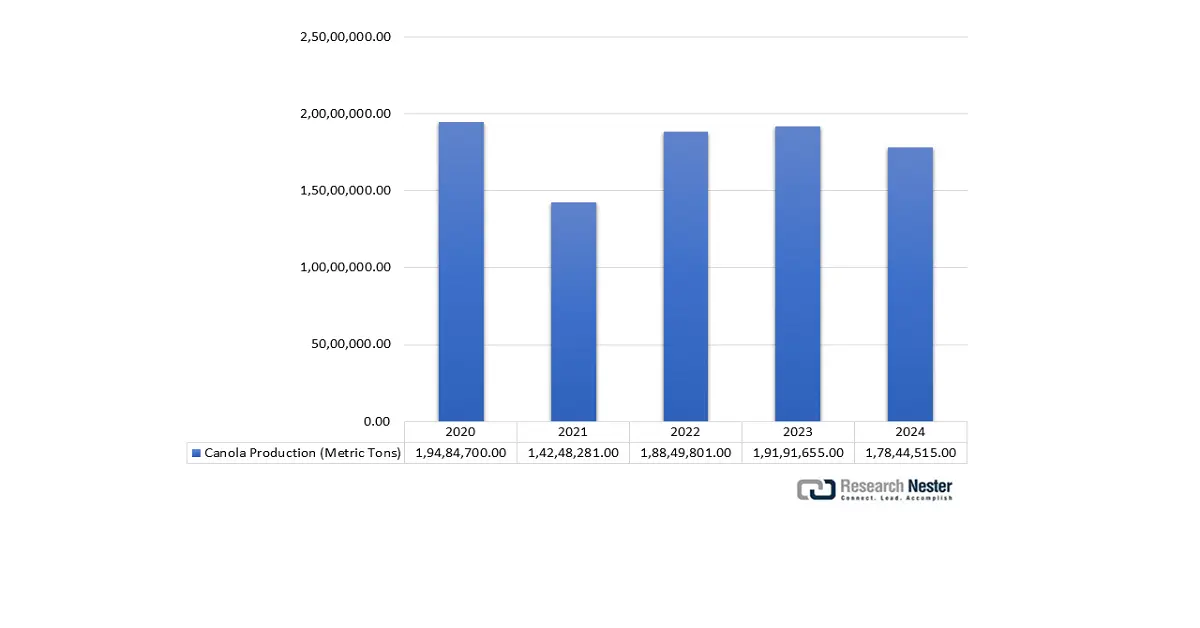

The linolenic acid market in Canada is projected to grow steadily during the forecast years, mainly led by flaxseed production, which is a large source of alpha-linolenic acid. Canada is exhibiting high agricultural potential in flaxseed production, with a high of 257,974 metric tons to date in 2024, which is a consistent output to sustain both domestic processing and export demand. Flaxseed is also one of the main sources of alpha-linolenic acid, and the consistent production of the product in Canada is important in terms of providing a stable supply to the nutraceutical, food, and bio-based chemical industries. Continued production of flax seeds strengthens Canada as a major producer of the linolenic acid value chain. The scientists of the Canadian Grain Commission claimed that the oil composition of Canada Western Brown Flaxseed was 44.8% and that alpha-linolenic acid (C18:3) was 55.8% of the oil. These values make Canada a major producer of oil rich in ALA to meet the increasing demand in the nutraceutical, functional foods, and bio-based chemical industries. The export trends, international price of oilseeds, and sustainable agriculture investment also affect linolenic acid market dynamics.

Canada Agriculture Production: Canola from 2020 to 2024

Source: CEIC

Europe Market Insights

Europe is anticipated to hold 20.6% of the linolenic acid market revenue by the year 2035, primarily fueled by stringent environmental regulations imposed by the European Chemicals Agency (ECHA) and a growing commitment to sustainable chemical practices in line with the European Green Deal. The demand for bio-based linolenic acid chemicals is increasing across the food, pharmaceuticals, and cosmetics industries, bolstered by innovation grants and public-private partnerships facilitated by Horizon Europe. New stricter regulations by the European Chemicals Agency (ECHA) and large-scale sustainability efforts by the European Green Deal are the primary causes of this growth. The European Commission is spending more than €7.3 billion via its work programme Horizon Europe 2025 to enhance research, innovation, and competitiveness in all fields, including sustainable bioeconomy and food production. Having allocated funds specifically on food, bio economy, natural resources, agriculture, and environment, this funding will aid in the development of sustainable fatty acid production, like linolenic acid, which encourages the use of greener alternatives and less reliance on traditional sources. This project is in line with the increasing market demand in the European linolenic acid market of sustainable and plant-based omega-3 fatty acids, which drives innovation and competitive development in the market.